Standalone Financial Statements

Independent Auditor’s Report to the Members of Mindtree Limited

Report on the Standalone Financial Statements

We have audited the accompanying standalone financial statements of MINDTREE LIMITED (“the Company”), which comprise the Balance Sheet as at March 31, 2018, and the Statement of Profit and Loss (including Other Comprehensive Income), the Cash Flow Statement and the Statement of Changes in Equity for the year then ended, and a summary of the significant accounting policies and other explanatory information.

Management’s Responsibility for the Standalone Financial Statements

The Company’s Board of Directors is responsible for the matters stated in Section 134(5) of the Companies Act, 2013 (“the Act”) with respect to the preparation of these standalone financial statements that give a true and fair view of the financial position, financial performance including other comprehensive income, cash flows and changes in equity of the Company in accordance with the Indian Accounting Standards (Ind AS) prescribed under section 133 of the Act read with the Companies (Indian Accounting Standards) Rules, 2015, as amended, and other accounting principles generally accepted in India.

This responsibility also includes maintenance of adequate accounting records in accordance with the provisions of the Act for safeguarding the assets of the Company and for preventing and detecting frauds and other irregularities; selection and application of appropriate accounting policies; making judgements and estimates that are reasonable and prudent; and design, implementation and maintenance of adequate internal financial controls, that were operating effectively for ensuring the accuracy and completeness of the accounting records, relevant to the preparation and presentation of the standalone financial statements that give a true and fair view and are free from material misstatement, whether due to fraud or error.

Auditor’s Responsibility

Our responsibility is to express an opinion on these standalone financial statements based on our audit.

In conducting our audit, we have taken into account the provisions of the Act, the accounting and auditing standards and matters which are required to be included in the audit report under the provisions of the Act and the Rules made thereunder and the Order issued under section 143(11) of the Act.

We conducted our audit of the standalone financial statements in accordance with the Standards on Auditing specified under Section 143(10) of the Act. Those Standards require that we comply with ethical requirements and plan and perform the audit to obtain reasonable assurance about whether the standalone financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and the disclosures in the standalone financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the standalone financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal financial control relevant to the Company’s preparation of the standalone financial statements that give a true and fair view in order to design audit procedures that are appropriate in the circumstances. An audit also includes evaluating the appropriateness of the accounting policies used and the reasonableness of the accounting estimates made by the Company’s Directors, as well as evaluating the overall presentation of the standalone financial statements.

We believe that the audit evidence obtained by us is sufficient and appropriate to provide a basis for our audit opinion on the standalone financial statements.

Opinion

In our opinion and to the best of our information and according to the explanations given to us,the aforesaid standalone financial statements give the information required by the Act in the manner so required and give a true and fair view in conformity with the Ind AS and other accounting principles generally accepted in India, of the state of affairs of the Company as at March 31, 2018, and its profit, total comprehensive income, its cash flows and the changes in equity for the year ended on that date.

Report on Other Legal and Regulatory Requirements

1. As required by Section 143(3) of the Act, we report that:

a) We have sought and obtained all the information and explanations which to the best of our knowledge and belief were necessary for the purposes of our audit

b) In our opinion, proper books of account as required by law have been kept by the Company so far as it appears from our examination of those books.

c) The Balance Sheet, the Statement of Profit and Loss including Other Comprehensive Income, the Cash Flow Statement and Statement of Changes in Equity dealt with by this Report are in agreement with the books of account.

d) In our opinion, the aforesaid standalone financial statements comply with the Ind AS prescribed under section 133 of the Act.

e) On the basis of the written representations received from the directors of the Company as on March 31, 2018 taken on record by the Board of Directors, none of the directors is disqualified as on March 31, 2018 from being appointed as a director in terms of Section 164(2) of the Act.

f) With respect to the adequacy of the internal financial controls over financial reporting of the Company and the operating effectiveness of such controls, refer to our separate Report in “Annexure A”. Our report expresses an unmodified opinion on the adequacy and operating effectiveness of the Company’s internal financial controls over financial reporting.

g) With respect to the other matters to be included in the Auditor’s Report in accordance with Rule 11 of the Companies (Audit and Auditors) Rules, 2014, as amended, in our opinion and to the best of our information and according to the explanations given to us:

i. The Company has disclosed the impact of pending litigations on its financial position in its standalone financial statements;

ii. The Company did not have any long-term contracts including derivative contracts for which there were any material foreseeable losses

iii. There has been no delay in transferring amounts, required to be transferred, to the Investor Education and Protection Fund by the Company.

2. As required by the Companies (Auditor’s Report) Order, 2016 (“the Order”) issued by the Central Government in terms of Section 143(11) of the Act, we give in “Annexure B” a statement on the matters specified in paragraphs 3 and 4 of the Order.

For Deloitte Haskins & Sells

Chartered Accountants

(Firm’s Registration No. 008072S)

V. Balaji

Partner

(Membership No. 203685)

Bengaluru, April 18, 2018

Annexure “A” to the Independent Auditor’s Report

(Referred to in paragraph 1(f) under ‘Report on Other Legal and Regulatory Requirements’ section of our report of even date)

Report on the Internal Financial Controls Over Financial Reporting under Clause (i) of Sub-section 3 of Section 143 of the Companies Act, 2013 (“the Act”)

We have audited the internal financial controls over financial reporting of MINDTREE LIMITED (“the Company”) as of March 31, 2018 in conjunction with our audit of the standalone financial statements of the Company for the year ended on that date.

Management’s Responsibility for Internal Financial Controls

The Company’s management is responsible for establishing and maintaining internal financial controls based on the internal control over financial reporting criteria established by the Company considering the essential components of internal control stated in the Guidance Note on Audit of Internal Financial Controls Over Financial Reporting issued by the Institute of Chartered Accountants of India. These responsibilities include the design, implementation and maintenance of adequate internal financial controls that were operating effectively for ensuring the orderly and efficient conduct of its business, including adherence to company’s policies, the safeguarding of its assets, the prevention and detection of frauds and errors, the accuracy and completeness of the accounting records, and the timely preparation of reliable financial information, as required under the Companies Act, 2013.

Auditor’s Responsibility

Our responsibility is to express an opinion on the Company’s internal financial controls over financial reporting based on our audit. We conducted our audit in accordance with the Guidance Note on Audit of Internal Financial Controls Over Financial Reporting (the “Guidance Note”) issued by the Institute of Chartered Accountants of India and the Standards on Auditing prescribed under Section 143(10) of the Companies Act, 2013, to the extent applicable to an audit of internal financial controls. Those Standards and the Guidance Note require that we comply with ethical requirements and plan and perform the audit to obtain reasonable assurance about whether adequate internal financial controls over financial reporting was established and maintained and if such controls operated effectively in all material respects.

Our audit involves performing procedures to obtain audit evidence about the adequacy of the internal financial controls system over financial reporting and their operating effectiveness. Our audit of internal financial controls over financial reporting included obtaining an understanding of internal financial controls over financial reporting, assessing the risk that a material weakness exists, and testing and evaluating the design and operating effectiveness of internal control based on the assessed risk. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion on the Company’s internal financial controls system over financial reporting.

Meaning of Internal Financial Controls Over Financial Reporting

A company’s internal financial control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company’s internal financial control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorisations of management and directors of the company; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorised acquisition, use, or disposition of the company’s assets that could have a material effect on the financial statements.

Inherent Limitations of Internal Financial Controls Over Financial Reporting Because of the inherent limitations of internal financial controls over financial reporting, including the possibility of collusion or improper management override of controls, material misstatements due to error or fraud may occur and not be detected. Also, projections of any evaluation of the internal financial controls over financial reporting to future periods are subject to the risk that the internal financial control over financial reporting may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Opinion

In our opinion, to the best of our information and according to the explanations given to us, the Company has, in all material respects, an adequate internal financial controls system over financial reporting and such internal financial controls over financial reporting were operating effectively as at March 31, 2018, based on the internal control over financial reporting criteria established by the Company considering the essential components of internal control stated in the Guidance Note on Audit of Internal Financial Controls Over Financial Reporting issued by the Institute of Chartered Accountants of India.

For Deloitte Haskins & Sells

Chartered Accountants

(Firm’s Registration No. 008072S)

V. Balaji

Partner

(Membership No. 203685)

Bengaluru, April 18, 2018

Annexure “B” to the Independent Auditor’s Report

(Referred to in paragraph 2 under ‘Report on Other Legal and Regulatory Requirements’ section of our report of even date)

(i) (a) The Company has maintained proper records showing full particulars, including quantitative details and situation of fixed assets.

(b) The Company has a program of verification of fixed assets to cover all the items in a phased manner over a period of 3 years which, in our opinion, is reasonable having regard to the size of the Company and the nature of its assets. Pursuant to the program, certain fixed assets were physically verified by the Management during the year. According to the information and explanations given to us, no material discrepancies were noticed on such verification.

(c) According to the information and explanations given to us and the records examined by us and based on the examination of the registered conveyance deed/ approved building plan provided to us, we report that, the title deeds, comprising all the immovable properties of buildings which are freehold as at the balance sheet date, are held in the name of the Company. In respect of immovable properties of land that have been taken on lease, the lease agreements are in the name of the Company, where the Company is the lessee in the agreement.

(ii) The Company does not have any inventory and hence reporting under clause (ii) of the Order is not applicable

(iii) The Company has not granted any loans, secured or unsecured, to companies, firms, limited liability partnerships or other parties covered in the register maintained under section 189 of the Act.

(iv) In our opinion and according to the information and explanations given to us, the Company has complied with the provisions of Section 186 of the Act in respect of investments made. According to the information and explanations given to us, the Company has not granted any loan or provided any guarantees and securities.

(v) According to the information and explanations given to us, the Company has not accepted any deposits during the year and does not have any unclaimed deposits.

(vi) Having regard to the nature of the Company’s business/ activities, reporting under clause

(vi) of the Order with regard to cost records is not applicable.

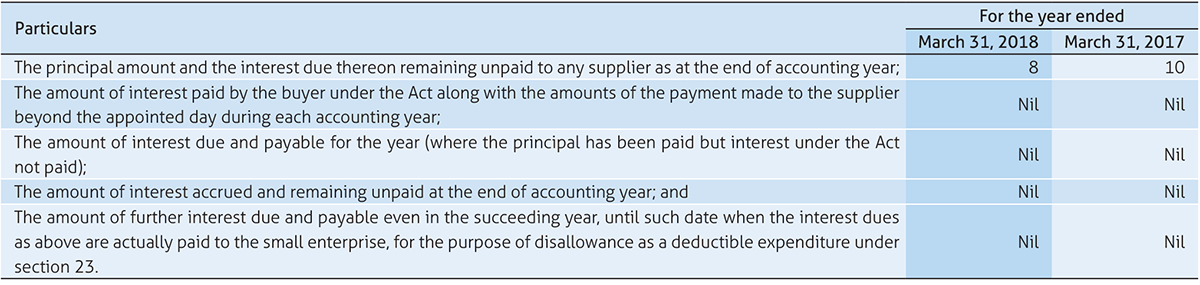

(vii) According to the information and explanations given to us, in respect of statutory dues:

(a) The Company has generally been regular in depositing undisputed statutory dues, including Provident Fund, Employees’ State Insurance, Income-tax, Goods and Services Tax, Sales Tax, Service Tax, Customs Duty, Excise Duty, Value Added Tax, Cess and other material statutory dues applicable to it to the appropriate authorities. There were no undisputed amounts payable in respect of Provident Fund, Employees’ State Insurance, Income-tax, Goods and Services Tax, Sales Tax, Service Tax, Customs Duty, Excise Duty, Value Added Tax, Cess and other material statutory dues in arrears as at March 31, 2018 for a period of more than six months from the date they became payable.

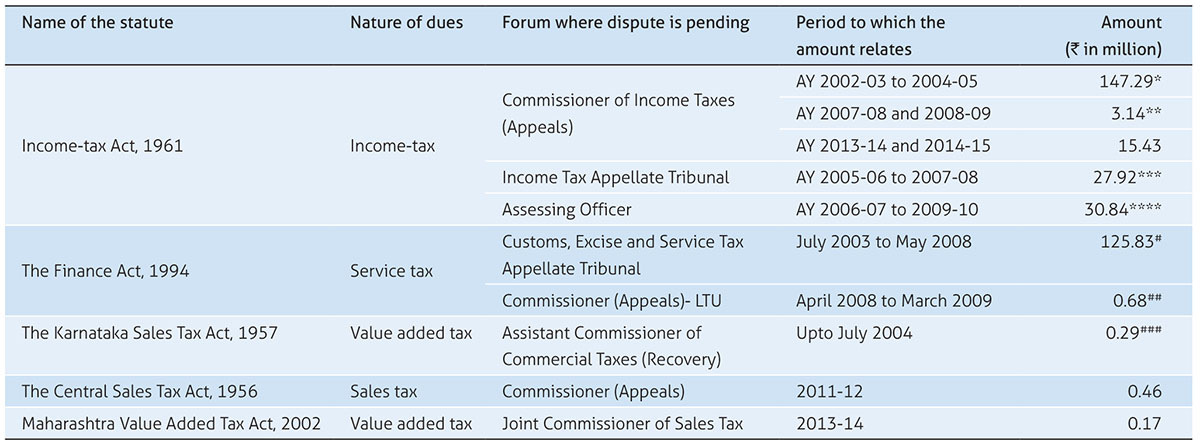

(b) Details of dues of Income-tax, Sales Tax, Service Tax, Customs Duty, Excise Duty and Value Added Tax which have not been deposited as on March 31, 2018 on account of disputes are given below:

* Net of ₹ 177.47 Mio adjusted against amount paid under protest and refunds.

** Net of ₹ 18.13 Mio adjusted against refunds.

*** Net of ₹ 33.18 Mio adjusted against amount paid under protest and refunds.

**** Net of ₹ 365.02 Mio adjusted against refunds.

# Net of ₹ 30.03 Mio adjusted against amount paid under protest.

## Net of ₹ 0.12 Mio adjusted against amount paid under protest.

### Net of ₹ 0.50 Mio adjusted against amount paid under protest.

(viii) In our opinion and according to the information and explanations given to us, the Company has not defaulted in repayment of loans to bank and government. There are no borrowings from financial institutions and the Company has not issued any debentures.

(ix) The Company has not raised moneys by way of initial public offer or further public offer (including debt instruments) or term loans and hence reporting under clause (ix) of the Order is not applicable

(x) To the best of our knowledge and according to the information and explanations given to us, no fraud by the Company and no material fraud on the Company by its officers or employees has been noticed or reported during the year

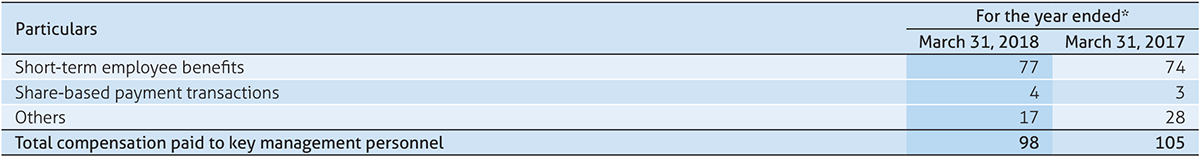

(xi) In our opinion and according to the information and explanations given to us, the Company has paid / provided managerial remuneration in accordance with the requisite approvals mandated by the provisions of section 197 read with Schedule V to the Act.

(xii) The Company is not a Nidhi Company and hence reporting under clause (xii) of the Order is not applicable

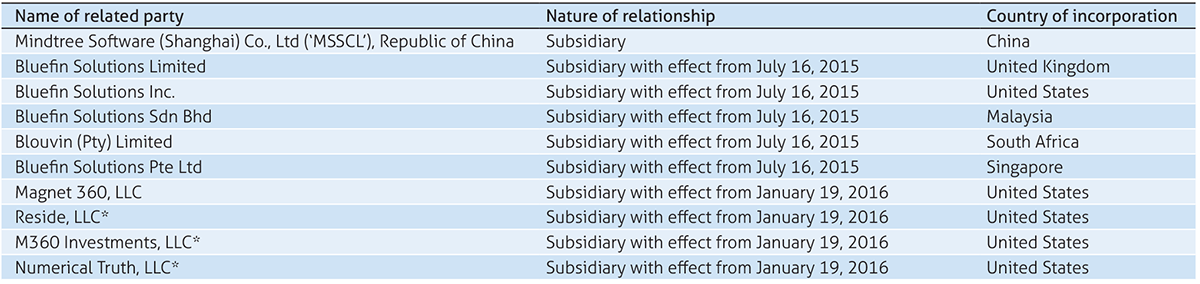

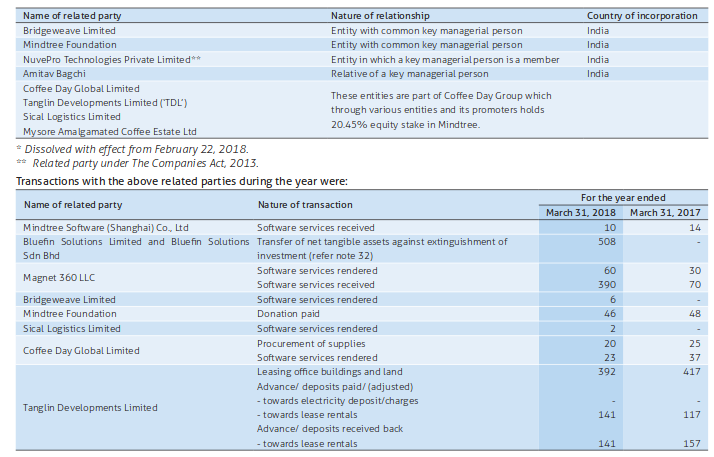

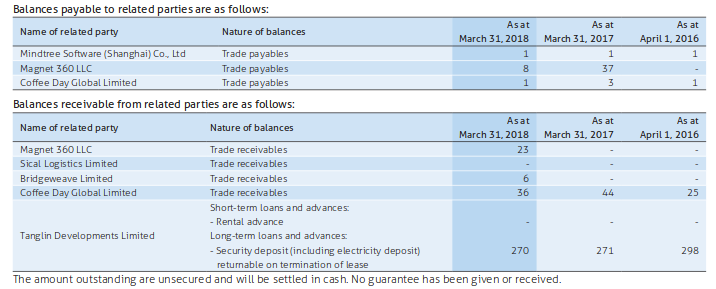

(xiii) In our opinion and according to the information and explanations given to us, the Company is in compliance with Section 177 and 188 of the Act for all transactions with the related parties and the details of related party transactions have been disclosed in the financial statements etc. as required by the applicable accounting standards

(xiv) During the year, the Company has not made any preferential allotment or private placement of shares or fully or partly convertible debentures and hence reporting under clause (xiv) of the Order is not applicable to the Company.

(xv) In our opinion and according to the information and explanations given to us, during the year the Company has not entered into any noncash transactions with its directors or directors of its subsidiaries or persons connected with them and hence provisions of section 192 of the Act are not applicable

(xvi) The Company is not required to be registered under section 45-IA of the Reserve Bank of India Act, 1934

For Deloitte Haskins & Sells

Chartered Accountants

(Firm’s Registration No. 008072S)

V. Balaji

Partner

(Membership No. 203685)

Bengaluru, April 18, 2018

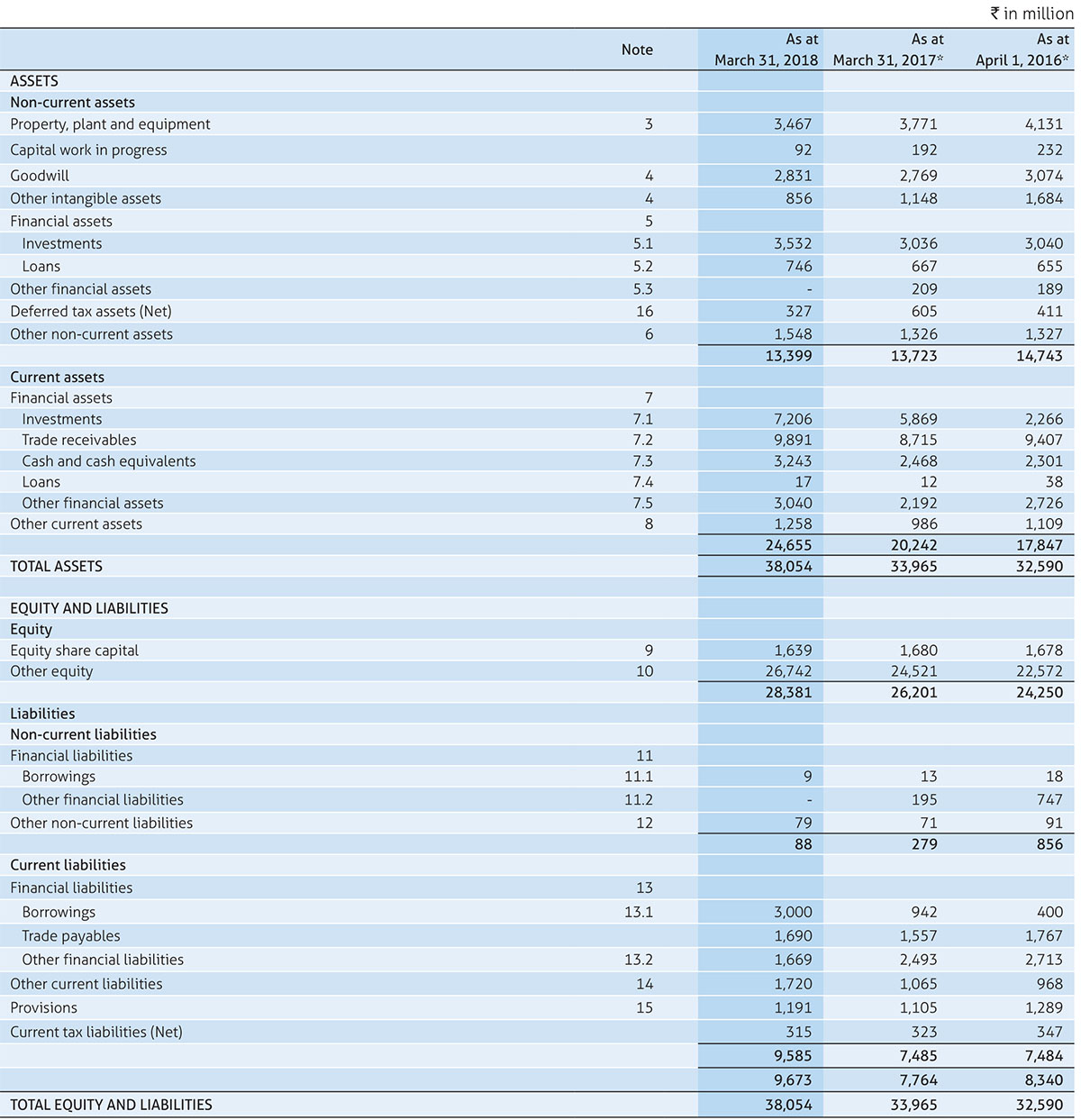

Balance Sheet

* Refer note 32

See accompanying notes to the financial statements

As per our report of even date attached

For Deloitte Haskins & Sells

Chartered Accountants

Firm’s Registration No. 008072S

V. Balaji

Partner

(Membership No. 203685)

Bengaluru, April 18, 2018

For and on behalf of the Board of Directors of Mindtree Limited

N. Krishnakumar

Chairman

Rostow Ravanan

CEO & Managing Director

Jagannathan Chakravarthi

Chief Financial Officer

Vedavalli Sridharan

Company Secretary

Place: Bengaluru

Date: April 18, 2018

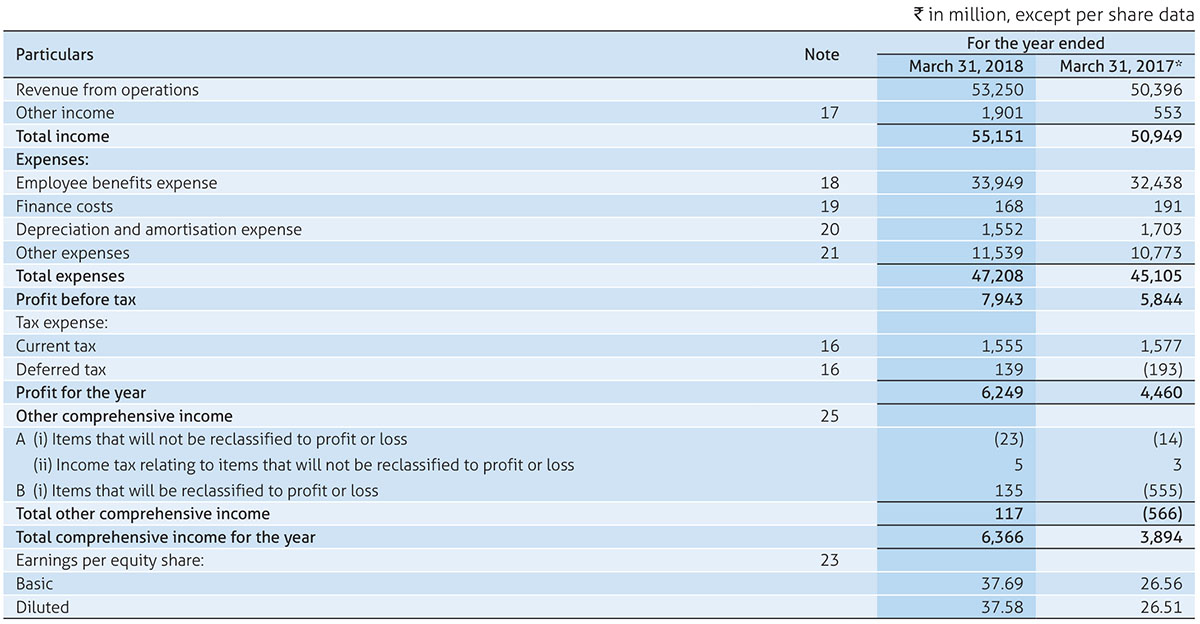

Statement of profit and loss

* Refer note 32

See accompanying notes to the financial statements

As per our report of even date attached

For Deloitte Haskins & Sells

Chartered Accountants

Firm’s Registration No. 008072S

V. Balaji

Partner

(Membership No. 203685)

Bengaluru, April 18, 2018

For and on behalf of the Board of Directors of Mindtree Limited

N. Krishnakumar

Chairman

Rostow Ravanan

CEO & Managing Director

Jagannathan Chakravarthi

Chief Financial Officer

Vedavalli Sridharan

Company Secretary

Place: Bengaluru

Date: April 18, 2018

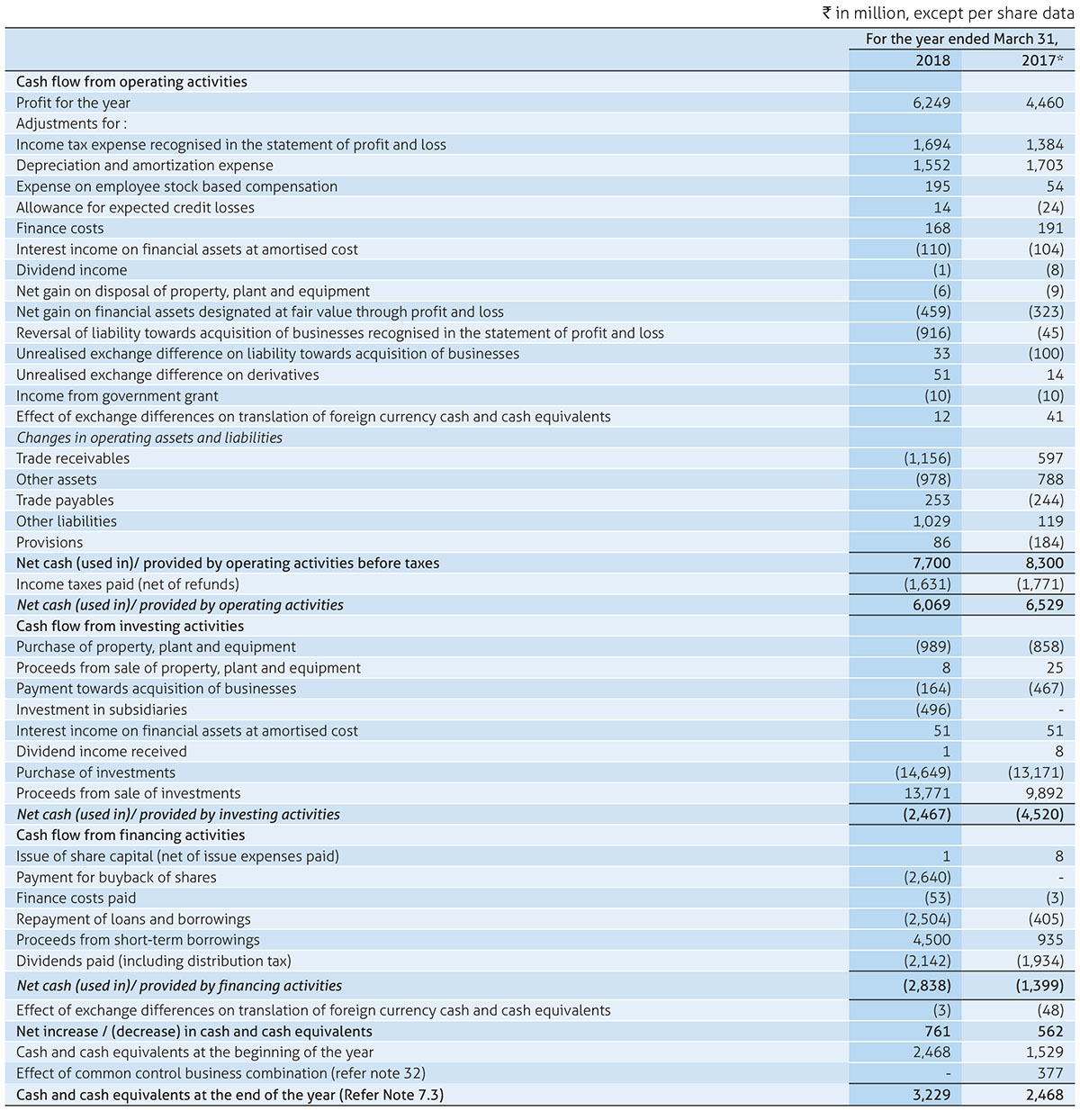

Statement of cash flows

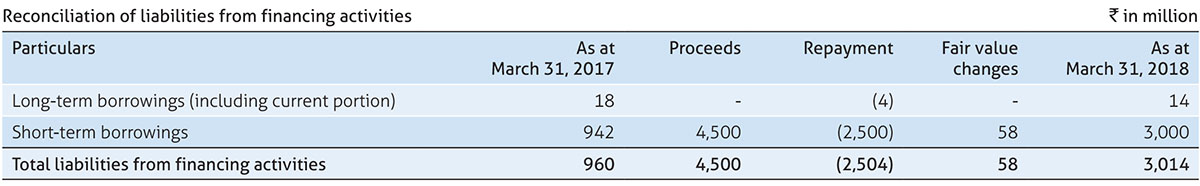

Reconciliation of liabilities from financing activities

* Refer note 32

See accompanying notes to the financial statements

As per our report of even date attached

For Deloitte Haskins & Sells

Chartered Accountants

Firm’s Registration No. 008072S

V. Balaji

Partner

(Membership No. 203685)

Bengaluru, April 18, 2018

For and on behalf of the Board of Directors of Mindtree Limited

N. Krishnakumar

Chairman

Rostow Ravanan

CEO & Managing Director

Jagannathan Chakravarthi

Chief Financial Officer

Vedavalli Sridharan

Company Secretary

Place: Bengaluru

Date: April 18, 2018

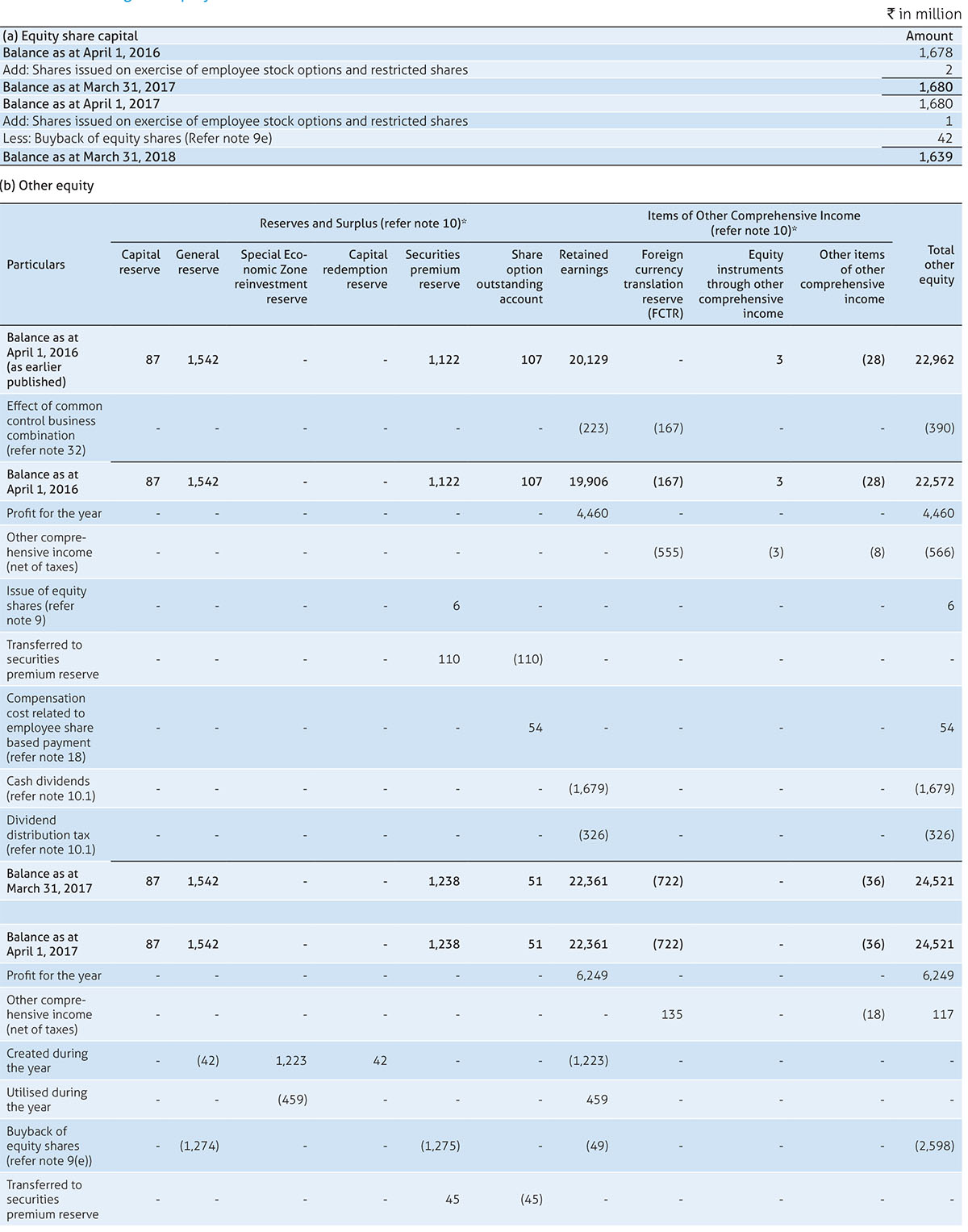

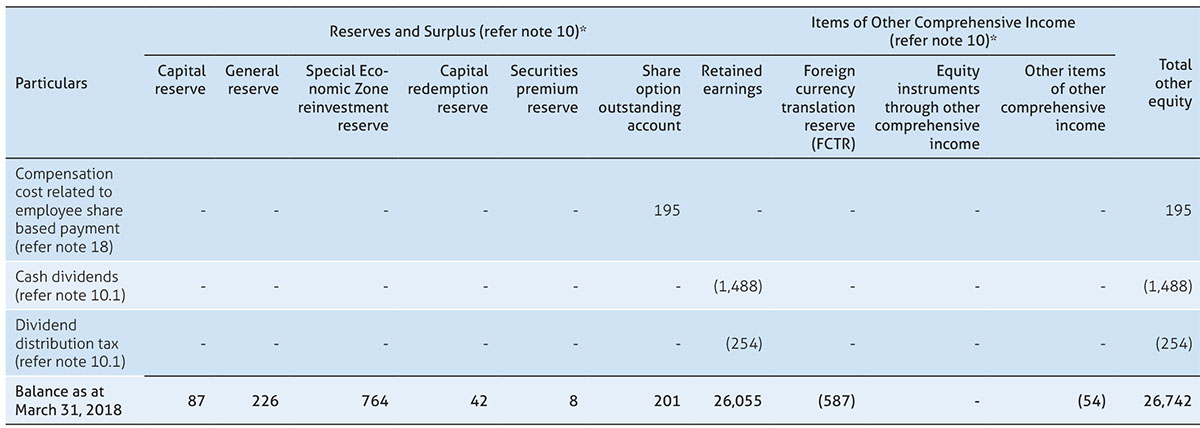

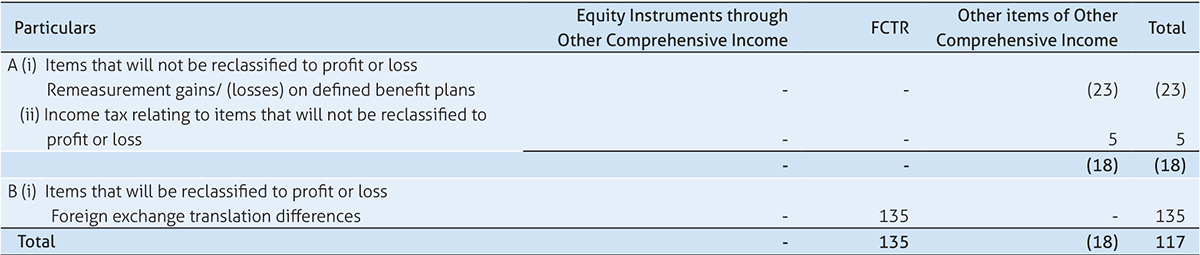

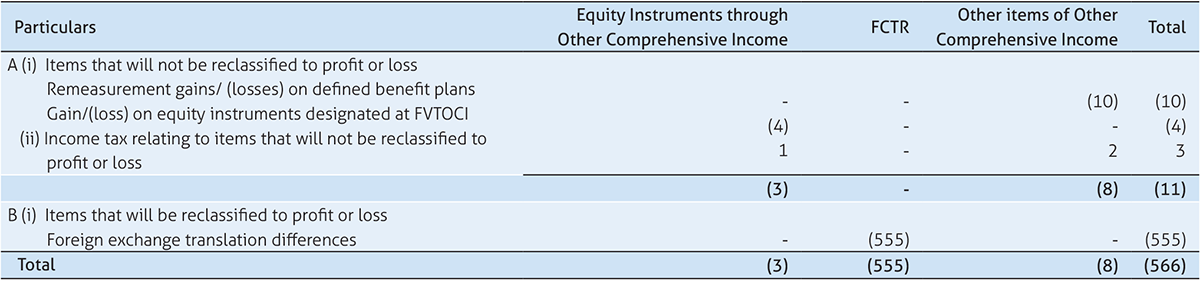

Statement of changes in equity

* Refer note 32

See accompanying notes to the financial statements

As per our report of even date attached

For Deloitte Haskins & Sells

Chartered Accountants

Firm’s Registration No. 008072S

V. Balaji

Partner

(Membership No. 203685)

Bengaluru, April 18, 2018

For and on behalf of the Board of Directors of Mindtree Limited

N. Krishnakumar

Chairman

Rostow Ravanan

CEO & Managing Director

Jagannathan Chakravarthi

Chief Financial Officer

Vedavalli Sridharan

Company Secretary

Place: Bengaluru

Date: April 18, 2018

Significant accounting policies and notes to the accounts for the year ended March 31, 2018 (₹ in millions, except share and per share data, unless otherwise stated)

1. Company overview

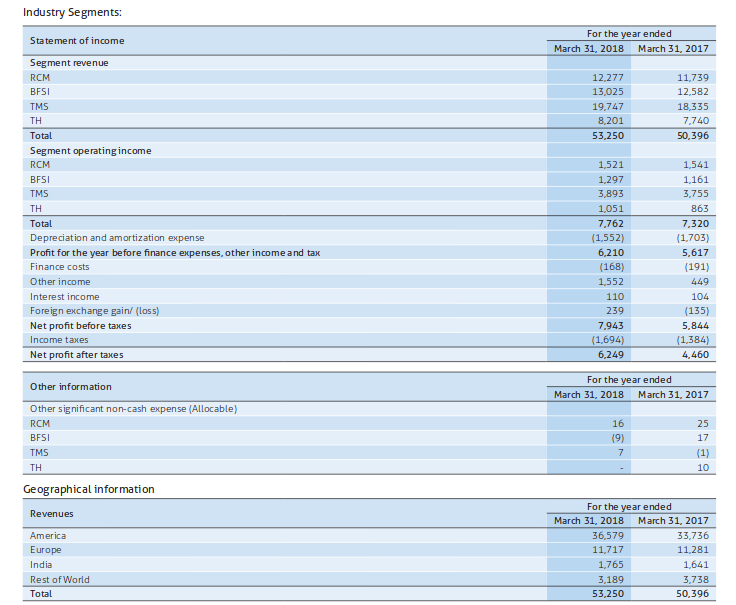

Mindtree Limited (‘Mindtree’ or ‘the Company’) is an international Information Technology consulting and implementation company that delivers business solutions through global software development. The Company is structured into four industry verticals – Retail, CPG and Manufacturing (RCM), Banking, Financial Services and Insurance (BFSI), Technology, Media and Services (TMS) and Travel and Hospitality (TH). The Company offers services in the areas of agile, analytics and information management, application development and maintenance, business process management, business technology consulting, cloud, digital business, independent testing, infrastructure management services, mobility, product engineering and SAP services.

The Company is a public limited company incorporated and domiciled in India and has its registered office at Bengaluru, Karnataka, India and has offices in India, United States of America (USA), United Kingdom, Japan, Singapore, Malaysia, Australia, Germany, Switzerland, Sweden, South Africa, UAE, Netherlands, Canada, Belgium, France, Ireland, Poland and Republic of China. The Company has its primary listings on the Bombay Stock Exchange and National Stock Exchange in India. The financial statements were authorized for issuance by the Company’s Board of Directors on April 18, 2018.

2. Significant accounting policies

2.1 Basis of preparation and presentation

a) Statement of compliance

These financial statements have been prepared in accordance with Indian Accounting Standards (“Ind AS”) notified under the Companies (Indian Accounting Standards) Rules, 2015 and Companies (Indian Accounting Standards) Amendment Rules, 2016 as applicable.

b) Basis of measurement

The financial statements have been prepared on a historical cost convention and on an accrual basis, except for the following material items that have been measured at fair value as required by relevant Ind AS:

i. Derivative financial instruments;

ii. Certain financial assets and liabilities measured at fair value (refer accounting policy on financial instruments);

iii. Share based payment transactions and

iv. Defined benefit and other long-term employee benefits.

c) Use of estimates and judgment

The preparation of financial statements in conformity with Ind AS requires management to make judgments, estimates and assumptions that affect the application of accounting policies and the reported amounts of assets, liabilities, income and expenses. Actual results may differ from these estimates.

Estimates and underlying assumptions are reviewed on a periodic basis. Revisions to accounting estimates are recognized in the period in which the estimates are revised and in any future periods affected. In particular, information about significant areas of estimation, uncertainty and critical judgments in applying accounting policies that have the most significant effect on the amounts recognized in the financial statements is included in the following notes:

i) Revenue recognition: The Company uses the percentage of completion method using the input (cost expended) method to measure progress towards completion in respect of fixed price contracts. Percentage of completion method accounting relies on estimates of total expected contract revenue and costs. This method is followed when reasonably dependable estimates of the revenues and costs applicable to various elements of the contract can be made. Key factors that are reviewed in estimating the future costs to complete include estimates of future labor costs and productivity efficiencies. Because the financial reporting of these contracts depends on estimates that are assessed continually during the term of these contracts, recognized revenue and profit are subject to revisions as the contract progresses to completion. When estimates indicate that a loss will be incurred, the loss is provided for in the period in which the loss becomes probable.

ii) Income taxes: The Company’s two major tax jurisdictions are India and the U.S., though the Company also files tax returns in other foreign jurisdictions. Significant judgments are involved in determining the provision for income taxes, including the amount expected to be paid or recovered in connection with uncertain tax positions. Also refer to note 16.

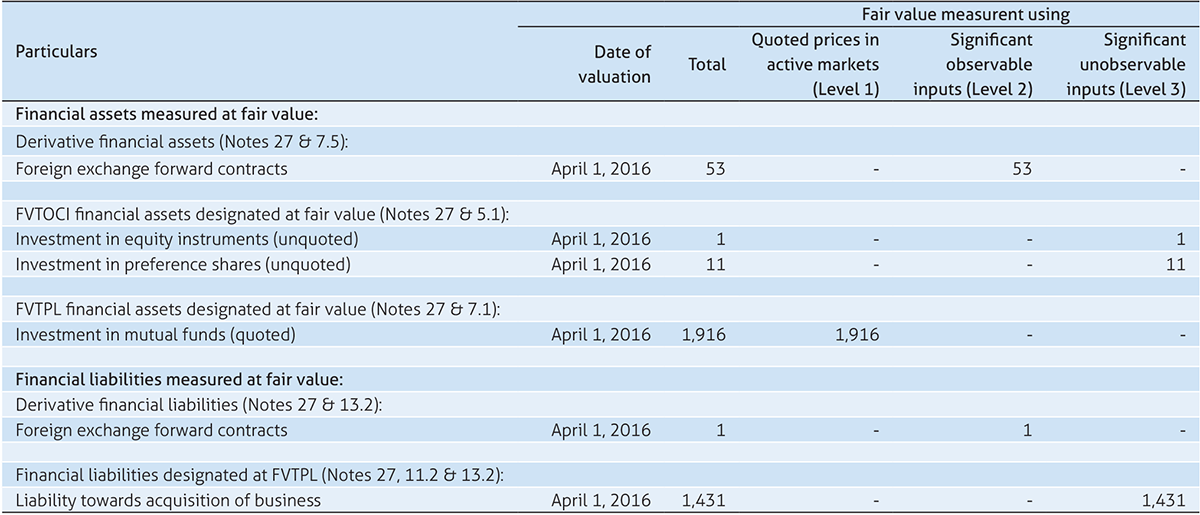

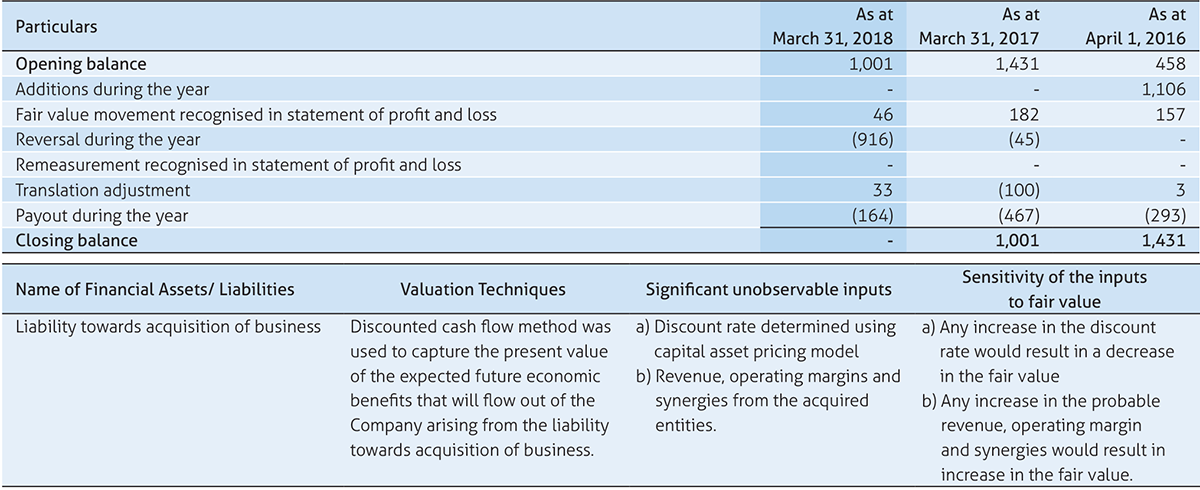

iii) Liability towards acquisition of businesses: Contingent consideration representing liability towards acquisition of business is reassessed at every reporting date. Any increase or decrease in the probability of achievement of financial targets would impact the measurement of the liability. Appropriate changes in estimates are made when the Management becomes aware of the circumstances surrounding such estimates.

iv) Other estimates: The preparation of financial statements involves estimates and assumptions that affect the reported amount of assets, liabilities, disclosure of contingent liabilities at the date of financial statements and the reported amount of revenues and expenses for the reporting period. Specifically, the Company estimates the probability of collection of accounts receivable by analyzing historical payment patterns, customer concentrations, customer credit-worthiness and current economic trends. If the financial condition of a customer deteriorates, additional allowances may be required. The stock compensation expense is determined based on the Company’s estimate of equity instruments that will eventually vest.

2.2 Summary of significant accounting policies

(i) Functional and presentation currency

Items included in the financial statements of the Company are measured using the currency of the primary economic environment in which the Company operates (i.e. the “functional currency”). The financial statements are presented in Indian Rupee, the national currency of India, which is the functional currency of the Company.

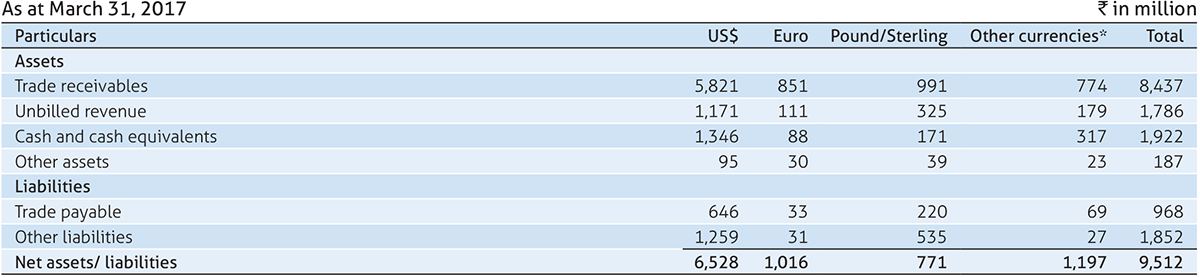

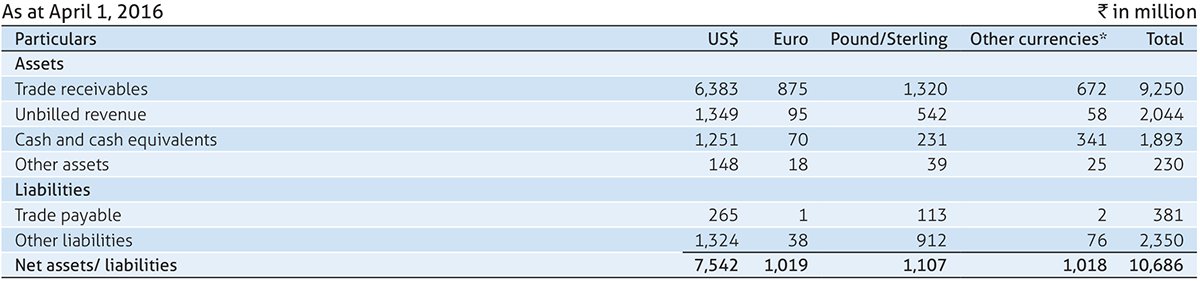

(ii) Foreign currency transactions and balances

Transactions in foreign currency are translated into the respective functional currencies using the exchange rates prevailing at the dates of the respective transactions. Foreign exchange gains and losses resulting from the settlement of such transactions and from the translation at the exchange rates prevailing at reporting date of monetary assets and liabilities denominated in foreign currencies are recognized in the statement of profit and loss and reported within foreign exchange gains/ (losses). Non-monetary assets and liabilities denominated in a foreign currency and measured at historical cost are translated at the exchange rate prevalent at the date of transaction.

(iii) Investment in subsidiaries

Investment in subsidiaries is measured at cost. Dividend income from subsidiaries is recognised when its right to receive the dividend is established.

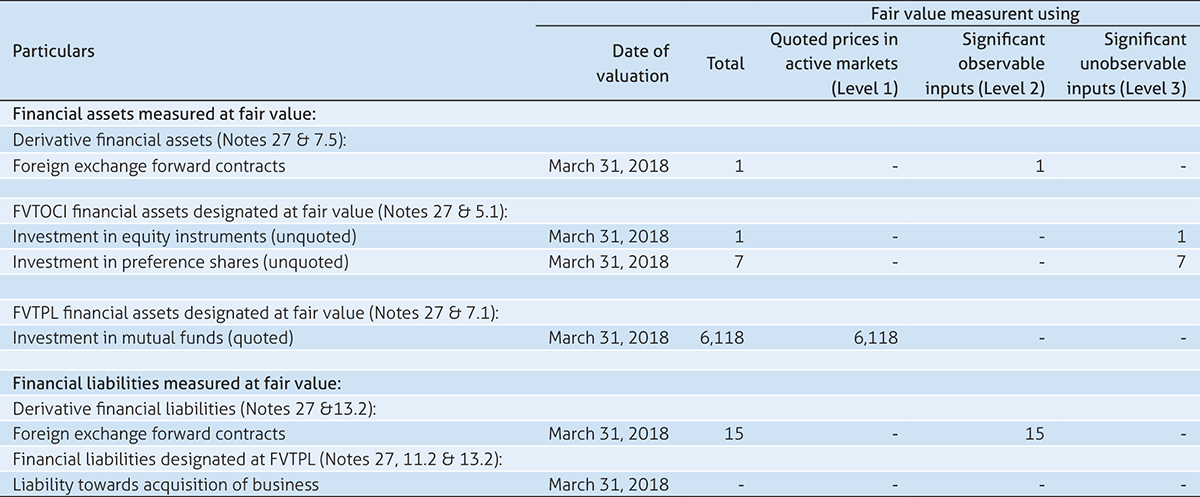

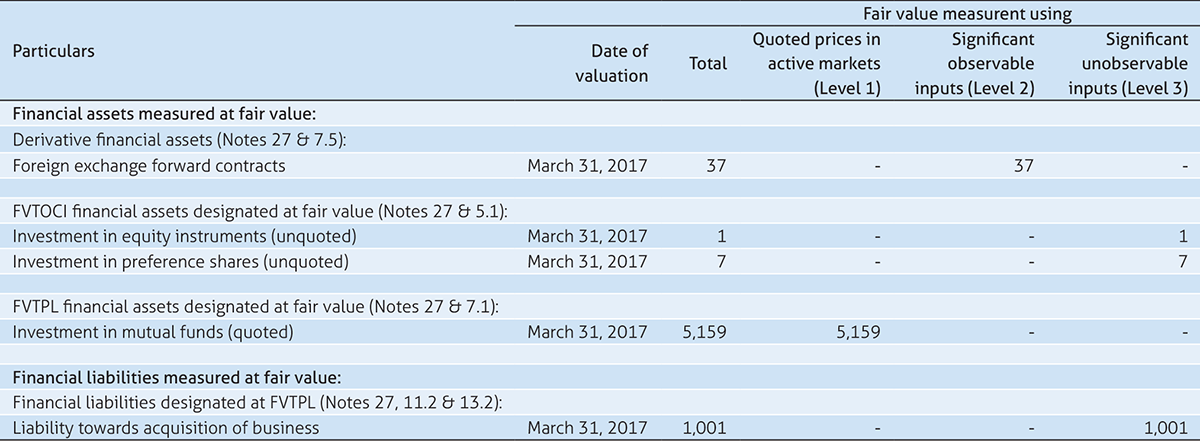

(iv) Financial instruments

All financial instruments are recognised initially at fair value. Transaction costs that are attributable to the acquisition of the financial asset (other than financial assets recorded at fair value through profit or loss) are included in the fair value of the financial assets. Purchase or sale of financial assets that require delivery of assets within a time frame established by regulation or convention in the market place (regular way trade) are recognised on trade date. While, loans and borrowings and payables are recognised net of directly attributable transaction costs.

For the purpose of subsequent measurement, financial instruments of the Company are classified in the following categories: nonderivative financial assets comprising amortised cost, debt instruments at fair value through other comprehensive income (FVTOCI), equity instruments at FVTOCI or fair value through profit and loss account (FVTPL), non derivative financial liabilities at amortised cost or FVTPL and derivative financial instruments (under the category of financial assets or financial liabilities) at FVTPL.

The classification of financial instruments depends on the objective of the business model for which it is held. Management determines the classification of its financial instruments at initial recognition.

a) Non-derivative financial assets

(i) Financial assets at amortised cost A financial asset shall be measured at amortised cost if both of the following conditions are met:

(a) the financial asset is held within a business model whose objective is to hold financial assets in order to collect contractual cash flows and

(b) the contractual terms of the financial asset give rise on specified dates to cash flows that are solely payments of principal and interest (SPPI) on the principal amount outstanding.

They are presented as current assets, except for those maturing later than 12 months after the reporting date which are presented as non-current assets. Financial assets are measured initially at fair value plus transaction costs and subsequently carried at amortized cost using the effective interest rate method, less any impairment loss.

Amortised cost are represented by trade receivables, security deposits, cash and cash equivalents, employee and other advances and eligible current and non-current assets. Cash and cash equivalents comprise cash on hand and in banks and demand deposits with banks which can be withdrawn at any time without prior notice or penalty on the principal. For the purposes of the cash flow statement, cash and cash equivalents include cash on hand, in banks and demand deposits with banks, net of outstanding bank overdrafts that are repayable on demand, book overdraft and are considered part of the Company’s cash management system.

(ii) Debt instruments at FVTOCI

A debt instrument shall be measured at fair value through other comprehensive income if both of the following conditions are met:

(a) the objective of the business model is achieved by both collecting contractual cash flows and selling financial assets and

(b) the asset’s contractual cash flow represent SPPI

Debt instruments included within FVTOCI category are measured initially as well as at each reporting period at fair value plus transaction costs. Fair value movements are recognised in other comprehensive income (OCI). However, the Company recognises interest income, impairment losses & reversals and foreign exchange gain/(loss) in statement of profit and loss. On derecognition of the asset, cumulative gain or loss previously recognised in OCI is reclassified from equity to profit and loss. Interest earned is recognised under the effective interest rate (EIR) model.

(iii) Equity instruments at FVTOCI

All equity instruments are measured at fair value. Equity instruments held for trading is classified as FVTPL. For all other equity instruments, the Company may make an irrevocable election to present subsequent changes in the fair value in OCI. The Company makes such election on an instrument-by-instrument basis.

If the Company decides to classify an equity instrument as at FVTOCI, then all fair value changes on the instrument, excluding dividend are recognised in OCI which is not subsequently recycled to statement of profit and loss.

(iv) Financial assets at FVTPL

FVTPL is a residual category for financial assets. Any financial asset which does not meet the criteria for categorization as at amortised cost or as FVTOCI, is classified as FVTPL.

In addition the Company may elect to designate the financial asset, which otherwise meets amortised cost or FVTOCI criteria, as FVTPL if doing so eliminates or significantly reduces a measurement or recognition inconsistency.

Financial assets included within the FVTPL category are measured at fair values with all changes in the statement of profit and loss.

b) Non-derivative financial liabilities

(i) Financial liabilities at amortised cost

Financial liabilities at amortised cost represented by borrowings, trade and other payables are initially recognized at fair value, and subsequently carried at amortized cost using the effective interest rate method.

(ii) Financial liabilities at FVTPL Financial liabilities at FVTPL represented by contingent consideration are measured at fair value with all changes recognised in the statement of profit and loss.

c) Derivative financial instruments

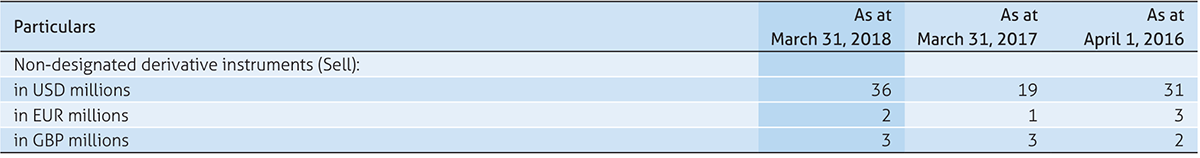

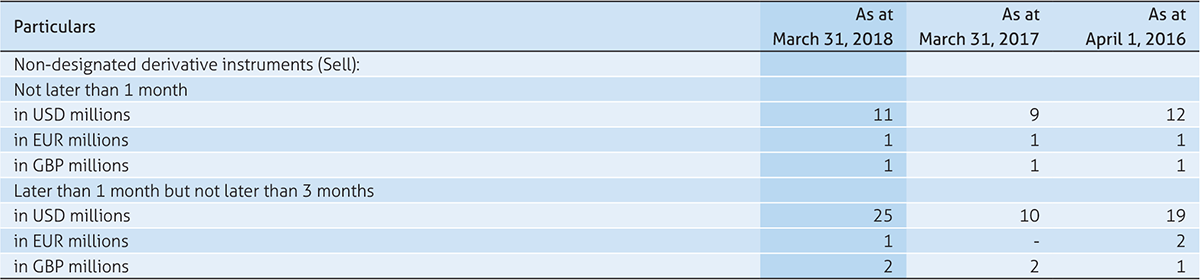

The Company holds derivative financial instruments such as foreign exchange forward contracts to mitigate the risk of changes in foreign exchange rates on foreign currency assets or liabilities and forecasted cash flows denominated in foreign currencies. The counterparty for these contracts is generally a bank.

Derivatives are recognized and measured at fair value. Attributable transaction costs are recognized in statement of profit and loss.

(i) Cash flow hedges: Changes in the fair value of the derivative hedging instrument designated as a cash flow hedge are recognized in other comprehensive income and presented within equity in the cash flow hedging reserve to the extent that the hedge is effective.

To the extent that the hedge is ineffective, changes in fair value are recognized in the statement of profit and loss. If the hedging instrument no longer meets the criteria for hedge accounting, expires or is sold, terminated or exercised, then hedge accounting is discontinued prospectively. The cumulative gain or loss previously recognized in the cash flow hedging reserve is transferred to the statement of profit and loss upon the occurrence of the related forecasted transaction.

(ii) Others: Changes in fair value of foreign currency derivative instruments not designated as cash flow hedges and the ineffective portion of cash flow hedges are recognized in the statement of profit and loss and reported within foreign exchange gains/(losses).

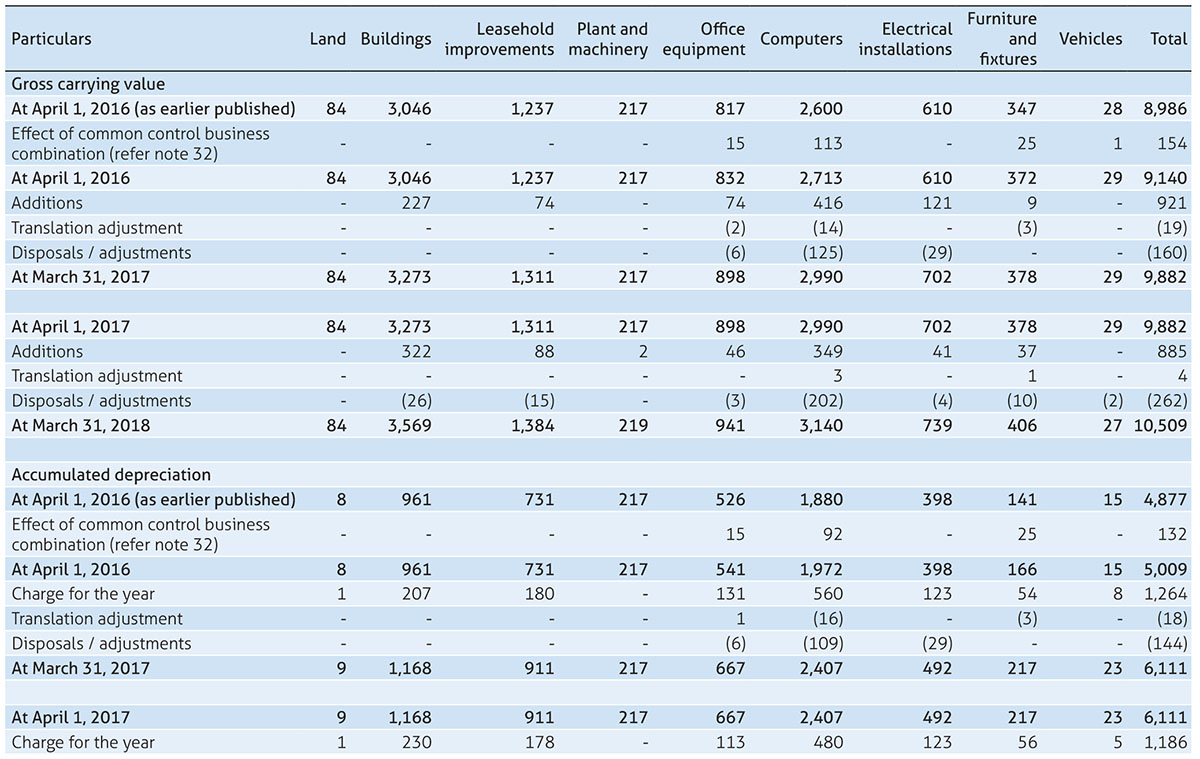

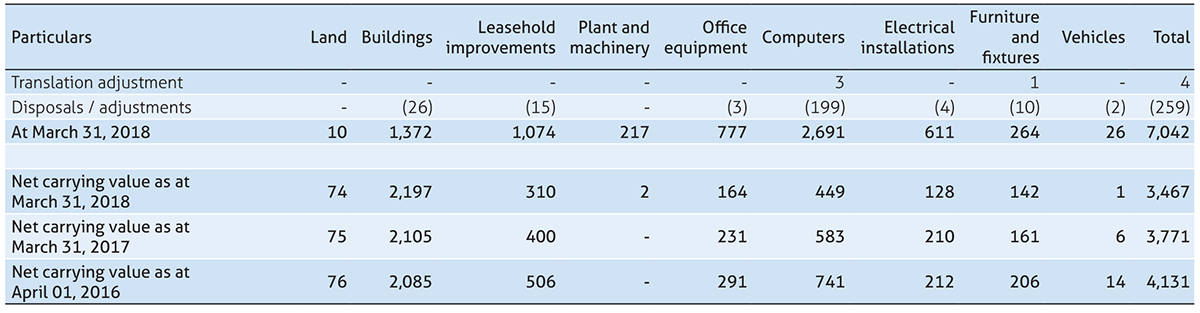

(v) Property, plant and equipment

a) Recognition and measurement: Property, plant and equipment are measured at cost less accumulated depreciation and impairment losses, if any. Cost includes expenditures directly attributable to the acquisition of the asset.

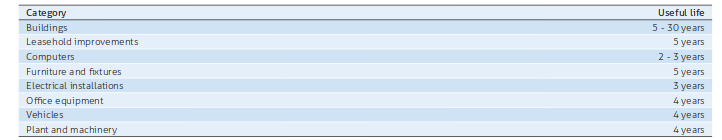

b) Depreciation: The Company depreciates property, plant and equipment over the estimated useful life on a straight-line basis from the date the assets are ready for intended use. Assets acquired under finance lease and leasehold improvements are amortized over the lower of estimated useful life and lease term. The estimated useful lives of assets for the current and comparative period of significant items of property, plant and equipment are as follows:

Depreciation methods, useful lives and residual values are reviewed at each reporting date.

When parts of an item of property, plant and equipment have different useful lives, they are accounted for as separate items (major components) of property, plant and equipment. Subsequent expenditure relating to property, plant and equipment is capitalized only when it is probable that future economic benefits associated with these will flow to the Company and the cost of the item can be measured reliably. Repairs and maintenance costs are recognized in the statement of profit and loss when incurred. The cost and related accumulated depreciation are eliminated from the financial statements upon sale or disposition of the asset and the resultant gains or losses are recognized in the statement of profit and loss.

Amounts paid towards the acquisition of property, plant and equipment outstanding as of each reporting date and the cost of property, plant and equipment not ready for intended use before such date are disclosed under capital advances and capital work- in-progress respectively.

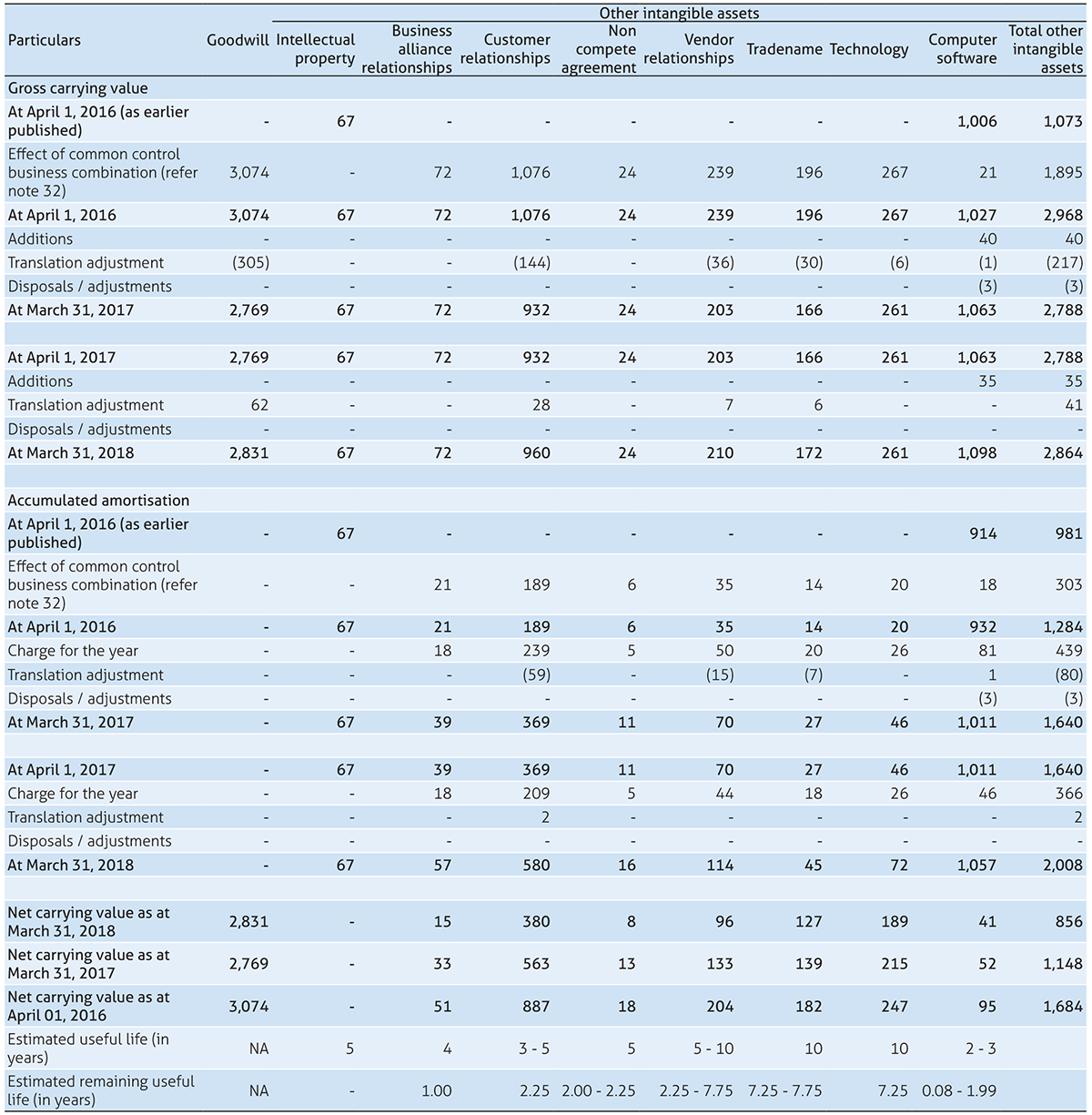

(vi) Intangible assets

Intangible assets are stated at cost less accumulated amortization and impairment. Intangible assets are amortized over their respective estimated useful lives on a straightline basis, from the date that they are available for use. The estimated useful life of an identifiable intangible asset is based on a number of factors including the effects of obsolescence, demand, competition and other economic factors (such as the stability of the industry and known technological advances)and the level of maintenance expenditures required to obtain the expected future cash flows from the asset.

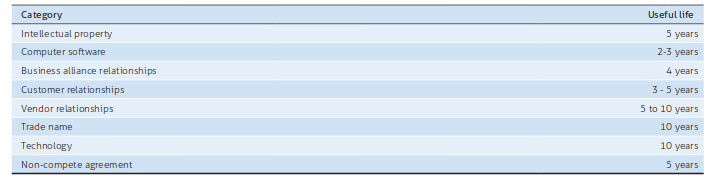

The estimated useful lives of intangibles are as follows:

(vii) Business combination, Goodwill and Intangible assets

Business combinations are accounted for using the purchase (acquisition) method. The cost of an acquisition is measured as the fair value of the assets given, equity instruments issued and liabilities incurred or assumed at the date of exchange. The cost of acquisition also includes the fair value of any contingent consideration. Identifiable assets acquired and liabilities and contingent liabilities assumed in a business combination are measured initially at their fair value on the date of acquisition.

Transaction costs incurred in connection with a business combination are expensed as incurred.

a) Goodwill

The excess of the cost of acquisition over the Company’s share in the fair value of the acquiree’s identifiable assets, liabilities and contingent liabilities is recognized as goodwill. If the excess is negative, a bargain purchase gain is recognized in capital reserve.

b) Intangible assets

Ind AS 103 requires the identifiable intangible assets and contingent consideration to be fair valued in order to ascertain the net fair value of identifiable assets, liabilities and contingent liabilities of the acquiree. Significant estimates are required to be made in determining the value of contingent consideration and intangible assets. These valuations are conducted by independent valuation experts.

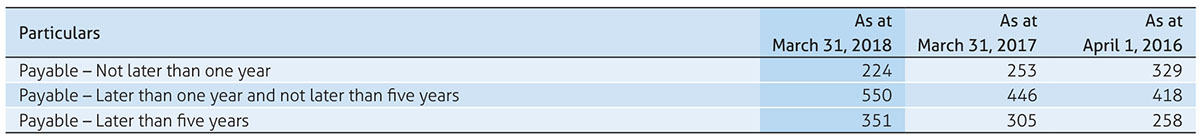

(viii) Leases

Leases under which the Company assumes substantially all the risks and rewards of ownership are classified as finance leases. When acquired, such assets are capitalized at fair value or present value of the minimum lease payments at the inception of the lease, whichever is lower. Lease payments under operating leases are recognised as an expense on a straight line basis in the statement of profit and loss over the lease term except where the lease payments are structured to increase in line with expected general inflation.

(ix) Impairment

a) Financial assets

In accordance with Ind AS 109, the Company applies expected credit loss (ECL) model for measurement and recognition of impairment loss. The Company follows ‘simplified approach’ for recognition of impairment loss allowance on trade receivable.

The application of simplified approach does not require the Company to track changes in credit risk. Rather, it recognises impairment loss allowance based on lifetime ECLs at each reporting date, right from its initial recognition.

For recognition of impairment loss on other financial assets and risk exposure, the Company determines that whether there has been a significant increase in the credit risk since initial recognition. If credit risk has not increased significantly, 12-month ECL is used to provide for impairment loss. However, if credit risk has increased significantly, lifetime ECL is used. If in subsequent period, credit quality of the instrument improves such that there is no longer a significant increase in credit risk since initial recognition, then the entity reverts to recognising impairment loss allowance based on 12-month ECL.

Lifetime ECLs are the expected credit losses resulting from all possible default events over the expected life of a financial instrument. The 12-month ECL is a portion of the lifetime ECL which results from default events that are possible within 12-months after the reporting date. ECL is the difference between all contractual cash flows that are due to the Company in accordance with the contract and all the cash flows that the entity expects to receive (i.e. all shortfalls), discounted at the original EIR. When estimating the cash flows, an entity is required to consider:

(i) All contractual terms of the financial instrument (including prepayment, extension etc.) over the expected life of the financial instrument. However, in rare cases when the expected life of the financial instrument cannot be estimated reliably, then the entity is required to use the remaining contractual term of the financial instrument.

(ii) Cash flows from the sale of collateral held or other credit enhancements that are integral to the contractual terms.

As a practical expedient, the Company uses a provision matrix to determine impairment loss on portfolio of its trade receivable. The provision matrix is based on its historically observed default rates over the expected life of the trade receivable and is adjusted for forward-looking estimates. At every reporting date, the historically observed default rates are updated and changes in forward-looking estimates are analysed.

ECL impairment loss allowance (or reversal) recognised during the period is recognised as income/expense in the statement of profit and loss. The balance sheet presentation for various financial instruments is described below:

Financial assets measured at amortised cost, contractual revenue receivable: ECL is presented as an allowance, i.e. as an integral part of the measurement of those assets in the balance sheet. The allowance reduces the net carrying amount. Until the asset meets write off criteria, the Company does not reduce impairment allowance from the gross carrying amount.

b) Non-financial assets

The Company assesses at each reporting date whether there is any objective evidence that a non financial asset or a group of non financial assets is impaired. If any such indication exists, the Company estimates the amount of impairment loss.

An impairment loss is calculated as the difference between an asset’s carrying amount and recoverable amount. Losses are recognised in profit or loss and reflected in an allowance account. When the Company considers that there are no realistic prospects of recovery of the asset, the relevant amounts are written off. If the amount of impairment loss subsequently decreases and the decrease can be related objectively to an event occurring after the impairment was recognised, then the previously recognised impairment loss is reversed through profit or loss.

The recoverable amount of an asset or cash-generating unit (as defined below) is the greater of its value in use and its fair value less costs to sell. In assessing value in use, the estimated future cash flows are discounted to their present value using a pre-tax discount rate that reflects current market assessments of the time value of money and the risks specific to the asset. For the purpose of impairment testing, assets are grouped together into the smallest group of assets that generates cash inflows from continuing use that are largely independent of the cash inflows of other assets or groups of assets (the “cash-generating unit”).

Goodwill is tested for impairment on an annual basis and whenever there is an indication that goodwill may be impaired, relying on a number of factors including operating results, business plans and future cash flows. For the purpose of impairment testing, goodwill acquired in a business combination is allocated to the Group’s cash generating units(CGU) or groups of CGU’s expected to benefit from the synergies arising from the business combination. A CGU is the smallest identifiable group of assets that generates cash inflows that are largely independent of the cash inflows from other assets or group of assets. Impairment occurs when the carrying amount of a CGU including the goodwill, exceeds the estimated recoverable amount of the CGU. The recoverable amount of a CGU is the higher of its fair value less cost to sell and its value-in-use. Value-in-use is the present value of future cash flows expected to be derived from the CGU.

Total impairment loss of a CGU is allocated first to reduce the carrying amount of goodwill allocated to the CGU and then to the other assets of the CGU prorata on the basis of the carrying amount of each asset in the CGU. An impairment loss on goodwill is recognised in statement of profit and loss and is not reversed in the subsequent period.

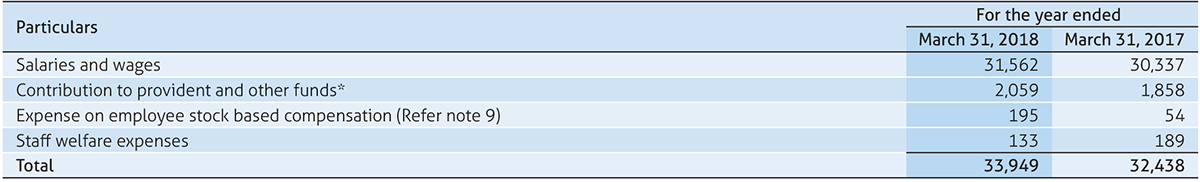

(x) Employee Benefits

The Company participates in various employee benefit plans. Post-employment benefits are classified as either defined contribution plans or defined benefit plans. Under a defined contribution plan, the Company’s only obligation is to pay a fixed amount with no obligation to pay further contributions if the fund does not hold sufficient assets to pay all employee benefits. The related actuarial and investment risks fall on the employee. The expenditure for defined contribution plans is recognized as expense during the period when the employee provides service. Under a defined benefit plan, it is the Company’s obligation to provide agreed benefits to the employees. The related actuarial and investment risks fall on the Company. The present value of the defined benefit obligations is calculated using the projected unit credit method.

The Company has the following employee benefit plans: a) Social security plans

Employees contributions payable to the social security plan, which is a defined contribution scheme, are charged to the statement of profit and loss in the period in which the employee renders services.

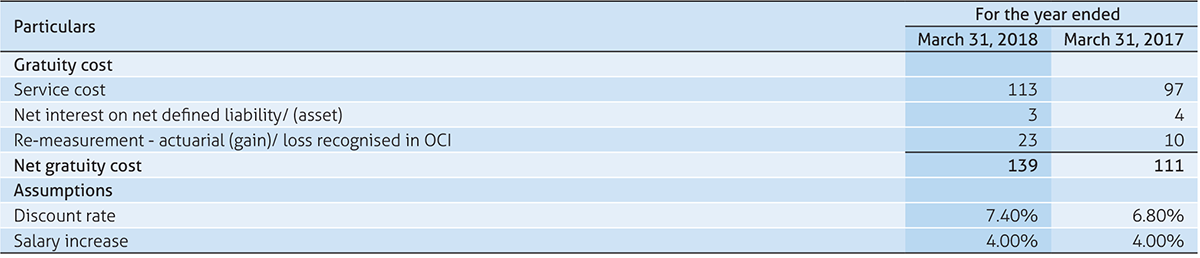

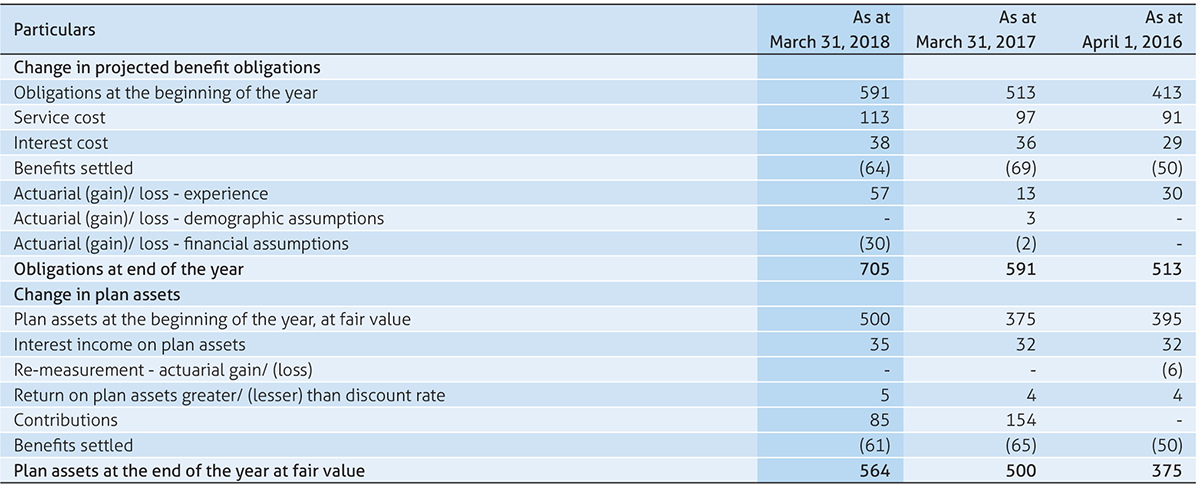

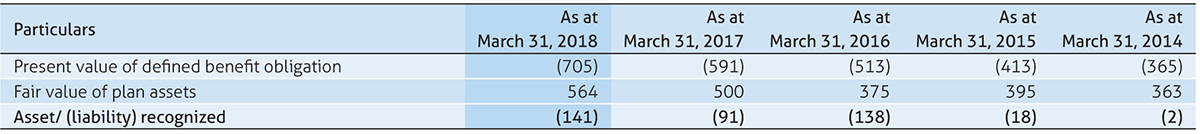

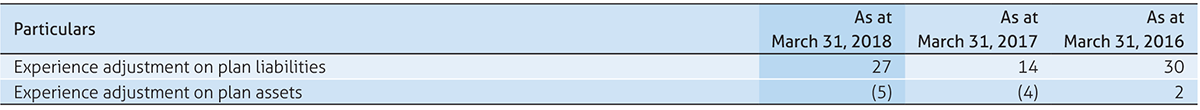

b) Gratuity

In accordance with the Payment of Gratuity Act, 1972, the Company provides for a lump sum payment to eligible employees, at retirement or termination of employment based on the last drawn salary and years of employment with the Company. The gratuity fund is managed by the Life Insurance Corporation of India (LIC), ICICI Prudential Life Insurance Company and SBI Life Insurance Company. The Company’s obligation in respect of the gratuity plan, which is a defined benefit plan, is provided for based on actuarial valuation using the projected unit credit method.

Actuarial gains or losses are recognized in other comprehensive income. Further, the profit or loss does not include an expected return on plan assets. Instead net interest recognized in profit or loss is calculated by applying the discount rate used to measure the defined benefit obligation to the net defined benefit liability or asset. The actual return on the plan assets above or below the discount rate is recognized as part of re-measurement of net defined liability or asset through other comprehensive income. Remeasurements comprising actuarial gains or losses and return on plan assets (excluding amounts included in net interest on the net defined benefit liability) are not reclassified to profit or loss in subsequent periods.

c) Compensated absences

The employees of the Company are entitled to compensated absences. The employees can carry forward a portion of the unutilised accumulating compensated absences and utilise it in future periods or receive cash at retirement or termination of employment. The Company records an obligation for compensated absences in the period in which the employee renders the services that increases this entitlement. The Company measures the expected cost of compensated absences as the additional amount that the Company expects to pay as a result of the unused entitlement that has accumulated at the end of the reporting period. The Company recognizes accumulated compensated absences based on actuarial valuation. Non-accumulating compensated absences are recognized in the period in which the absences occur. The Company recognizes actuarial gains and losses immediately in the statement of profit and loss.

(xi) Share based payments

Employees of the Company receive remuneration in the form of equity settled instruments, for rendering services over a defined vesting period. Equity instruments granted are measured by reference to the fair value of the instrument at the date of grant. The expense is recognized in the statement of profit and loss with a corresponding increase to the share based payment reserve, a component of equity.

The equity instruments generally vest in a graded manner over the vesting period. The fair value determined at the grant date is expensed over the vesting period of the respective tranches of such grants (accelerated amortization). The stock compensation expense is determined based on the Company’s estimate of equity instruments that will eventually vest. The fair value of the amount payable to the employees in respect of phantom stocks, which are settled in cash, is recognized as an expense with a corresponding increase in liabilities, over the period during which the employees become unconditionally entitled to payment.

The liability is remeasured at each reporting date and at settlement date based on the fair value of the phantom stock options plan. Any changes in the liability are recognized in statement of profit and loss.

(xii) Provisions

Provisions are recognized when the Company has a present obligation (legal or constructive) as a result of a past event, it is probable that an outflow of economic benefits will be required to settle the obligation, and a reliable estimate can be made of the amount of the obligation.

The amount recognized as a provision is the best estimate of the consideration required to settle the present obligation at the end of the reporting period, taking into account the risks and uncertainties surrounding the obligation. When some or all of the economic benefits required to settle a provision are expected to be recovered from a third party, the receivable is recognized as an asset, if it is virtually certain that reimbursement will be received and the amount of the receivable can be measured reliably.

Provisions for onerous contracts are recognized when the expected benefits to be derived by the Company from a contract are lower than the unavoidable costs of meeting the future obligations under the contract. Provisions for onerous contracts are measured at the present value of lower of the expected net cost of fulfilling the contract and the expected cost of terminating the contract.

(xiii) Revenue

The Company derives revenue primarily from software development and related services. The Company recognizes revenue when the significant terms of the arrangement are enforceable, services have been delivered and the collectability is reasonably assured. The method for recognizing revenues and costs depends on the nature of the services rendered:

a) Time and materials contracts Revenues and costs relating to time and materials contracts are recognized as the related services are rendered.

b) Fixed-price contracts

Revenues from fixed-price contracts are recognized using the “percentage-of-completion” method. Percentage of completion is determined based on project costs incurred to date as a percentage of total estimated project costs required to complete the project. The cost expended (or input) method has been used to measure progress towards completion as there is a direct relationship between input and productivity.

If the Company does not have a sufficient basis to measure the progress of completion or to estimate the total contract revenues and costs, revenue is recognized only to the extent of contract cost incurred for which recoverability is probable.

When total cost estimates exceed revenues in an arrangement, the estimated losses are recognized in the statement of profit and loss in the period in which such losses become probable based on the current contract estimates. ‘Unbilled revenues’ represent cost and earnings in excess of billings as at the end of the reporting period.

‘Unearned revenues’ represent billing in excess of revenue recognized. Advance payments received from customers for which no services are rendered are presented as ‘Advance from customers’.

c) Maintenance contracts

Revenue from maintenance contracts is recognized ratably over the period of the contract. When services are performed through an indefinite number of repetitive acts over a specified period of time, revenue is recognized on a straight line basis over the specified period or under some other method that better represents the stage of completion.

In arrangements for software development and related services and maintenance services, the Company has applied the guidance in Ind AS 18, Revenue, by applying the revenue recognition criteria for each separately identifiable component of a single transaction. The arrangements generally meet the criteria for considering software development and related services as separately identifiable components. For allocating the consideration, the Company has measured the revenue in respect of each separable component of a transaction at its fair value, in accordance with principles given in Ind AS 18.

The Company accounts for volume discounts and pricing incentives to customers by reducing the amount of revenue recognized at the time of sale. Revenues are shown net of sales tax, value added tax, service tax, goods and services tax and applicable discounts and allowances.

The Company accrues the estimated cost of post contract support services at the time when the revenue is recognized. The accruals are based on the Company’s historical experience of material usage and service delivery costs.

(xiv) Warranty provisions

The Company provides warranty provisions on all its products sold. A liability is recognised at the time the product is sold. The Company does not provide extended warranties or maintenance contracts to its customers.

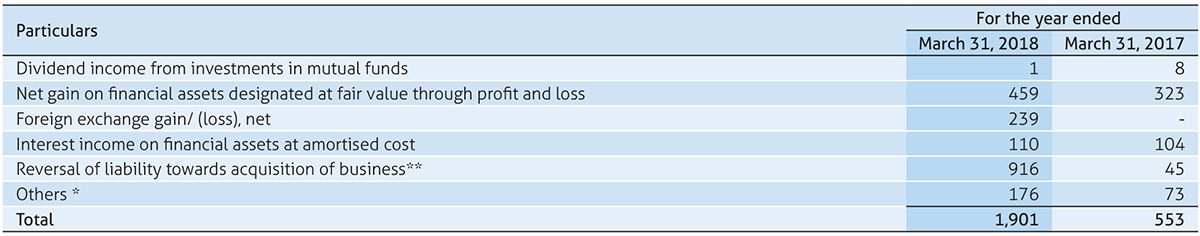

(xv) Finance income and expense

Finance income consists of interest income on funds invested, dividend income and gains on the disposal of FVTPL financial assets. Interest income is recognized as it accrues in the statement of profit and loss, using the effective interest method.

Dividend income is recognized in the statement of profit and loss on the date that the Company’s right to receive payment is established. Finance expenses consist of interest expense on loans and borrowings. Borrowing costs are recognized in the statement of profit and loss using the effective interest method. Foreign currency gains and losses are reported on a net basis. This includes changes in the fair value of foreign exchange derivative instruments, which are accounted at fair value through profit or loss.

(xvi) Income tax

Income tax comprises current and deferred tax. Income tax expense is recognized in the statement of profit and loss except to the extent it relates to items directly recognized in equity or in other comprehensive income.

a) Current income tax

Current income tax for the current and prior periods are measured at the amount expected to be recovered from or paid to the taxation authorities based on the taxable income for the period. The tax rates and tax laws used to compute the current tax amount are those that are enacted or substantively enacted by the reporting date and applicable for the period. The Company offsets current tax assets and current tax liabilities, where it has a legally enforceable right to set off the recognized amounts and where it intends either to settle on a net basis or to realize the asset and liability simultaneously.

b) Deferred income tax

Deferred income tax is recognized using the balance sheet approach. Deferred income tax assets and liabilities are recognized for deductible and taxable temporary differences arising between the tax base of assets and liabilities and their carrying amount in financial statements, except when the deferred income tax arises from the initial recognition of goodwill or an asset or liability in a transaction that is not a business combination and affects neither accounting nor taxable profits or loss at the time of the transaction.

Deferred income tax asset is recognized to the extent that it is probable that taxable profit will be available against which the deductible temporary differences, and the carry forward of unused tax credits and unused tax losses can be utilized.

Deferred income tax liabilities are recognized for all taxable temporary differences. The carrying amount of deferred income tax assets is reviewed at each reporting date and reduced to the extent that it is no longer probable that sufficient taxable profit will be available to allow all or part of the deferred income tax asset to be utilized. Deferred income tax assets and liabilities are measured at the tax rates that are expected to apply in the period when the asset is realized or the liability is settled, based on tax rates (and tax laws) that have been enacted or substantively enacted at the reporting date.

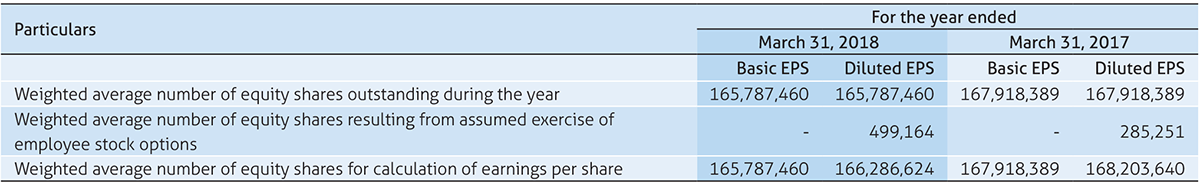

(xvii) Earnings per share (EPS)

Basic earnings per share is computed using the weighted average number of equity shares outstanding during the period. Diluted EPS is computed by dividing the net profit after tax by the weighted average number of equity shares considered for deriving basic EPS and also weighted average number of equity shares that could have been issued upon conversion of all dilutive potential equity shares. Dilutive potential equity shares are deemed converted as of the beginning of the period, unless issued at a later date. Dilutive potential equity shares are determined independently for each period presented. The number of equity shares and potentially dilutive equity shares are adjusted for bonus shares, as appropriate.

(xviii) Research and development costs

Research costs are expensed as incurred. Development costs are expensed as incurred unless technical and commercial feasibility of the project is demonstrated, future economic benefits are probable, the Company has an intention and ability to complete and use or sell the software and the costs can be measured reliably.

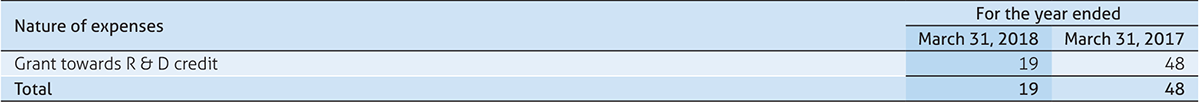

(xix) Government grants

Grants from the government are recognised when there is reasonable assurance that:

(i) the Company will comply with the conditions attached to them; and

(ii) the grant will be received.

Government grants related to revenue are recognised on a systematic basis in the statement of profit and loss over the periods necessary to match them with the related costs which they are intended to compensate. Such grants are deducted in reporting the related expense. When the grant relates to an asset, it is recognized as income over the expected useful life of the asset.

Where the Company receives non-monetary grants, the asset is accounted for on the basis of its acquisition cost. In case a non-monetary asset is given free of cost it is recognised at a fair value. When loan or similar assistance are provided by government or related institutions, with an interest rate below the current applicable market rate, the effect of this favourable interest is recognized as government grant. The loan or assistance is initially recognized and measured at fair value and the government grant is measured as the difference between the initial carrying value of the loan and the proceeds received.

New standards and interpretations not yet adopted

Appendix B to Ind AS 21, Foreign currency transactions and advance consideration:

On March 28, 2018, Ministry of Corporate Affairs (“MCA”) has notified the Companies (Indian Accounting Standards) Amendment Rules, 2018 containing Appendix B to Ind AS 21, Foreign currency transactions and advance consideration which clarifies the date of the transaction for the purpose of determining the exchange rate to use on initial recognition of the related asset, expense or income, when an entity has received or paid advance consideration in a foreign currency. The amendment will come into force from April 1, 2018. The Company is evaluating the effect of this on the financial statements.

Ind AS 115- Revenue from Contract with Customers: On March 28, 2018, the Ministry of Corporate Affairs notified Ind AS 115 Revenue from Contracts with Customers. The standard replaces Ind AS 11 Construction Contracts and Ind AS 18 Revenue.

The new standard applies to contracts with customers. The core principle of the new standard is that an entity should recognize revenue to depict transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. Further, the new standard requires enhanced disclosures about the nature, timing and uncertainty of revenues and cash flows arising from the entity’s contracts with customers. The new standard offers a range of transition options. An entity can choose to apply the new standard to its historical transactions and retrospectively adjust each comparative period. Alternatively, an entity can recognize the cumulative effect of applying the new standard at the date of initial application - and make no adjustments to its comparative information. The chosen transition option can have a significant effect on revenue trends in the financial statements. A change in the timing of revenue recognition may require a corresponding change in the timing of recognition of related costs. The standard is effective for annual periods beginning on or after 1 April 2018. The Company is currently evaluating the requirements of Ind AS 115, and has not yet determined the impact on the financial statements.

Non-current assets

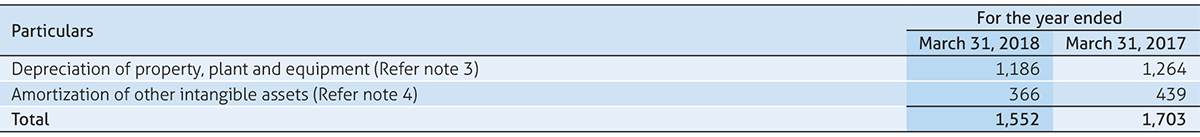

3. Property, plant and equipment

Non-current assets

4. a) Goodwill and other intangible assets

4. Goodwill and other intangible assets

b) Impairment

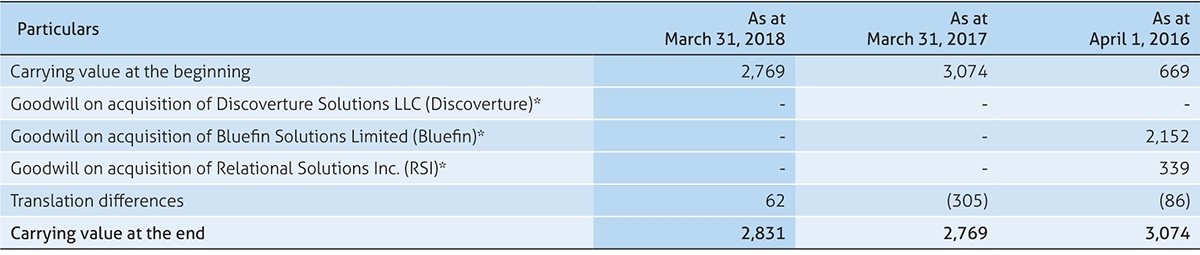

Following is a summary of changes in the carrying amount of goodwill:

* Refer Note 32

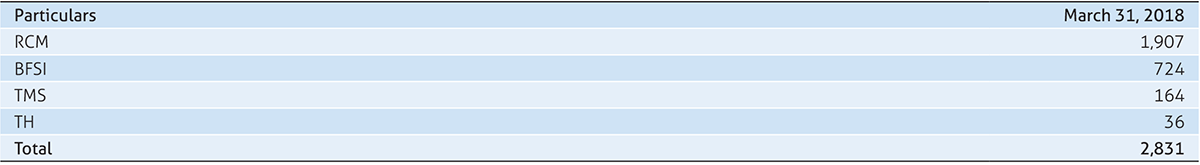

For the purpose of impairment testing, goodwill acquired in a business combination is allocated to the cash generating units (CGU) or groups of CGU’s, which benefit from the synergies of the acquisition. The chief operating decision maker reviews the goodwill for any impairment at the operating segment level, which is represented through groups of CGU’s. The goodwill on acquisition of Discoverture, Bluefin and RSI has been allocated as follows:

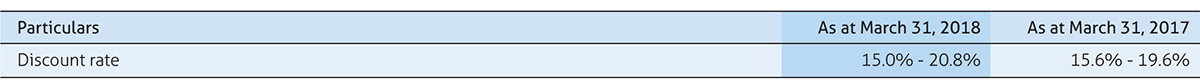

The recoverable amount of a CGU is the higher of its fair value less cost to sell and its value-in-use. The fair value of a CGU is determined based on the market capitalization. The value-in-use is determined based on specific calculations. These calculations use pre tax cash flow projections over a period of five years, based on financial budgets approved by management and an average of the range of each assumption mentioned below. As of March 31, 2018, the estimated recoverable amount of the CGU exceeded its carrying amount, hence impairment is not triggered. The key assumptions used for the calculations are as follows:

Non-current assets

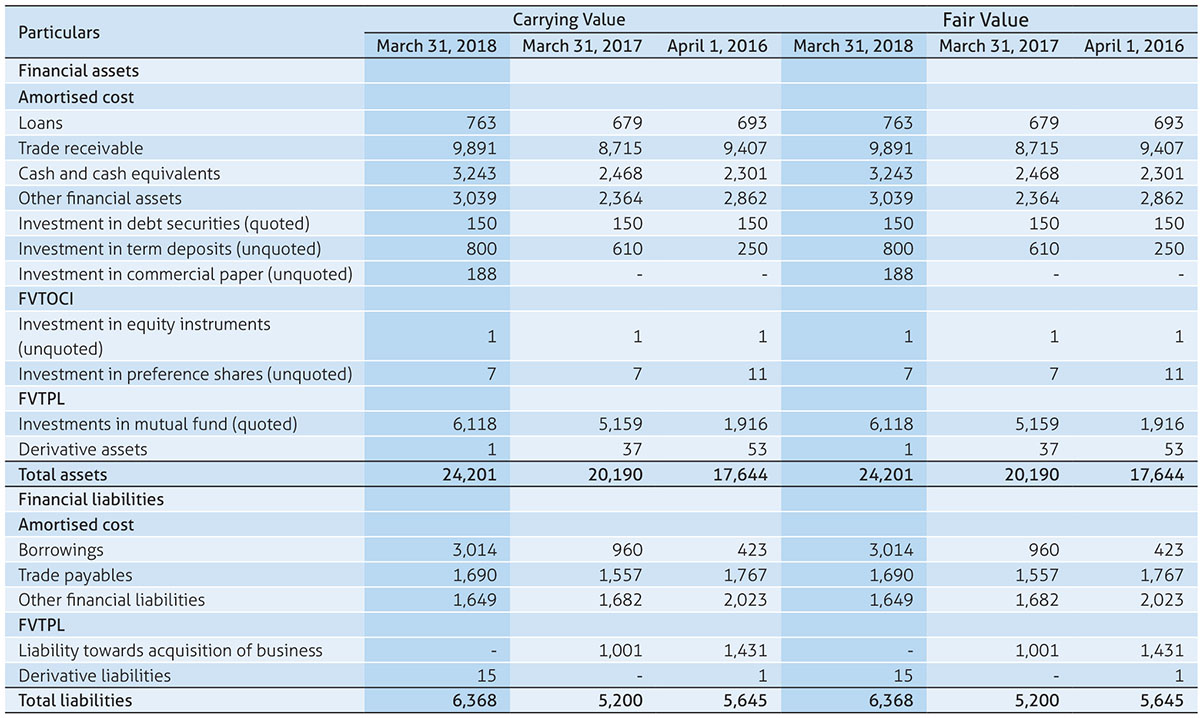

5. Financial assets

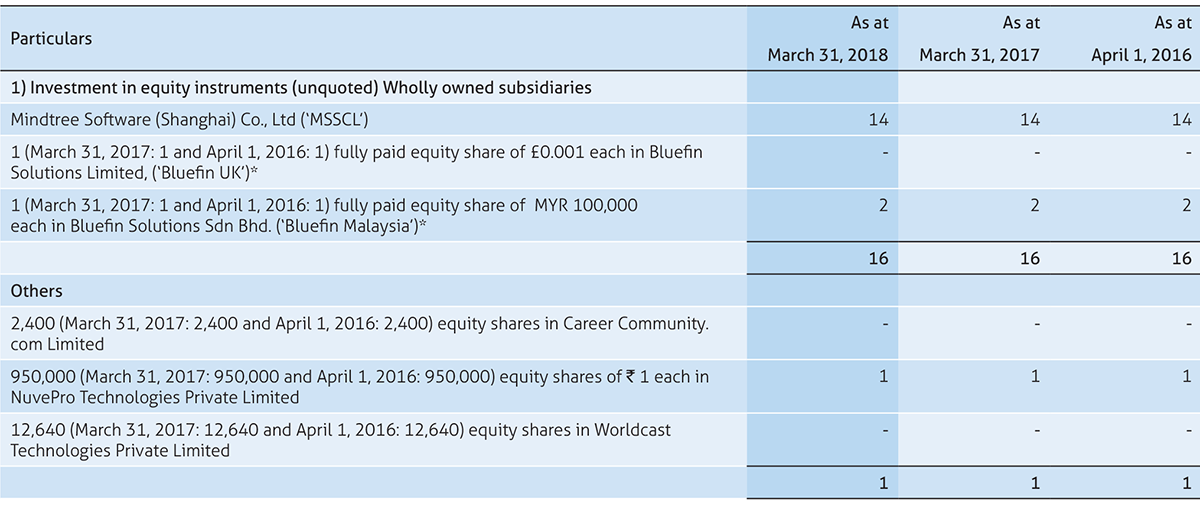

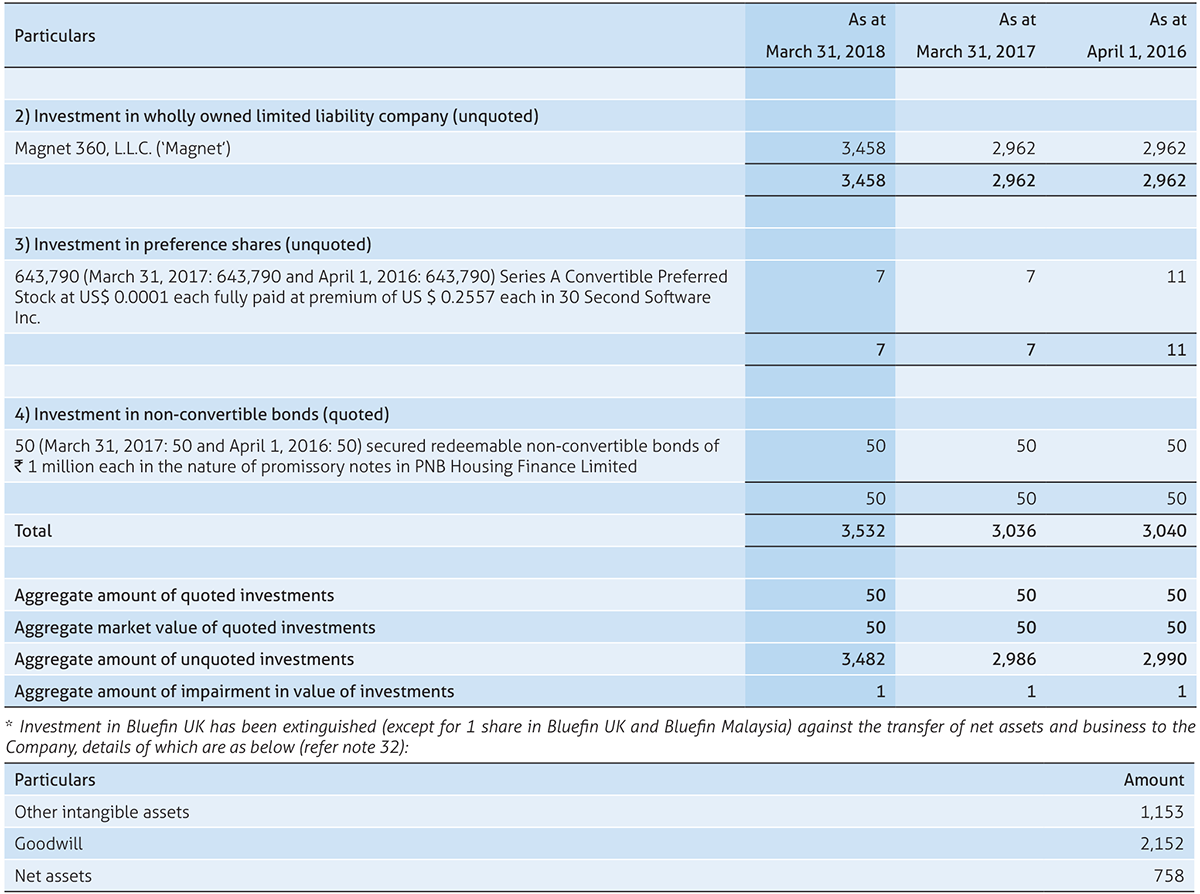

5.1 Investments

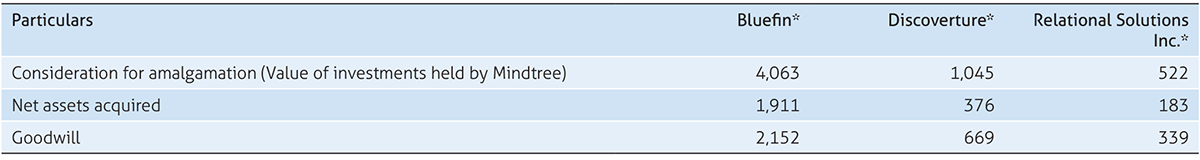

* Investment in Bluefin UK has been extinguished (except for 1 share in Bluefin UK and Bluefin Malaysia) against the transfer of net assets and business to the Company, details of which are as below (refer note 32):

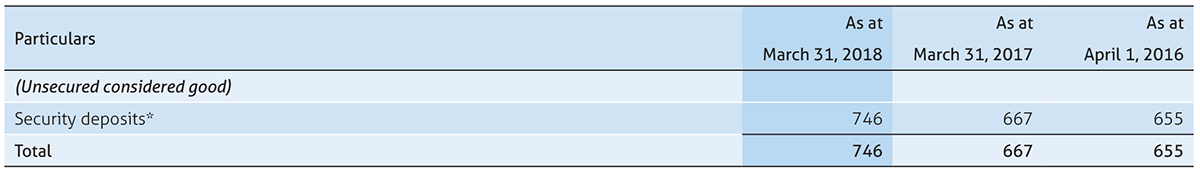

5.2 Loans

* Includes deposits with related parties ₹ 270 as at March 31, 2018 (As at March 31, 2017: ₹ 270 and April 1, 2016: ₹ 270). Refer note 31 for related party balances.

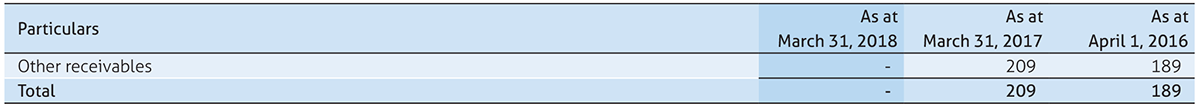

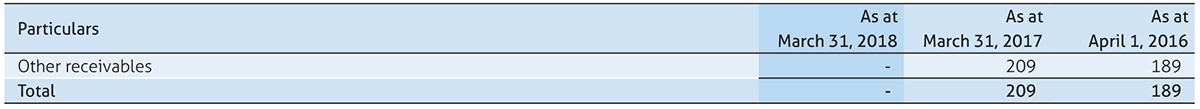

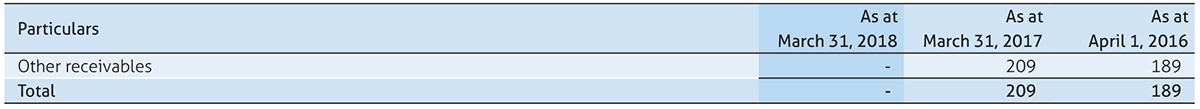

5.3 Other financial assets

6. Other non-current assets

Current assets

7. Financial assets

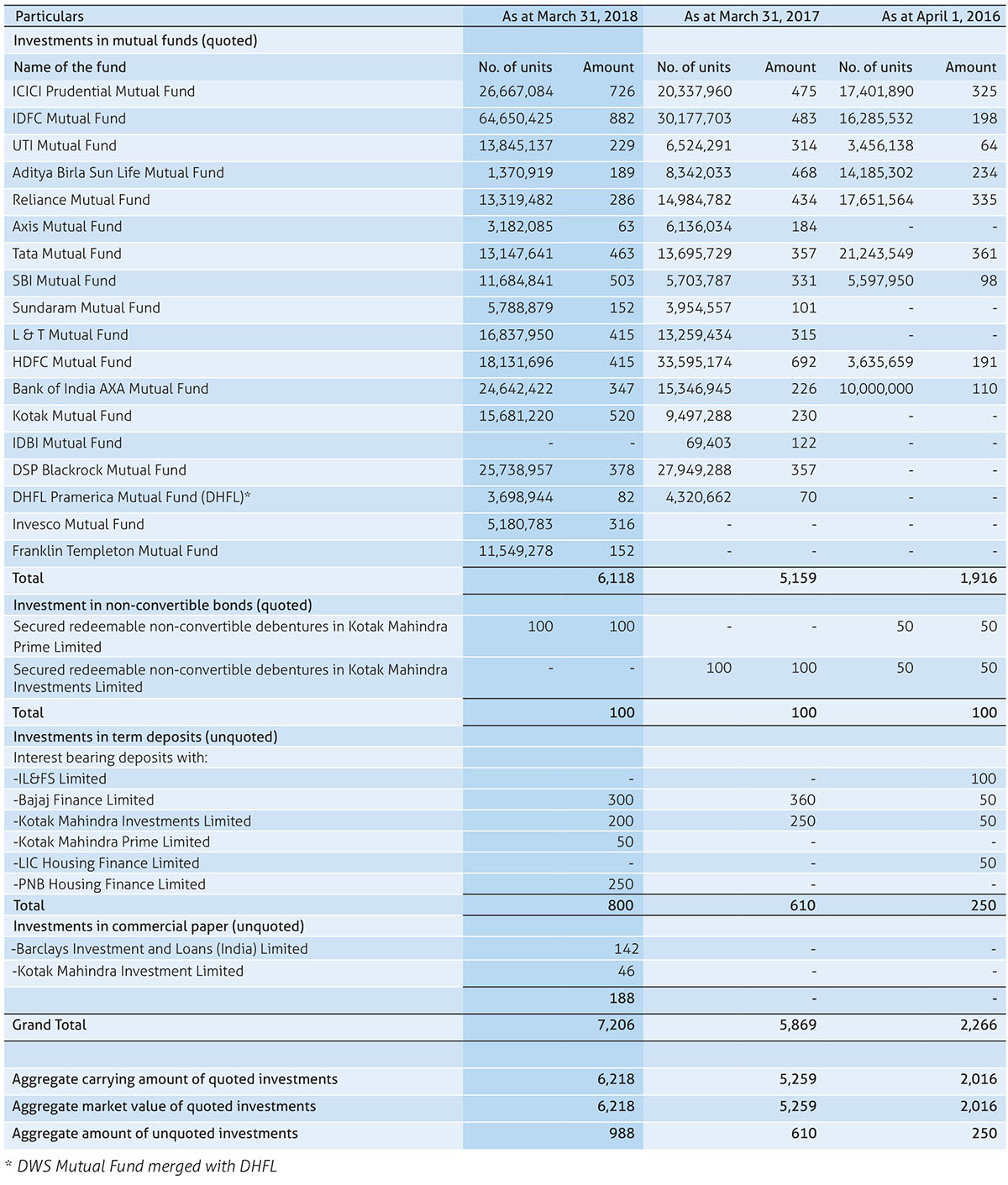

7.1 Investments

* DWS Mutual Fund merged with DHFL

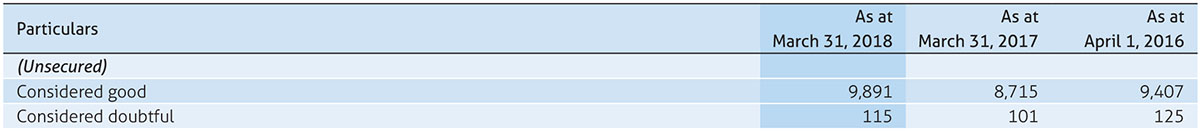

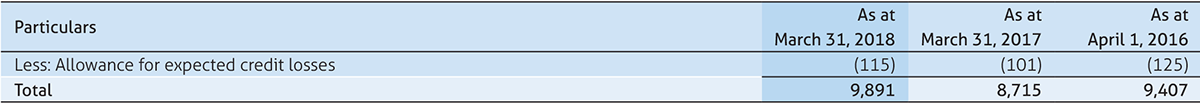

7.2 Trade receivables

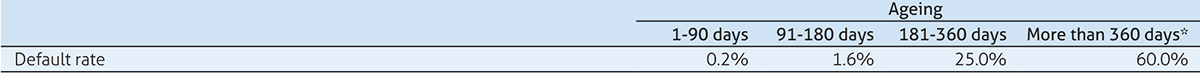

The Company uses a provision matrix to determine impairment loss on portfolio of its trade receivable. The provision matrix is based on its historically observed default rates over the expected life of the trade receivable and is adjusted for forward- looking estimates. At every reporting date, the historically observed default rates are updated and changes in forward-looking estimates are analysed. The Company estimates the following matrix at the reporting date.

* In case of probability of non-collection, default rate is 100%

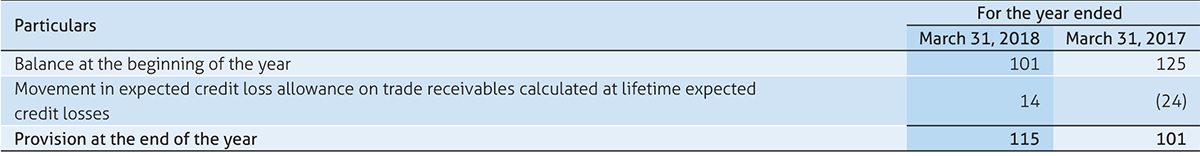

Movement in the expected credit loss allowance

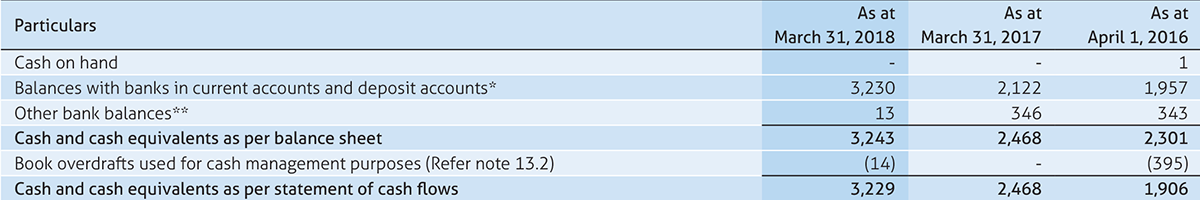

7.3 Cash and cash equivalents

* The deposits maintained by the Company with banks comprises time deposits, which can be withdrawn by the Company at any point without prior notice or penalty on the principal. ** Other bank balances represent earmarked balances in respect of unpaid dividends and dividend payable.

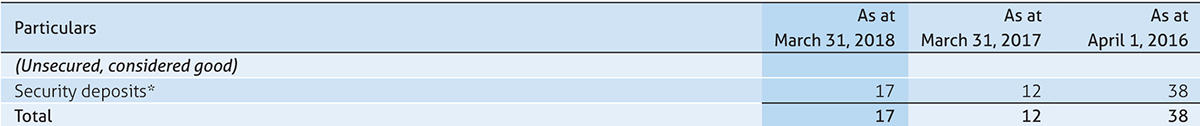

7.4 Loans

* Includes deposits with related parties ₹ Nil as at March 31, 2018 (As at March 31, 2017: ₹ Nil and April 1, 2016: ₹ 28). Refer note 31 for related party balances.

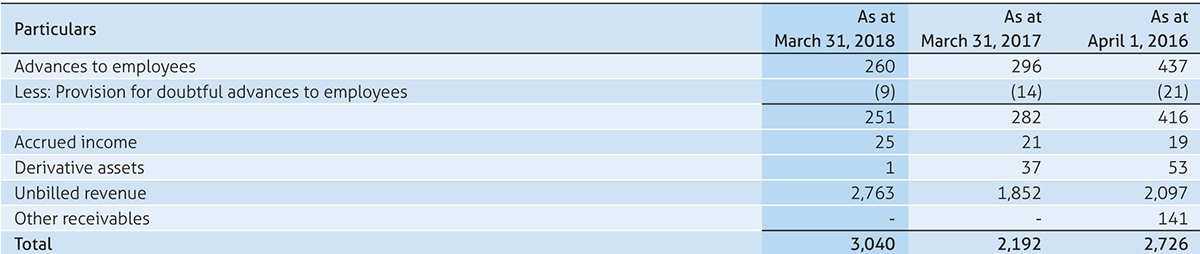

7.5 Other financial assets

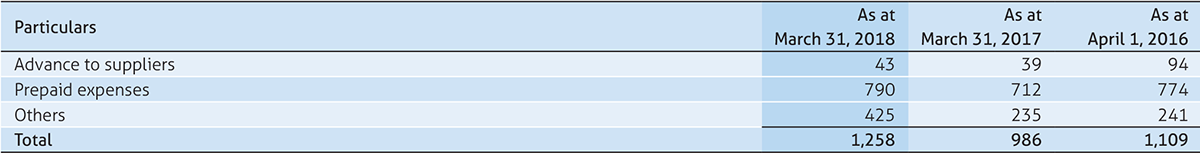

8. Other current assets

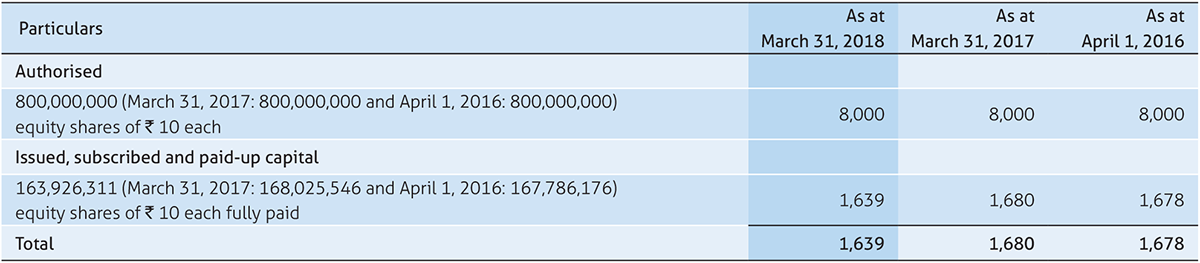

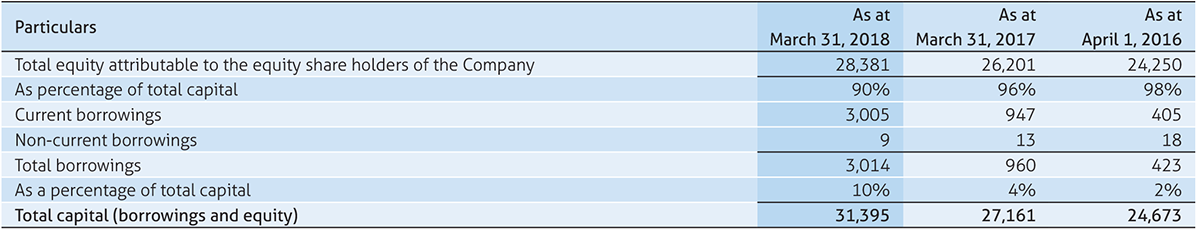

9. Equity share capital

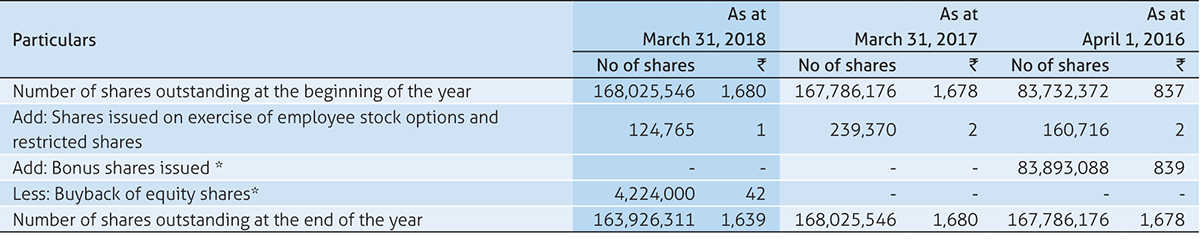

b) Reconciliation of the number of equity shares outstanding at the beginning and at the end of the reporting year are as given below:

* Refer note 9 (e)

c) The Company has only one class of shares referred to as equity shares having a par value of ₹ 10 each.

Terms/rights attached to equity shares

Each holder of the equity share, as reflected in the records of the Company as of the date of the shareholder meeting, is entitled to one vote in respect of each share held for all matters submitted to vote in the shareholders meeting.

The Company declares and pays dividends in Indian rupees and foreign currency. The dividend proposed by the Board of Directors is subject to the approval of the shareholders in the Annual General Meeting. In the event of liquidation of the Company, the holders of equity shares will be entitled to receive any of the remaining assets of the Company after distribution of all preferential amounts. However, no such preferential amounts exist currently. The distribution will be in proportion to the number of equity shares held by the shareholders.

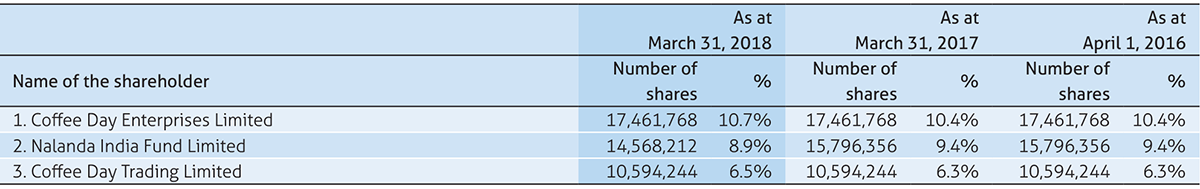

d) Equity shareholder holding more than 5 percent of equity shares along with the number of equity shares held at the beginning and at the end of the year are as given below:

e) In the period of five years immediately preceding March 31, 2018:

i) The Company has allotted 83,893,088 and 41,765,661 fully paid up equity shares during the quarter ended March 31, 2016 and June 30, 2014 respectively, pursuant to 1:1 bonus share issue approved by shareholders. Consequently, options/ units granted under the various employee share based plans are adjusted for bonus share issue.

ii) Pursuant to the approval of the Board and the Administrative Committee at its meetings held on June 28, 2017 and July 20, 2017 respectively, the Company bought back 4,224,000 equity shares of ₹ 10 each on a proportionate basis, at a price of ₹ 625 per equity share for an aggregate consideration of ₹ 2,640 (Rupees Two thousand six hundred and forty million only), and completed the extinguishment of the equity shares bought back. Capital redemption reserve has been created to the extent of nominal value of share capital extinguished amounting to ₹ 42 million. The buyback and creation of capital redemption reserve was effected by utilizing the securities-premium and free reserves.

iii) The Company has not allotted any equity shares as fully paid up without payment being received in cash.

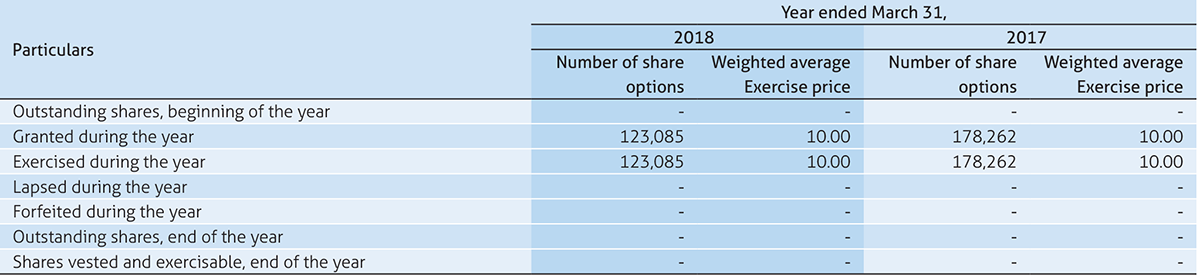

f) Employee stock based compensation

The Company instituted the Employees Stock Option Plan (‘ESOP’) in fiscal year 2000, which was approved by the Board of Directors (‘the Board’). The Company currently administers seven stock option programs, a restricted stock purchase plan and a phantom stock option plan. Program 1 [ESOP 1999]

This plan was terminated on September 30, 2001 and there are no options outstanding as at March 31, 2018, March 31, 2017 and April 1, 2016.

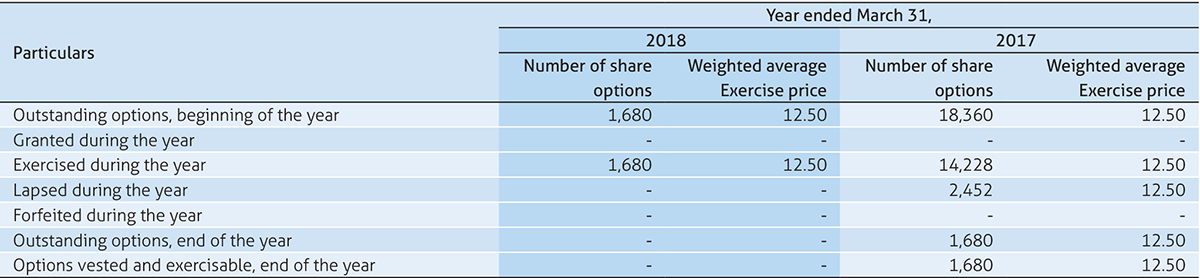

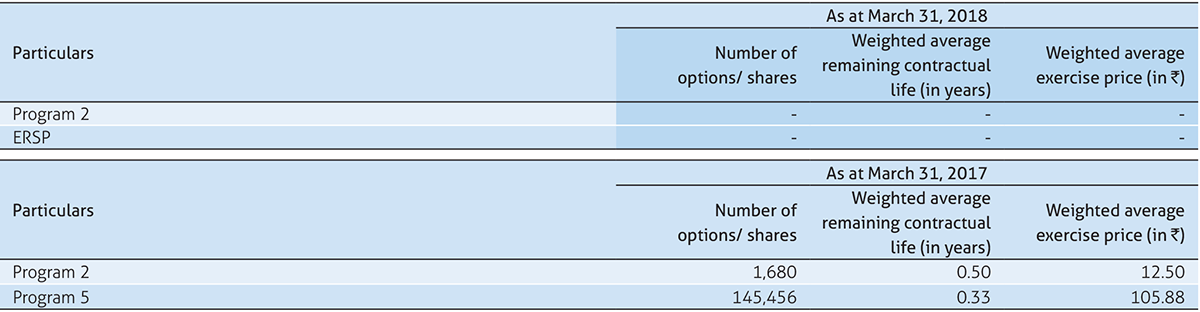

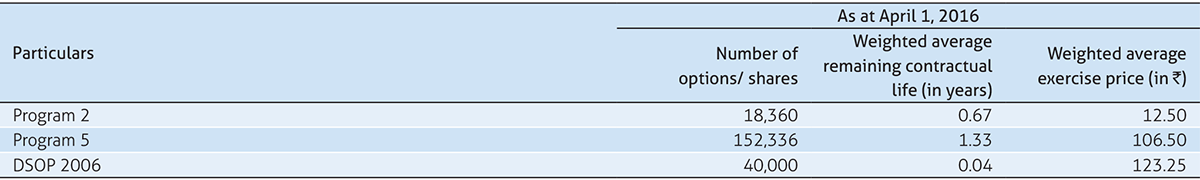

Program 2 [ESOP 2001]

Options under this program have been granted to employees at an exercise price of ₹ 50 per option (₹ 12.5 per option post bonus issue). All stock options have a four-year vesting term and vest and become fully exercisable at the rate of 15%, 20%, 30% and 35% at the end of 1, 2, 3 and 4 years respectively from the date of grant. Each option is entitled to 1 equity share of 10 each. This program extends to employees who have joined on or after October 1, 2001 or have been issued employment offer letters on or after August 8, 2001 or options granted to existing employees with grant date on or after October 1, 2001. This plan was terminated on April 30, 2006. The contractual life of each option is 11 years after the date of grant.

Program 3 [ESOP 2006 (a)]

This plan was terminated on October 25, 2006 and there are no options outstanding as at March 31, 2018, March 31, 2017 and April 1, 2016.

Program 4 [ESOP 2006 (b)]

Options under this program are granted to employees at an exercise price periodically determined by the Nomination and Remuneration Committee. All stock options have a four-year vesting term and vest and become fully exercisable at the rate of 15%, 20%, 30% and 35% at the end of 1, 2, 3 and 4 years respectively from the date of grant. Each option is entitled to 1 equity share of ₹ 10 each. This program extends to employees to whom the options are granted on or after October 25, 2006. The contractual life of each option is 5 years after the date of grant. There are no outstanding options as at March 31, 2018, March 31, 2017 and April 1, 2016.

Program 5 [ESOP 2008A]

Options under this program were granted to employees of erstwhile Aztecsoft Limited as per swap ratio of 2:11 as specified in the merger scheme. Each new option is entitled to 1 equity share of ₹ 10 each.

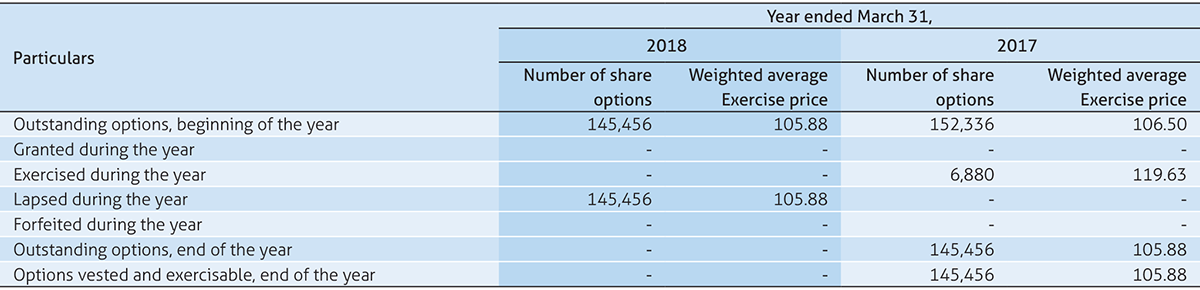

Directors’ Stock Option Plan, 2006 (‘DSOP 2006’)

Options under this program have been granted to independent directors at an exercise price periodically determined by the Nomination and Remuneration Committee. All stock options vest and become fully exercisable equally over three year vesting term at the end of 1, 2 and 3 years respectively from the date of the grant. Each option is entitled to 1 equity share of ₹ 10 each. The contractual life of each option is 4 years after the date of the grant.

Program 7 [ESOP 2010A]

In-principle approvals for administering the seventh stock option program i.e. ESOP 2010A have been received by the Company from the BSE and NSE for 1,135,000 equity shares of ₹ 10 each. No options have been granted under the program as at March 31, 2018, March 31, 2017 and April 1, 2016.

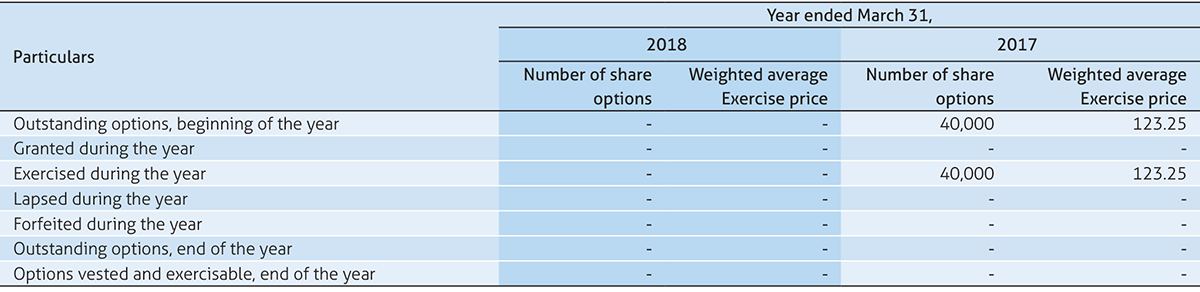

Employee Restricted Stock Purchase Plan 2012 (‘ERSP 2012’)

ERSP 2012 was instituted with effect from July 16, 2012 to issue equity shares of nominal value of ₹ 10 each. Shares under this program are granted to employees at an exercise price of not less than ₹ 10 per equity share or such higher price as determined by the Nomination and Remuneration Committee. Shares shall vest over such term as determined by the Nomination and Remuneration Committee not exceeding ten years from the date of the grant. All shares will have a minimum lock in period of one year from the date of allotment.

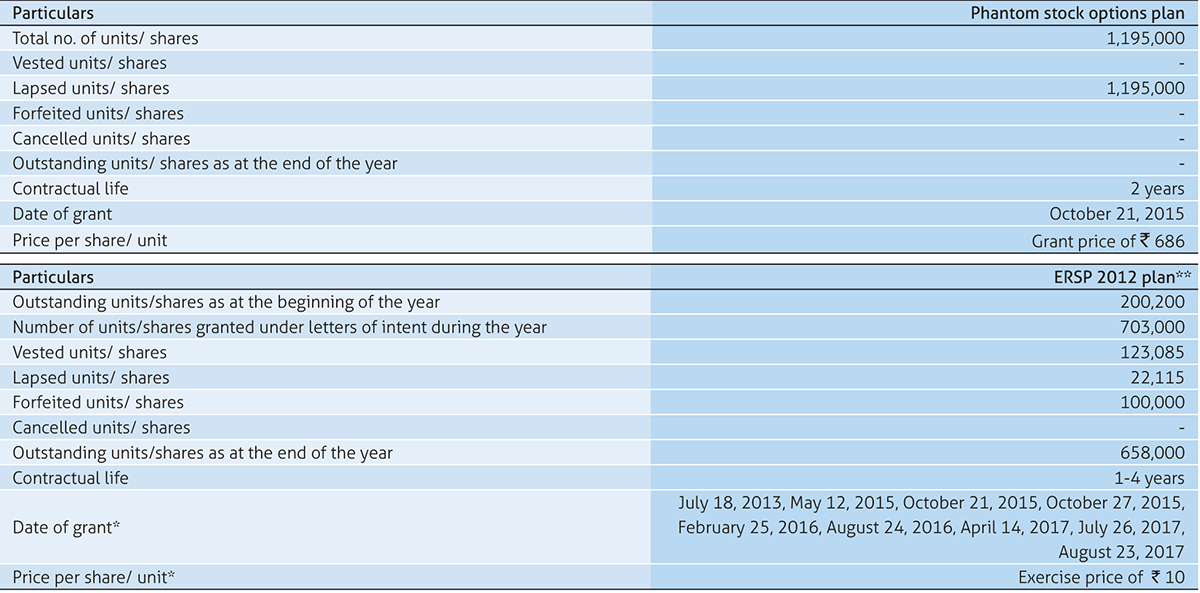

Other Stock Based Compensation Arrangements

The Company has also granted phantom stock options and letter of intent to issue shares under ERSP 2012 plan to certain employees which is subject to certain vesting conditions. Details of the outstanding options/ units as at March 31, 2018 are given below:

* Based on Letter of Intent

** Does not include direct allotment of shares

The following tables summarize information about the options/ shares outstanding under various programs as at March 31, 2018, March 31, 2017 and April 1, 2016 respectively:

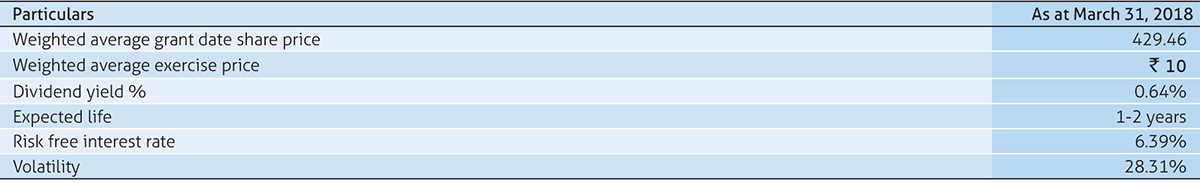

The weighted average fair value of each unit under the above mentioned ERSP 2012 plan, granted during the year ended March 31, 2018 was ₹ 442.90 using the Black-Scholes model with the following assumptions:

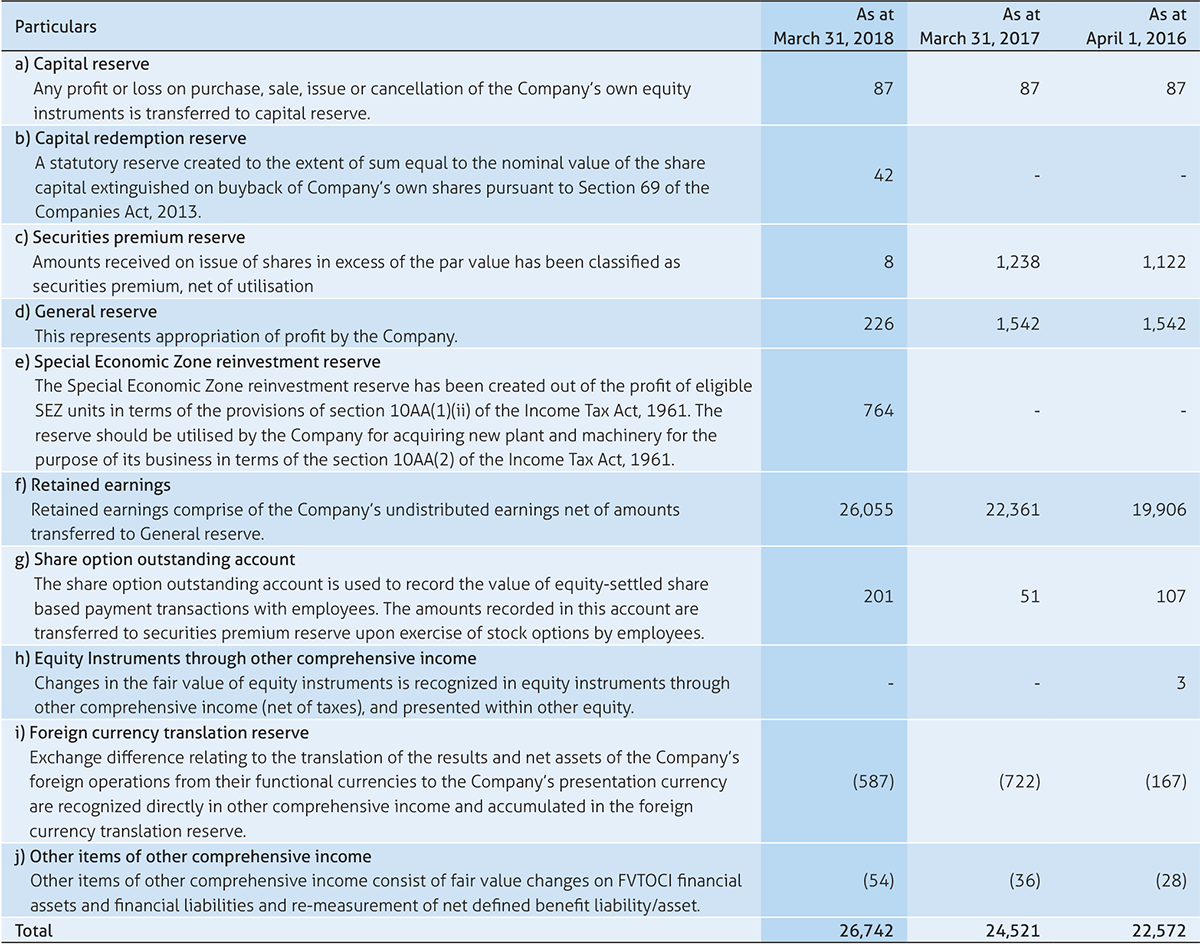

10. Other equity

10.1 Distributions made and proposed

The amount of per share dividend recognized as distributions to equity shareholders for the year ended March 31, 2018 and year ended March 31, 2017 was ₹ 9 and ₹ 10 respectively.

The Board of Directors at its meeting held on April 20, 2017 had recommended a final dividend of 30% (₹ 3 per equity share of par value ₹ 10 each). The proposal was approved by shareholders at the Annual General Meeting held on July 18, 2017. This has resulted in a cash outflow of ₹ 607 inclusive of dividend distribution tax of ₹ 103. The Board of Directors at its meeting held on October 25, 2017 had declared an interim dividend of 20% (₹ 2 per equity share of par value ₹ 10 each) and special dividend of 20% (₹ 2 per equity share of par value ₹ 10 each) due to completion of ten years of Initial Public Offering (IPO). Also, the Board of Directors at its meeting held on January 17, 2018 had declared an interim dividend of 20% (₹ 2 per equity share of par value ₹ 10 each). The aforesaid interim and special dividends were paid during the year. The Board of Directors at its meeting held on April 18, 2018, have declared an interim dividend of 20% (₹ 2 per equity share of par value ₹ 10 each) and recommended a final dividend of 30% (₹ 3 per equity share of par value ₹ 10 each) which is subject to approval of shareholders.

Non-current liabilities

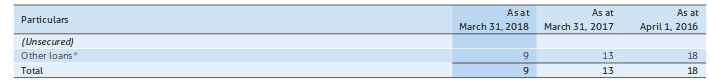

11. Financial liabilities

11.1 Borrowings

* Unsecured long term borrowings represent the amount received from Council for Scientific and Industrial Research (CSIR) to develop a project under “Development of Intelligent Video Surveillance Server (IVSS) system”. The loan is an unsecured loan carrying a simple interest of 3% p.a on the outstanding amount of loan. Repayment of loan is in 10 equal annual installments from June 2011. Any delay in repayment entails a liability of 12% p.a. compounded monthly for the period of delay. The loan carries an effective interest rate of 3% p.a and is repayable in full in June 2021. There is no default in the repayment of the principal loan and interest amounts.

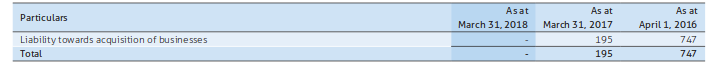

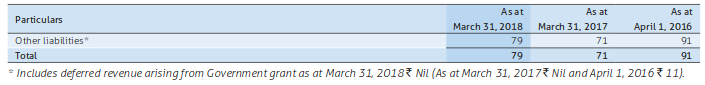

11.2 Other financial liabilities

12. Other non-current liabilities

Current liabilities

13. Financial liabilities

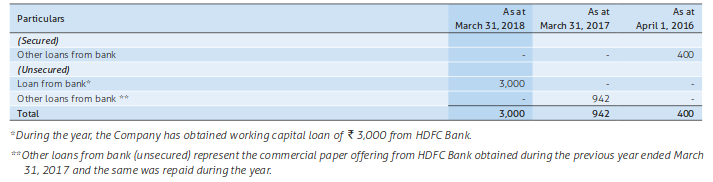

13.1 Borrowings

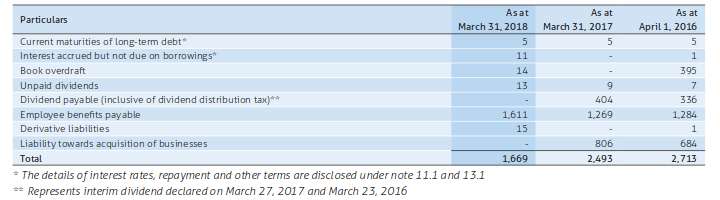

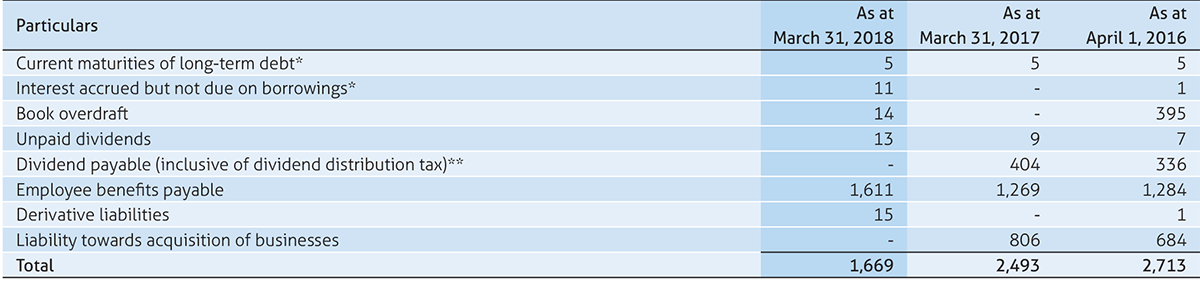

13.2 Other financial liabilities

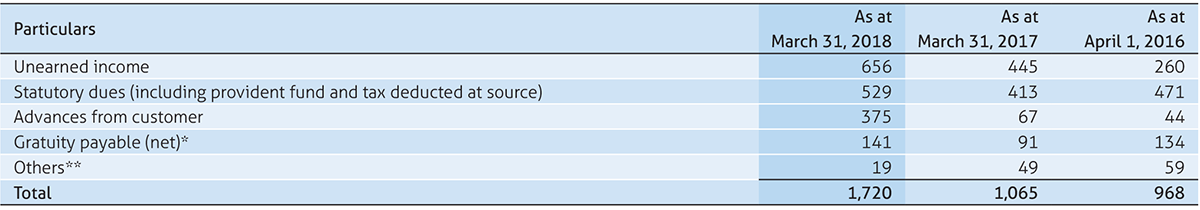

14. Other current liabilities

* Refer note 18 for details of gratuity plan as per Ind AS 19. ** Includes deferred revenue arising from Government grant as at March 31, 2018 ₹ Nil (As at March 31, 2017 ₹ 10 and April 1, 2016 ₹ 10).

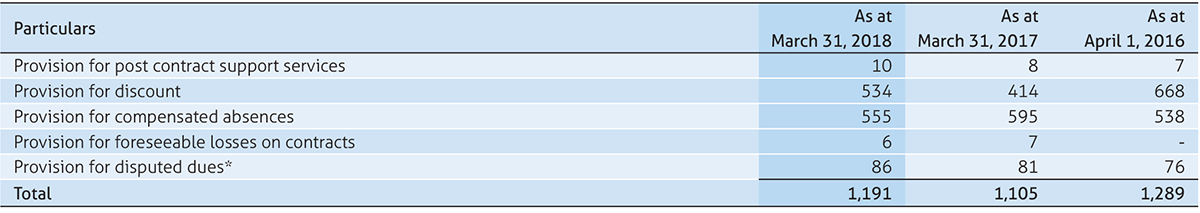

15. Provisions

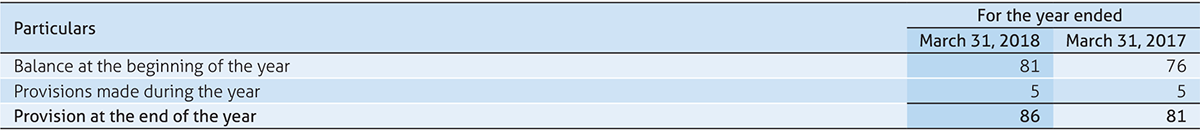

* Represents disputed tax dues provided pursuant to unfavourable order received from the tax authorities against which the Company has preferred an appeal with the relevant authority. In respect of the provisions of Ind AS 37, the disclosures required have not been provided pursuant to the limited exemption provided under paragraph 92 of Ind AS 37. The disclosure of provisions movement as required under the provisions of Ind AS 37 is as follows:-

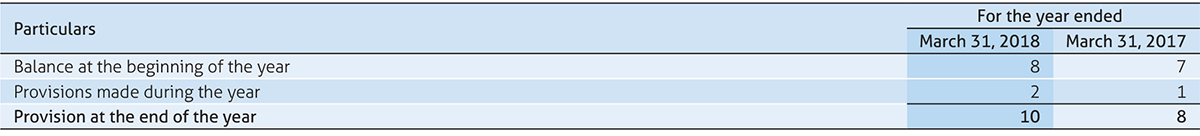

Provision for post contract support services

Provision for post contract support services represents cost associated with providing sales support services which are accrued at the time of recognition of revenues and are expected to be utilized within a period of 1 year.

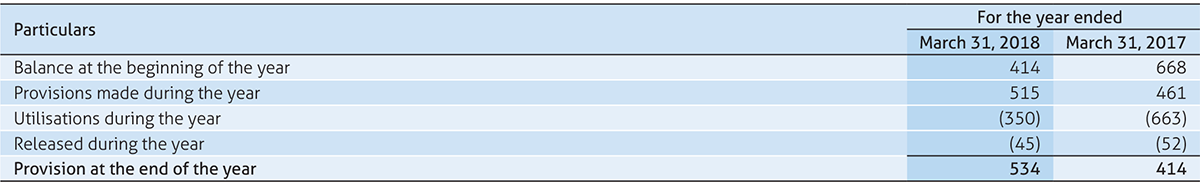

Provision for discount

Provision for discount are for volume discounts and pricing incentives to customers accounted for by reducing the amount of revenue recognized at the time of sale.

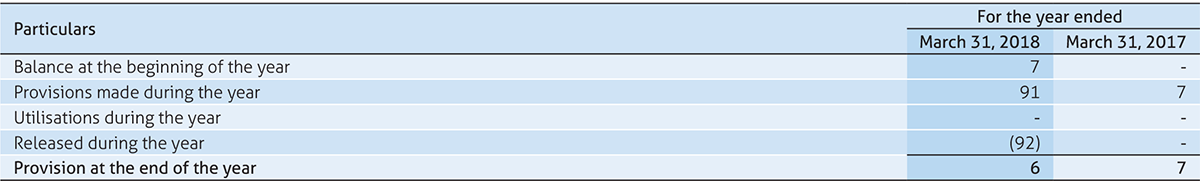

Provision for foreseeable losses on contracts

Provision for foreseeable losses on contracts represents excess of estimated cost over the future revenues to be recognised and expected to be utilized within a period of one year

Provision for disputed dues

16. Income tax

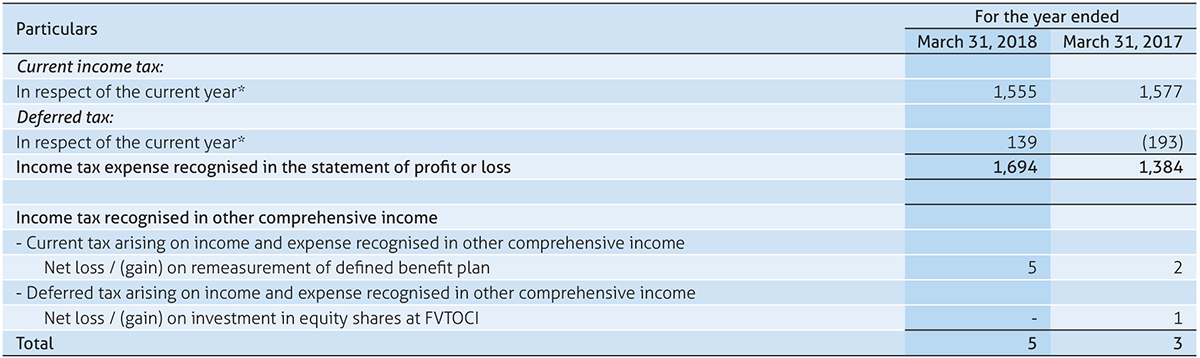

Income tax expense in the statement of profit and loss consists of:

*Tax expense for the year ended March 31, 2018 is net of reversals of ₹ 250 on submission of tax filings.

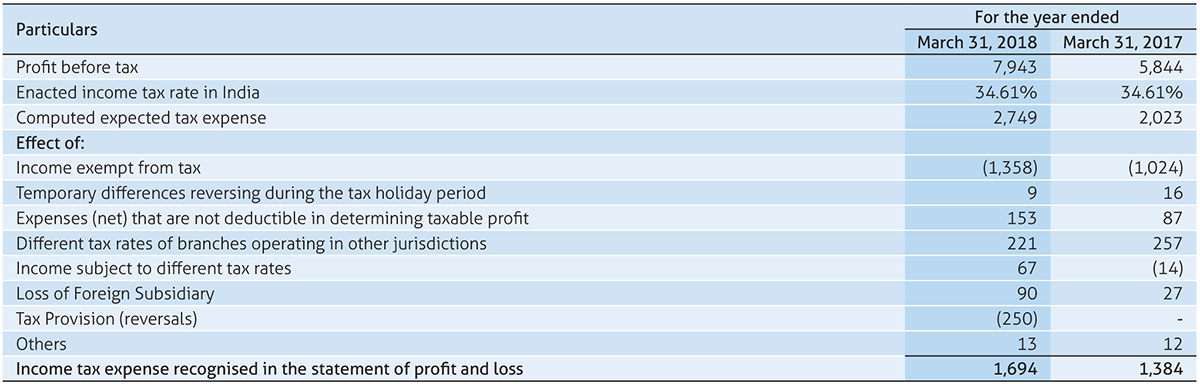

The reconciliation between the provision for income tax of the Company and amounts computed by applying the Indian statutory income tax rate to profit before taxes is as follows:

The tax rates under Indian Income Tax Act, for the year ended March 31, 2018 and March 31, 2017 is 34.61%.

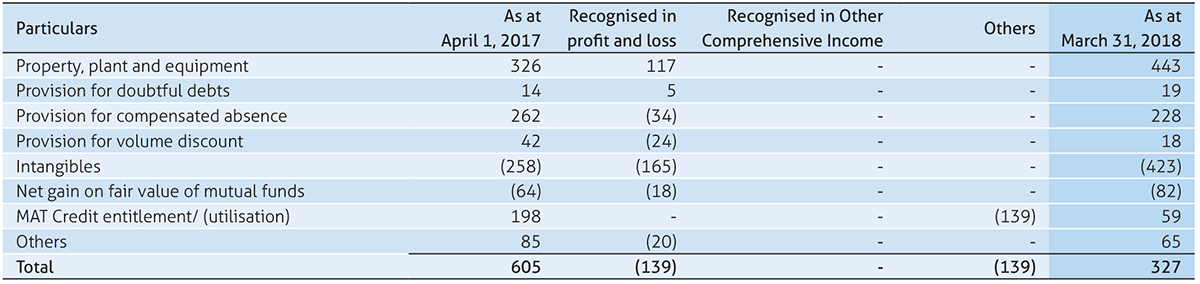

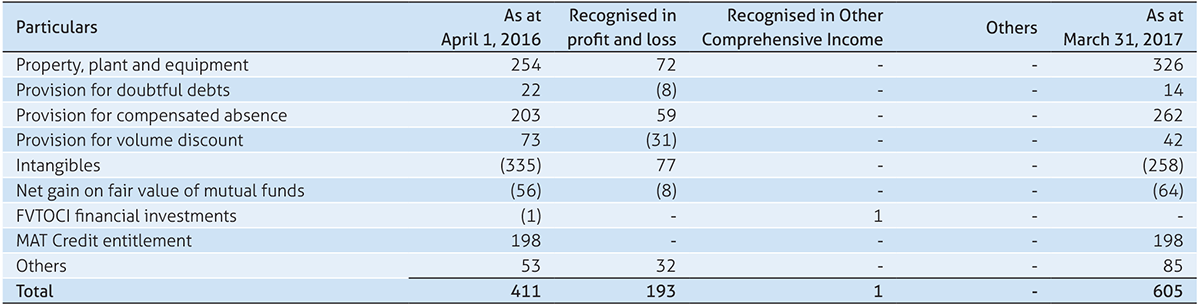

Deferred tax

Deferred tax assets/(liabilities) as at March 31, 2018 in relation to:

Deferred tax assets/ (liabilities) as at March 31, 2017 in relation to:

The Company has not created deferred tax assets on the following:

The Company has units at Bengaluru, Hyderabad, Chennai and Bhubaneshwar registered as Special Economic Zone (SEZ) units which are entitled to a tax holiday under Section 10AA of the Income Tax Act, 1961.

The Company also has STPI units at Bengaluru and Pune which are registered as a 100 percent Export Oriented Unit, which were earlier entitled to a tax holiday under Section 10B and Section 10A of the Income Tax Act, 1961.