Directors’ Report

Dear Shareholders,

Your Directors have immense pleasure in presenting Nineteenth Board’s Report of Mindtree Limited (“Mindtree”) or (“Company”), together with the audited consolidated and standalone financial statements for the year ended March 31, 2018. The consolidated performance of the Company has been referred to wherever required.

Your Company’s financial statements for the year ended March 31, 2018 are the financial statements prepared in accordance with Ind AS notified under the Companies (Indian Accounting Standards) Rules, 2015 and Companies (Indian Accounting Standards) Amendment Rules, 2016, as applicable. The standalone numbers for all the comparative periods have been restated to give impact to the Amalgamation of subsidiaries with your Company resulting in a common control business combination (refer to Note 32 of the standalone financial statements).

Company Performance

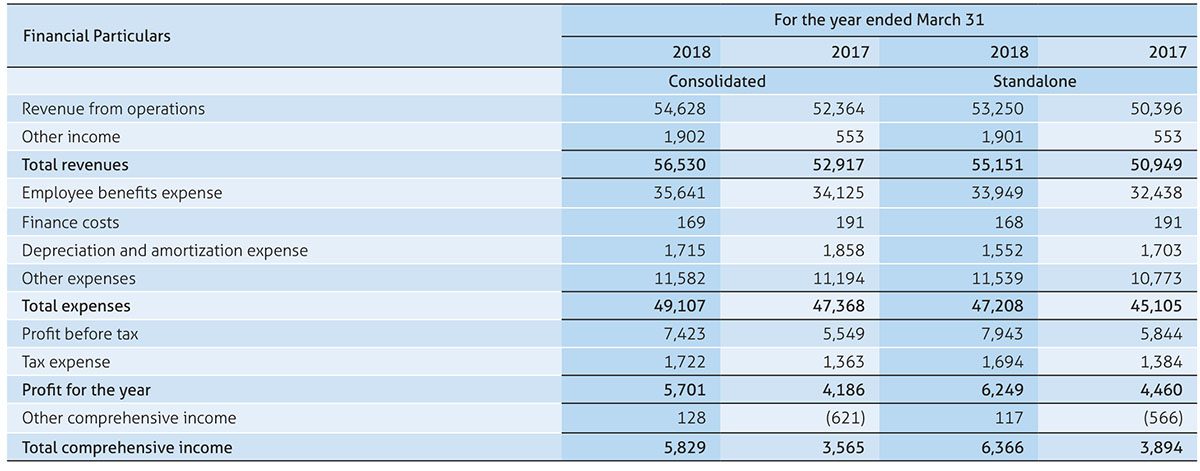

On consolidated basis, revenue for the year was ₹ 54,628 million signifying a growth of 4.3% in Rupee terms. Your Company had 338 active customers as on March 31, 2018 of which 118 customers had revenues in excess of US$ 1 million, 38 customers had revenues in excess of US$ 5 million, 17 customers had revenues in excess of US$ 10 million, 4 customers had revenues in excess of US$ 25 million, 1 customer had revenues in excess of US$ 50 million and 1 customer had revenues in excess of US$ 100 million.

EBITDA margins have dropped marginally by 0.1% from 13.7% in the previous year to 13.6% in the current year. Total employee benefit expense have increased by 4.4%. Employee benefits expense, as a percentage to revenue, has remained the same at 65.2%. The increase is in line with increase in revenue and increase in head count (March 31, 2018: 17,723; March 31, 2017: 16,470). Other expenses increased due to increase in travel expenses and subcontractor expenses.

Our effective tax rate is at 23.2% when compared to 24.6% in the previous year. PAT has grown by 36.2% and as a percentage of revenue, has increased from 8.0% to 10.4% in the current year, mainly on account of increase in revenue, other income and foreign exchange gain in the current year as compared to forex loss in the previous year.

On standalone basis, revenue for the year was ₹ 53,250 million signifying a growth of 5.7% in Rupee terms. EBITDA margins have increased marginally from 14.5% in the previous year to 14.6%. The growth in revenue (5.7%) was higher than the growth in employee benefits expense (4.7%). Other expenses increased due to increase in travel expenses and subcontractor expenses.

Our effective tax rate is at 21.3% when compared to 23.7% in the previous year. PAT has increased by 40.1% to ₹ 6,249 million as compared to ₹ 4,460 million in the previous year mainly on account of increase in revenue, other income and foreign exchange gain in the current year as compared to forex loss in the previous year.

Buyback of Equity Shares

Pursuant to the approval of the Board of Directors on June 28, 2017, your Company completed the Buyback of 42,24,000 Equity Shares of ₹ 10/- each at a price of ₹ 625/- per Equity Share amounting to ₹ 2,640 million representing 2.51% of the total issued and paid-up equity share capital of the Company.The Buyback was undertaken by the Company to return surplus funds to the Equity Shareholders and thereby, enhancing the overall returns to Shareholders. The shares were bought back on a proportionate basis, from those Shareholders who were Shareholders of the Company as on July 11, 2017, the record date for the buyback under the tender offer route in accordance with the provisions contained in SEBI (Buyback Regulations), 1998, as amended and the Companies Act, 2013 and the applicable Rules thereof. In accordance with the Companies Act, 2013, the Company has created a Capital Redemption Reserve of Rs. 42 million equal to the nominal value of the shares bought back.

Share Capital

Your Company allotted 124,765 Equity Shares of ₹10/- each, to various employees (“Mindtree Minds”) on exercise of stock options under various Employee Stock Option Plans (ESOPs)/ Mindtree Employee Restricted Stock Purchase Plan 2012 (ESPS/ERSP 2012) during Financial Year 2017-18. Further, 42,24,000 Equity Shares of ₹10/- each, were bought back during the year. Consequently, the paid-up equity share capital has changed from ₹ 1,680,255,460/- as on March 31, 2017 to ₹1,639,263,110/- as on March 31, 2018.

People Function

Making Mindtree a Great Place to Work

In pursuit to our technology transformation journey, we are progressing extensively as early adaptors of Automation, the current technology wave. Two major focus areas – Industrialization of Automation and Extension of Automation Services have been identified. To list out a few of our solutions in Automation – Advanced Learning Engine (ALEN), Mindflow, CodeMill and MACI. MACI, is an internal chat bot created on People Hub, our intranet, to address queries of Mindtree Minds. More than 6,530 Mindtree Minds have interacted with MACI and 100,000+ queries have been addressed. We stand out to be a leader in Automation and are ensuring to leverage the benefits of Automation for our own internal processes and systems.

Exhibiting outstanding work to our customers has been our key driver to making Mindtree a memorable Company. Our annual client experience survey results have been the best we have earned so far.

337 respondents across 127 Mindtree Clients have provided detailed feedback and our clients rank us highly in our four key metrics of Advocacy, Satisfaction, Loyalty and Value for Money. There are many factors contributing to these positive results but the single largest determinant is our Delivery Excellence.

At Mindtree, we firmly believe in the power of inclusiveness, and have been encouraging effective action for advancing and recognizing women across Mindtree. While women formed 16% of our talent pool in 2004, today that number is at 30%. We believe that our strong focus in this area - via policy guidance, strategic push in talent acquisition, special support mechanisms for women, engagement forums, career tracks, coaching and mentoring for growth have enabled us to reach this position today.

Headcount

The total number of Mindtree Minds including subsidiaries as on March 31, 2018 was 17,723 as against 16,470 as on March 31, 2017.

Business Responsibility Report

At Mindtree, fulfilment of environmental, social and governance responsibility is an integral part of its operations. The Business Responsibility Report comprehensively covers your Company’s philosophy on Corporate Social Responsibility and sustainability initiatives pertaining to the conservation of environment, conducting green awareness events, its commitment towards society, enhancing primary education, etc. The Business Responsibility Report, which is in line with SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (hereinafter “LODR Regulations”) is attached hereto in this Annual Report. The Business Responsibility Report is also available on the Company’s website: https://www.mindtree.com/about-us/investors.

Credit Rating

Your Company has been rated by India Ratings and Research Private Limited (Ind-Ra, a Fitch Group Company) for its Banking facilities. It has re-affirmed the highest credit rating for your Company’s Short Term facilities with A1+ rating. For Long Term bank facilities, it has also re-affirmed Long Term Issuer Rating of ‘IND AA’ with a Stable outlook to your Company. The affirmation reflects your company’s continued strong credit profile, liquidity position, strong corporate governance practices, financial flexibility and conservative financial policies.

Mergers and Amalgamations

During the year, your Company received the Order of the Hon’ble National Company Law Tribunal (“Hon’ble NCLT”) approving the Scheme of Amalgamation of Discoverture Solutions LLC and Relational Solutions Inc., the wholly owned subsidiaries with your Company. The Order was filed with the Registrar of Companies on June 7, 2017, which being the effective date of Amalgamation. Your Company’s Board of Directors approved the Amalgamation of Magnet 360, LLC, the wholly owned subsidiary of Mindtree Limited with the Company on October 06, 2017. The Hon’ble NCLT, Bengaluru Bench of Karnataka vide its Order dated December 14, 2017, had directed a meeting of Unsecured Creditors and Equity Shareholders of your Company on Wednesday, January 31, 2018 at 10.00 AM and 11.00 AM, respectively, for the purpose of approving the Scheme of Amalgamation of Magnet 360, LLC with Mindtree Limited under Sections 230 to 232 read with Section 234 and other applicable provisions of the Companies Act, 2013. The Unsecured Creditors have approved the Scheme of Amalgamation unanimously and the Shareholders have approved the same with requisite majority, as prescribed under applicable laws and in accordance with the Order of the Hon’ble NCLT. Subsequently your Company has filed a petition with the Hon’ble NCLT and the final Order approving the Scheme of Amalgamation is awaited.

Dividend

Your Directors have declared the following interim dividends during the year:

(i) The Board of Directors on October 25, 2017, declared a first interim dividend of ₹ 2/- per equity share of face value of ₹ 10/- each and a special dividend (interim) of ₹ 2/- per equity share of face value of ₹ 10/- each on account of completion of 10 years of Initial Public Offering (IPO). The above dividends were paid to the Shareholders on November 7, 2017;

(ii) The Board on January 17, 2018, declared a second interim dividend of ₹ 2/- per equity share of face value of ₹ 10/- each, to the Shareholders which was paid on January 30, 2018;

(iii) The Board on April 18, 2018 declared an interim dividend of ₹ 2/- per equity share of face value of ₹ 10/- each, to the Shareholders, which will be paid on or before May 10, 2018.

Further, your Directors have also recommended, a final dividend of ₹ 3/- per equity share of face value of ₹ 10/- each, for the Financial Year ended March 31, 2018 which is payable on obtaining the Shareholders’ approval at the Nineteenth Annual General Meeting. The final dividend, if approved, will be paid on or before July 31, 2018. The dividend payout amount for the current year inclusive of tax on dividend will be ₹ 1,742 million as compared to ₹ 2,005 million in the previous year.

Dividend Policy

Your Company has formulated Dividend Policy in accordance with LODR Regulations, for bringing transparency in the matter of declaration of dividend and to protect the interest of investors. The Dividend Policy is available on the website of the Company: https://www.mindtree.com/dividend-policy

Your Company intends to maintain similar or better levels of dividend payout over the next few years. However, the actual dividend payout in each year will be subject to the investment requirements of the annual operating plan for the year and any other strategic priorities identified by the Company.

Subsidiaries

Your Company had four direct subsidiaries and three step down subsidiaries as on March 31, 2018. The Board of Directors at its meeting held on January 19, 2017, have approved the proposal to transfer the business and net assets of its wholly owned subsidiary, Bluefin Solutions Limited (Bluefin) to your Company against the cancellation and extinguishment of the Company’s investment in Bluefin. The same was completed during the year. Further, the dormant step down subsidiaries, Reside, LLC, Numerical Truth, LLC and M360 Investments, LLC were liquidated during the year.

In accordance with Section 129 (3) of the Companies Act, 2013, a separate statement containing salient features of the financial statement of the subsidiaries of the Company in Form AOC-1 is given in Annexure 1.

In accordance with Section 136 (1) of the Companies Act, 2013, the annual report of your Company containing inter alia, financial statements including consolidated financial statements, has been placed on our website:https://www.mindtree.com/about-us/investors. Further, the financial statements of the subsidiaries have also been placed on our website:https://www.mindtree.com/about-us/investors. The Company will make available physical copies of these documents upon written request by any Shareholder of the Company.

Awards and Recognitions

During the year under review, your Company received the following awards and recognitions:

- Named as a leader in Continuous Testing Services in the Digital space by Forrester Research Inc.;

- Positioned as leader in Application Testing Services by Information Services Group (ISG);

- Named as a ‘Rising Star’ for Application Development Services by ISG;

- Named as a “Rising Star” in Public Cloud Infrastructure Consulting and Implementation Services, Public Cloud Infrastructure Managed Services and Public Cloud SAP Services by ISG;

- Mindtree’s SAP Practice wins the SAP Gold Quality Award in United Kingdom for workforce planning using SAP Business Planning & Consolidation suite;

- Positioned as a leader in the Zinnov Zones for Product Engineering Services 2017;

- Named among the Large System Integrators for Agile and DevOps services by Gartner;

- SAFA Best presented Annual Report Award for 2016 for the Communication and Information Technology Sector for transparency, accountability and governance in our Annual Report by South Asian Federation of Accountants;

- Winner of Golden Peacock Award of “Special Commendation in Corporate Governance - 2017” awarded by the Golden Peacock Awards Secretariat, Institute of Directors;

- Winner of the Silver Shield for the Annual Report including the financial statements for the year ended March 31, 2017 by the Institute of Chartered Accountants of India (ICAI).

Branding

At Mindtree, we firmly believe that our brand represents our identity, values and beliefs. We function on the principles of Collaborative Spirit, Unrelenting Dedication and Expert Thinking and have therefore consciously and deliberately incorporated these elements into our branding and logo. Mindtree’s brand voice is bright, confident and active which reflects our forward thinking, confidence, strength and passion. These themes are woven across all our collaterals in a unique and personalized way fostered by our fresh design thinking.

Every year Mindtree elevates its brand by wielding the right mix of Public Relations, Social Media, Advertisement and Digital Marketing. This year we have embarked upon executing our new digital strategy, ‘Mindtree 3.0’ which has been instrumental in strengthening our digital leadership and deepening our engagements. We have also launched a brand new website which is a reiteration of the fact that digital is in our DNA. The website being a key asset to drive sales and engagement has been designed to provide optimal user experience across all digital devices with intuitive navigation and streamlined menus. In addition, with a meticulously planned social media strategy we have doubled our follower base with focused advertisement campaigns.

Investor Relations

Your Company has an effective Investor Relations Program (“IR”) through which the company continuously interacts with the investment community across various channels (Periodic Earnings Calls, Annual Investor / Analyst Day, Individual Meetings, Video-conferences, Participation in sell-side conferences, One on One interactions through Non-Deal Roadshows). Your Company ensures that critical information about the Company is available to all the investors by uploading all such information on the Company’s website under the Investors section. Your Company also sends regular email updates to analysts and investors on upcoming events like earnings calls, declaration of quarterly and annual earnings with financial statements. Your Company is receptive to the needs of the investment community through periodic IR Perception Studies conducted by an independent agency and also by seeking direct feedback from the analysts and investors. Your company strives to adopt emerging best practices in IR and building a relationship of mutual understanding with investor/analysts.

Infrastructure

In the beginning of the year, your Company had 22,29,340 sq. ft of space consisting of 17,768 seats spread across various locations in India apart from Mindtree Kalinga – Training and residential facility for 500 campus minds measuring about 3,02,000 sq. ft . Following are the key changes made during the year:

Bhubaneswar: Your Company has not added any new seats during the year under review. However, Company has taken up construction of Software Development Block Building measuring about 180,000 sq.ft, which is nearing completion. One floor consisting of about 400 seats will be ready for occupation by May 2018. Rest of 800 seats will be made ready for occupation as and when business requires the same.

Hyderabad: Your Company has signed up for leasing additional space and about 650 seats are likely to be ready for occupation by October 2018.

Your Company has sufficient capacity to meet its growth needs over short and medium terms. Your Company has prioritized adopting sustainable best practices in accordance with LEED green building design for creating & maintaining workplace infrastructure projects.

You will be happy to know that East campus of your Company located at Whitefield, Bengaluru and also Mindtree Kalinga Campus located at Bhubaneswar have been certified as PLATINUM rated facilities by India Green Building Council. In addition, East Campus of Mindtree at Whitefield has won prestigious EMERSON CUP for innovative and energy efficient HVAC design. Your Company is in the process of installation of 550KW solar power plant at Mindtree Kalinga – Bhubaneswar. This is likely to be commissioned by June 2018. When completed, this will meet about 30% of power requirement of the campus. These achievements stand testimony to your company’s strong commitment towards sustainable best practices.

Deposits

Your Company has not accepted any Deposits during the Financial Year 2017-18 and as such, no principal or interest were outstanding as on March 31, 2018 as per the provisions of Companies Act, 2013 and the Rules framed thereunder.

Board of Directors

At the year ended March 31, 2018, the Board of Directors comprised of three Executive and Promoter Directors, one Non-Executive and Promoter Director and five Independent Directors including two Women Directors. As per the Articles of Association of the Company, one third of the Directors are liable to retire by rotation at the Annual General Meeting of the Company, every year. Mr. N S Parthasarathy, Executive Vice Chairman retires by rotation and being eligible, offers himself for reappointment at the ensuing Nineteenth Annual General Meeting.

Dr. Albert Hieronimus, and Prof. Pankaj Chandra, Non-Executive and Independent Directors of the Company have retired from the Board on April 01, 2017 and April 01, 2018 respectively, due to the completion of their tenure. Mr. V G Siddhartha, Non-Executive Director resigned from the Board on March 9, 2018 due to pre-occupation with his primary businesses. There were no other changes in Key Managerial Personnel (KMP) during the year.

Criteria for the appointment of Directors

The Nomination and Remuneration Committee (NRC) is responsible for developing competency requirements for the Board based on Industry and Strategy of the Company. The Board composition analysis reflects in depth understanding of the Company’s strategies, environment, operations, financial conditions, compliance requirements, etc.

In terms of Section 178(3), (4) of the Companies Act, 2013 and LODR Regulations, NRC has formulated criteria for determining qualifications, positive attributes and Independence of Directors which are as follows:

a. Qualifications: The Board nomination process encourages diversity of thought, experience, knowledge, age and gender. It also ensures that the Board has an appropriate blend of functional and industry expertise, personal, professional or business standing. b. Expertise: The person to be chosen as a Director shall have relevant expertise in the fields of information technology, sales /marketing, finance, taxation, law, governance and general management. c. Positive Attributes: Apart from the duties of Directors as prescribed in the Companies Act, 2013, Directors are expected to demonstrate high standards of integrity, ethical behavior and independent judgement. The Directors are also expected to abide by the applicable code of conduct. d. Independence: The Committee satisfies itself with regard to the criteria for independence of the Directors as required under applicable statutes in order to enable the Board to discharge its function and duties effectively. e. Reappointment: In case of reappointment of Non-Executive and Independent Directors, the NRC and the Board takes into consideration the performance evaluation of the Director and his/her engagement level.

Remuneration Policy

Your Company’s remuneration policy framed by NRC is focused on recruiting, retaining and motivating high talented individuals. It is driven by the success and performance of the individual employees and the Company. Your Company endeavors to attract, retain, develop and motivate a high performance workforce. Your Company follows a compensation mix of fixed pay, benefits and performance based variable pay. Individual performance pay is determined by business performance of the Company. The Company pays remuneration by way of salary, benefits, perquisites and allowances (fixed component) and performance incentives, commission (variable component) to its Chairman, Managing Director and other Executive Directors. Annual increments are decided by NRC within the salary scale approved by the Board and Shareholders.

Details of remuneration to Directors

The information relating to remuneration of Directors as required under Section 197(12) of the Companies Act, 2013, is given in Annexure 3.

Declaration of Independence by Independent Directors

The Company has received necessary declaration from each Independent Director of the Company under Section 149(7) of the Companies Act, 2013 and LODR Regulations, confirming that they meet the criteria of independence as laid down in Section 149(6) of the Companies Act, 2013 and that of LODR Regulations.

Board Evaluation

The Board has carried out annual evaluation of performance through an external agency in line with the applicable provisions of the Companies Act, 2013 and LODR Regulations of the following in detail:

(i) The Board as a whole; (ii) The Functioning of Audit Committee, Nomination and Remuneration Committee, Risk Management Committee, Stakeholders’ Relationship Committee and Corporate Social Responsibility Committee; (iii) Individual Directors including that of Independent Directors; (iv) Chairman of the Board

The participants in the process were Board Members, Company Secretary and People Function representatives. The Board evaluation was conducted through questionnaires having qualitative parameters and one on one sessions with Directors to deep dive into Directors’ responses to the questionnaires. The questionnaires were framed in line with the guidance note issued by SEBI on January 05, 2017. The performance of the Board was evaluated after seeking inputs from all the Directors on the basis of criteria such as Board composition, Board mechanism, Board information, dynamics, Board member engagement and development, roles and responsibilities of Mindtree Board, engagement with stakeholders and regulators,etc. The performance of the Committees were evaluated after seeking inputs from the Committee members on the criteria such as understanding the terms of reference, Committee composition, Independence, contribution to Board decisions, etc. The performance of the individual Directors was evaluated after seeking inputs from all the Directors other than the one who is being evaluated. The evaluation was based on the criteria such as Directors’ understanding on the Company’s mission, Company’s market position, qualification and experience of the Director, Directors’ commitment, preparation at the meetings, etc. The performance of the Board Chairman was evaluated after seeking inputs from all the Directors on the basis of the criteria such as commitment, positive and appropriate relationship with CEO/Board members, promotion of effective relationship and communication, etc. The Board evaluation report was submitted to the Board Chairperson and the Chairperson of Nomination and Remuneration Committee. The Board Chairperson discussed the results of evaluation of the individual Directors separately with them in detail. The evaluation report highlighted that Mindtree is already at the forefront of many global good practices on board processes and governance. The report also suggested the areas where we need to focus on strengthening few processes. The outcome of the evaluation of the Board, Committee and that of Chairperson were discussed at NRC and at the Board meeting in detail.

Number of meetings of the Board

The Board of Directors of the Company met seven times during the Financial Year 2017-18. The details of Board Meetings are provided in the Corporate Governance Report. The gap intervening between two meetings of the board is within the stipulated time frame prescribed in the Companies Act 2013 and LODR Regulations.

Board Committees

The following are the details of the Board Committees during the Financial Year 2017-18:

1 Audit Committee;

2 Nomination and Remuneration Committee;

3 Stakeholders’ Relationship Committee;

4 Corporate Social Responsibility Committee;

5 Risk Management Committee and

6 Administrative Committee

The composition of each of the above Committees, their respective roles and responsibilities are provided in detail in the Corporate Governance Report.

Vigil Mechanism / Whistle Blower Policy

The Company’s vigil mechanism allows Directors and employees to report their concerns anonymously about unethical behavior, actual/ suspected fraud, violation of Code of Conduct/business ethics. The vigil mechanism provides adequate safeguards against victimization of Directors and Employees, who avail this mechanism. All employees and Directors have access to the Chairperson of the Audit Committee. The Company has established a Whistle Blower Policy. The details of the Whistle Blower Policy and the Committee which oversees the compliance are explained in detail in the Corporate Governance Report.

Related Party Transactions

All related party transactions were entered into with the prior approval of the Audit Committee. During the Financial Year 2017-18, all the transactions with related parties were entered into at arm’s length and in the ordinary course of business. None of such related party transactions required the approval of the Board of Directors or the Shareholders as per Companies Act, 2013 or LODR Regulations. Further, there were no materially significant related party transactions that may have potential conflict of interests of the Company at large. The policy for determining material related party transactions as approved by the Board is uploaded on the Company’s website and can be accessed at http://www.mindtree.com/policy-for-determining-material-related-party-transactions. The details of the related party transactions as required under the Companies Act, 2013 and rules made thereunder are attached in Form AOC-2 as Annexure 5.

Employee Stock Option Plans and Employee Stock Purchase Scheme

Your Company believes that granting ESOPs will result in wealth creation and retention of employees, attracting new talents and inculcating the feeling of employee ownership as they are responsible for the management, growth and prospects of your Company. During the year, your Company has granted Restricted Stock Units under Employee Stock Purchase Scheme namely Mindtree Employee Restricted Stock Purchase Plan 2012 (ESPS or ERSP 2012). The Employee Stock Option Plans and ESPS or ERSP 2012 are in compliance with SEBI (Share Based Employee Benefits) Regulations, 2014 (“Employee Benefit Regulations”) and there has been no material changes to these Plans during the Financial Year 2017-18. The summary information of various Employee Stock Option Plans (ESOPs) and ESPS or ERSP 2012 of the Company is provided under Notes to Accounts under Standalone Financial Statements of this Annual Report. The Company has recorded compensation cost for all grants using the fair value- based method of accounting, in line with prescribed SEBI guidelines. Refer to Notes to accounts of Standalone Financial Statements of this Annual Report for details on accounting policy.

Disclosure on ESOPs or ESPS or ERSP 2012, details of options granted, shares allotted on exercise, etc. as required under Employee Benefits Regulations read with SEBI circular no. CIR/CFD/POLICYCELL/2/2015 dated June 16, 2015 are available on the Company’s website: https://www.mindtree.com/about-us/investors. No employee was granted options (under ESOPs or ESPS/ERSP 2012), during the year, equal to or exceeding 1% of the issued capital.

Details of unclaimed shares

The details of unclaimed shares as required under LODR Regulations is provided in Annexure 2.

Liquidity

Your Company maintains sufficient cash to meet its operations and strategic objectives. Cash and investments (net of short term borrowings) have increased from ₹ 7,390 million as on March 31, 2017 to ₹ 7,430 million as on March 31, 2018. The funds have been invested with banks, highly rated financial institutions and debt schemes of mutual funds.

Litigation

No material litigation was outstanding as on March 31, 2018. Details of litigation on tax matters are disclosed in the financial statements.

Corporate Governance

At Mindtree, Corporate Governance is not a mere legal obligation. Your Company provides utmost importance to best Governance practices and are designed to act in the best interest of its stakeholders. The Fundamentals of the Governance at Mindtree includes transparency, accountability, integrity and Independence. A detailed report on Corporate Governance is available as a separate section in this Annual Report. Auditors’ Certificate on Corporate Governance obtained from Deloitte Haskins & Sells, Chartered Accountants (Firm Registration No.008072S) for compliance with LODR Regulations, is provided as Annexure 9 and is a part of this Report.

Transfer of Dividend to Investor Education and Protection Fund (IEPF)

Pursuant to the applicable provisions of the Companies Act, 2013, read with Investor Education and Protection Fund Authority (Accounting, Audit, Transfer and Refund) Rules, 2016, as amended, Dividends that are unpaid/ unclaimed for a period of seven years are required to be transferred to the Investor Education and Protection Fund administered by the Central Government. The balance lying with the unpaid/unclaimed dividend accounts have been transferred to the account of IEPF authority on attainment of the said 7 years, in accordance with the above provisions. The Company had transferred unpaid dividend amounts within the statutory period to the IEPF. During the Financial Year 2017-18, unpaid or unclaimed dividend of ₹ 554,450/- (Rupees Five Lakhs Fifty Four Thousand Four Hundred and Fifty only) was transferred to the IEPF. The details of the consolidated unclaimed/unpaid dividend details drawn up to the date of Eighteenth Annual General Meeting on July 18, 2017 as required under the Companies Act 2013, and rules made thereunder has been uploaded on the Company’s website: http://www.mindtree.com/about-us/investors/unpaid-dividend-information

Attention is drawn that the unclaimed/ unpaid dividend for the Financial Years 2010-11 (Final) and 2011-12 (Interim) is due for transfer to IEPF during August 2018 and November 2018. In view of this, the Members of the Company, who have not yet encashed their dividend warrant(s) or those who have not claimed their dividend amounts, may write to the Company/ Company’s Registrar and Share Transfer Agent, Link Intime India Private Limited.

Transfer of Shares in favor of Investor Education and Protection Fund (IEPF) Authority

Pursuant to the applicable provisions of the Companies Act, 2013 read with the Investor Education and Protection Fund Authority (Accounting, Audit, Transfer and Refund) Rules, 2016, the shares on which dividends have not been claimed for 7 consecutive years were required to be transferred in favor of IEPF authority. Accordingly, the Company through individual notices and a newspaper notice in Business Standard and Kannada Prabha, requested concerned Shareholders to encash their unclaimed dividend warrants on or before the dates mentioned in those notices, in order to circumvent their shares being transferred in favor of IEPF Suspense account. Post the above due dates mentioned in those notices, the Company had transferred 9,900 shares in favor of IEPF Authority during the Financial Year 2017-18.

Auditors

a) Statutory Auditors: Your Company at its Sixteenth Annual General Meeting held on June 22, 2015 has appointed M/s. Deloitte Haskins & Sells, Chartered Accountants (Firm Registration No. 008072S) as Statutory Auditors of the Company up to the conclusion of the Twenty First Annual General Meeting at a remuneration as may be fixed by the Board of Directors and Audit Committee in consultation with the Auditors thereof.

b) Secretarial Auditor: Pursuant to the provisions of Section 204 of the Companies Act, 2013 and the Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014, Secretarial Audit has been carried out by Mr. G Shanker Prasad, Practising Company Secretary

Auditor’s Report and Secretarial Audit Report

The Auditor’s report and Secretarial Audit Report do not contain any qualifications, reservations or adverse remarks. Report of the Secretarial Auditor is annexed as Annexure 8 and is a part of this report.

Particulars of Employees

Information as required under the provisions of Rules 5(2) & 5(3) of the Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014, are set out in Annexure 3 to the Directors’ Report. As per the proviso to Rule 5(3) of the Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014, the particulars of employees posted and working outside India not being Directors or their relatives, drawing the salary in excess of the prescribed limits under the above Rules need not be included in the statement but, such particulars shall be furnished to the Registrar of Companies. Accordingly, the statement included in this report does not contain the particulars of employees who are posted and working outside India. If any Member is interested in obtaining a copy thereof, such Member may write to the Company in this regard.

Conservation of Energy, Technology Absorption, Foreign Exchange Earnings and Outflow

Pursuant to the provisions of Section 134(3)(m) of the Companies Act, 2013, read with Rule 8 of the Companies (Accounts) Rules, 2014, the details of Conservation of Energy, Technology Absorption, Foreign Exchange Earnings and Outgo are attached as Annexure 6 to this report.

Directors’ Responsibility Statement

Your Company’s Directors make the following statement in terms of sub-section (5) of Section 134 of the Companies Act, 2013, which is to the best of their knowledge and belief and according to the information and explanations obtained by them: I. The financial statements have been prepared in conformity with the applicable Accounting Standards and requirements of the Companies Act, 2013, to the extent applicable to company; on the historical cost convention; as a going concern and on the accrual basis. There are no material departures in the adoption of the applicable Accounting Standards.

II. The Board of Directors have selected such accounting policies and applied them consistently and made judgments and estimates that are reasonable and prudent so as to give a true and fair view of the state of affairs of the Company at the end of the financial year and of the profit of the Company for that period.

III. The Board of Directors have taken proper and sufficient care for the maintenance of adequate accounting records in accordance with the provisions of the Companies Act, 2013, for safeguarding the assets of the Company and for preventing and detecting fraud and other irregularities.

IV. The Board of Directors have laid down internal financial controls to be followed by the Company and that such internal financial controls are adequate and were operating effectively.

V. The Board of Directors have devised proper systems to ensure compliance with the provisions of all applicable laws and that such systems were adequate and operating effectively.

VI. The financial statements have been audited by M/s. Deloitte Haskins & Sells, Chartered Accountants, the Company’s Auditors.

VII. The Audit Committee meets periodically with the Internal Auditors and the Statutory Auditors to review the manner in which the Auditors are discharging their responsibilities and to discuss audit, internal control and financial reporting issues.

VIII. To ensure complete independence, the Statutory Auditors and the Internal Auditors have full and free access to the Members of the Audit Committee to discuss any matter of substance.

Management Discussion and Analysis Report

Management Discussion and Analysis Report as required under LODR Regulations, is disclosed separately in this Annual Report.

Sustainability and Corporate Social Responsibility Initiatives

Sustainability framework at Mindtree is based on triple-bottom line, people, planet and profit. Sustainability is ingrained into our vision of making societies flourish. While sustainability makes smart business sense in terms of resource conservation, our technological competencies give us an opportunity to solve larger issues of sustainable development. Mindtree is increasingly involved in taking these opportunities forward. Our priorities are set by pressing sustainability issues in the global and national contexts, issues that touch us deeply and our capabilities to execute ideas. Our short term goals are satisfactorily bearing fruit in terms of resource efficiencies, and our medium term plans for clean energy have progressed well. As part of its Corporate Social Responsibility (CSR) initiatives, Your Company has undertaken several projects in accordance with Schedule VII of the Companies Act, 2013. Mindtree implements its CSR initiatives via three channels: - Directly by Mindtree;

- Through Mindtree Foundation;

- Through “Individual Social Responsibility” programs undertaken by Mindtree Minds and supported by Mindtree as appropriate.

Further, Mindtree’s CSR primarily focuses on programs that: - Benefit the differently abled;

- Promote education;

- Create sustainable livelihood opportunities.

The Annual Report on CSR activities, is annexed herewith as Annexure 7.

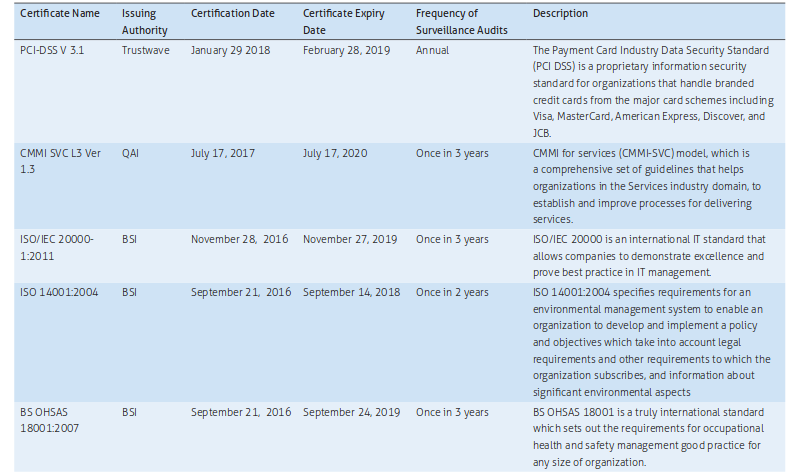

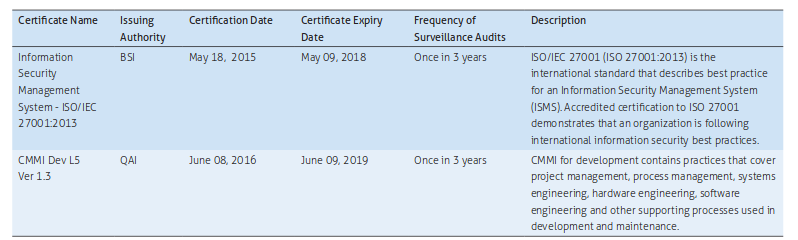

Quality Initiatives and Certifications

Your Company continues its journey of delivering value to its clients through investments in quality programs. Your Company has adopted several external benchmarks and certifications. Your Company is certified under various standards to meet clients’ requirements and enhancing valuable delivery and following is the summary of certifications held by your company.

Code of Conduct for Prevention of Insider Trading in Mindtree securities

Your Company has formulated Code of Conduct for Prevention of Insider Trading in Mindtree Securities (“Code”) in accordance with SEBI (Prohibition of Insider Trading) Regulations, 2015. The objective of this Code is to protect the interest of Shareholders at large, to prevent misuse of any price sensitive information and to prevent any insider trading activity by dealing in shares of the Company by its Directors, Designated Persons and other Mindtree Minds. Mr. Jagannathan Chakravarthi, CFO, continues to act as Compliance Officer under the Code.

Internal Control Systems and Adequacy of Internal Financial Controls

The Company has an Internal Control System, commensurate with the size, scale and complexity of its operations. The Audit committee defines the scope and authority of the Internal Auditor. The Audit Committee, comprises of professionally qualified Directors, who interact with the statutory auditors, internal auditors and management in dealing with matters within its terms of reference. The Company has a proper and adequate system of internal controls. Adequate internal controls ensures transactions are authorized, recorded and reported correctly and assets are safeguarded and protected against loss from unauthorized use or disposition. In addition, there are operational controls and fraud risk controls, covering the entire spectrum of internal financial controls. An extensive program of internal audits and management reviews supplements the process of internal financial control framework. Documented policies, guidelines and procedures are in place for effective management of internal financial controls. To maintain its objectivity and independence, the internal auditor reports to the Chairman of the Audit Committee of the Board. The internal auditor monitors and evaluates the efficacy and adequacy of internal control system in the Company, its compliance with operating systems, accounting procedures and policies at all locations of the Company and its subsidiaries. Based on the report of internal auditor, process owners undertake corrective action in their respective areas and thereby strengthen the controls. Significant audit observations and corrective actions proposed to fix the observations are presented to the Audit Committee of the Board. The internal financial control framework design ensures that the financial and other records are reliable for preparing financial and other statements. In addition, the Company has identified and documented the key risks and controls for each process that has a relationship to the financial operations and reporting. At regular intervals, internal teams test identified key controls. The internal auditors also perform an independent check of effectiveness of key controls in identified areas of internal financial control reporting.

Disclosure as required under Section 22 of Sexual Harassment of Women at Workplace (Prevention, Prohibition and Redressal) Act, 2013

Your Company is committed to provide a work environment that ensures every Mindtree Mind is treated with dignity and respect. The Company is also committed to promote equality at work and an environment that is conducive to the professional growth for all employees and encourages equal opportunity. Your Company does not tolerate any form of sexual harassment and is committed to take all necessary steps to ensure that its employees are not subjected to any form of harassment including sexual harassment. The Company has in place a Prevention of Sexual Harassment (POSH) policy in line with the requirements of the Sexual Harassment of Women at Workplace (Prevention, Prohibition and Redressal) Act, 2013. Mindtree has constituted a POSH Committee at various locations. This Committee governs and regulates the behavior of Mindtree Minds in all matters regarding Sexual Harassment. The POSH Committee at various locations handles all complaints arising out of respective locations of the Company. Frequent communication of this policy is done in assimilation programs and at regular intervals to Mindtree Minds. Following are some of the awareness programs imparted to train Mindtree Minds and Internal committee: – Every Mindtree Mind is supposed to undergo mandatory e-learning module on “Prevention of Sexual Harassment” at workplace.

– Every new employee is trained on Prevention of Sexual Harassment during induction program. Policy of “Prevention of Sexual Harassment” at workplace is available on intranet for Mindtree Minds to access as and when required.

Mindtree has setup an Internal Complaints Committee (ICC) both at the head office / corporate office and at every location where it operates in India. ICC has equal representation of men and women and is chaired by senior lady mind and has an external women representation. The Internal Complaints Committee is trained by external agencies. ICC investigates and provides its recommendations to the management and it acts upon such recommendations. Penal consequences of Sexual Harassment (“SH”) and the constitution of the ICC is displayed at conspicuous places.

The following are the summary of the complaints received and disposed off during the Financial Year 2017-18:

In India

a) No. of SH complaints received: 1

b) No. of SH complaints disposed off: 1

Rest of the World

a) No. of SH complaints received: 0

b) No. of SH complaints disposed off: 0

Any other material changes and commitments

Any material changes and commitments affecting the financial position of the Company, occurred between April 1, 2018 and the date of signing this report have been reported in the financial statements.

Audit Committee Recommendation

During the year, all recommendations of the Audit Committee were accepted by the Board. The Composition of the Audit Committee is as described in the Corporate Governance Report.

Extract of Annual Return

The details forming part of extract of the Annual Return in form MGT-9 is annexed herewith as Annexure 4.

Significant & Material Orders passed by Regulators or Courts

There are no significant and material orders passed by Regulators or Courts, during the year under review.

Particulars of Loans, Guarantees and Investments u/s 186

Disclosure on details of loans, guarantees and investments pursuant to the provisions of Section 186 of the Companies Act, 2013, and LODR Regulations, are provided in the financial statements.

Risk Management Policy

Enterprise Risk Management (ERM) program is a strategic discipline, which supports the Mindtree’s objective to support sustainable growth and generating value for its customers, investors, employees and other stakeholders. ERM encompasses areas of organizational exposure to risk (financial, strategic, operational and compliance). ERM also provides a structured process for management of risks whether those risks are quantitative or qualitative in nature. This is achieved by deploying an effective risk management framework, which helps proactively identifying, prioritize and mitigate risks. The Enterprise Risk Management (ERM) framework at Mindtree is designed by incorporating elements of leading risk management standards such as:

- COSO; Enterprise Risk Management- Framework by Treadway Commission

- ISO 31000: 2009 by ISO

- IRM Risk Management Standard

Listing Fees

The Company affirms that the annual listing fees for the year 2018-19 to both National Stock Exchange of India Limited (NSE) and BSE Limited (Bombay Stock Exchange) has been paid.

Acknowledgements

The Board places on record, their deep sense of appreciation to all the Mindtree Minds, support staff, for adopting to the values of the Company, viz., Collaborative Spirit, Unrelenting Dedication and Expert Thinking, for making Mindtree an expertise led organization and the Company’s customers for letting us deliver the Company’s Mission statement, to engineer meaningful technology solutions to help the businesses and societies flourish. The Board also immensely thank all the Departments of Central and State Governments, Tax Authorities, Reserve Bank of India, Ministry of Corporate Affairs, Securities and Exchange Board of India, Stock Exchanges and other governmental/ Semi-governmental bodies and look forward to their continued support in all future endeavors . The Board also would like to thank our Shareholders, investors, vendors, service providers, bankers and academic institutions and all other stakeholders for their continued and consistent support to the Company during the year.

For and on behalf of the Board of Directors

Krishnakumar Natarajan

Chairman

Place: Bengaluru

Date: April 18, 2018