Corporate Governance Report 2017-18

I. Company’s Philosophy on Corporate Governance

Mindtree Limited (hereinafter referred to as ‘Mindtree’ or ‘Company’), believes that Corporate Governance is an essential element of business, which helps the Company to fulfill its responsibilities to all its stakeholders. Mindtree is committed to adopting global best practices in Governance and Disclosure. Mindtree believes that highest standards of Corporate Governance are essential to enhance long term value of the Company for its stakeholders and practice the same at all levels of the organization. Ethical business conduct, integrity and commitment to values, which enhance and retain stakeholders’ trust are the traits of your Company’s Corporate Governance. Good Governance practices stem from the culture and mindset of the organization. Your Company considers fair and transparent Corporate Governance as one of its core management tenets. Your Company follows the best governance practices with highest integrity, transparency and accountability. Your Company has won the Golden Peacock Award of “Special Commendation in Corporate Governance – 2017” awarded by the Golden Peacock Awards Secretariat, Institute of Directors, which is a token of your Company’s identification for adopting exemplary Corporate Governance practices.

Salient features of Mindtree’s Corporate Governance Philosophy

The Corporate Governance Structure of Mindtree can be described through three layers namely:

- Shareholders appoint Board of Directors and entrust them necessary powers;

- Board leads strategic management and appoints various Committees to handle specific areas of responsibilities;

- The Executive Management and the Committees take up specific responsibilities and day to day affairs as set by the Board.

Mindtree’s Values

Mindtree strongly believes in integrity and transparency in its operations and stakeholders’ communication. All employees (“Mindtree Minds”) are expected to adhere to the highest standards of integrity. Mindtree Minds are guided by the values of collaborative spirit, unrelenting dedication and expert thinking. These values are core to all our operations.

Mindtree’s Mission

We engineer meaningful technology solutions to help businesses and societies flourish. Mindtree believes in the power of people and the impact people can have on technology. The roots grew from this belief that people with diverse points of view could come together to build a different kind of technology Company. This belief drives its vision for tomorrow to build technology experts who are focused on one goal, helping its clients succeed.

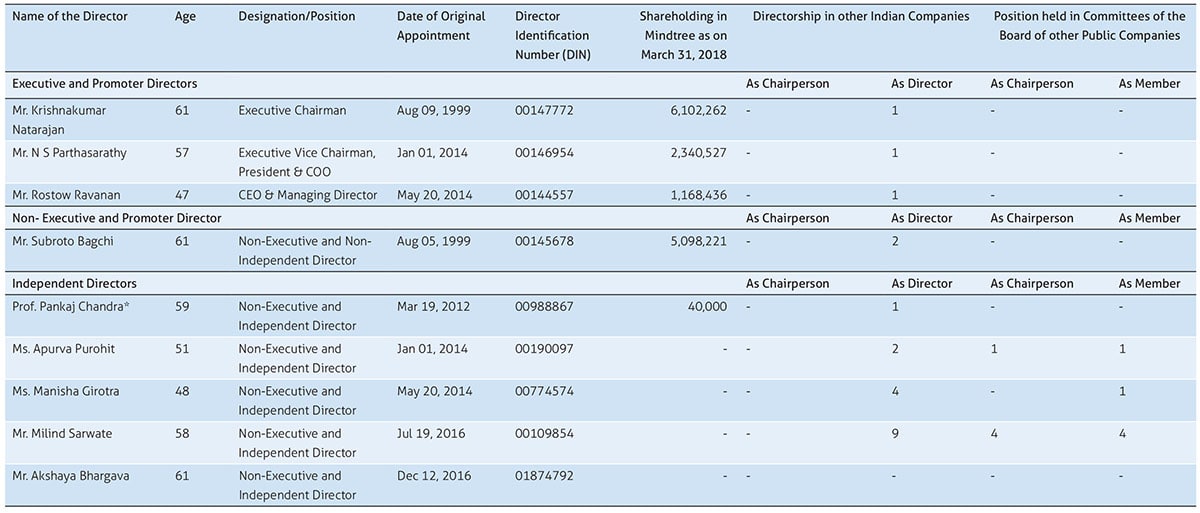

II. The Board of Directors (The Board) As on March 31, 2018, more than half of the Board comprised of Independent Directors. The Board composition comprised of nine Directors consisting three Executive and Promoter Directors, one Non-Executive and Promoter Director, five Non-Executive and Independent Directors, including two Women Directors. The composition of the Board was in accordance with SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (hereinafter referred as “Listing Regulations”) and Companies Act, 2013. The Board Members are not related to each other. Number of Directorships held by Executive, Non-Executive and Independent Directors are within the permissible limits under Listing Regulations and Companies Act, 2013. The necessary disclosures regarding change in Committee positions, if any, have been made by all the Directors, during the year under review. None of the Directors is a Member of more than 10 Committees or Chairperson of more than 5 Committees across all Public Companies (only Audit Committee and Stakeholders’ Relationship Committee). The details of Board Members along with shareholding details in the Company, number of Directorship(s)/ Chairmanship in other Indian Companies and position on Committee Chairmanship /Membership on the Board of other Public Companies (only Audit Committee and Stakeholders’ Relationship Committee) as on March 31, 2018 are provided below:

Appointments, Resignations, Retirements, Service Contracts, Notice Period and Severance Fees of Directors

Mr. Krishnakumar Natarajan was reappointed as Executive Chairman from July 01, 2017 to June 30, 2020 at the Eighteenth Annual General Meeting. The notice period for his resignation is twelve months.

Mr. N S Parthasarathy was elevated from Executive Director to Executive Vice Chairman for a period commencing from October 21, 2016 to December 31, 2018 and his notice period for resignation is three months. Further, Mr. N S Parthasarathy will be retiring by rotation and being eligible, offers himself for reappointment and the matter is being placed before the Shareholders at the ensuing Nineteenth Annual General Meeting for approval. The brief resume of Mr. N S Parthasarathy is furnished in the Notice of the Nineteenth Annual General Meeting pursuant to Listing Regulations, Companies Act, 2013 and Secretarial Standards.

Mr. Rostow Ravanan was appointed as CEO & Managing Director from April 1, 2016 to March 31, 2021 and his notice period for resignation is twelve months. Further, the appointment of the Managing Director and Executive Director/Whole-time Director(s) is governed by the Articles of Association of the Company, resolutions passed by the Board of Directors/Committees and the Members of the Company along with Service/Employment Contracts.

Mr. Subroto Bagchi continues as Non-Executive and Non- Independent Director with effect from April 01, 2016.

Ms. Apurva Purohit was appointed as Independent Director for a period commencing from January 01, 2014 to December 31, 2018. Ms. Manisha Girotra was appointed as Independent Director for a period commencing from May 20, 2014 to May 19, 2019. Mr. Milind Sarwate was appointed as Independent Director for a period commencing from July 19, 2016 to July 18, 2021. Mr. Akshaya Bhargava was appointed as Independent Director for a period commencing from December 12, 2016 to September 30, 2021. Prof. Pankaj Chandra was appointed as Independent Director for a period commencing from March 19, 2012 to March 31, 2018. He retired from the Board on April 01, 2018, due to the completion of his tenure.

Mr. V G Siddhartha, Non-Executive Director resigned from the Board on March 09, 2018, due to pre-occupation with his primary businesses. Dr. Albert Hieronimus, Independent Director retired from the Board on April 01, 2017, due to completion of his tenure. The service contracts, notice period and severance fees are not applicable to Non-Executive and/or Independent Directors.

Independent Directors

Independent Director is a Non-Executive Director, who fulfils the criteria as laid down under Listing Regulations and Companies Act, 2013, including any amendments thereto.

The Company has issued formal letter of appointment to its Independent Directors. The terms and conditions of draft appointment letter is published on the website of the Company in the following link: Letter of Appointment for Independent Director. The tenure of Independent Directors is in accordance with the Companies Act, 2013 and Listing Regulations.

Familiarization Programme for Independent Directors

Your Company has a well laid down onboarding/ orientation programme for the Independent Directors. The Business Heads, CFO and Executive Directors update the Board on business model of the Company, the nature of industry and its dynamism, the roles, responsibilities and liabilities of Independent Directors, etc. Further, business, legal, regulatory and industry updates are made available to the Independent Directors, especially to the Audit Committee members on an ongoing basis, by internal teams, external consultants, law firms, statutory and internal auditors, on a quarterly basis. See more at Details of Familiarization programme for Independent Directors

Lead Independent Director

Ms. Apurva Purohit is the Lead Independent Director and she leads the meeting of Independent Directors.

III. Board Meetings

Board Calendar

The Board meeting dates are decided in consultation with the Board members and the schedule of such meetings is communicated to all Directors two years in advance. Generally, the Board Meetings are held at Bengaluru where the Registered Office of the Company is situated.

Information flow to the Board members

The Board has complete access to Company information. The Chairperson of the Board shares an interim update with the Board for their review, inputs and approval on a quarterly basis.

Board Agenda

The Agenda of Board Meetings cover a detailed update on Business and Finance highlights for the quarter, presentation on key issues, key risks and the steps to overcome those risks. Business presentations are focused on lightening talks. The CEO provides quarterly information on top risks, top actions and other key updates to the Board. The Board agenda covers strategic matters. The management uploads the agenda, detailed notes and the business presentations on an online portal, which meets the high standards of security.

The agenda for the Board Meetings includes all the matters as required to be placed under Listing Regulations and that of Companies Act, 2013. The agenda is generally uploaded on the portal, seven clear days prior to the date of the meeting. The draft resolutions include detailed notes on the items to be discussed at the meeting to enable the Directors to take informed decisions.

During the year, the Board also reviewed the compliance reports pertaining to all laws applicable to the Company and took necessary steps to rectify the instances of non-compliances, if any. The Board agenda covers the following matters:

- Annual operating plans, budgets and any updates;

- Capital Budgets and any updates;

- Quarterly and/or Annual results for the Company and its operating divisions or business segments;

- Key business risks faced by the Company;

- Minutes of meetings of Audit Committee and other Committees of the Board;

- The information on recruitment and remuneration of senior officers just below the board level, including appointment or removal of Chief Financial Officer and the Company Secretary;

- On the issue of Show cause, demand, prosecution notices and penalty notices, which are materially important;

- On the Fatal or serious accidents, dangerous occurrences, any material effluent or pollution problems, if any;

- Material default in financial obligations to and by the Company, or substantial non-payment for goods sold by the Company, if any;

- Any issue, which involves possible public or product liability claims of substantial nature, including any judgment or order which, may have passed strictures on the conduct of the Company or taken an adverse view regarding another enterprise that can have negative implications on the Company;

- Details of any joint venture or collaboration agreements, if any;

- Transactions that involve substantial payment towards goodwill, brand equity, or intellectual property;

- Significant labor problems and their proposed solutions. Any significant development in Human Resources/ Industrial Relations front like signing of wage agreement, implementation of Voluntary Retirement Scheme etc.;

- Sale of investments, subsidiaries, assets, which are material in nature and not in normal course of business;

- Quarterly details of foreign exchange exposures and the steps taken by management to limit the risks of adverse exchange rate movement, if material and

- Non-compliance of any regulatory, statutory or listing requirements and shareholders service such as non-payment of dividend, delay in share transfer etc. and such other matters as stated in Part A of Schedule II of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015.

In case of urgent business needs, the Board’s approval is obtained by way of circular resolutions in accordance with the Companies Act, 2013.

During the year, members of the Board and key Executives disclosed to the Board whether they, directly, indirectly or on behalf of third parties, have a material interest in any transaction or matter directly affecting the Company. The Board and key Executives made necessary disclosures so as to meet the expectations of operational transparency to stakeholders, while at the same time maintaining confidentiality of information in order to foster a culture for good decision-making.

Number of Board Meetings

Your Board met seven times during the Financial Year 2017-18 i.e. on April 20, 2017, June 28, 2017, July 19, 2017, October 06, 2017, October 25, 2017, January 17, 2018 and March 09, 2018. The Board has passed one Circular Resolution during the Financial Year 2017-18.

In addition to the above, the Board met on March 9 and 10, 2018 for the Annual Plan and Strategy offsite meeting. The Strategy session focused on the strategy for the future of various business Industry Groups (IGs). The presentations also covered an update on Finance Plan for Financial Year 2019 and other functions. The session also provided a good perspective of the future opportunities and challenges.

The necessary quorum was present for all the Board Meetings. The maximum interval between any two Board Meetings was well within the maximum allowed gap of one hundred and twenty days. After each Board Meeting, your Company has a well-articulated system of follow up, review and reporting on actions taken by the Management on the decisions of the Board and Committees of the Board.

Meeting of Independent Directors

The Independent Directors of the Company met among themselves after every quarterly Board meeting, without the presence of the Executive Directors and members of the Management of the Company. These meetings were held on the same day as that of the quarterly Board Meetings, i.e. on April 20, 2017, July 19, 2017, October 25, 2017 and January 17, 2018. The practice of quarterly meeting of Independent Directors is in existence since 2007 and the purpose of these meetings is to promote open and candid discussion among the Independent Directors. In the said meetings, the Independent Directors reviewed the matters as required under the Listing Regulations and that of Companies Act, 2013. Action items, if any, were communicated to the Executive management and tracked to closure to the satisfaction of Independent Directors.

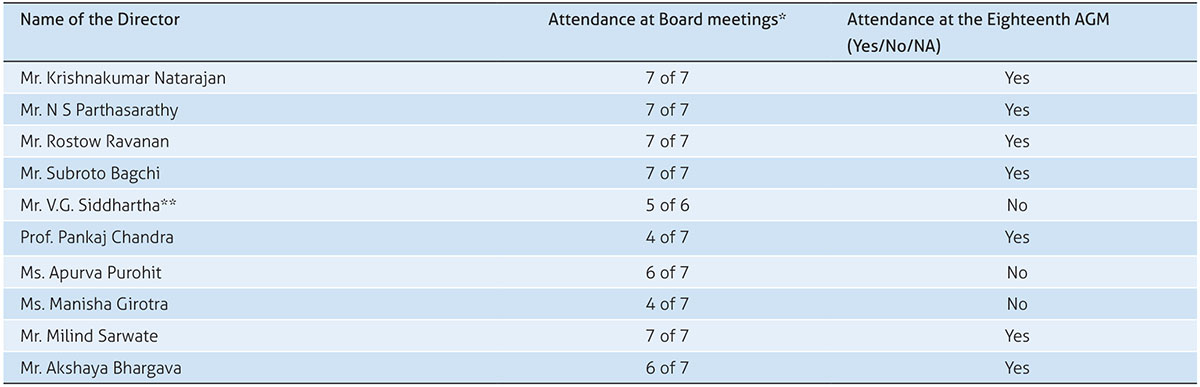

Attendance of Board Meetings and Eighteenth Annual General Meeting (AGM)

The Attendance Record of the Directors at the Board Meetings and at the Eighteenth AGM for the Financial 2017-18 are as follows:

*Meetings attended includes attendance through audio visual means/video conferencing.

**Mr. V G Siddhartha, Non-Executive Director resigned from the Board on March 09, 2018.

Note: Dr. Albert Hieronimus, Independent Director retired from the Board on April 01, 2017.

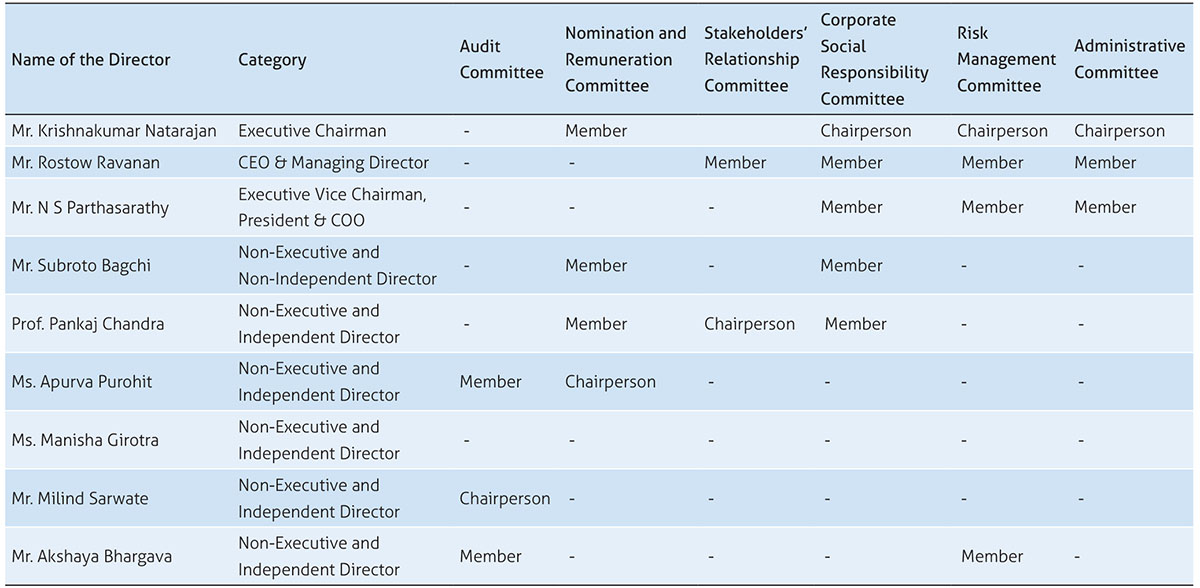

IV. Governance by the Committees of the Board

Your Board has constituted the following Committees and each Committee has their terms of reference as a Charter. The Chairperson of each Committee along with the other Members of the Committee and if required with other Members of the Board, decide the agenda, frequency and the duration of each meeting of that Committee. The Committees Chairperson provide a brief Committee update during the Board meetings. The Board had constituted the following Committees during the year 2017-18:

- Audit Committee;

- Nomination and Remuneration Committee;

- Stakeholders’ Relationship Committee;

- Corporate Social Responsibility Committee;

- Risk Management Committee and

- Administrative Committee

Composition of various Committees

As on the year ended March 31, 2018, the composition of various committees is as under:

Notes:

1. Mr. V G Siddhartha, Non-Executive Director ceased to be a member of Audit Committee with effect from March 09, 2018.

2. Ms. Vedavalli S, Company Secretary and Compliance Officer acted as the Secretary to the Audit Committee, Corporate Social Responsibility Committee, Stakeholders’ Relationship Committee and Administrative Committee.

3. Mr. N S Parthasarathy, Executive Vice Chairman, President & COO acted as the Secretary to the Nomination and Remuneration Committee.

4. Mr. Vijay Y H, Chief Risk Officer acted as the Secretary to the Risk Management Committee

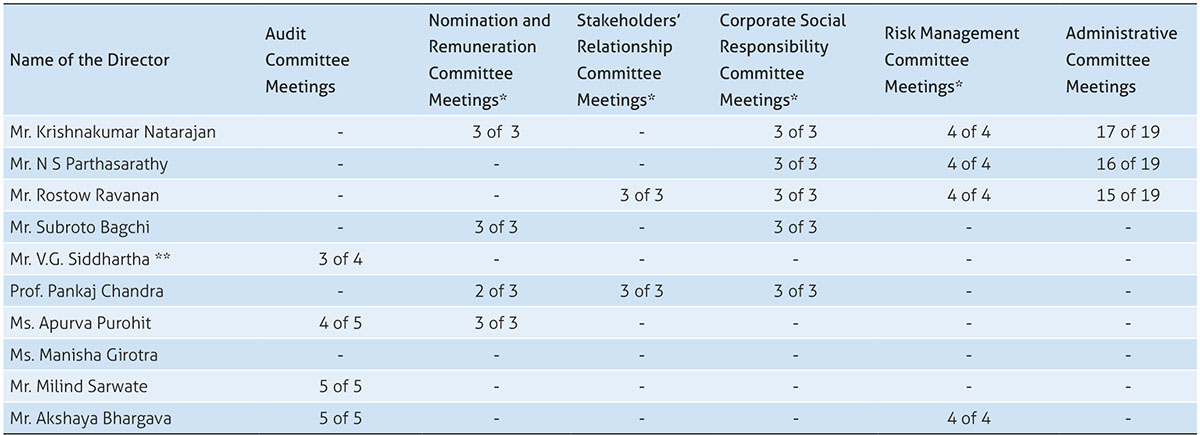

Attendance at Committee meetings

Meetings attended includes attendance through audio visual means/video conferencing.

** Mr. V G Siddhartha, Non-Executive Director ceased to be a Member of Audit Committee with effect from March 09, 2018.

Note: Dr. Albert Hieronimus, Independent Director ceased to be a Member of Audit Committee and Nomination and Remuneration Committee and Chairperson of Stakeholders’ Relationship Committee with effect from April 01, 2017.

1. Audit Committee

The Audit Committee was constituted in accordance with the requirement of statutes. The Audit Committee reports to the Board. The roles, responsibilities and the terms of reference of the Audit Committee are as follows:

- Overseeing of the Company’s financial reporting process and the disclosure of its financial information to ensure that the financial statement is correct, sufficient and credible;

- Recommendation for appointment, remuneration and terms of appointment of auditors of the Company;

- Approval of payment to statutory auditors for any other services rendered by the statutory auditors;

- Reviewing, with the management, the annual financial statements and auditor’s report thereon before submission to the Board for approval, with particular reference to:

- a. Matters required to be included in the Director’s Responsibility Statement to be included in the Board’s report in terms of clause (c) of sub-section (3) of Section 134 of the Companies Act, 2013;

b. Changes, if any, in accounting policies and practices and reasons for the same;

c. Major accounting entries involving estimates based on the exercise of judgment by management;

d. Significant adjustments made in the financial statements arising out of audit findings;

e. Compliance with listing and other legal requirements relating to financial statements;

f. Disclosure of any related party transactions;

g. Qualifications in the draft audit report, if any;

h. Modified opinion(s) in the draft audit report, if any - Reviewing, with the management, the quarterly financial statements before submission to the Board for approval;

- Reviewing, with the management, the statement of uses / application of funds raised through an issue (public issue, rights issue, preferential issue, etc.), the statement of funds utilized for purposes other than those stated in the offer document / prospectus / notice and the report submitted by the monitoring agency monitoring the utilization of proceeds of a public or rights issue, and making appropriate recommendations to the Board to take up steps in this matter;

- Reviewing and monitoring the auditor’s independence and performance and effectiveness of audit process;

- Approval or any subsequent modification of transactions of the Company with related parties;

- Scrutiny of inter-corporate loans and investments;

- Valuation of undertakings or assets of the Company, wherever it is necessary;

- Evaluation of internal financial controls and risk management systems;

- Reviewing, with the management, performance of statutory and internal auditors, adequacy of the internal control systems;

- Reviewing the adequacy of internal audit function, if any, including the structure of the internal audit department, staffing and seniority of the official heading the department, reporting structure coverage and frequency of internal audit;

- Discussion with internal auditors any significant findings and follow up there on;

- Reviewing the findings of any internal investigations by the internal auditors into matters where there is suspected fraud or irregularity or a failure of internal control systems of a material nature and reporting the matter to the board;

- Discussion with statutory auditors before the audit commences, about the nature and scope of audit as well as post-audit discussion to ascertain any area of concern;

- To look into the reasons for substantial defaults in the payment to the depositors, debenture holders, shareholders (in case of nonpayment of declared dividends) and creditors;

- To review the functioning of the Whistle Blower mechanism;

- Approval of appointment of CFO after assessing the qualifications, experience & background, etc. of the candidate;

- Carrying out any other function as is mentioned in the terms of reference of the Audit Committee;

- Management discussion and analysis of financial condition and results of operations;

- Statement of significant related party transactions (as defined by the Audit Committee), submitted by management;

- Management letters/ letters of internal control weaknesses issued by the statutory auditors;

- Internal audit reports relating to internal control weaknesses;

- The appointment, removal and terms of remuneration of the chief internal auditor shall be subject to review by the Audit Committee;

- Quarterly statement of deviation(s) including report of monitoring agency, if applicable, submitted to stock exchange(s) in terms of Regulation 32(1) of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015;

- Annual Statement of funds utilized for purposes other than those stated in the offer document/ prospectus/ notice in terms of Regulation 32(7) of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 and

- The Audit Committee shall also review the financial statements, in particular, the investments made by the unlisted subsidiaries.

The Chairperson and the members of Audit Committee are financially literate and have the required accounting and financial management expertise. The Chairperson of the Audit Committee was present at the Eighteenth Annual General Meeting to answer Shareholders’ queries. The CFO, Chief Risk Officer, Legal Counsel, Finance Controller, representatives of the Statutory Auditor/Internal Auditor are the regular invitees to attend the Audit Committee meetings. The Audit Committee also invited such other executives as it considered appropriate to be present at the meetings of the Committee. The Audit Committee had powers of investigation, within the terms of reference, wherever necessary during the year. The Audit Committee met five times during the Financial Year 2017-18 i.e. on April 19, 2017, July 18, 2017, October 25, 2017, January 16, 2018 and March 10, 2018 and not more than one hundred and twenty days had elapsed between two Audit Committee meetings. The necessary quorum was present for all the said Audit Committee Meetings.

2. Nomination and Remuneration Committee The Nomination and Remuneration Committee was constituted in accordance with the requirement of statutes.

The roles responsibilities and terms of reference of Nomination and Remuneration Committee are as follows:

- Review and approve the total compensation of the Chairman and CEO (inclusive of fixed compensation, performance based incentives, benefits and any other equity linked plans);

- Review and approve the remuneration (inclusive of fixed compensation, performance based incentives, benefits and any other equity linked plans) of business leaders reporting to the CEO;

- Devising a policy on diversity of board of directors;

- Identifying persons who are qualified to become directors and who may be appointed in senior management in accordance with the criteria laid down, and recommend to the board of directors about their appointment and removal;

- Review and approve any stock based schemes such as ESPS, RSU, Phantom Stock and the like including the list of people who are recommended to be covered under such plans;

- Recommend to the Board on the policy relating to remuneration payable to Directors, KMPs and other employees;

- Recommend to the Board the composition of the Board and it’s committees including framing the criteria for determining qualifications, positive attributes and Independence of a Director, that should be used to induct new members to the Board;

- Recommend to the Board on evaluation, appointment and reappointment of Directors/continuation on the terms of appointment of Independent Directors on the basis of the report of performance evaluation of Independent Directors;

- To formulate a criteria for evaluation of independent directors performance and select the external partner who would carry out the evaluation annually;

- Create a guideline on corporate governance, as may be required and review the same periodically;

- To provide a consultative role for senior appointments like Chief Financial Officer, Chief People Officer and other business leaders reporting to the CEO as and when required;

- Review the succession plan and development initiatives for identified successors to the CEO and other leaders reporting to the CEO and

- Any other matter referred to the Nomination and Remuneration Committee by the Board of Directors of the Company.

The Nomination and Remuneration Committee met three times during the Financial Year 2017-18 i.e. on April 20, 2017, July 19, 2017 and January 17, 2018.

The frequency, agenda, duration, etc., are as set by the Chairperson of the Committee. Prof. Pankaj Chandra, Member of the Nomination and Remuneration Committee was present at the Eighteenth Annual General Meeting to answer the Shareholders’ queries.

Board Membership Criteria

The Nomination and Remuneration Committee along with the Board, identifies the right candidate with right characteristics, skills and experience required for an individual member to possess and the Board as a whole. The Nomination and Remuneration Committee considers qualification, expertise and experience of the Directors in their respective fields i.e., personal, professional or business standing and the diversity of the Board while selecting the candidate as a Board member.

In addition to the above, in case of appointment of Independent Directors, the Committee shall satisfy itself with regard to the independence of the Directors so as to enable the Board to discharge its function and duties effectively.

Board Evaluation

The Nomination and Remuneration Committee is also responsible for the performance evaluation of Directors including Independent Directors. The criteria for evaluation includes Director’s attendance and contribution at meetings, preparedness for the meetings, expression of opinions and suggestions, commitment, domain knowledge to evaluate current business and strategic options.

The Nomination and Remuneration Committee has engaged an external agency to perform Board Evaluation in detail, for the evaluation of the Board as a whole, its Directors including Independent Directors, Committees and the Chairman of the Board, for the Financial Year 2017-18.

The details of the Board evaluation are provided in detail in the Directors’ Report.

Succession Planning

The Nomination and Remuneration Committee follows an effective mechanism for succession planning which focuses on orderly succession for the Board including CEO & Executive Directors, one level below the Board and other key employees. The Nomination and Remuneration Committee updates the Board about the Succession Planning on a periodical basis.

Remuneration Policy

Your Company’s remuneration policy, framed by Nomination and Remuneration Committee, is focused on recruiting, retaining and motivating high talented individuals. It is driven by the success and performance of the individual employees and the Company. Through its compensation programme, Mindtree endeavors to attract, retain, develop and motivate a high performance workforce. Mindtree follows a compensation mix of fixed pay, benefits and performance based variable pay. Individual performance pay is determined by business performance of the Company. The Company pays remuneration by way of salary, benefits, perquisites and allowances (fixed component) and performance incentives, commission (variable component) to its Chairman, Managing Director and other Executive Directors. Annual increments are decided by the Nomination and Remuneration Committee within the salary scale approved by the Board and Shareholders. Further, the Nomination and Remuneration Committee is also responsible for reviewing the overall goals and objectives of compensation programs, as well as our compensation plans and making changes to such goals, objectives and plans.

Remuneration paid to Directors

Members of the Company at the 15th Annual General Meeting of the Company held on July 18, 2014, have approved payment of remuneration by way of commission to Non-Executive and/or Independent Directors, a sum not exceeding 1% per annum of the net profits of the Company in aggregate for one financial year.

Remuneration to Independent Directors and Non-Executive Directors, is fixed by the Nomination and Remuneration Committee and the Board based on (i) the contribution they make to the decision making at the Board level and (ii) Industry standards/practice. No sitting fees was paid to them for attending any meeting of the Board and or its Committees.

No stock options have been granted to any Executive Directors, Non- Executive and/or Independent Directors during the Financial Year 2017-18.

During the year, there were no pecuniary relationships or transactions between the Company and any of its Non-Executive and/or Independent Directors apart from the remuneration and the transactions under the Related Party Transactions, as disclosed in the financial statements. The details of remuneration paid to Executive, Non-Executive and/or Independent Directors for the Financial Year 2017-18 are provided in Annexure 4, extract of Annual Return, annexed to the Directors’ Report in Form MGT-9, as required under the provisions of Section 92 of the Companies Act, 2013.

3. Stakeholders’ Relationship Committee

Prof. Pankaj Chandra, Independent and Non-Executive Director was the Chairperson of Stakeholders’ Relationship Committee as on March 31, 2018.

Ms. Vedavalli S, Company Secretary and Compliance Officer acted as Secretary to the Stakeholders’ Relationship Committee. Further she is also appointed as Nodal Officer for the purpose of IEPF Rules.

The terms of reference, roles and responsibilities of Stakeholders’ Relationship Committee are as follows:

1. To address and resolve grievances/ requests raised by Equity shareholders and other security holders of the Company;

2. Redressal of Shareholders’ grievances in general and relating to :

a. Non-receipt of declared dividends;

b. Non-receipt of Annual Reports;

c. Complaints related to share transfers, transmissions, transpositions, buybacks and other corporate actions.

3. Shareholder Engagement initiatives;

4. Such other matters as may be required under various statutes and

5. Any other matter referred to the Stakeholders’ Relationship Committee by the Board of Directors.

The Stakeholders’ Relationship Committee met thrice during the Financial Year 2017-18 i.e. on June 12, 2017, July 19, 2017 and January 17, 2018. The Chairperson of the Stakeholders’ Relationship Committee was present at the Eighteenth Annual General Meeting to answer the Shareholders’ queries. Grievances received from investors and other miscellaneous correspondence on change of address, mandates, etc. are processed by the Registrar and Share Transfer Agent in due course after verification.

Your Company has a designated e-mail ID, investors@mindtree.com for the redressal of any Stakeholders’ related grievances exclusively for the purpose of registering complaints by Members/stakeholders. Your Company has also displayed the said email ID under the investors section at its website, www.mindtree.com and other relevant details prominently for creating investor/stakeholder awareness.

SEBI Complaints Redress System (SCORES)

The Investors can also raise complaints in a centralized web-based complaints redress system called “Scores”. The Company uploads the action taken report on the complaints raised by the Shareholders on “Scores”, which can be viewed by the Shareholder. The complaints are closed to the satisfaction of the Shareholder and SEBI.

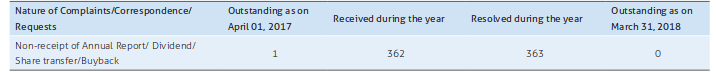

Details of complaints/requests etc., received and resolved during the Financial Year 2017-18 are as below:

4. Corporate Social Responsibility Committee (CSR Committee)

The Board has constituted the CSR Committee as per the requirements of the Companies Act, 2013 along with applicable rules. The Company has framed a CSR policy which is available on the following link: https://www.mindtree.com/about/investors/policies/policy-corporate-social-responsibility The CSR Committee met thrice during the Financial Year 2017-18 i.e. on June 12, 2017, July 19, 2017 and January 17, 2018. The frequency, agenda, duration, etc., are as set by the Chairperson of the Committee.

5. Risk Management Committee The Board has constituted the Risk Management Committee in accordance with the Listing Regulations, voluntarily. The roles, responsibilities and the terms of reference of the Risk Management Committee are as follows:

- Framing, implementation, monitoring and review of the Mindtree risk management policy/ plan;

- Evaluation of Mindtree risk management procedures including risk recognition, assessment, minimization and definition of risk appetite;

- Reviewing and discussing adoption of the Risk Management Policy and management’s recommended risk management framework;

- Ensuring the company is taking the appropriate measures to achieve prudent balance between risk and reward in both ongoing and new activities;

- Reviewing management’s prioritization of risks as set out in the framework and recommend significantly high risks to the Board for review;

- Reviewing and discussing management’s annual risk management program to ensure risks are managed in a systematic and prioritized manner and assessed regularly;

- Conducting an annual review with the owner of the process by which Mindtree manages its enterprise risks;

- Reviewing risk issues identified by audits and the resolution of such issues by management;

- Ensuring key risks identified are audited, if required;

- Reviewing quarterly risk reports provided by the Chief Risk Officer;

- Providing executive sponsorship for significantly high enterprise-level risks;

- Taking decisions on organization-level risk treatment options;

- Resolving conflicts of interests (in the context of risk management) and

- Any other matter referred to the Risk Management Committee (RMC) by the Mindtree Board of Directors.

The Risk Management Committee met four times during the Financial Year 2017-18 i.e. on April 19, 2017, July 11, 2017, October 04, 2017 and January 04, 2018. The frequency, agenda, duration, etc., are as set by the Chairperson of the Committee.

Internal Controls and Risk Management Your Company has robust system for Internal Audit and Corporate risk assessment and mitigation. Business risk assessment procedures have been set in place for self-assessment of business risks, operating controls and compliance with corporate policies. There is an ongoing process to track the evolution of risks and delivery of mitigating action plans.

Enterprise Risk Management (ERM) program is a strategic discipline, which supports Mindtree’s objective to support sustainable growth and generating value for its customers, investors, employees and other stakeholders. ERM encompasses areas of organizational exposure to risk (financial, strategic, operational and compliance). ERM also provides a structured process for management of risks whether those risks are quantitative or qualitative in nature.

This is achieved by deploying an effective risk management framework, which helps proactively identifying, prioritize and mitigate risks. The Mindtree Enterprise Risk Management (ERM) framework is designed by incorporating elements of leading risk management standards such as:

• COSO; Enterprise Risk Management- Framework by Treadway Commission

• ISO 31000: 2009 by ISO

• IRM Risk Management Standard

6. Administrative Committee

The Board has constituted Administrative Committee for managing day to day business transactions. The roles, responsibilities and terms of reference of Administrative Committee are as follows:

• Allotment under DSOP/ ESOP & ESPS Schemes;

• Rematerialisation of shares, Issue of Duplicate Share Certificates, Demat, and transfer of shares;

• Authorisation with regard to operation of Bank Account including opening, closing, change in signatories, entering into Foreign Exchange derivative contracts, other working capital facilities and other short term credit facilities;

• Authorising the officers of the Company to enter into various agreements, including Registration of Lease, commercial vendor contracts, etc.;

• Fixing record dates for corporate actions/benefits;

• Activation & Closure of Dividend accounts;

• Authorizing officers to sign various documents, represent themselves on behalf of the Company with Statutory and Government Authorities;

• Authorizing officers to sign various documents, represent themselves on behalf of the Company with Statutory and Government Authorities for wholly owned subsidiaries;

• To grant General/Special Power of Attorneys;

• Authorizing officers to sign documents with AMEX for corporate credit card account;

• Opening and registration of branch offices, appointing officials as authorized signatories and representatives thereof;

• Approval and Adoption of Branch accounts as per the respective countries laws; • Any decision related to short term working capital requirements such as issuance of Commercial papers, etc.;

• To negotiate, make necessary amendments, to execute additional agreements and such other documents in connection with investments made by the Company;

• Any other matter referred to the Administrative Committee (Admin Committee) by the Mindtree Board of Directors and

• Any other duties as may be delegated by the Board from time to time, but not limited to the above.

V Governance to Shareholders

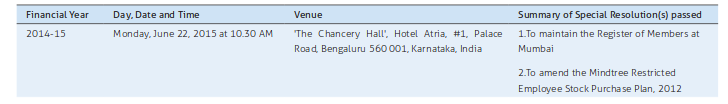

General Meetings, Postal Ballot and Hon’ble National Company Law Tribunal (“Hon’ble NCLT”) convened Meeting Annual General Meetings of the earlier three years:

Extra-Ordinary General Meetings (EGM) of the earlier three years:

No EGMs were held during the last three years.

Postal Ballot

No resolution was passed through Postal Ballot during the Financial Year 2017-18.

Hon’ble National Company Law Tribunal (“Hon’ble NCLT”) Convened Meeting

Pursuant to the Order dated December 14, 2017 of the Bengaluru Bench of the Hon’ble National Company Law Tribunal (“Hon’ble NCLT”), your Company had conducted a meeting of Unsecured Creditors and Equity Shareholders (“Shareholders”) of the Company on Wednesday, January 31, 2018 at 10.00 AM and 11.00 AM respectively, at Hotel ‘Radisson Blu Atria Bengaluru’, No. 1, Palace Road, Bengaluru – 560 001, Karnataka, for the purpose of considering, and if thought fit, approving with or without modification (s), the Scheme of Amalgamation of Magnet 360, LLC with Mindtree Limited under Sections 230 to 232 read with Section 234 of the Companies Act, 2013 and other applicable provisions of the Companies Act, 2013. The Hon’ble NCLT had appointed Mr. Nagendra D Rao, Practicing Company Secretary as the scrutinizer to conduct and scrutinize the voting in fair and transparent manner.

The Unsecured Creditors have approved the Scheme of Amalgamation unanimously and the Shareholders have approved the same with requisite majority, as prescribed under applicable laws and in accordance with the Order of the Hon’ble NCLT, Bengaluru Bench of Karnataka. The results were displayed on the website of the Company and the necessary disclosures were made to the Stock Exchanges. Please refer the results under the following link:

VI. Means of Communication

Quarterly and Annual Financial Results

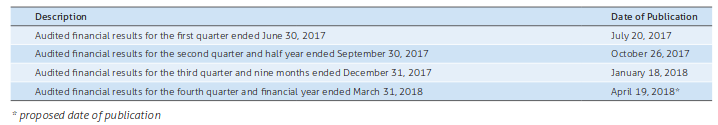

The communication is the key element of the overall Corporate Governance framework. Your Company constantly interacts with Shareholders through multiple channels of communication such as result announcement, annual report, media releases, Company’s website and other specific communications, as applicable. The management participates in the press call and earnings call every quarter, after the announcement of results. During the Financial Year 2017-18, your Company had participated in four Earnings/Analysts Call. The transcripts of the quarterly earnings calls with Analysts have also been published on its website. Your Company also sends quarterly financial updates to all Investors and Shareholders whose e-mail ids/ addresses are registered/made available to us. Further, the Company had conducted an Investor and Analyst meet on August 21, 2017 at Mumbai. The presentations made at the Investor and Analyst meet were shared with the stock exchanges and were also uploaded on the website of the Company. Newspaper publications on Financial Results

Quarterly and Annual financial results are also published in English and Regional (Kannada) newspapers, i.e., Business Standard and Kannada Prabha. The details of publication of financial results for the year under review are given below:

Website

The Company’s website www.mindtree.com contains a dedicated segment called ‘Investors’, where all the information as may be required by the Shareholders is available including press releases, quarterly results and presentations made by the Company to Financial Analysts and Institutional Investors, fact sheet reports, earnings conference call transcripts, shareholding pattern, stock exchange disclosures, shareholders’ reports, investor presentations, Annual Reports, Subsidiary Financials, Policies, additional disclosures, etc. in accordance with Regulation 46 of Listing Regulations.

Official Media releases and presentations made to Institutional Investors/Financial Analysts

Press releases/official media releases are sent to stock exchanges and are also displayed on the Company’s website at www.mindtree.com

Detailed presentations are made to the Institutional Investors/ Financial Analysts on the Company’s quarterly and annual financial results. These presentations are sent to stock exchanges and are also displayed on the Company’s website at www.mindtree.com

Stock Exchange filings

The Company also uploads its disclosures and announcements under the Listing Regulations at the link, https://www.connect2nse.com/LISTING/ to NSE Electronic Application Processing System (NEAPS) and to BSE Online Listing Centre at the link, http://listing.bseindia.com/ During the year, the Company also submitted a quarterly compliance report on Corporate Governance to the stock exchanges within 15 days from the close of quarter as per the formats given under the Listing Regulations.

VII. General Shareholders’ Information

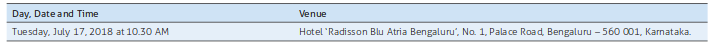

Nineteenth Annual General Meeting

In compliance with the provisions of Section 108 of the Companies Act, 2013 read with Rule 20 of the Companies (Management and Administration) Rules, 2014 and Regulation 44 of Listing Regulations, the Company has extended e-voting facility, for its Members to enable them to cast their votes electronically on the proposed resolutions in the Notice of the Nineteenth AGM. Instructions for e-voting are listed under the segment “Notes” in the Notice of the Nineteenth AGM. The Shareholders/Members, who cannot attend the AGM in person, can appoint a proxy to represent themselves at the AGM by sending a Proxy Form. The Proxy Form in order to be effective should be duly completed and deposited at the Registered Office of the Company, not less than 48 hours before the commencement of the AGM.

Financial Year

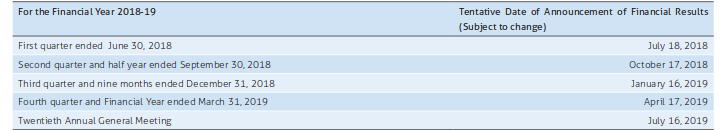

Board Calendar: Financial Year from April 1, 2018 to March 31, 2019

Date of Book Closure

The dates of book closure shall be from Wednesday, July 11, 2018 to Tuesday, July 17, 2018 (both the days inclusive).

Details of Dividend for the Financial Year 2017-18

Your Directors have declared the following interim dividends during the year:

(i) The Board of Directors on October 25, 2017, declared a first interim dividend of ₹ 2/- per equity share of face value of ₹ 10/- each and a special (interim) dividend of ₹ 2/- per equity share of face value of ₹ 10/- each on account of completion of 10 years of Initial Public Offering (IPO). The above dividends were paid to the Shareholders on November 7, 2017;

(ii) The Board of Directors on January 17, 2018, declared a second interim dividend of ₹ 2/- per equity share of face value of ₹ 10/- each, to the Shareholders, which was paid on January 30, 2018;

(iii) The Board of Directors on April 18, 2018, declared an interim dividend of ₹ 2/- per equity share of face value of ₹ 10/- each, to the Shareholders, which will be paid on or before May 10, 2018.

Further, your Directors have also recommended, a final dividend of ₹ 3/- per equity share of face value of ₹ 10/- each, for the Financial Year ended March 31, 2018 which is payable on obtaining the Shareholders’ approval at the Nineteenth Annual General Meeting. The final dividend, if approved, will be paid on or before July 31, 2018.

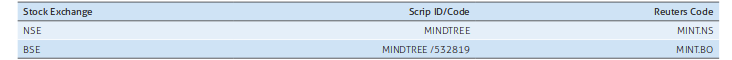

Listing on Stock Exchanges

Your Company’s equity shares are listed on the following Stock Exchanges as on March 31, 2018:

(i) BSE Limited (Bombay Stock Exchange), Phiroze Jeejeebhoy Towers, Dalal Street, Mumbai 400 001 &

(ii) National Stock Exchange of India Limited (NSE), Exchange Plaza, Bandra Kurla Complex, Bandra (East), Mumbai 400 051. Listing fees for the Financial Year 2018-19 has been paid to both NSE and BSE Limited within the stipulated time.

Stock Code

Corporate Identity Number (CIN)

The Corporate Identity Number (CIN) allotted by the Ministry of Corporate Affairs, Government of India, is L72200KA1999PLC025564 and the Company’s Registration No. is 08/25564 of 1999. Your Company is registered in the State of Karnataka, India.

Registered Office

The Registered Office of the Company is situated at: Global Village, RVCE Post, Mysore Road, Bengaluru-560 059, Karnataka, India. Ph: +91-80-6706 4000, Fax: +91-80-6706 4100, Website: www.mindtree.com

International Securities Identification Number (ISIN)

ISIN is an identification number for traded shares. This number needs to be quoted in each transaction relating to the dematerialized equity shares of the Company. Your Company’s ISIN number for its equity shares is INE018I01017.

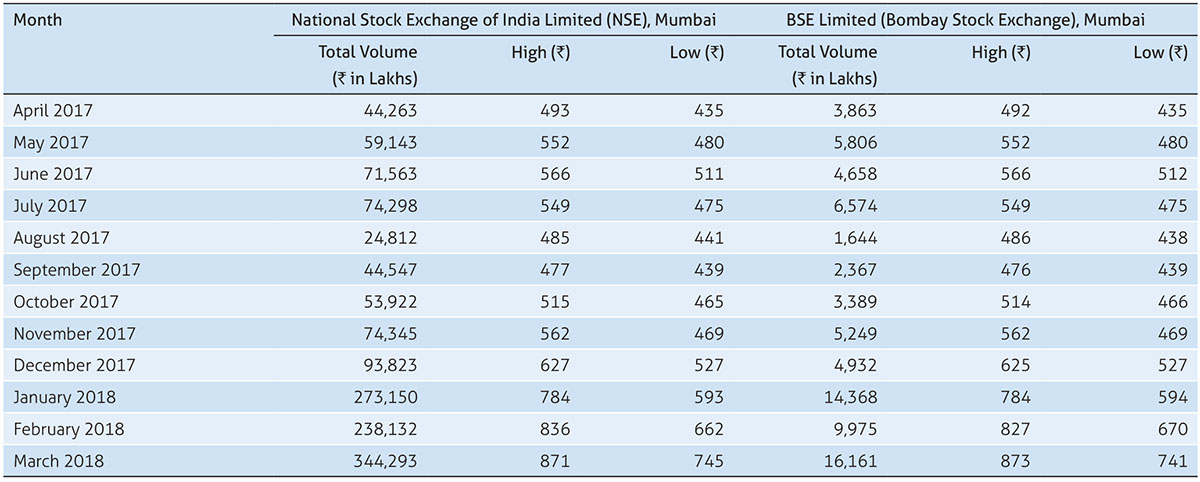

Market Price Data: High, Low during each month in the Financial Year 2017-18

The Company’s monthly high and low share price as well as the total turnover at the NSE and BSE Limited are given herein. The share price data during each month in the Financial Year 2017-18 on the National Stock Exchange of India Limited and BSE Limited (Bombay Stock Exchange) are as mentioned below:

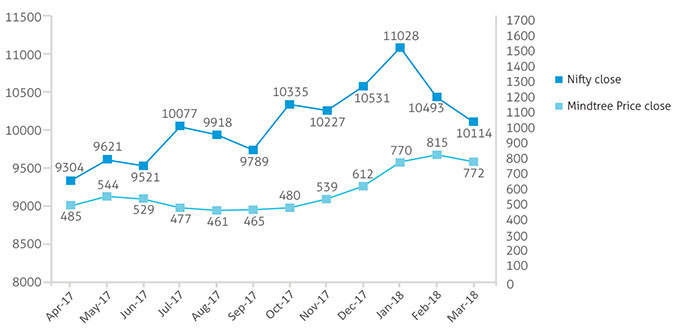

Performance in comparison to broad-based indices such as NSE Nifty and BSE Sensex Mindtree’s share price movement compared to NSE Nifty (closing price on last trading day of the month)

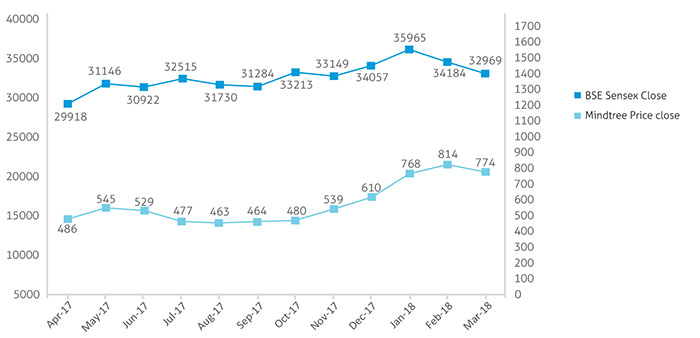

Mindtree’s share price movement compared to BSE Sensex (closing price on last trading day of the month)

Registrar and Share Transfer Agent All work related to Share Registry, both in physical form and electronic form, are handled by the Company’s Registrar and Share Transfer Agent, Link Intime India Private Limited. The communication address of the Registrar and Share Transfer Agent is given hereunder:

Link Intime India Pvt. Ltd. C-101, 247 Park, L.B.S Marg, Vikhroli (W), Mumbai – 400 083, India. Tel: +91 22 4918 6000 | Fax: +91 22 4918 6060 | e-mail: rnt.helpdesk@linkintime.co.in | Website: www.linkintime.co.in

Share transfer system

Link Intime India Private Limited is the common Share Transfer Agent for both physical and dematerialised mode. Transfer of shares in electronic form are processed and approved by National Securities Depository Limited (“NSDL”) / Central Depository Services (India) Limited (“CDSL”) through their Depository Participant without the involvement of the Company. Transfer of shares in physical form are registered and transferred to the respective transferees within the prescribed time as per the Listing Regulations, after the confirmation from Registrar and Share Transfer Agent on the completeness of documentation. The Share transfers are approved by the Administrative Committee. The details of share transfers during the quarter are also placed before the Board meetings and the Board takes the same on record. In case of any grievances related to share transfers, the same are placed before Stakeholders’ Relationship Committee. The Company did not have any instances of Shareholders grievance on share transfers during the year.

The Company also obtains a certificate from the Company Secretary under Regulation 40(9) of the Listing Regulations, to the effect that all share certificates have been issued within 30 days of lodgment of the transfer, sub-division, consolidation and renewal and files the same with stock exchanges.

Reconciliation of Share Capital Audit

The Reconciliation of Share Capital Audit was undertaken on a quarterly basis and the audit covers the reconciliation of the total admitted capital with NSDL and CDSL and the total issued and listed capital. The audit has also confirmed that the aggregate of the total issued/paid up capital is in agreement with the total number of shares in physical form, shares allotted & advised for demat credit but pending execution and the total number of dematerialized shares held with NSDL and CDSL. The report thereof was submitted to the Stock Exchanges, where the Company’s shares are listed and is also placed on the website of the Company.

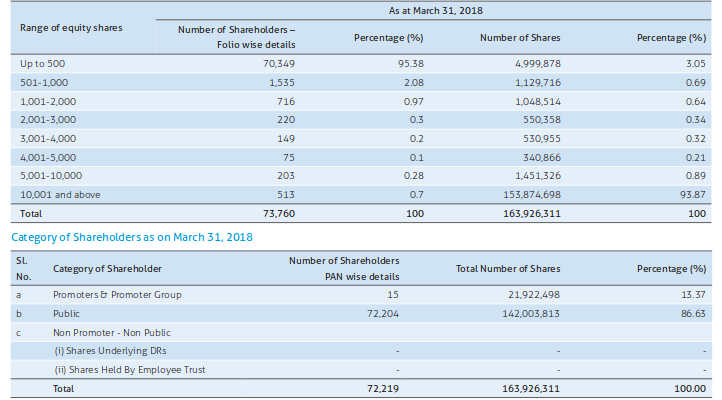

Distribution of Shareholding

The detailed shareholding pattern is provided in Annexure 4, the extract of the Annual Return, annexed to the Directors Report in Form MGT-9 as required under provisions of Section 92 of the Companies Act, 2013.

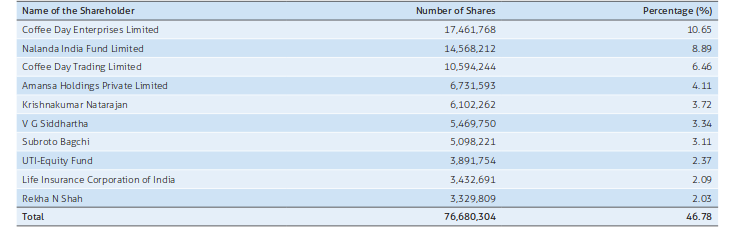

List of Top Ten Shareholders of the Company as on March 31, 2018

Dematerialization of Shares and Liquidity

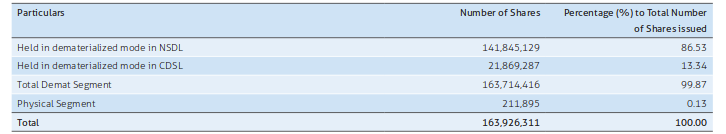

Your Company’s shares are admitted into both the Depositories i.e. NSDL and CDSL by the Company’s Registrar and Share Transfer Agent, Link Intime India Private Limited. 99.87% of the Company’s shares are held in electronic/demat form as on March 31, 2018. As on March 31, 2018, the number of shares held in dematerialized and physical mode are as under:

Shares held in Demat or Electronic Form

For shares held in electronic form, after confirmation of sale/purchase transaction from the Broker, Shareholders should approach their respective Depositary Participant (DP) with a request to debit or credit the account for the transaction. The DP will immediately arrange to complete the transaction by updating the account. There is no need for separate communication to either Company or Registrar and Share Transfer Agent to register such share transfers in electronic/demat form. For matters regarding shares held in demat/electronic form and for matters related to dividends, change of address, change of bank mandates, etc., Shareholders should communicate directly with their respective Depository Participant.

Shares held in Physical Form

For matters regarding shares held in physical form, share certificates, dividends, change of address, etc., Shareholders should communicate with Link Intime India Private Limited, our Registrar and Share Transfer Agent.

Outstanding GDRs/ADRs/Warrants or any Convertible instruments, conversion date and likely impact on equity

There are no outstanding GDRs / ADRs / Warrants / Convertible Instruments of the Company and hence, the same is not applicable to the Company.

Commodity price risk or foreign exchange risk and hedging activities

Your Company do not have any Commodity price risk. Your Company has a formal Board approved hedging strategy which is reviewed periodically. Judiciously hedging against adverse foreign exchange exposures helps minimize the impact of exchange fluctuations. We continue to maintain a prudent and balanced forex management policy which will help us manage risk appropriately.

Branch Locations of the Company

The branch locations consisting of address and other contact details have been provided separately in this Annual Report and the details are also available at https://www.mindtree.com/about/locations.

Address for Correspondence

Shareholders can also send their correspondence to the Company with respect to their shares, dividend, request for annual reports and other grievances. The contact details are provided below:

Ms. Vedavalli S

Company Secretary and Compliance Officer

Mindtree Limited, Global Village, RVCE Post, Mysore Road, Bengaluru - 560 059, India.

P + 91 80 6706 4000 | F + 91 80 6706 4100 | Email:investors@mindtree.com | Website: www.mindtree.com

Analysts can reach our Investor Relations Team for any queries and clarifications on Financial/Investor Relations related matters. The contact details are provided below:

Mr. Sushanth Pai

Head - Investor Relations

Mindtree Limited, Global Village, RVCE Post, Mysore Road, Bengaluru - 560 059, India.

P + 91 80 3395 5458 | F + 91 80 6706 4100 | Email: sushanth.pai@mindtree.com | Website: www.mindtree.com

VIII. Governance by Management and other Disclosures

Management Discussion and Analysis

Management Discussion and Analysis Report as required under Listing Regulations is provided separately in this Annual Report.

Policies relating to Corporate Governance

The Board has laid down the following policies to ensure governance in an ethical manner:

• Code of Conduct

• Policy on Corporate Social Responsibility

• Policy for determining material information

• Policy for determining material subsidiary

• Whistle Blower Policy

• Policy on determining material related party transactions

• Document Retention & Archival Policy

• Code of Conduct for Prevention of Insider Trading in Mindtree Securities • Dividend Policy

The above policies are also available on our website at https://www.mindtree.com/about/investors.

Code of Conduct

Your Company has laid down a Code of Conduct (“Code”) for all the Board Members (which includes the duties of Independent Directors as laid down under the Companies Act, 2013) and Senior Management Personnel of the Company. The Code is available on the website of the Company i.e., https://www.mindtree.com/code-conduct. All Directors and Senior Management Personnel of the Company have affirmed compliance with the Company’s Code of Conduct and disclosure under Regulation 26(5) and 26(6) of Listing Regulations, for the Financial Year ended March 31, 2018. A declaration signed by the Chief Executive Officer (CEO) to this effect is attached as Annexure A to the Corporate Governance Report in this Annual Report.

Compliance Certificate by CEO and CFO

The Compliance Certificate by CEO and CFO as required under the Regulation 17 of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, is provided as Annexure B to the Corporate Governance Report in this Annual Report.

Compliance of Prohibition of Insider Trading Regulations

Your Company has formulated Code of Conduct for Prevention of Insider Trading in Mindtree Securities (“Code”) in accordance with SEBI (Prohibition of Insider Trading) Regulations, 2015. The objective of this Code is to protect the interest of Shareholders at large, to prevent misuse of any price sensitive information and to prevent any insider trading activity by dealing in shares of the Company by its Directors, Designated Persons and other employees. The details of the trading by Designated and other Mindtree Minds are placed before the Audit Committee and Board meeting on a quarterly basis. Mr. Jagannathan Chakravarthi, CFO, continues to act as Compliance Officer under the Code of Conduct for Prevention of Insider Trading in Mindtree Securities. The Code is available on the website of the Company on the following link: https://www.mindtree.com/about/investors/code-conduct-prevention-insider-trading-mindtree-securities

Whistle Blower Policy /Vigil Mechanism

Your Company has adopted a Whistle Blower Policy and has established vigil mechanism in line with the requirements under the Companies Act, 2013 and Listing Regulations for the employees and other stakeholders to report concerns about unethical behavior, actual or suspected fraud or violation of the integrity policy. The Whistle Blower Policy is available at the following link: https://www.mindtree.com/about/investors.

The vigil mechanism provides adequate safeguards to the whistle blowers against any victimization or vindictive practices like retaliation, threat or any adverse (direct or indirect) action on their employment. The Policy also ensures that strict confidentiality is maintained whilst dealing with concerns and also that no discrimination will be made to any person for a genuinely raised concern. The Company has constituted Cultural Protection Committee and Internal Complaints Committee (POSH Committee) which looks into the complaints raised and resolves the same. The above Committees report to the Audit Committee and Board. The Audit Committee looks into matters reported on a quarterly basis and track matters to closure as per law. No personnel has been denied access to the Audit Committee.

Disclosure of Related Party Transactions

Your Company has formulated a policy on materiality of related party transactions and on dealing with related party transactions in accordance with Companies Act, 2013 and Listing Regulations. The policy is available on the Company’s website in the following link: https://www.mindtree.com/policy-for-determining-material-related-party-transactions.

All related party transactions are entered into with the prior approval of the Audit Committee. The interested Directors do not participate in the discussions and vote on such matters, when they are placed for approval. During the Financial Year 2017-18, there were no such related party transactions, either as per Companies Act, 2013 or Listing Regulations, which were required to be approved by the Board of Directors or the Shareholders of the Company. Further, there were no materially significant related party transactions that may have potential conflict of interests of the Company at large. Register under Section 189 of the Companies Act, 2013 is maintained and particulars of transactions are entered in the Register, wherever applicable. The related party transactions, as set out in the financial statements are provided to the Board and Audit Committee on a quarterly basis. The Audit Committee and the Board takes the same on record and notes that these transactions are at arm’s length and in the ordinary course of business.

Disclosure on Accounting treatment in preparation of Financial Statements The Company has prepared financial statements in accordance with Indian Accounting Standards (“Ind AS”) notified under the Companies (Indian Accounting Standards) Rules, 2015 and Companies (Indian Accounting Standards) Amendment Rules, 2016, as applicable.

Details of non-compliance by the Company, penalties, strictures imposed on the Company by the Stock Exchange(s) or SEBI or any statutory authority, on any matter related to capital markets, during the last three years

No penalty or stricture was imposed by the Stock Exchanges or SEBI or any other authority, during the last 3 (three) years, since all applicable requirements were fully complied with.

Details of compliance with mandatory and adoption of non-mandatory requirements under SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015

The Company has disclosed and complied with all the mandatory requirements under Listing Regulations. The details of these compliances have been given in the relevant sections of this report.

Among non-mandatory requirements, as specified in Part E of Schedule II of Listing Regulations, the Company has adopted the following:

Separate posts of Chairman and CEO – The Chairman and CEO/ Managing Director are two separate persons -The position of Chairman and CEO is bifurcated in the Company.

Shareholders’ Rights – Quarterly/ half yearly financial results along with the press release are uploaded on the website of the Company at https://www.mindtree.com/about/investors. The quarterly /half yearly consolidated financial results along with the key highlights for the quarter/ half year are also sent to those Shareholders electronically who have registered their email addresses with Registrar and Share Transfer Agent/ Company.

Reporting of Internal Auditor – The Internal auditor reports directly to the Audit Committee.

Audit Qualifications – The Company has unqualified financial statements since inception. The Auditors of the Company, have issued Audit Reports with unmodified opinion on the standalone and consolidated financial statements for the year ended March 31, 2018.

Disclosure of Subsidiaries

Your Company does not have any material subsidiary. The details of subsidiaries are provided in detail in Directors’ Report. The performance of the subsidiaries are monitored by the Company inter alia, by the following means:

• The Audit Committee reviews the financial statements of subsidiaries, including the investments made by the subsidiaries, if any, on a regular basis;

• Minutes of Board meetings of unlisted subsidiaries are placed before the Board on a quarterly basis;

• A statement containing all significant transactions and arrangements entered into by unlisted subsidiaries is placed before the Company’s Board on a quarterly basis.

The Company’s Policy for determining material subsidiaries is available on the following link: http://www.mindtree.com/policy-for-determining-material-subsidiary

Secretarial Audit

During the Financial Year 2017-18, Secretarial Audit was conducted as required under the provisions of Section 204 of the Companies Act, 2013. Mr. G. Shanker Prasad, Practicing Company Secretary, Membership Number: 6357; CP Number: 6450 conducted the audit and the Secretarial Audit Report is in Annexure 8 to the Directors’ Report.

Non-compliance of Regulations relating to Corporate Governance under SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, if any

Your Company is fully compliant with all the regulations and there are no such non-compliances.

Compliance with SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015

The Auditors’ Certificate on Corporate Governance obtained from Deloitte Haskins & Sells, Chartered Accountants (Firm Registration No.008072S) for compliance with SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, is provided as Annexure 9 to the Directors’ Report.

Disclosure on Compliance

Your Company has complied with the requirements of the Regulation 17 to 27 and Clauses (b) to (i) of sub-regulation (2) of Regulation 46 of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015.

Annexure A

Declaration by the CEO under the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 regarding compliance with Code of Conduct

In accordance with the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, I hereby confirm that, all Board Members and Senior Management Personnel of the Company have affirmed compliance with the Code of Conduct, as applicable to them, for the Financial Year ended March 31, 2018.

Rostow Ravanan

CEO & Managing Director

Place: Bengaluru

Date: April 18, 2018

Annexure B

Compliance Certificate

{As per Regulation 17 (8) of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015}

We, Rostow Ravanan, CEO & Managing Director and Jagannathan Chakravarthi, Chief Financial Officer of Mindtree Limited, to the best of our knowledge, information and belief, certify that:

- We have reviewed financial statements and the cash flow statement for the year ended March 31, 2018 and:

a. These Financial Statements do not contain any materially untrue statement or omit any material fact or contain statements that might be misleading;

b. These Financial Statements together present, in all material respects, a true and fair view of the Company’s affairs, the financial condition and results of operations and are in compliance with applicable accounting standards, laws and regulations. - There are, to the best of our knowledge and belief, no transactions entered into by the Company during the year which are fraudulent, illegal or which violate the Company’s code of conduct.

- We are responsible for establishing and maintaining internal controls over financial reporting by the Company and we have:

a. Designed such controls to ensure that material information relating to the Company, including its consolidated subsidiaries, is made known to us by others;

b. Designed or caused to be designed, such internal control systems over financial reporting, so as to provide reasonable assurance regarding the preparation of financial statements in accordance with Indian Accounting Standards (Ind AS) in India; and

c. Evaluated the effectiveness of internal control systems of the Company pertaining to financial reporting. - During the year, we have disclosed to the Company’s Auditors and the Audit Committee of the Board of Directors:

a. Any change, that has materially affected or is reasonably likely to materially affect, the Company’s internal control over financial reporting;

b. Any significant changes in accounting policies during the year, and that the same have been disclosed appropriately in the notes to the financial statements;

c. Instances of significant fraud, if any, that we are aware especially if any Member of management or employee involved in financial reporting related process. No such instances were noticed during the year 2017-18;

d. All significant changes and deficiencies, if any, in the design or operation of internal controls, which could adversely affect the Company’s ability to record, process, summarize and report financial data; and

e. Any material weaknesses in internal controls over financial reporting including any corrective actions with regard to deficiencies. - In the event of any materially significant misstatements or omissions, we will return to the Company that part of any bonus or incentive which was inflated on account of such mistakes or omissions.

- We affirm that we have not denied any employee, access to the Audit Committee of the Company (in respect of matters involving alleged misconduct) and we have provided protection to whistleblowers from unfair termination and other unfair or prejudicial employment practices.

- We further declare that, all Board Members and senior managerial personnel have affirmed compliance with the code of conduct for the current year.

Rostow Ravanan

CEO & Managing Director

Jagannathan Chakravarthi

Chief Financial Officer

Place: Bengaluru

Date: April 18, 2018