IFRS Financial Statements 2017-18

Independent Auditor’s Report to the Board of Directors of Mindtree Limited

Report on the Consolidated Financial Statements

We have audited the accompanying Consolidated Financial Statements of MINDTREE LIMITED (“the Company”) and its subsidiaries (the Company and its subsidiaries together referred to as “the Group”), which comprise the Consolidated Statement of Financial Position as at March 31, 2018, the Consolidated Statement of Profit or Loss, the Consolidated Statement of Comprehensive Income for the year ended March 31, 2018, the Consolidated Statement of Changes in Equity and the Consolidated Statement of Cash Flows for the year then ended, and a summary of significant accounting policies and other explanatory information (hereinafter referred to as “the consolidated financial statements”).

Management’s Responsibility for the Consolidated Financial Statements

The Company’s Board of Directors are responsible for the preparation of these consolidated financial statements that give a true and fair view of the consolidated financial position, consolidated financial performance, consolidated total comprehensive income, consolidated changes in equity and consolidated cash flows of the Group in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board.

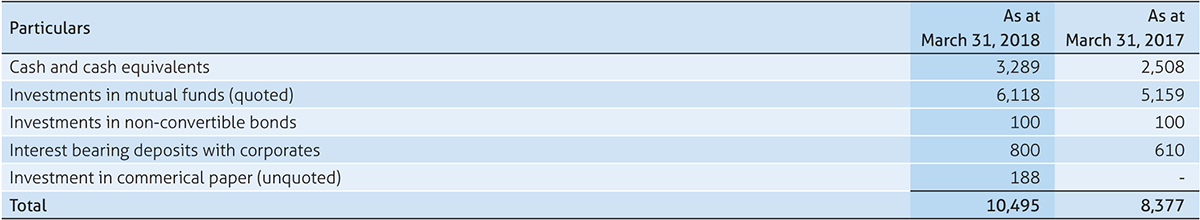

This responsibility also includes maintenance of adequate accounting records, for safeguarding the assets of the Group and for preventing and detecting frauds and other irregularities; the selection and application of appropriate accounting policies; making judgments and estimates that are reasonable and prudent; and the design, implementation and maintenance of adequate internal financial controls, that were operating effectively for ensuring the accuracy and completeness of the accounting records, relevant to the preparation and presentation of the financial statements that give a true and fair view and are free from material misstatement, whether due to fraud or error.

Auditor’s Responsibility

Our responsibility is to express an opinion on these consolidated financial statements based on our audit. We conducted our audit in accordance with the Standards on Auditing issued by the Institute of Chartered Accountants of India. Those Standards require that we comply with ethical requirements and plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the consolidated financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the consolidated financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal financial control relevant to the Company’s preparation and presentation of the consolidated financial statements that give a true and fair view in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of the accounting estimate made by the management, as well as evaluating the overall presentation of the consolidated financial statements.

We believe that the audit evidence obtained by us is sufficient and appropriate to provide a basis for our audit opinion on the consolidated financial statements.

Opinion

In our opinion and to the best of our information and according to the explanations given to us, the aforesaid consolidated financial statements give a true and fair view in conformity with the aforesaid accounting principles, of the consolidated state of affairs of the Group as at March 31, 2018, the consolidated profit and consolidated total comprehensive income for the year then ended, consolidated changes in equity and the consolidated cash flows for the year ended on that date.

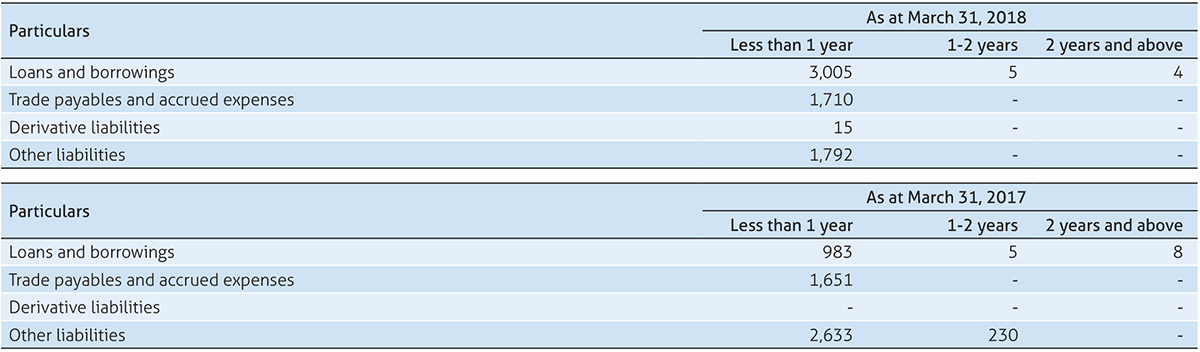

For Deloitte Haskins & Sells

Chartered Accountants

(Firm’s Registration No. 008072S)

V. Balaji

Partner

(Membership No. 203685)

Bengaluru, April 18, 2018

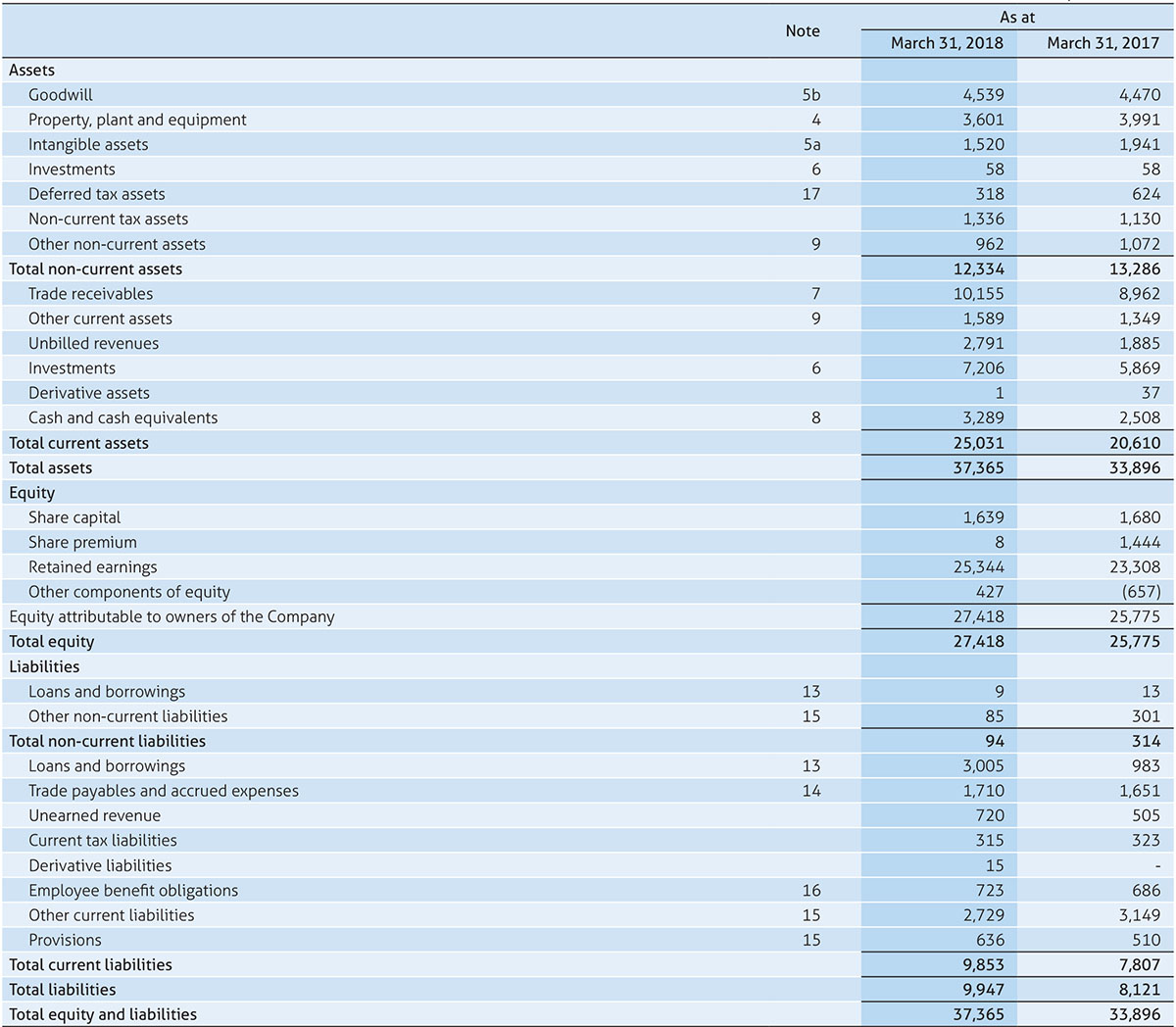

Consolidated statement of financial position

The accompanying notes form an integral part of these consolidated financial statements.

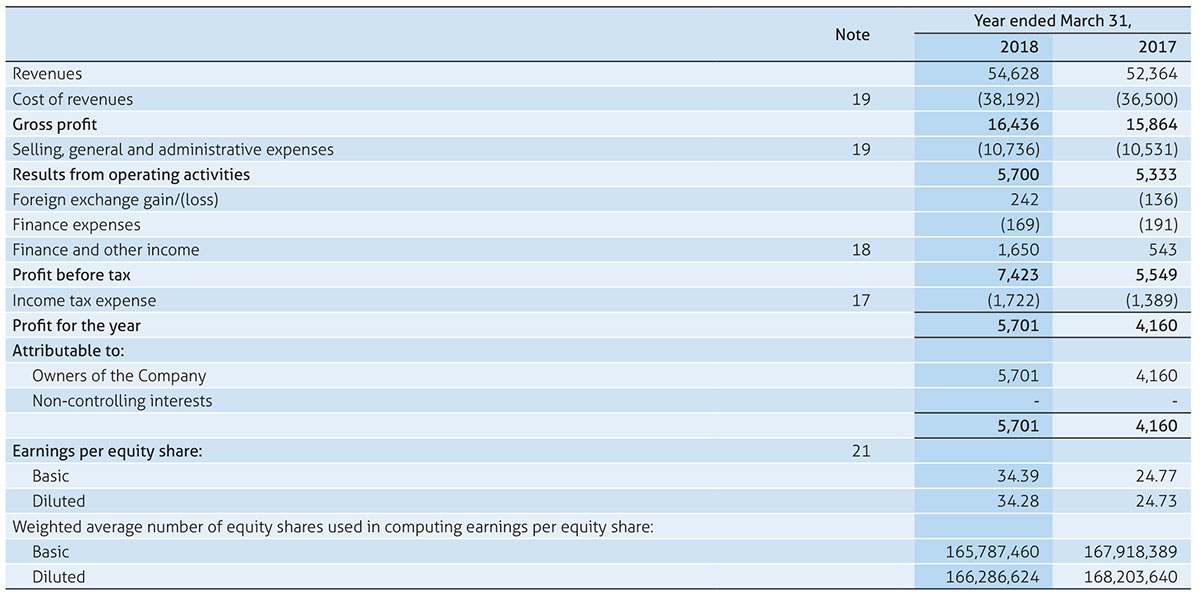

Consolidated statement of profit or loss

The accompanying notes form an integral part of these consolidated financial statements.

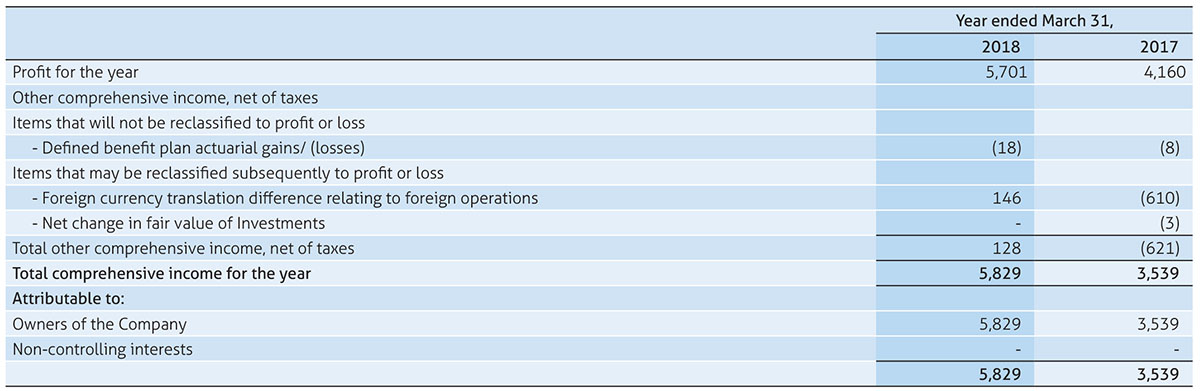

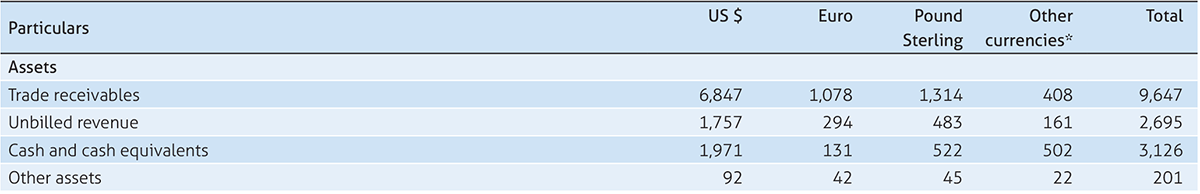

Consolidated statement of comprehensive income

The accompanying notes form an integral part of these consolidated financial statements.

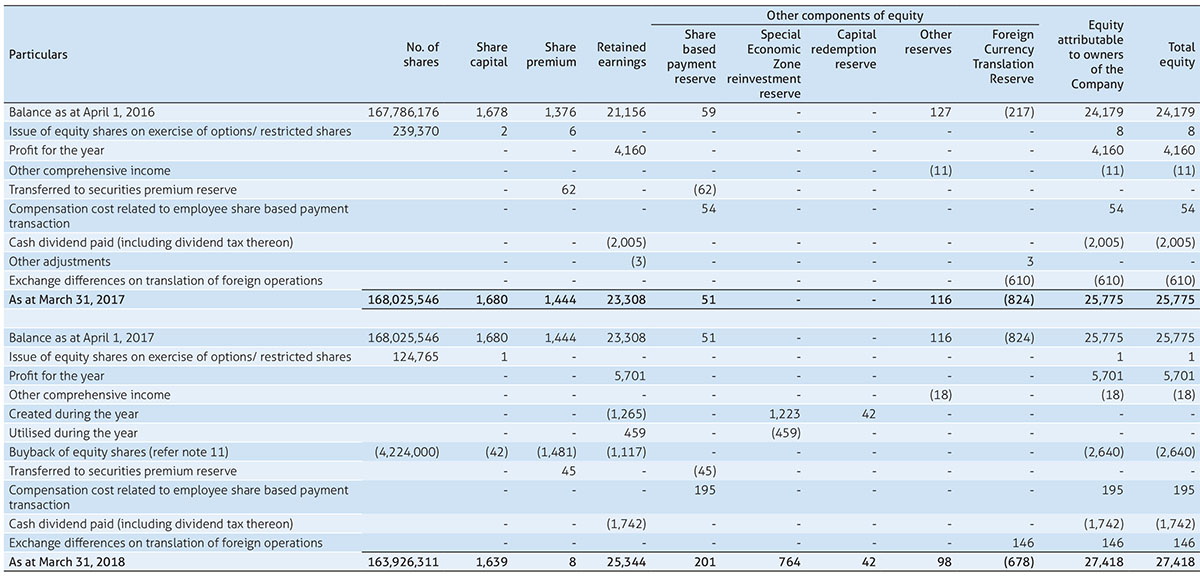

Consolidated statement of changes in equity

The accompanying notes form an integral part of these consolidated financial statements.

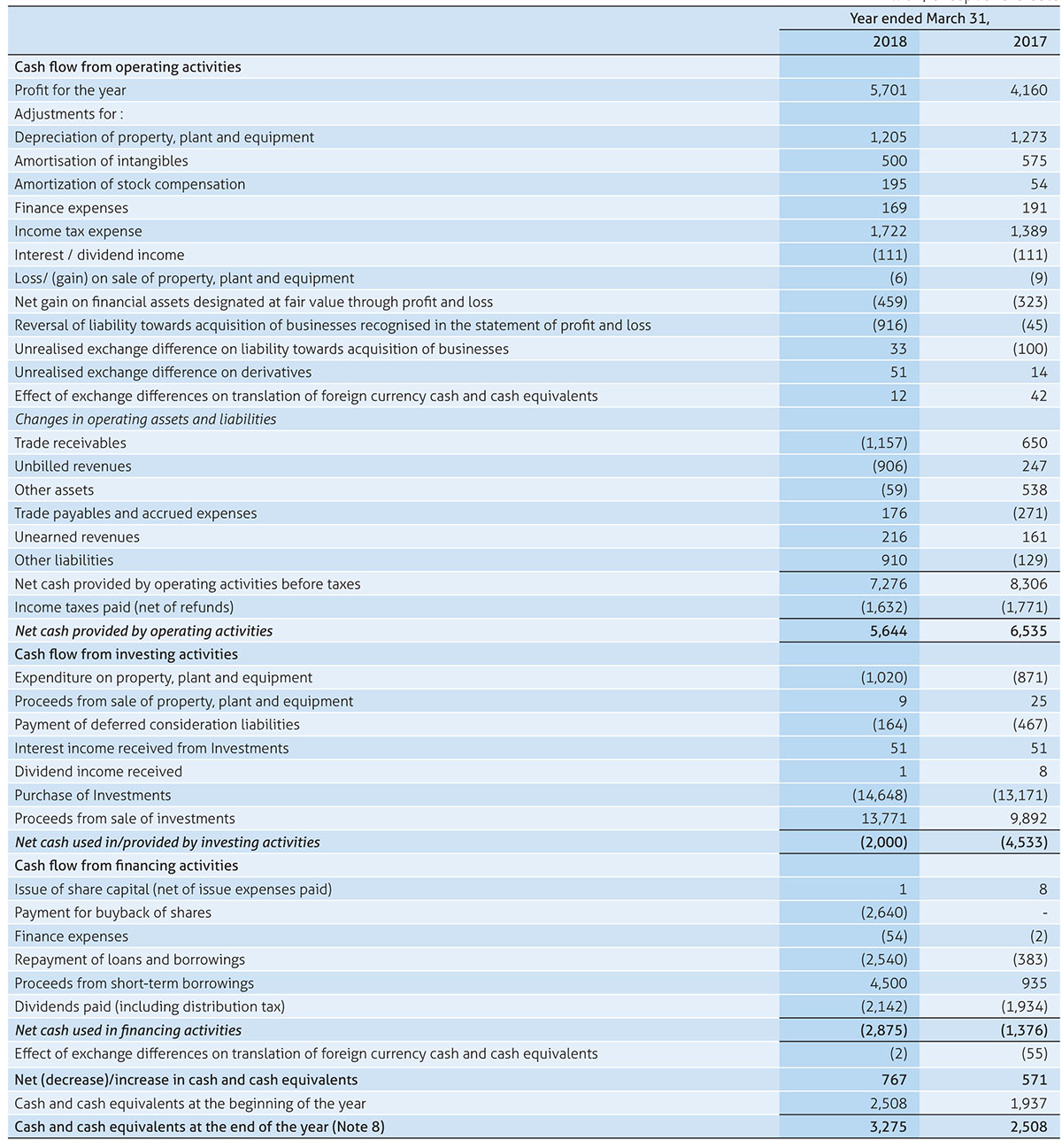

Consolidated statement of cash flows

The accompanying notes form an integral part of these consolidated financial statements.

Notes to the consolidated financial statement

(Rs in millions, except share and per share data, unless otherwise stated)

1. Company overview

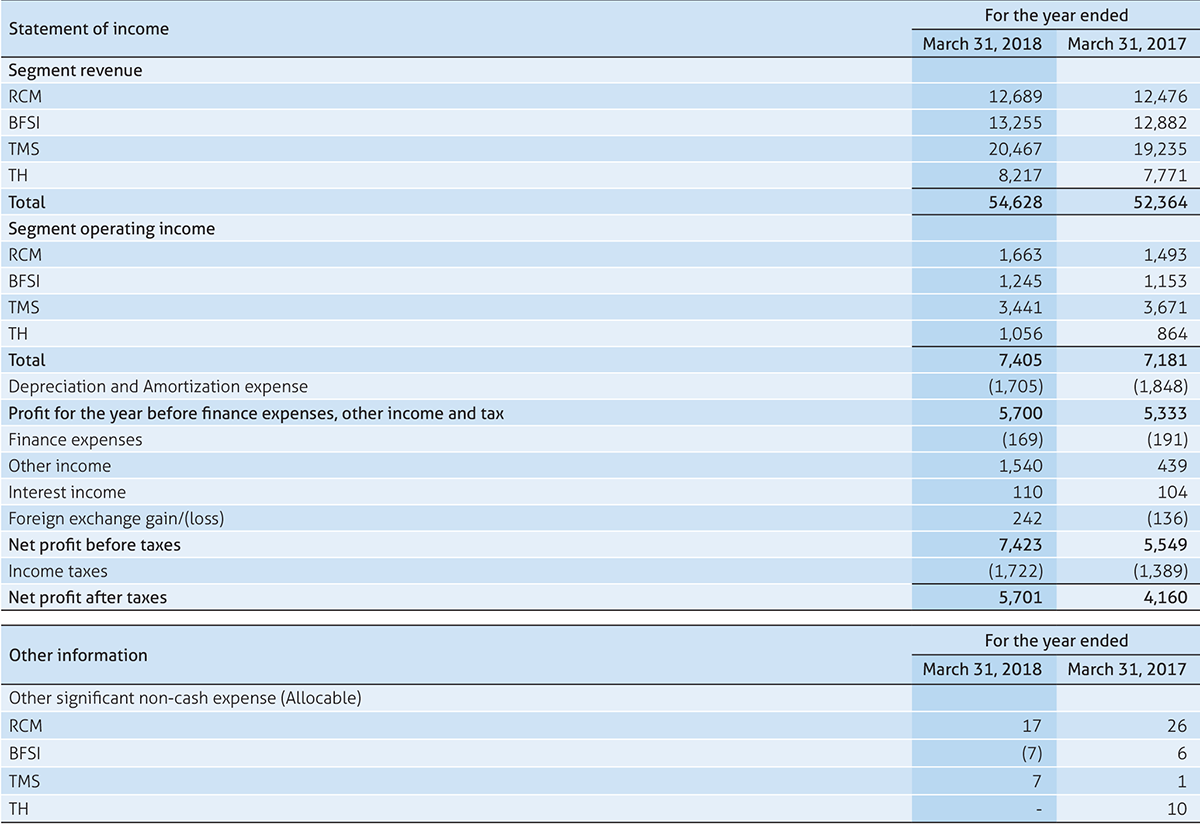

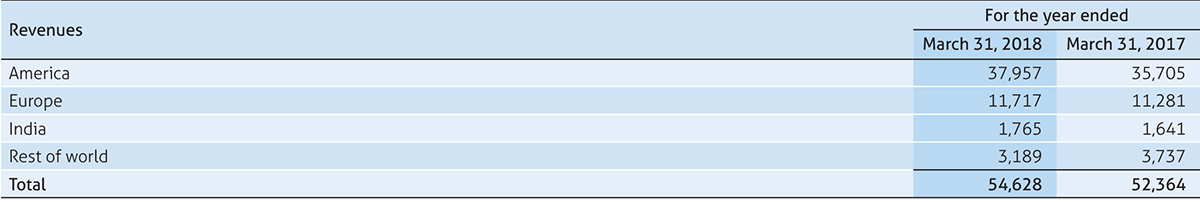

Mindtree Limited (‘Mindtree’ or ‘the Company’) together with its subsidiaries Mindtree Software (Shanghai) Co. Ltd, Bluefin Solutions Limited, Bluefin Solutions Sdn Bhd., and Magnet 360, LLC collectively referred to as ‘the Group’ is an international Information Technology consulting and implementation Group that delivers business solutions through global software development. The Group is structured into four industry verticals – Retail, CPG and Manufacturing (RCM), Banking, Financial Services and Insurance (BFSI), Technology, Media and Services (TMS), Travel and Hospitality (TH). The Group offers services in the areas of agile, analytics and information management, application development and maintenance, business process management, business technology consulting, cloud, digital business, independent testing, infrastructure management services, mobility, product engineering and SAP services.

The Company is a public limited company incorporated and domiciled in India and has its registered office at Bengaluru, Karnataka, India and has offices in India, United States of America (USA), United Kingdom, Japan, Singapore, Malaysia, Australia, Germany, Switzerland, Sweden, South Africa, UAE, Netherlands, Canada, Belgium, France, Ireland, Poland and Republic of China. The Company has its primary listings on the Bombay Stock Exchange and National Stock Exchange in India. The consolidated financial statements were authorized for issuance by the Company’s Board of Directors on April 18, 2018.

2. Basis of preparation of financial statements

(a) Statement of compliance

The consolidated financial statements as at and for the year ended March 31, 2018 have been prepared in accordance with International Financial Reporting Standards and its interpretations (“IFRS”), as issued by the International Accounting Standards Board (“IASB”).

(b) Basis of measurement

The consolidated financial statements have been prepared on a historical cost convention and on an accrual basis, except for the following material items that have been measured at fair value as required by relevant IFRS:

i. Derivative financial instruments;

ii. Certain financial assets and liabilities measured at fair value (refer accounting policy on financial instruments);

iii. Share based payment transactions and

iv. Defined benefit and other long-term employee benefits

(c) Functional and presentation currency

The consolidated financial statements are presented in Indian rupees, which is the functional currency of the parent company and the currency of the primary economic environment in which the entity operates. All financial information presented in Indian rupees has been rounded to the nearest million except share and per share data.

(d) Use of estimates and judgment

The preparation of consolidated financial statements in conformity with IFRS requires management to make judgments, estimates and assumptions that affect the application of accounting policies and the reported amounts of assets, liabilities, income and expenses. Actual results may differ from these estimates.

Estimates and underlying assumptions are reviewed on a periodic basis. Revisions to accounting estimates are recognized in the period in which the estimates are revised and in any future periods affected. In particular, information about significant areas of estimation, uncertainty and critical judgments in applying accounting policies that have the most significant effect on the amounts recognized in the consolidated financial statements is included in the following notes:

i) Revenue recognition: The Group uses the percentage of completion method using the input (cost expended) method to measure progress towards completion in respect of fixed price contracts. Percentage of completion method accounting relies on estimates of total expected contract revenue and costs. This method is followed when reasonably dependable estimates of the revenues and costs applicable to various elements of the contract can be made. Key factors that are reviewed in estimating the future costs to complete include estimates of future labor costs and productivity efficiencies. Because the financial reporting of these contracts depends on estimates that are assessed continually during the term of these contracts, recognized revenue and profit are subject to revisions as the contract progresses to completion. When estimates indicate that a loss will be incurred, the loss is provided for in the period in which the loss becomes probable.

ii) Income taxes: The Group’s two major tax jurisdictions are India and the U.S., though the Group also files tax returns in other foreign jurisdictions. Significant judgments are involved in determining the provision for income taxes, including the amount expected to be paid or recovered in connection with uncertain tax positions. Also refer to Note 17.

iii) Contingent consideration: Contingent consideration representing liability towards acquisition of business is reassessed at every reporting date. Any increase or decrease in the probability of achievement of financial targets would impact the measurement of the liability. Appropriate changes in estimates are made when the Management becomes aware of the circumstances surrounding such estimates.

iv) Other estimates: The preparation of financial statements involves estimates and assumptions that affect the reported amount of assets, liabilities, disclosure of contingent liabilities at the date of financial statements and the reported amount of revenues and expenses for the reporting period. Specifically, the Group estimates the probability of collection of accounts receivable by analyzing historical payment patterns, customer concentrations, customer credit-worthiness and current economic trends. If the financial condition of a customer deteriorates, additional allowances may be required. The stock compensation expense is determined based on the Group’s estimate of equity instruments that will eventually vest.

3. Significant accounting policies

(i) Basis of consolidation

Subsidiaries

The consolidated financial statements incorporate the financial statements of the Parent Company and entities controlled by the Parent Company (its subsidiaries).

Control exists when the parent has power over an investee, exposure or rights to variable returns from its involvement with the investee and ability to use its power to affect those returns. Power is demonstrated through existing rights that give the ability to direct relevant activities, those which significantly affect the entity’s returns. Subsidiaries are consolidated from the date control commences until the date control ceases.

The financial statement of subsidiaries are consolidated on a line-by-line basis and intra-group balances and transactions including unrealized gain/ loss from such transactions are eliminated upon consolidation. The financial statements are prepared by applying uniform policies in use at the Group.

(ii) Functional and presentation currency

Items included in the consolidated financial statements of each of the Group’s subsidiaries are measured using the currency of the primary economic environment in which these entities operate (i.e. the “functional currency”). The consolidated financial statements are presented in Indian Rupee, the national currency of India, which is the functional currency of the Company.

(iii) Foreign currency transactions and balances

Transactions in foreign currency are translated into the respective functional currencies using the exchange rates prevailing at the dates of the respective transactions. Foreign exchange gains and losses resulting from the settlement of such transactions and from the translation at the exchange rates prevailing at reporting date of monetary assets and liabilities denominated in foreign currencies are recognized in the statement of profit or loss and reported within foreign exchange gains/ (losses).

Non-monetary assets and liabilities denominated in a foreign currency and measured at historical cost are translated at the exchange rate prevalent at the date of transaction.

For the purposes of presenting the consolidated financial statements assets and liabilities of Group’s foreign operations with functional currency different from the Company are translated into Company’s functional currency i.e. INR using exchange rates prevailing at the end of each reporting period. Income and expense items are translated at the average exchange rates for the period, unless exchange rates fluctuate significantly during that period, in which case the exchange rates at the dates of the transactions are used.

Exchange differences arising, if any are recognised in other comprehensive income and accumulated in equity. On the disposal of foreign operation, all of the exchange differences accumulated in equity in respect of that operation attributable to the owners of the Company are reclassified to the statement of profit and loss.

Goodwill and fair value adjustments arising on the acquisition of a foreign entity are treated as assets and liabilities of the foreign entity and translated at the exchange rate in effect at the balance sheet date.

(iv) Financial instruments

All financial instruments are recognised initially at fair value. Transaction costs that are attributable to the acquisition of the financial asset (other than financial assets recorded at fair value through profit or loss) are included in the fair value of the financial assets. Purchase or sale of financial assets that require delivery of assets within a time frame established by regulation or convention in the market place (regular way trade) are recognised on trade date. Loans and borrowings and payable are recognised net of directly attributable transactions costs.

For the purpose of subsequent measurement, financial instruments of the Group are classified in the following categories: non-derivative financial assets comprising amortised cost, debt instruments at fair value through other comprehensive income (FVTOCI), equity instruments at FVTOCI or fair value through profit and loss account (FVTPL), non-derivative financial liabilities at amortised cost or FVTPL and derivative financial instruments (under the category of financial assets or financial liabilities) at FVTPL. The classification of financial instruments depends on the objective of the business model for which it is held. Management determines the classification of its financial instruments at initial recognition.

a) Non-derivative financial assets

(i) Financial assets at amortised cost

A financial asset shall be measured at amortised cost if both of the following conditions are met:

(a) the financial asset is held within a business model whose objective is to hold financial assets in order to collect contractual cash flows and

(b) the contractual terms of the financial asset give rise on specified dates to cash flows that are solely payments of principal and interest on the principal amount outstanding (SPPI).

They are presented as current assets, except for those maturing later than 12 months after the reporting date which are presented as noncurrent assets. Financial assets are measured initially at fair value plus transaction costs and subsequently carried at amortized cost using the effective interest method, less any impairment loss.

Financial assets at amortised cost are represented by trade receivables, security deposits, cash and cash equivalents, employee and other advances and eligible current and non-current assets. Cash and cash equivalents comprise cash on hand and in banks and demand deposits with banks which can be withdrawn at any time without prior notice or penalty on the principal. For the purposes of the cash flow statement, cash and cash equivalents include cash on hand, in banks and demand deposits with banks, net of outstanding bank overdrafts that are repayable on demand and are considered part of the Group’s cash management system.

(ii) Debt instruments at FVTOCI

A debt instrument shall be measured at fair value through other comprehensive income if both of the following conditions are met:

(a) the objective of the business model is achieved by both collecting contractual cash flows and selling financial assets and

(b) the asset’s contractual cash flow represent SPPI

Debt instruments included within FVTOCI category are measured initially as well as at each reporting period at fair value plus transaction costs. Fair value movements are recognised in other comprehensive income (OCI). However, the Group recognises interest income, impairment losses & reversals and foreign exchange gain/(loss) in statement of profit or loss. On derecognition of the asset, cumulative gain or loss previously recognised in OCI is reclassified from equity to profit or loss. Interest earned is recognised under the effective interest rate (EIR) model.

(iii) Equity instruments at FVTOCI

All equity instruments are measured at fair value. Equity instruments held for trading is classified as FVTPL. For all other equity instruments, the Group may make an irrevocable election to present subsequent changes in the fair value in OCI. The Group makes such election on an instrument-by-instrument basis.

If the Group decides to classify an equity instrument as at FVTOCI, then all fair value changes on the instrument, excluding dividend are recognised in OCI. There is no recycling of the amount from OCI to statement of profit and loss, even on sale of the instrument. However, the Group may transfer the cumulative gain or loss within the equity.

(iv) Financial assets at FVTPL

FVTPL is a residual category for financial assets. Any financial asset which does not meet the criteria for categorization as at amortised cost or as FVTOCI, is classified as FVTPL.

In addition, the Group may elect to designate the financial asset, which otherwise meets amortised cost or FVTOCI criteria, as FVTPL if doing so eliminates or significantly reduces a measurement or recognition inconsistency. Financial assets included within the FVTPL category are measured at fair values with all changes in the statement of profit or loss.

b) Non-derivative financial liabilities

(i) Financial liabilities at amortised cost: Financial liabilities at amortised cost represented by borrowings, trade and other payables are initially recognized at fair value, and subsequently carried at amortized cost using the effective interest rate method.

(ii) Financial liabilities at FVTPL: Financial liabilities at FVTPL represented by contingent consideration are measured at fair value with all changes recognised in the consolidated statement of profit or loss.

c) Derivative financial instruments

The Group holds derivative financial instruments such as foreign exchange forward and option contracts to mitigate the risk of changes in foreign exchange rates on foreign currency assets or liabilities and forecasted cash flows denominated in foreign currencies. The counterparty for these contracts is generally a bank. Derivatives are recognized and measured at fair value. Attributable transaction costs are recognized in statement of profit or loss as cost.

(i) Cash flow hedges: Changes in the fair value of the derivative hedging instrument designated as a cash flow hedge are recognized in other comprehensive income and presented within equity in the cash flow hedging reserve to the extent that the hedge is effective. To the extent that the hedge is ineffective, changes in fair value are recognized in the statement of profit or loss. If the hedging instrument no longer meets the criteria for hedge accounting, expires or is sold, terminated or exercised, then hedge accounting is discontinued prospectively. The cumulative gain or loss previously recognized in the cash flow hedging reserve is transferred to the consolidated statement of profit or loss upon the occurrence of the related forecasted transaction.

(ii) Others: Changes in fair value of foreign currency derivative instruments not designated as cash flow hedges and the ineffective portion of cash flow hedges are recognized in the consolidated statement of profit or loss and reported within foreign exchange gains/ (losses).

(v) Property, plant and equipment

a) Recognition and measurement:

Property, plant and equipment are measured at cost less accumulated depreciation and impairment losses, if any. Cost includes expenditures directly attributable to the acquisition of the asset.

b) Depreciation:

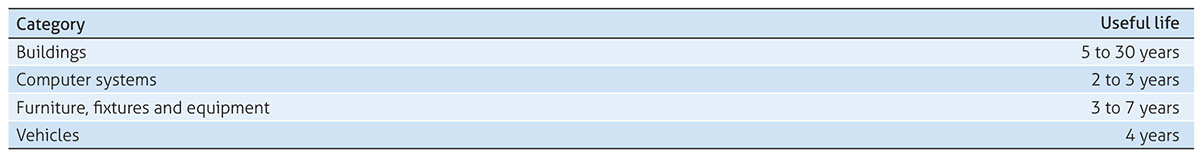

The Group depreciates property, plant and equipment over the estimated useful life on a straight-line basis from the date the assets are available for use. Assets acquired under finance lease and leasehold improvements are amortized over the shorter of estimated useful life or the related lease term. The estimated useful lives of assets for the current and comparative period of significant items of property, plant and equipment are as follows:

Depreciation methods, useful lives and residual values are reviewed at each reporting date.

When parts of an item of property, plant and equipment have different useful lives, they are accounted for as separate items (major components) of property, plant and equipment.

Subsequent expenditure relating to property, plant and equipment is capitalized only when it is probable that future economic benefits associated with these will flow to the Group and the cost of the item can be measured reliably. Repairs and maintenance costs are recognized in the consolidated statement of profit or loss when incurred. The cost and related accumulated depreciation are eliminated from the consolidated financial statements upon sale or disposition of the asset and the resultant gains or losses are recognized in the consolidated statement of profit or loss.

Amounts paid towards the acquisition of property, plant and equipment outstanding as of each reporting date and the cost of property, plant and equipment not ready for intended use before such date are disclosed under capital advances and capital work-in-progress respectively.

(vi) Business combination, Goodwill and Intangible assets

Business combinations are accounted for using the purchase (acquisition) method. The cost of an acquisition is measured as the fair value of the assets given, equity instruments issued and liabilities incurred or assumed at the date of exchange. The cost of acquisition also includes the fair value of any contingent consideration. Identifiable assets acquired and liabilities and contingent liabilities assumed in a business combination are measured initially at their fair value on the date of acquisition. Transaction costs incurred in connection with a business combination are expensed as incurred.

a) Goodwill

The excess of the cost of acquisition over the Company’s share in the fair value of the acquiree’s identifiable assets, liabilities and contingent liabilities is recognized as goodwill. If the excess is negative, a bargain purchase gain is recognized immediately in the statements of profit or loss.

b) Intangible assets

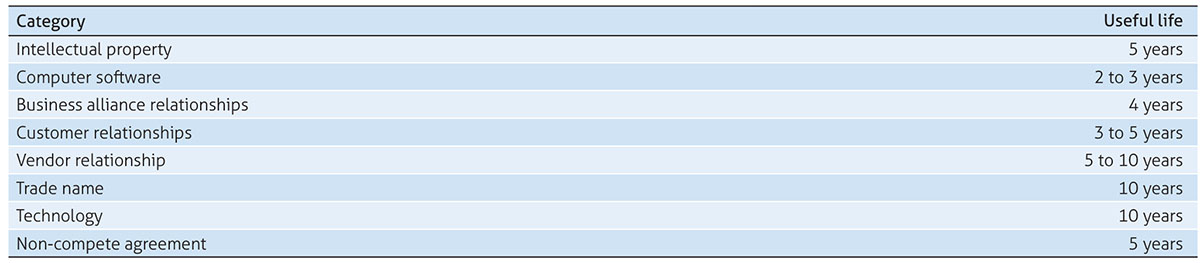

Intangible assets are stated at cost less accumulated amortization and impairments. Intangible assets are amortized over their respective individual estimated useful lives on a straight-line basis, from the date that they are available for use. The estimated useful life of an identifiable intangible asset is based on a number of factors including the effects of obsolescence, demand, competition and other economic factors (such as the stability of the industry and known technological advances) and the level of maintenance expenditures required to obtain the expected future cash flows from the asset.

The estimated useful lives of intangibles are as follows:

(vii) Leases

Leases under which the Group assumes substantially all the risks and rewards of ownership are classified as finance leases. When acquired, such assets are capitalized at fair value or present value of the minimum lease payments at the inception of the lease, whichever is lower. Lease payments under operating leases are recognised as an expense on a straight line basis in the statement of profit or loss over the lease term.

(viii) Impairment

a) Financial assets

In accordance with IFRS 9, the Group applies expected credit loss (ECL) model for measurement and recognition of impairment loss. The Group follows ‘simplified approach’ for recognition of impairment loss allowance on trade receivable.

The application of simplified approach does not require the Group to track changes in credit risk. Rather, it recognises impairment loss allowance based on lifetime ECLs at each reporting date, right from its initial recognition. For recognition of impairment loss on other financial assets and risk exposure, the Group determines that whether there has been a significant increase in the credit risk since initial recognition. If credit risk has not increased significantly, 12-month ECL is used to provide for impairment loss. However, if credit risk has increased significantly, lifetime ECL is used. If in subsequent period, credit quality of the instrument improves such that there is no longer a significant increase in credit risk since initial recognition, then the entity reverts to recognising impairment loss allowance based on 12-month ECL.

Lifetime ECLs are the expected credit losses resulting from all possible default events over the expected life of a financial instrument. The 12-month ECL is a portion of the lifetime ECL which results from default events that are possible within 12 months after the reporting date. ECL is the difference between all contractual cash flows that are due to the Group in accordance with the contract and all the cash flows that the entity expects to receive (i.e. all shortfalls), discounted at the original EIR. When estimating the cash flows, an entity is required to consider:

(i) All contractual terms of the financial instrument (including prepayment, extension etc.) over the expected life of the financial instrument. However, in rare cases when the expected life of the financial instrument cannot be estimated reliably, then the entity is required to use the remaining contractual term of the financial instrument;

(ii) Cash flows from the sale of collateral held or other credit enhancements that are integral to the contractual terms.

As a practical expedient, the Group uses a provision matrix to determine impairment loss on portfolio of its trade receivable. The provision matrix is based on its historically observed default rates over the expected life of the trade receivable and is adjusted for forward-looking estimates. At every reporting date, the historically observed default rates are updated and changes in forward-looking estimates are analysed.

ECL impairment loss allowance (or reversal) recognised during the period is recognised as income/expense in the statement of profit and loss. This amount is reflected under the head other expenses in the statement of profit and loss. The balance sheet presentation for various financial instruments is described below:

Financial assets measured at amortised cost, contractual revenue receivable. ECL is presented as an allowance, i.e. as an integral part of the measurement of those assets in the Balance Sheet. The allowance reduces the net carrying amount. Until the asset meets write off criteria, the Group does not reduce impairment allowance from the gross carrying amount.

b) Non-financial assets

The Group assesses at each reporting date whether there is any objective evidence that a non financial asset or a group of non financial assets is impaired. If any such indication exists, the Group estimates the amount of impairment loss.

An impairment loss is calculated as the difference between an asset’s carrying amount and the recoverable amount. Losses are recognised in statement of profit or loss and reflected in an allowance account. When the Group considers that there are no realistic prospects of recovery of the asset, the relevant amounts are written off. If the amount of impairment loss subsequently decreases and the decrease can be related objectively to an event occurring after the impairment was recognised, then the previously recognised impairment loss is reversed through statement of profit or loss.

The recoverable amount of an asset or cash-generating unit (as defined below) is the greater of its value-in-use and its fair value less costs to sell. In assessing value-in-use, the estimated future cash flows are discounted to their present value using a pre-tax discount rate that reflects current market assessments of the time value of money and the risks specific to the asset. For the purpose of impairment testing, assets are grouped together into the smallest group of assets that generates cash inflows from continuing use that are largely independent of the cash inflows of other assets or groups of assets (the “cash-generating unit”). The goodwill acquired in a business combination is, for the purpose of impairment testing, allocated to cash-generating units that are expected to benefit from the synergies of the combination.

Goodwill is tested for impairment on an annual basis and whenever there is an indication that goodwill may be impaired, relying on a number of factors including operating results, business plans and future cash flows. For the purpose of impairment testing, goodwill acquired in a business combination is allocated to the Group’s Cash Generating Units (CGU) or groups of CGUs expected to benefit from the synergies arising from the business combination. A CGU is the smallest identifiable group of assets that generates cash inflows that are largely independent of the cash inflows from other assets or group of assets. Impairment occurs when the carrying amount of a CGU including the goodwill, exceeds the estimated recoverable amount of the CGU. The recoverable amount of a CGU is the higher of its fair value less cost to sell and its value-in-use. Value-in-use is the present value of future cash flows expected to be derived from the CGU.

Total impairment loss of a CGU is allocated first to reduce the carrying amount of goodwill allocated to the CGU and then to the other assets of the CGU prorata on the basis of the carrying amount of each asset in the CGU. An impairment loss on goodwill is recognised in consolidated statement of profit or loss and is not reversed in the subsequent period.

(ix) Employee Benefits

The Group participates in various employee benefit plans. Post-employment benefits are classified as either defined contribution plans or defined benefit plans. Under a defined contribution plan, the Group’s only obligation is to pay a fixed amount with no obligation to pay further contributions if the fund does not hold sufficient assets to pay all employee benefits. The related actuarial and investment risks fall on the employee. The expenditure for defined contribution plans is recognized as expense during the period when the employee provides service. Under a defined benefit plan, it is the Group’s obligation to provide agreed benefits to the employees. The related actuarial and investment risks fall on the Group. The present value of the defined benefit obligations is calculated using the projected unit credit method.

The Group has the following employee benefit plans:

a) Social security plans

Employees Contributions payable to the social security plans, which are a defined contribution scheme, are charged to the statement of profit or loss in the period in which the employee renders services.

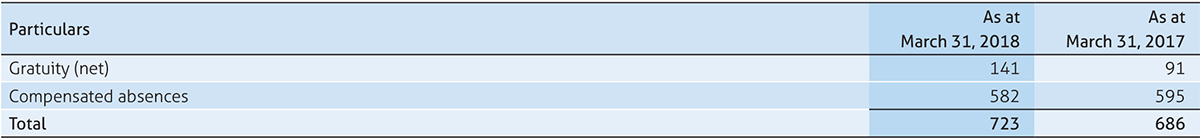

b) Gratuity

In accordance with the Payment of Gratuity Act, 1972, the Group provides for a lump sum payment to eligible employees, at retirement or termination of employment based on the last drawn salary and years of employment with the Company. The gratuity fund is managed by the Life Insurance Corporation of India (LIC), ICICI Prudential Life Insurance Company and SBI Life Insurance Company. The Group’s obligation in respect of the gratuity plan, which is a defined benefit plan, is provided for based on actuarial valuation using the projected unit credit method. The Group has applied IAS 19 (as revised in June 2011) Employee Benefits (‘IAS 19R’) and the related consequential amendments effective April 1, 2013. As a result, all actuarial gains or losses are immediately recognized in other comprehensive income and permanently excluded from profit or loss. Further, the profit or loss does not include an expected return on plan assets. Instead net interest recognized in profit or loss is calculated by applying the discount rate used to measure the defined benefit obligation to the net defined benefit liability or asset. The actual return on the plan assets above or below the discount rate is recognized as part of remeasurement of net defined liability or asset through other comprehensive income.

c) Compensated absences

The employees of the Group are entitled to compensated absences. The employees can carry forward a portion of the unutilised accumulating compensated absences and utilise it in future periods or receive cash at retirement or termination of employment.

The Group records an obligation for compensated absences in the period in which the employee renders the services that increases this entitlement. The Group measures the expected cost of compensated absences as the additional amount that the Group expects to pay as a result of the unused entitlement that has accumulated at the end of the reporting period. The Group recognizes accumulated compensated absences based on actuarial valuation. Non-accumulating compensated absences are recognized in the period in which the absences occur. The Group recognizes actuarial gains and losses immediately in the statement of profit or loss.

(x) Share based payment transactions

Employees of the Group receive remuneration in the form of equity settled instruments, for rendering services over a defined vesting period. Equity instruments granted are measured by reference to the fair value of the instrument at the date of grant.

The expense is recognized in the statement of profit or loss with a corresponding increase to the share based payment reserve, a component of equity.

The equity instruments generally vest in a graded manner over the vesting period. The fair value determined at the grant date is expensed over the vesting period of the respective tranches of such grants (accelerated amortization). The stock compensation expense is determined based on the Group’s estimate of equity instruments that will eventually vest. The fair value of the amount payable to the employees in respect of phantom stock, which are settled in cash, is recognized as an expense with a corresponding increase in liabilities, over the period during which the employees become unconditionally entitled to payment.

The liability is remeasured at each reporting date and at settlement date based on the fair value of the Phantom stock options plan. Any changes in the liability are recognized in statement of profit or loss.

(xi) Provisions

Provisions are recognized when the Group has a present obligation (legal or constructive) as a result of a past event, it is probable that an outflow of economic benefits will be required to settle the obligation, and a reliable estimate can be made of the amount of the obligation.

The amount recognized as a provision is the best estimate of the consideration required to settle the present obligation at the end of the reporting period, taking into account the risks and uncertainties surrounding the obligation. When some or all of the economic benefits required to settle a provision are expected to be recovered from a third party, the receivable is recognized as an asset, if it is virtually certain that reimbursement will be received and the amount of the receivable can be measured reliably.

Provisions for onerous contracts are recognized when the expected benefits to be derived by the Group from a contract are lower than the unavoidable costs of meeting the future obligations under the contract. Provisions for onerous contracts are measured at the present value of lower of the expected net cost of fulfilling the contract and the expected cost of terminating the contract.

(xii) Revenue

The Group derives revenue primarily from software development and related services. The Group recognizes revenue when the significant terms of the arrangement are enforceable, services have been delivered and the collectability is reasonably assured. The method for recognizing revenues and costs depends on the nature of the services rendered:

a) Time and materials contracts

Revenues and costs relating to time and materials contracts are recognized as the related services are rendered.

b) Fixed-price contracts

Revenues from fixed-price contracts are recognized using the “percentage-of-completion” method. Percentage of completion is determined based on project costs incurred to date as a percentage of total estimated project costs required to complete the project. The cost expended (or input) method has been used to measure progress towards completion as there is a direct relationship between input and productivity.

If the Group does not have a sufficient basis to measure the progress of completion or to estimate the total contract revenues and costs, revenue is recognized only to the extent of contract cost incurred for which recoverability is probable.

When total cost estimates exceed revenues in an arrangement, the estimated losses are recognized in the statement of profit or loss in the period in which such losses become probable based on the current contract estimates. ‘Unbilled revenues’ represent cost and earnings in excess of billings as at the end of the reporting period.

‘Unearned revenues’ represent billing in excess of revenue recognized. Advance payments received from customers for which no services are rendered are presented as ‘Advance from customers’.

c) Maintenance contracts

Revenue from maintenance contracts is recognized ratably over the period of the contract. When services are performed through an indefinite number of repetitive acts over a specified period of time, revenue is recognized on a straight line basis over the specified period or under some other method that better represents the stage of completion.

In arrangements for software development and related services and maintenance services, the Group has applied the guidance in IAS 18, Revenue, by applying the revenue recognition criteria for each separately identifiable component of a single transaction. The arrangements generally meet the criteria for considering software development and related services as separately identifiable components. For allocating the consideration, the Group has measured the revenue in respect of each separable component of a transaction at its fair value, in accordance with principles given in IAS 18.

The Group accounts for volume discounts and pricing incentives to customers by reducing the amount of revenue recognized at the time of sale.

Revenues are shown net of sales tax, value added tax, service tax, goods and services tax and applicable discounts and allowances. The Group accrues the estimated cost of post contract support services at the time when the revenue is recognized. The accruals are based on the Group’s historical experience of material usage and service delivery costs.

(xiii) Finance income and expense

Finance income consists of interest income on funds invested, dividend income and gains on the disposal of FVTPL financial assets. Interest income is recognized as it accrues in the statement of profit or loss, using the effective interest method.

Dividend income is recognized in the statement of profit or loss on the date that the Group’s right to receive payment is established. Finance expenses consist of interest expense on loans and borrowings and impairment losses recognized on financial assets (other than trade receivables). Borrowing costs are recognized in the statement of profit or loss using the effective interest method. Foreign currency gains and losses are reported on a net basis. This includes changes in the fair value of foreign exchange derivative instruments, which are accounted at fair value through profit or loss.

(xiv) Income tax

Income tax comprises current and deferred tax. Income tax expense is recognized in the statement of profit or loss except to the extent it relates to items directly recognized in equity or in other comprehensive income.

a) Current income tax

Current income tax for the current and prior periods are measured at the amount expected to be recovered from or paid to the taxation authorities based on the taxable income for the period. The tax rates and tax laws used to compute the current tax amount are those that are enacted or substantively enacted by the reporting date and applicable for the period. The Group offsets current tax assets and current tax liabilities, where it has a legally enforceable right to set off the recognized amounts and where it intends either to settle on a net basis or to realize the asset and liability simultaneously.

b) Deferred income tax

Deferred income tax is recognized using the balance sheet approach. Deferred income tax assets and liabilities are recognized for deductible and taxable temporary differences arising between the tax base of assets and liabilities and their carrying amount in financial statements, except when the deferred income tax arises from the initial recognition of goodwill or an asset or liability in a transaction that is not a business combination and affects neither accounting nor taxable profits or loss at the time of the transaction. Deferred income tax asset is recognized to the extent that it is probable that taxable profit will be available against which the deductible temporary differences, and the carry forward of unused tax credits and unused tax losses can be utilized.

Deferred income tax liabilities are recognized for all taxable temporary differences. The carrying amount of deferred income tax assets is reviewed at each reporting date and reduced to the extent that it is no longer probable that sufficient taxable profit will be available to allow all or part of the deferred income tax asset to be utilized.

Deferred income tax assets and liabilities are measured at the tax rates that are expected to apply in the period when the asset is realized or the liability is settled, based on tax rates (and tax laws) that have been enacted or substantively enacted at the reporting date.

(xv) Earnings Per Share (EPS)

Basic earnings per share is computed using the weighted average number of equity shares outstanding during the year. Diluted EPS is computed by dividing the net profit after tax by the weighted average number of equity shares considered for deriving basic EPS and also weighted average number of equity shares that could have been issued upon conversion of all dilutive potential equity shares. Dilutive potential equity shares are deemed converted as of the beginning of the year, unless issued at a later date. Dilutive potential equity shares are determined independently for each year presented. The number of equity shares and potentially dilutive equity shares are adjusted for bonus shares, as appropriate.

(xvi) Research and development costs

Research costs are expensed as incurred. Development costs are expensed as incurred unless technical and commercial feasibility of the project is demonstrated, future economic benefits are probable, the Group has an intention and ability to complete and use or sell the software and the costs can be measured reliably.

During the period of development, the asset is tested for impairment annually. (xvii) Government grants

Grants from the government are recognised when there is reasonable assurance that:

(i) the Group will comply with the conditions attached to them; and

(ii) the grant will be received.

Government grants related to revenue are recognised on a systematic basis in the consolidated statement of profit or loss over the periods necessary to match them with the related costs which they are intended to compensate. Such grants are deducted in reporting the related expense. Where the Group receives non-monetary grants, the asset is accounted for on the basis of its acquisition cost. In case a nonmonetary asset is given free of cost it is recognised at fair value.

New standards and interpretations not yet adopted

a) IFRS 15 Revenue from Contracts with Customers:

In May 2014, the IASB issued IFRS 15, Revenue from Contracts with Customers. The standard replaces IAS 11 Construction Contracts, IAS 18 Revenue, IFRIC 13 Customer Loyalty Programmes, IFRIC 15 Agreements for the Construction of Real Estate, IFRIC 18 Transfer of Assets from Customers and SIC-31 Revenue – Barter Transactions Involving Advertising Services.

The new standard applies to contracts with customers. The core principle of the new standard is that an entity should recognize revenue to depict transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. Further, the new standard requires enhanced disclosures about the nature, timing and uncertainty of revenues and cash flows arising from the entity’s contracts with customers. The new standard offers a range of transition options. An entity can choose to apply the new standard to its historical transactions and retrospectively adjust each comparative period.

Alternatively, an entity can recognize the cumulative effect of applying the new standard at the date of initial application and make no adjustments to its comparative information. The chosen transition option can have a significant effect on revenue trends in the financial statements. A change in the timing of revenue recognition may require a corresponding change in the timing of recognition of related costs.

The standard is effective for annual periods beginning on or after 1 January 2018, with early adoption permitted under IFRS. The Group is currently evaluating the requirements of IFRS 15, and has not yet determined the impact on the consolidated financial statements.

b) IFRS 16 Leases:

On January 13, 2016, the International Accounting Standards Board issued the final version of IFRS 16, Leases. IFRS 16 will replace the existing leases Standard, IAS 17 Leases, and related Interpretations. The Standard sets out the principles for the recognition, measurement, presentation and disclosure of leases for both parties to a contract i.e., the lessee and the lessor. IFRS 16 introduces a single lessee accounting model and requires a lessee to recognise assets and liabilities for all leases with a term of more than 12 months, unless the underlying asset is of low value. Currently, operating lease expenses are charged to the statement of comprehensive income. The Standard also contains enhanced disclosure requirements for lessees. IFRS 16 substantially carries forward the lessor accounting requirements in IAS 17. The effective date for adoption of IFRS 16 is annual periods beginning on or after January 1, 2019, though early adoption is permitted for companies applying IFRS 15 Revenue from Contracts with Customers. The Group is yet to evaluate the requirements of IFRS 16 and the impact on the consolidated financial statements.

c) IFRIC 22, Foreign currency transactions and advance consideration:

On December 8, 2016, the IFRS interpretations committee of the International Accounting Standards Board (IASB) issued IFRS interpretation, IFRIC 22, Foreign Currency Transactions and Advance Consideration which clarifies the accounting for transactions that include the receipt or payment of advance consideration in a foreign currency. The effective date for adoption of IFRIC 22 is annual reporting periods beginning on or after January 1, 2018, though early adoption is permitted. The Group is currently evaluating the impact of IFRIC 22 on the consolidated financial statements.

d) IFRIC 23, Uncertainty over Income Tax Treatments:

On June 7, 2017, the International Accounting Standards Board (IASB) issued IFRS interpretation IFRIC 23 Uncertainty over Income Tax Treatments which is to be applied while performing the determination of taxable profit (or loss), tax bases, unused tax losses, unused tax credits and tax rates, when there is uncertainty over income tax treatments under IAS 12, Income Taxes. The effective date for adoption of IFRIC 23 is annual periods beginning on or after January 1, 2019, though early adoption is permitted. The Group is currently evaluating the effect of IFRIC 23 on the consolidated financial statements.

e) Amendment to IAS 19 – plan amendment, curtailment or settlement:

On February 7, 2018, the IASB issued amendments to the guidance in IAS 19, ‘Employee Benefits’, in connection with accounting for plan amendments, curtailments and settlements.

The amendments require an entity:

i) to use updated assumptions to determine current service cost and net interest for the remainder of the period after a plan amendment, curtailment or settlement; and

ii) to recognise in profit or loss as part of past service cost, or a gain or loss on settlement, any reduction in a surplus, even if that surplus was not previously recognised because of the impact of the asset ceiling.

Effective date for application of this amendment is annual period beginning on or after January 1, 2019, though early application is permitted. The Group is evaluating the effect of this amendment on the consolidated financial statements.

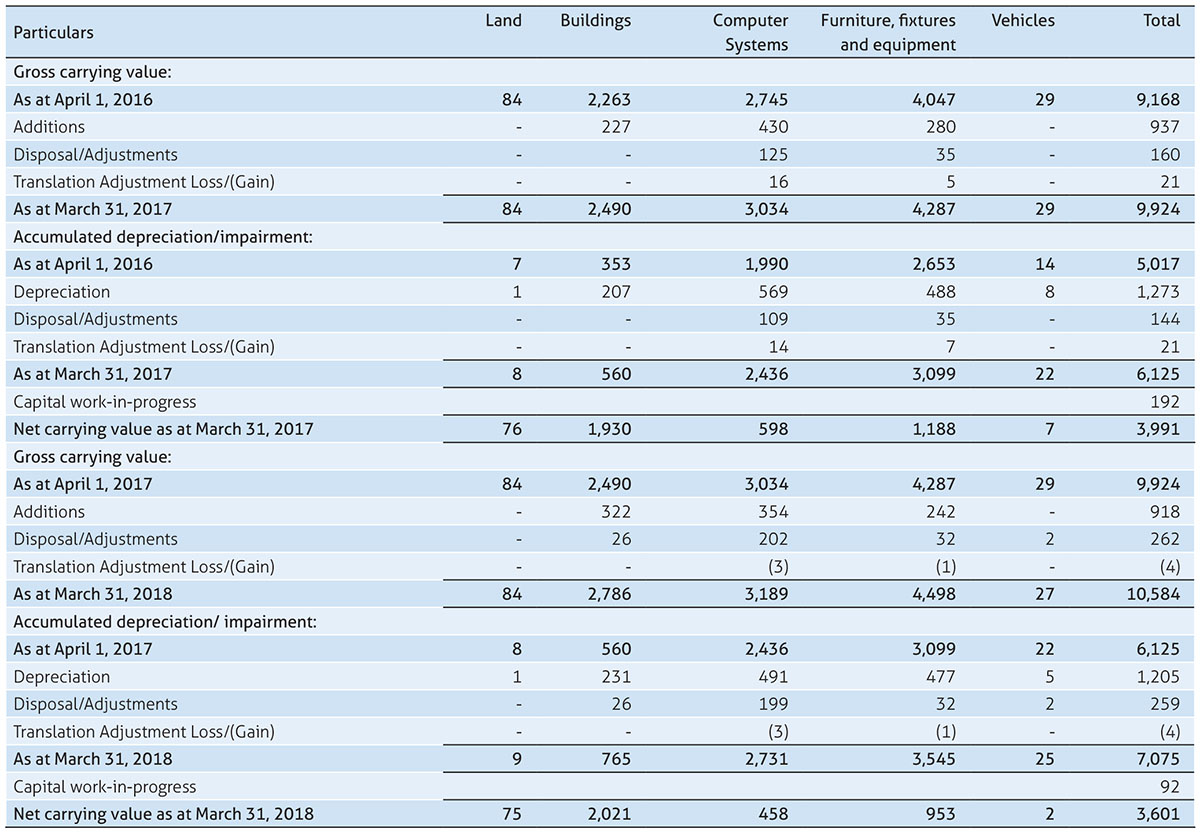

4. Property, plant and equipment

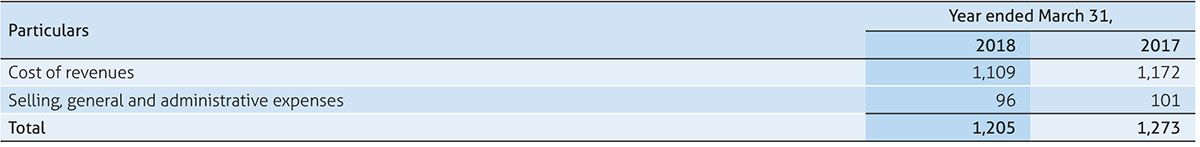

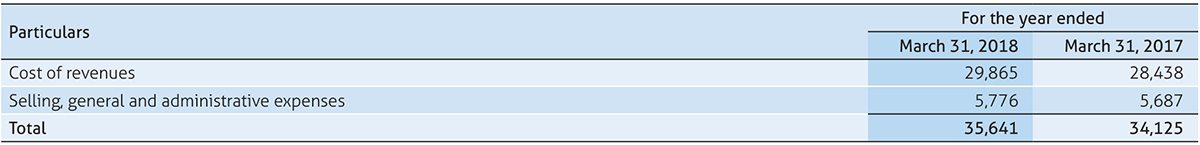

The depreciation expense for the year ended March 31, 2018 and March 31, 2017 is included in the following line items in the statement of profit or loss.

5. Intangible assets and Goodwill

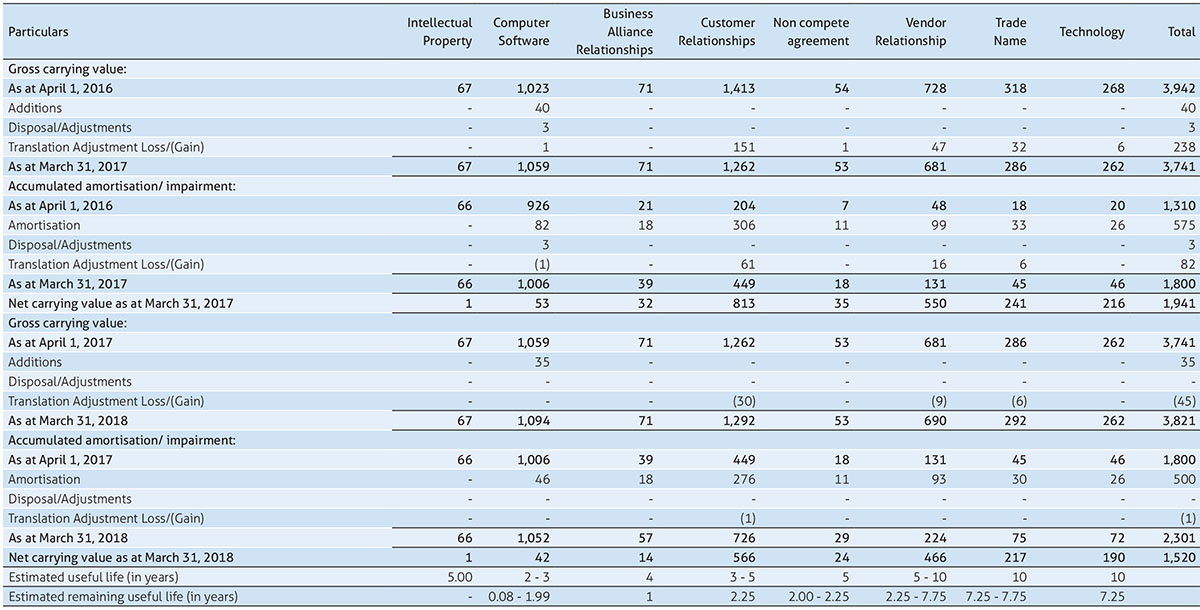

a) Intangible assets

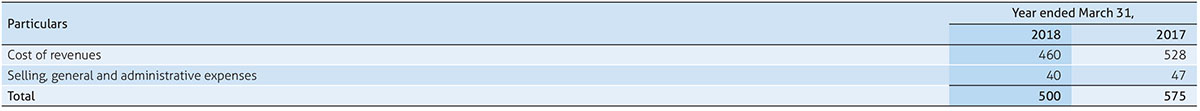

The aggregate amount of research and development expense recognized in the statement of profit or loss for the year ended March 31, 2018 is ₹ 396 (₹ 321 for the year ended March 31, 2017) The amortisation expense for the year ended March 31, 2018 and March 31, 2017 is included in the following line items in the statement of profit or loss.

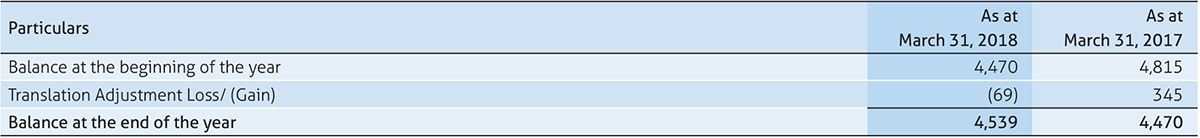

b) Goodwill

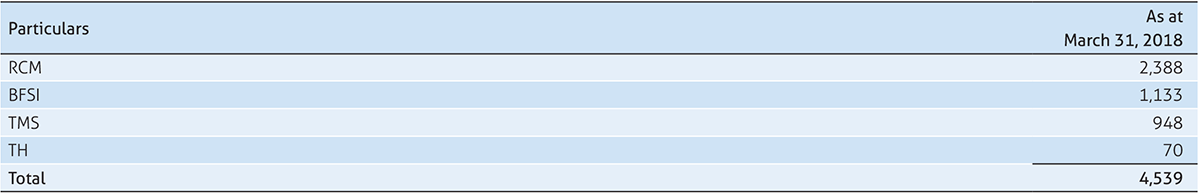

For the purpose of impairment testing, goodwill acquired in a business combination is allocated to the Cash Generating Units (CGU) or groups of CGUs, which benefit from the synergies of the acquisition. The Chief Operating Decision Maker reviews the goodwill for any impairment at the operating segment level, which is represented through groups of CGUs. The goodwill on acquisition of subsidiaries has been allocated as follows:

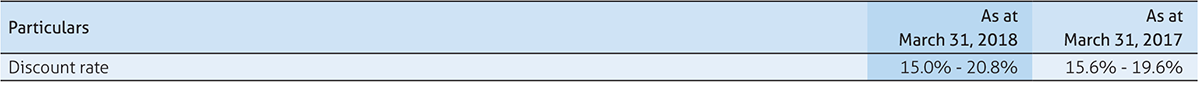

The recoverable amount of a CGU is the higher of its fair value less cost to sell and its value-in-use. The fair value of a CGU is determined based on the market capitalization. The value-in-use is determined based on specific calculations. These calculations use pre-tax cash flow projections over a period of five years, based on financial budgets approved by management and an average of the range of each assumption mentioned below. As of March 31, 2018, the estimated recoverable amount of the CGU exceeded its carrying amount, hence impairment is not triggered. The key assumptions used for the calculations are as follows:

The above discount rate is based on the Weighted Average Cost of Capital (WACC) of the Group. These estimates are likely to differ from future actual results of operations and cash flows.

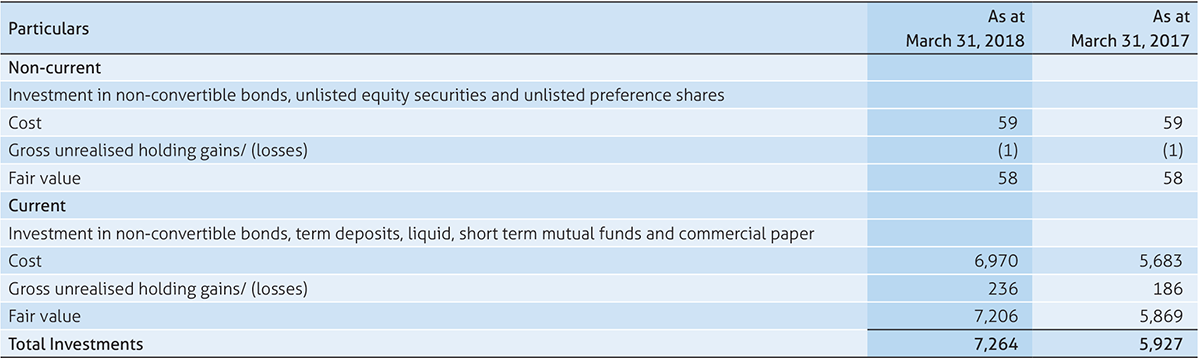

6. Investments

Investments in liquid and short term mutual fund units, non-convertible bonds, term deposits, unlisted equity securities and preference shares are classified as Investments.

Cost and fair value of the above are as follows:

As at March 31, 2018 and March 31, 2017

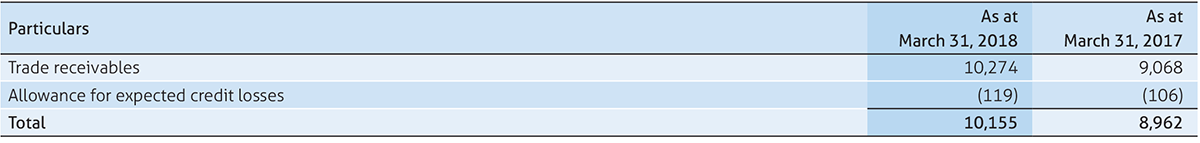

7. Trade receivables

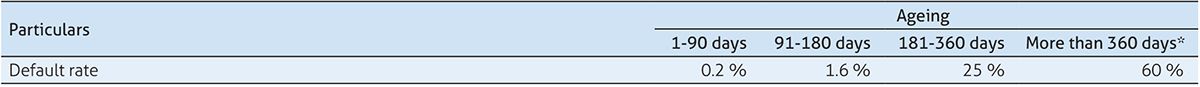

The Group uses a provision matrix to determine impairment loss on portfolio of its trade receivable. The provision matrix is based on its historically observed default rates over the expected life of the trade receivable and is adjusted for forward-looking estimates. At every reporting date, the historically observed default rates are updated and changes in forward-looking estimates are analysed. The Group estimates the following matrix at the reporting date.

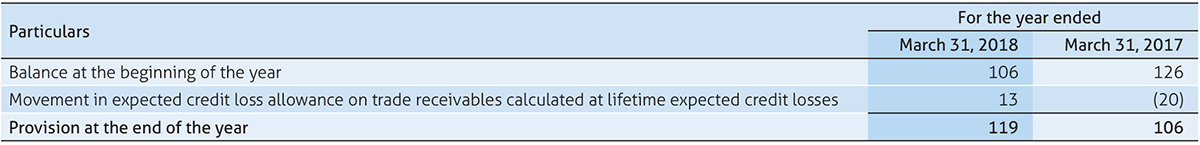

*In case of probability of non-collection, default rate is 100% Movement in the expected credit loss allowance:

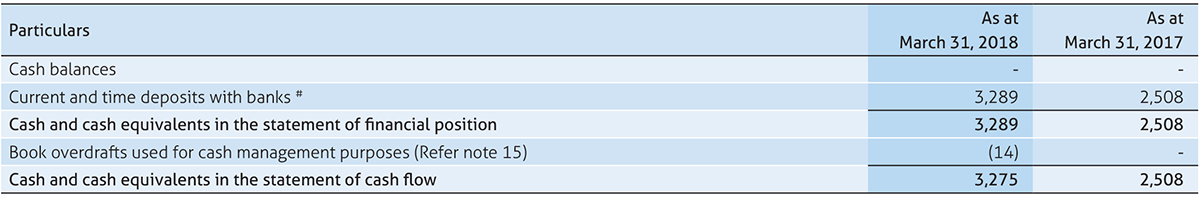

8. Cash and cash equivalents

Cash and cash equivalents consist of the following:

# Balance with banks amounting to ₹ 13 and ₹ 346 as of March 31, 2018 and March 31, 2017 respectively includes unpaid dividends and dividend payable. The deposits maintained by the Group with banks comprises time deposits, which can be withdrawn by the Group at any point without prior notice or penalty on the principal.

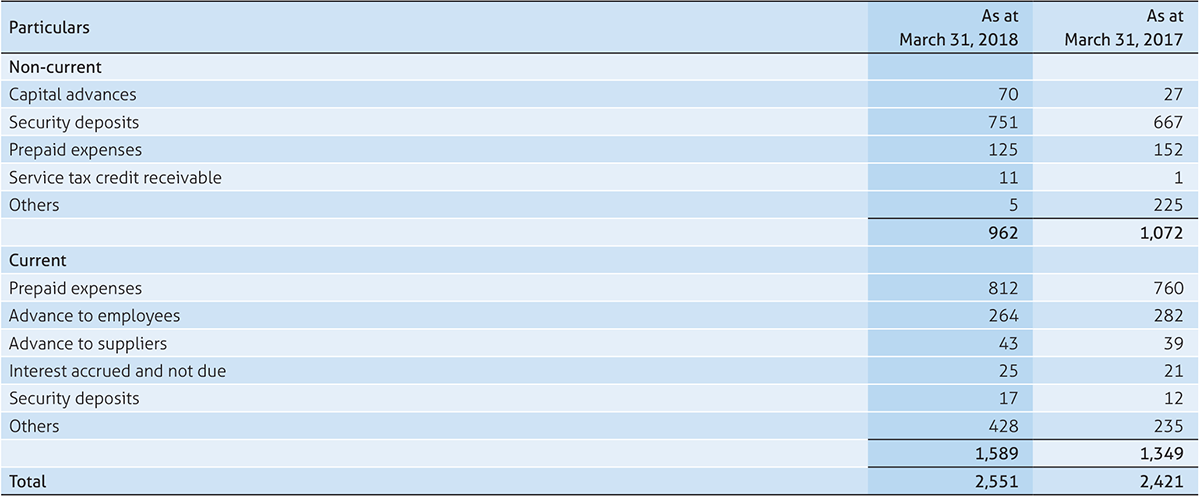

9. Other assets

10. Equity

a) Share capital and share premium

The Group has only one class of equity shares. The authorized share capital of the Group is 800,000,000 equity shares of ₹ 10 each. Par value of the equity shares is recorded as share capital and the amount received in excess of the par value is classified as share premium. The issued, subscribed and paid-up capital of the Group is 163,926,311 equity shares of ₹ 10 each amounting to ₹ 1,639.

The Group has only one class of shares referred to as equity shares having a par value of ₹ 10. Each holder of the equity share, as reflected in the records of the Group as of the date of the shareholder meeting, is entitled to one vote in respect of each share held for all matters submitted to vote in the shareholder meeting. The Group declares and pays dividends in Indian rupees and foreign currency. A final dividend, including tax thereon, on common stock is recorded as a liability on the date of approval by the shareholders.

In the event of liquidation of the Group, the holders of equity shares will be entitled to receive any of the remaining assets of the Group after distribution of all preferential amounts. However, no such preferential amounts exist currently. The distribution will be in proportion to the number of equity shares held by the shareholders. An interim dividend, including tax thereon, is recorded as a liability on the date of declaration by the board of directors.

Indian law mandates that any dividend be declared out of distributable profits only. The remittance of dividends outside India is governed by Indian law on foreign exchange and is subject to applicable taxes.

The amount of per share dividend recognized as distributions to equity shareholders for the year ended March 31, 2018 and year ended March 31, 2017 was ₹ 9 and ₹ 10 respectively.

The Board of Directors at its meeting held on April 20, 2017 had recommended a final dividend of 30% (₹ 3 per equity share of par value ₹ 10 each). The proposal was approved by shareholders at the Annual General Meeting held on July 18, 2017. This has resulted in a cash outflow of ₹ 607 inclusive of dividend distribution tax of ₹ 103. The Board of Directors at its meeting held on October 25, 2017 had declared an interim dividend of 20% (₹ 2 per equity share of par value ₹ 10 each) and special dividend of 20% (₹ 2 per equity share of par value ₹ 10 each) due to completion of ten years of Initial Public Offering (IPO). Also, the Board of Directors at its meeting held on January 17, 2018 had declared an interim dividend of 20% (₹ 2 per equity share of par value ₹ 10 each). The aforesaid interim and special dividends were paid during the year.

The Board of Directors at its meeting held on April 18, 2018, have declared an interim dividend of 20% (₹ 2 per equity share of par value ₹ 10 each) and recommended a final dividend of 30% (₹ 3 per equity share of par value ₹ 10 each) which is subject to approval of shareholders.

b) Retained earnings

Retained earnings comprises of undistributed earnings. A portion of these earnings amounting to ₹ 87 is not freely available for distribution

c) Share based payment reserve

The share based payment reserve is used to record the value of equity-settled share based payment transactions with employees. The amounts recorded in share based payment reserve are transferred to share premium upon exercise of stock options by employees.

d) Special Economic Zone reinvestment reserve

This Special Economic Zone reinvestment reserve has been created out of the profit of eligible SEZ units in terms of the provisions of section 10AA(1)(II) of the Income Tax Act, 1961. The reserve should be utilized by the Group for acquiring new plant and machinery for the purpose of its business in terms of the section 10AA(2) of Income Tax Act, 1961.

e) Capital redemption reserve

A statutory reserve created to the extent of sum equal to the nominal value of the share capital extinguished on buyback of Company’s own shares pursuant to Section 69 of the Companies Act, 2013.

f) Other reserve

Changes in the fair value of equity instruments is recognized in other comprehensive income (net of taxes), and presented within equity in other reserve.

g) Foreign currency translation reserve

Exchange difference relating to the translation of the results and net assets of the Company’s foreign operations from their functional currencies to the Group’s presentation currency are recognized directly in other comprehensive income and accumulated in the foreign currency translation reserve.

11. a) The Group has allotted 83,893,088 and 41,765,661 fully paid up equity shares during the quarter ended March 31, 2016 and June 30, 2014 respectively, pursuant to 1:1 bonus share issue approved by shareholders. Consequently, options/ units granted under the various employee share based plans are adjusted for bonus share issue.

b) Pursuant to the approval of the Board and the Administrative Committee at its meetings held on June 28, 2017 and July 20, 2017

respectively, the Group bought back 4,224,000 equity shares of ₹ 10 each on a proportionate basis, at a price of ₹ 625 per equity share for an aggregate consideration of ₹ 2,640 (Rupees Two thousand six hundred and forty million only), and completed the extinguishment of the equity shares bought back. Capital redemption reserve has been created to the extent of nominal value of share capital extinguished amounting to ₹ 42 million. The buyback and creation of capital redemption reserve was effected by utilizing the share premium and free reserves.

c) The Group has not allotted any equity shares as fully paid up without payment being received in cash.

12. Employee stock incentive plans

The Group instituted the Employees Stock Option Plan (‘ESOP’) in fiscal year 2000, which was approved by the Board of Directors (Board). The Group currently administers seven stock option programs, a restricted stock purchase plan and a phantom stock options plan.

Program 1 [ESOP 1999]

This plan was terminated on September 30, 2001 and there are no options outstanding as at March 31, 2018 and March 31, 2017.

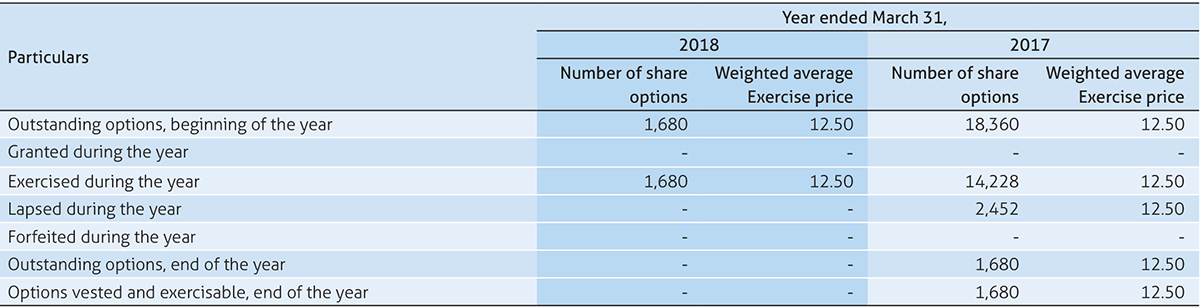

Program 2 [ESOP 2001]

Options under this program have been granted to employees at an exercise price of ₹ 50 per option (₹ 12.5 per option post bonus issue). All stock options have a four-year vesting term and vest and become fully exercisable at the rate of 15%, 20%, 30% and 35% at the end of 1, 2, 3 and 4 years respectively from the date of grant. Each option is entitled to 1 equity share of ₹ 10 each. This program extends to employees who have joined on or after October 1, 2001 or have been issued employment offer letters on or after August 8, 2001 or options granted to existing employees with grant date on or after October 1, 2001. This plan was terminated on April 30, 2006. The contractual life of each option is 11 years after the date of grant.

Program 3 [ESOP 2006 (a)]

This plan was terminated on October 25, 2006 and there are no options outstanding as at March 31, 2018 and March 31, 2017.

Program 4 [ESOP 2006 (b)]

Options under this program are granted to employees at an exercise price periodically determined by the Nomination and Remuneration Committee. All stock options have a four-year vesting term and vest and become fully exercisable at the rate of 15%, 20%, 30% and 35% at the end of 1, 2, 3 and 4 years respectively from the date of grant. Each option is entitled to 1 equity share of ₹ 10 each. This program extends to employees to whom the options are granted on or after October 25, 2006. The contractual life of each option is 5 years after the date of grant. There are no outstanding options as at March 31, 2018 and March 31, 2017.

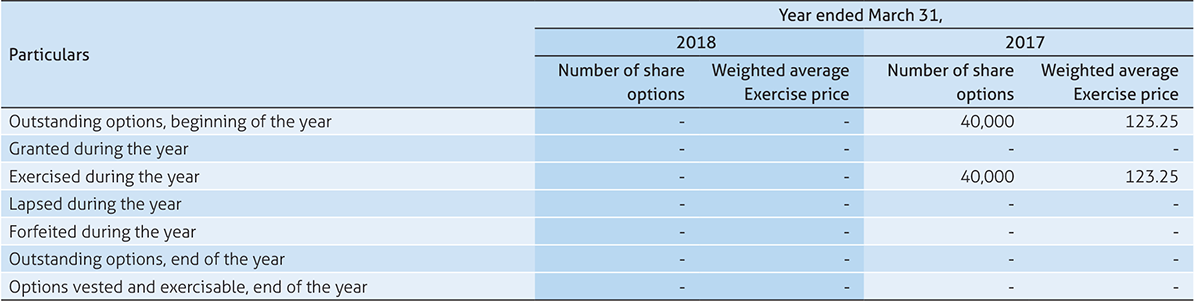

Program 5 [ESOP 2008A]

Options under this program are granted to employees of erstwhile Aztecsoft Limited as per swap ratio of 2:11 as specified in the merger scheme. Each new option is entitled to 1 equity share of ₹ 10 each.

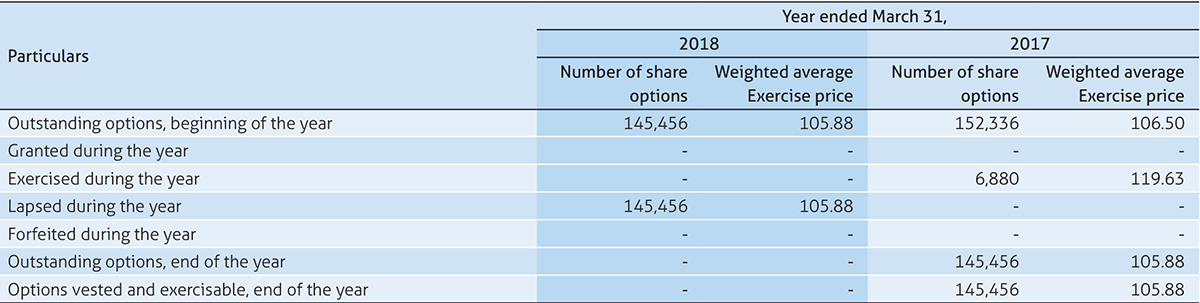

Directors’ Stock Option Plan, 2006 (‘DSOP 2006’)

Options under this program have been granted to independent directors at an exercise price periodically determined by the Nomination and Remuneration Committee. All stock options vest and become fully exercisable equally over three year vesting term at the end of 1, 2 and 3 years respectively from the date of the grant. Each option is entitled to 1 equity share of ₹ 10 each. The contractual life of each option is 4 years after the date of the grant.

Program 7 [ESOP 2010A]

In-principle approvals for administering the seventh stock option program i.e. ESOP 2010A have been received by the Group from the BSE and NSE for 1,135,000 equity shares of ₹ 10 each. No options have been granted under the program as at March 31, 2018 and March 31, 2017.

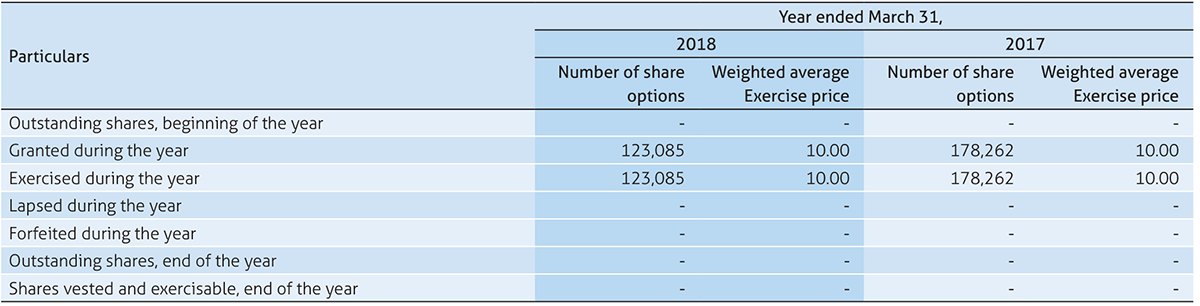

Employee Restricted Stock Purchase Plan 2012 (‘ERSP 2012’)

ERSP 2012 was instituted with effect from July 16, 2012 to issue equity shares of nominal value of ₹ 10 each. Shares under this program are granted to employees at an exercise price of not less than ₹ 10 per equity share or such higher price as determined by the Nomination and Remuneration Committee. Shares shall vest over such term as determined by the Nomination and Remuneration Committee not exceeding ten years from the date of the grant. All shares will have a minimum lock in period of one year from the date of allotment.

Other stock based compensation arrangements

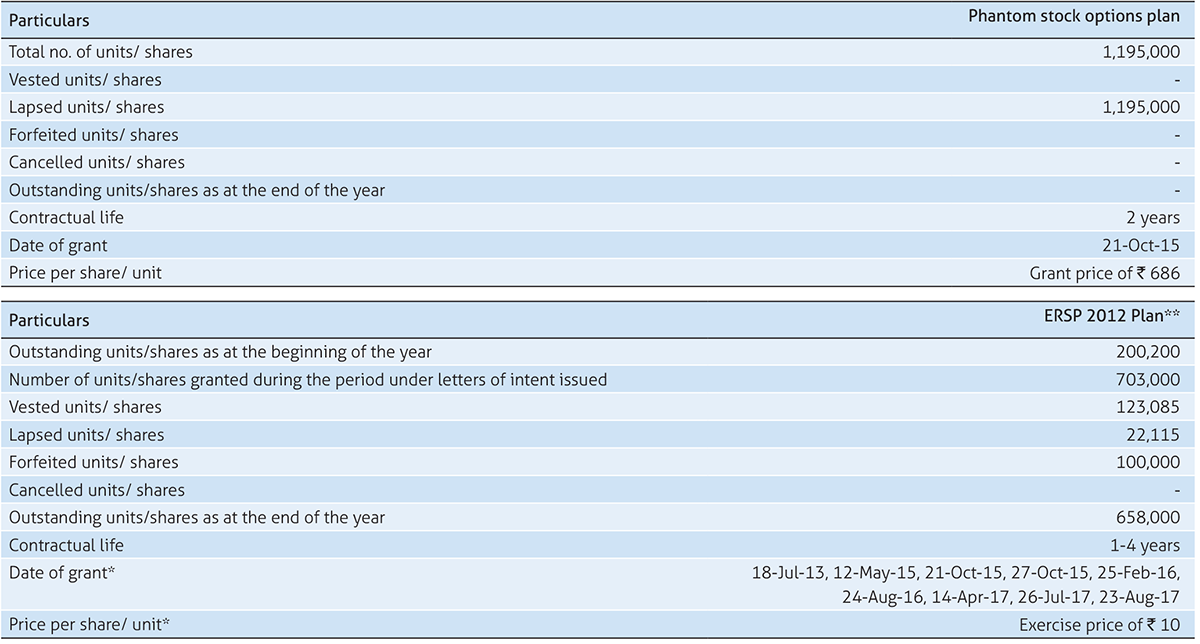

The Group has also granted phantom stock options and letter of intent to issue shares under ERSP 2012 plan to certain employees which is subject to certain vesting conditions. Details of the outstanding options/units as at March 31, 2018 are given below:

* Based on Letter of Intent ** Excludes direct allotment of shares

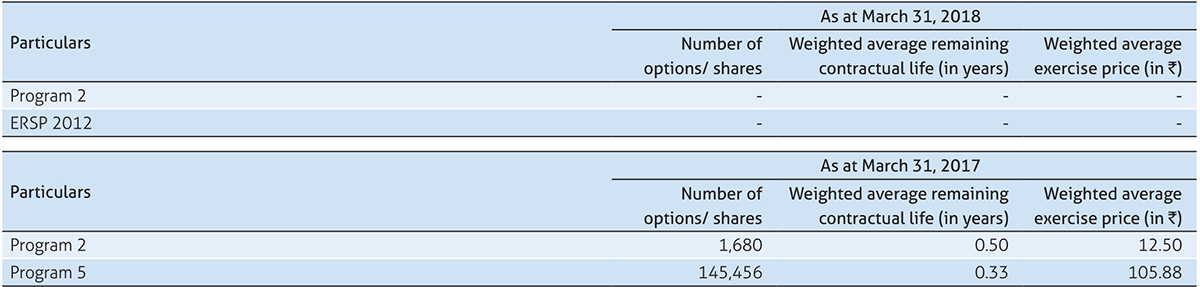

The following tables summarize information about the options/ shares outstanding under various programs as at March 31, 2018 and March 31, 2017.

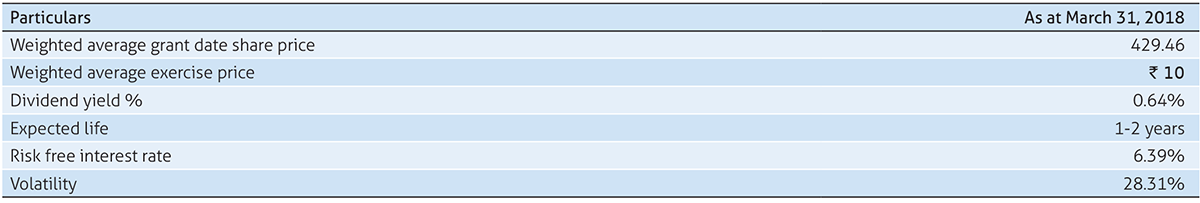

The weighted average fair value of each unit under the above mentioned ERSP 2012 plan, granted during the year ended was ₹ 442.9 using the Black-Scholes model with the following assumptions:

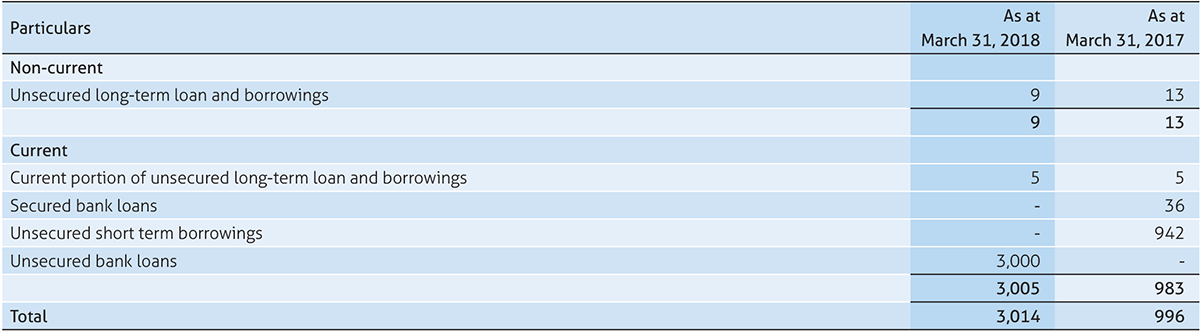

13. Loans and borrowings

A summary of loans and borrowings is as follows:

Unsecured long term borrowings represent the amount received from Council for Scientific and Industrial Research (CSIR) to develop a project under “Development of Intelligent Video Surveillance Server (IVSS) system”.

The Unsecured long term borrowings is an unsecured loan carrying a simple interest of 3% p.a. on the outstanding amount of loan. Repayment of loan is in 10 equal annual installments commencing from June 2011. Any delay in repayment entails a liability of 12% p.a. compounded monthly for the period of delay. The loan carries an effective interest rate of 3% p.a. and is repayable in full in June 2021. There is no default in the repayment of the principal loan and interest amounts.

Unsecured bank loans represents the working capital loan obtained from HDFC Bank during the year. Unsecured short term borrowings represent the commercial paper offering from HDFC Bank obtained during the previous year ended March 31, 2017 and the same was repaid during the year.

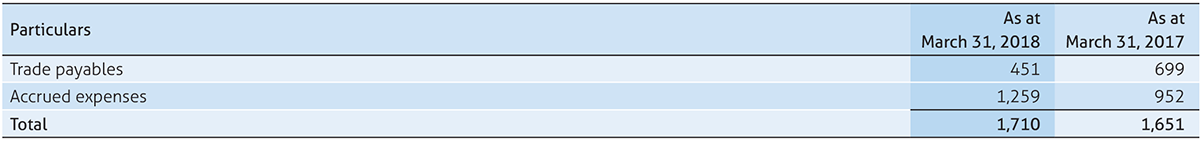

14. Trade payables and accrued expenses

Trade payables and accrued expenses consist of the following:

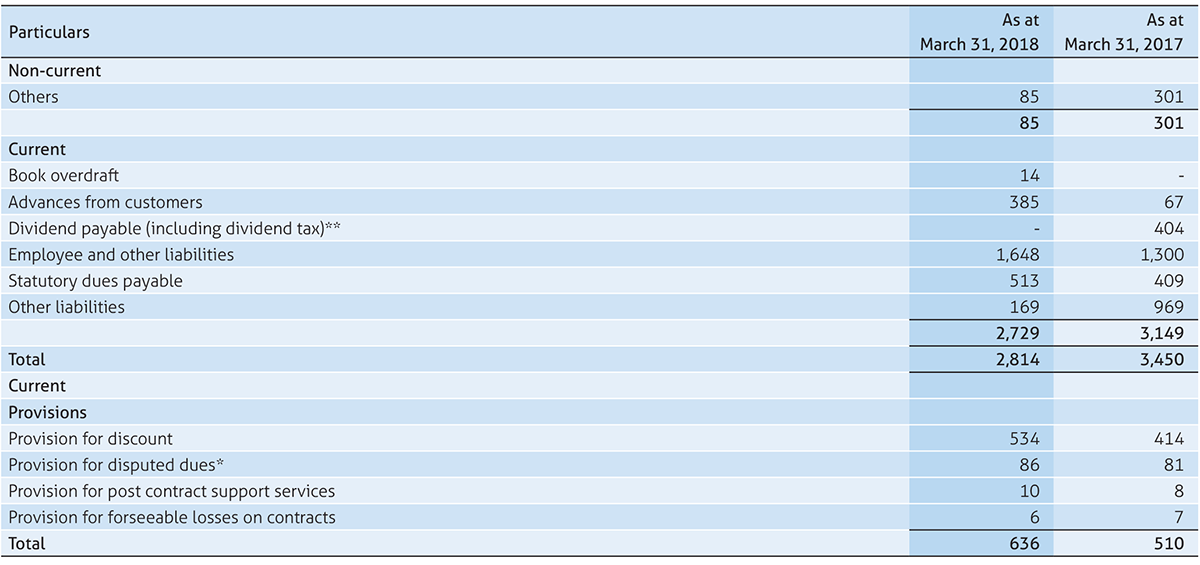

15. Other liabilities and provisions

* Represents disputed tax dues provided pursuant to unfavourable order received from the tax authorities against which the Group has preferred an appeal with the relevant authority.

** Represents interim dividend declared on March 27, 2017

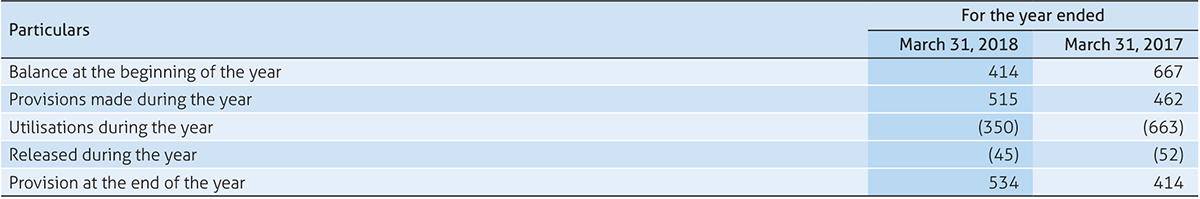

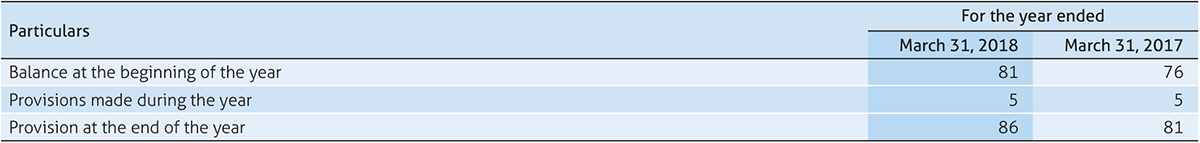

Provision for discount

Provision for discount are for volume discounts and pricing incentives to customers accounted for by reducing the amount of revenue recognized at the time of sale.

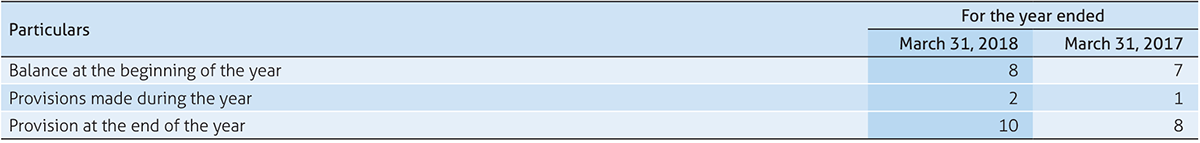

Provision for post contract support services

Provision for post contract support services represents cost associated with providing sales support services which are accrued at the time of recognition of revenues and are expected to be utilized within a period of one year.

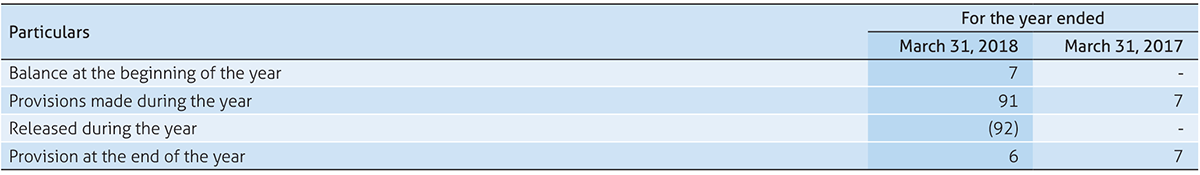

Provision for disputed dues

Provision for foreseeable losses on contracts

Provision for foreseeable losses on contracts represents excess of estimated cost over the future revenues to be recognised and expected to be utilized within a period of one year

16. Employee benefit obligations

Employee benefit obligations comprises of following:

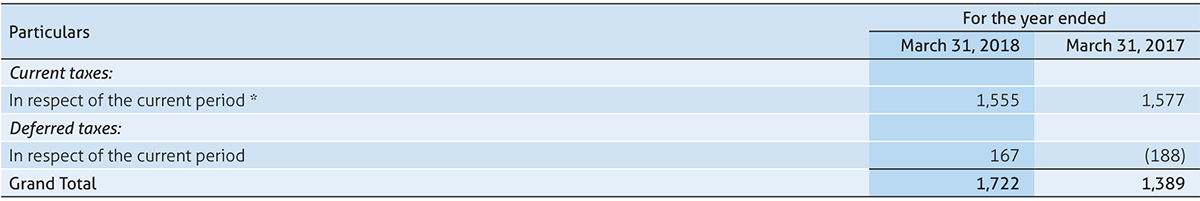

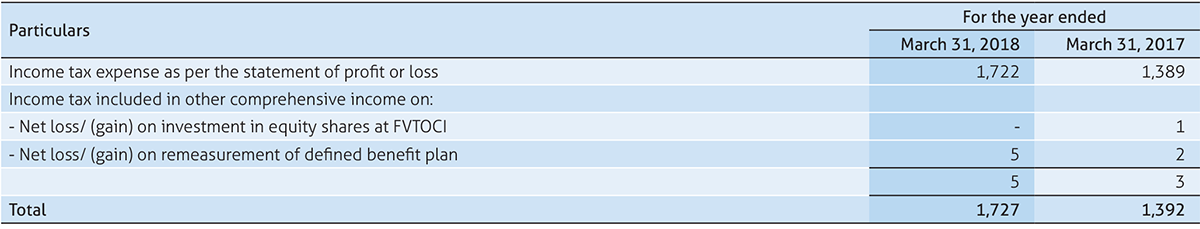

17. Income tax expense

Income tax expense in the statement of profit or loss consists of:

* Tax expense for the year ended March 31, 2018 is net of reversals of ₹ 250 on submission of tax filings. Income tax expense has been allocated as follows:

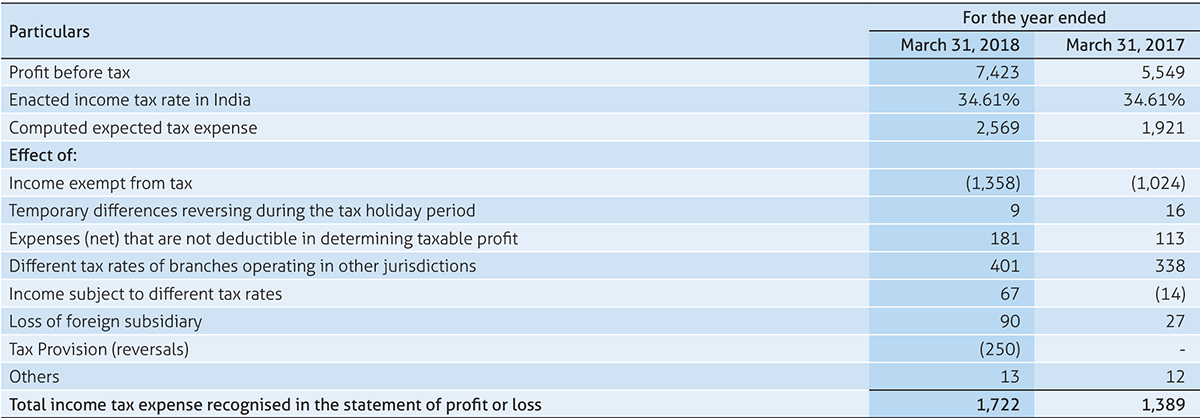

The reconciliation between the provision for income tax of the Group and amounts computed by applying the Indian statutory income tax rate to profit before taxes is as follows:

The tax rates under Indian Income Tax Act, for the year ended March 31, 2018 and March 31, 2017 is 34.61% and 34.61% respectively.

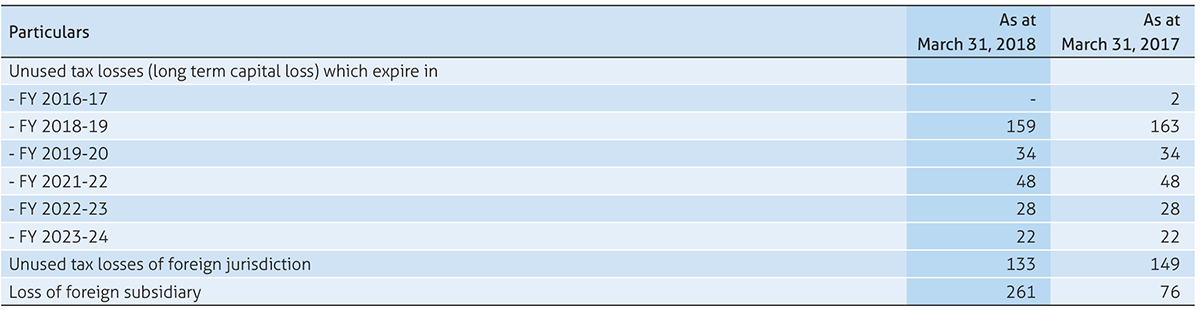

The Group has not created deferred tax assets on the following

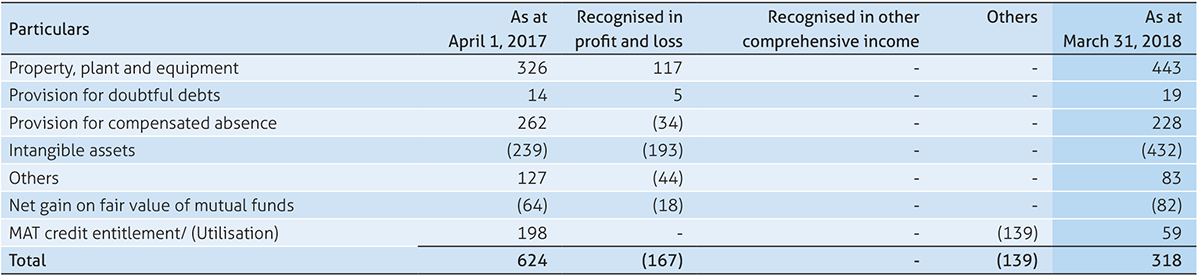

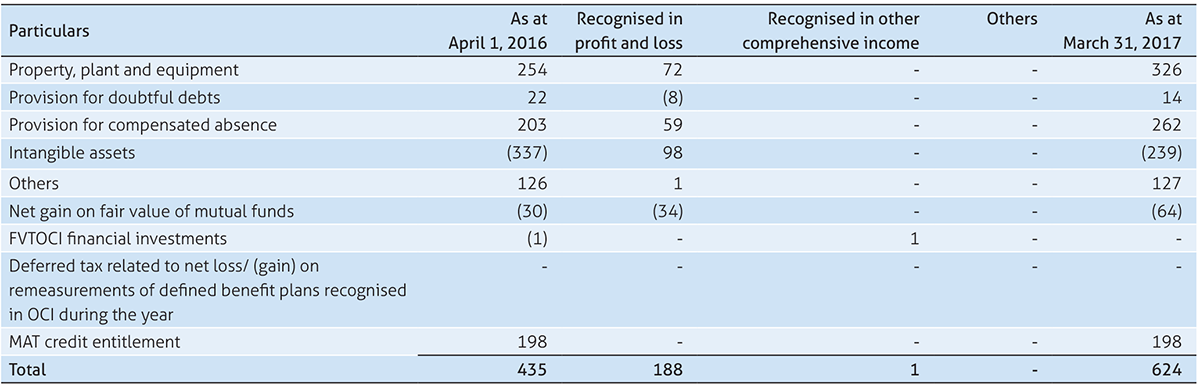

The components of deferred tax assets are as follows:

Deferred tax assets/ (liabilities) as at March 31, 2018 in relation to:

Deferred tax assets/ (liabilities) as at March 31, 2017 in relation to:

The Group has units at Bengaluru, Hyderabad, Chennai and Bhubaneshwar registered as Special Economic Zone (SEZ) units which are entitled to a tax holiday under Section 10AA of the Income Tax Act, 1961.

The Group also has STPI units at Bengaluru and Pune which are registered as a 100 percent Export Oriented Unit, which were earlier entitled to a tax holiday under Section 10B and Section 10A of the Income Tax Act, 1961.

A substantial portion of the profits of the Group’s India operations are exempt from Indian income taxes being profits attributable to export operations from undertakings situated in Special Economic Zone (SEZ). Under the Special Economic Zone Act, 2005 scheme, units in designated Special Economic Zones providing service on or after April 1, 2005 will be eligible for a deduction of 100 percent of profits or gains derived from the export of services for the first five years from commencement of provision of services and 50 percent of such profits and gains for a further five years. Certain tax benefits are also available for a further five years subject to the unit meeting defined conditions.

Dividend income from certain category of investments is exempt from tax. The difference between the reported income tax expense and income tax computed at statutory tax rate is primarily attributable to income exempt from tax. Pursuant to the changes in the Indian income tax laws in fiscal 2007, Minimum Alternate Tax (MAT) has been extended to income in respect of which deduction is claimed under the tax holiday schemes discussed above; consequently, the Company has calculated its tax liability for current domestic taxes after considering MAT. The excess tax paid under MAT provisions over and above normal tax liability can be carried forward and set-off against future tax liabilities computed under normal tax provisions. The Group is also subject to tax on income attributable to its permanent establishments in the foreign jurisdictions due to operation of its foreign branches and subsidiaries.

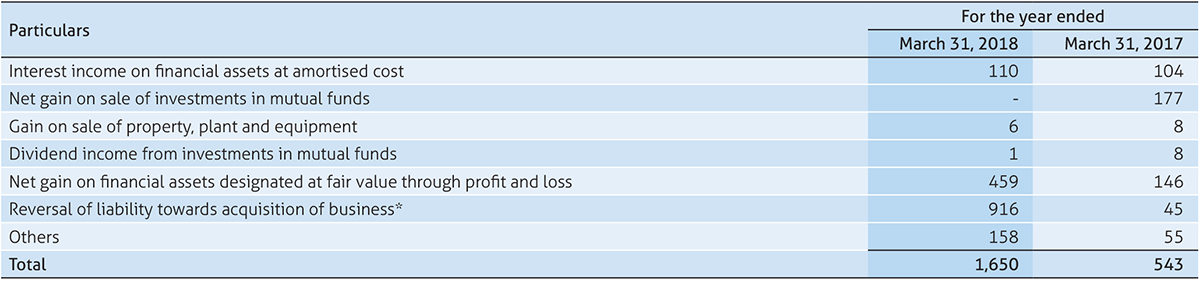

18. Finance and other income

* During the year ended March 31, 2018, the Group has written back earn out payable towards acquisition of business to the erstwhile shareholders of Bluefin Solutions Limited, Relational Solutions Inc. and Magnet 360 LLC amounting to ₹ 916.

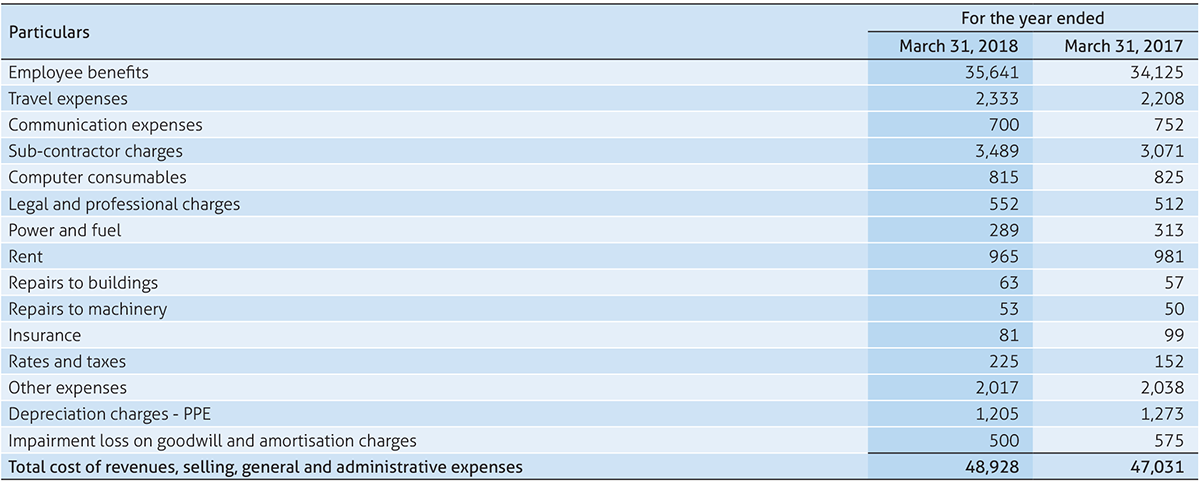

19. Expenses by nature

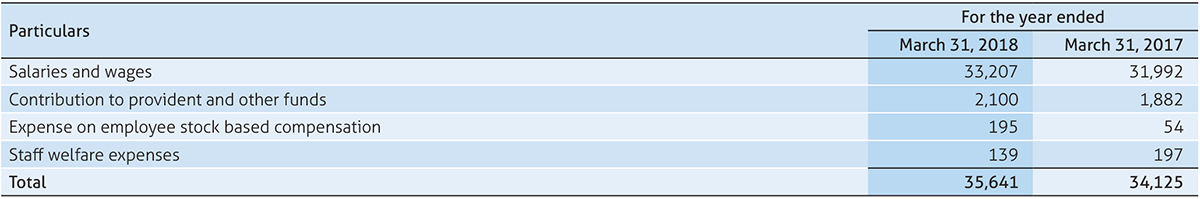

20. Employee benefits

The employee benefit cost is recognized in the following line items in the statement of profit or loss:

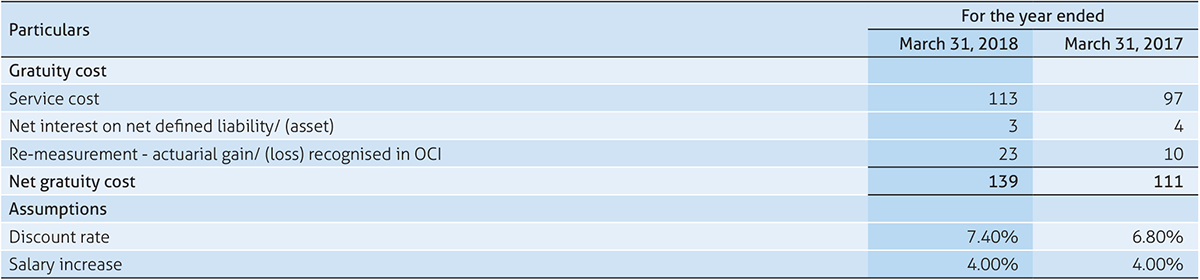

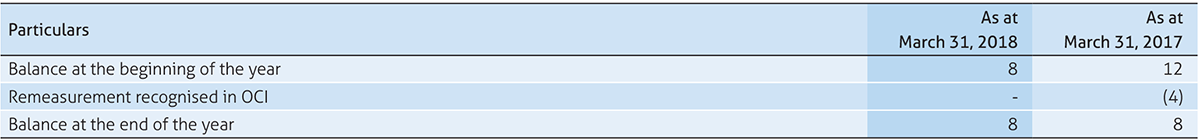

Defined benefit plans

Amount recognized in the statement of profit or loss in respect of gratuity cost (defined benefit plan) is as follows:

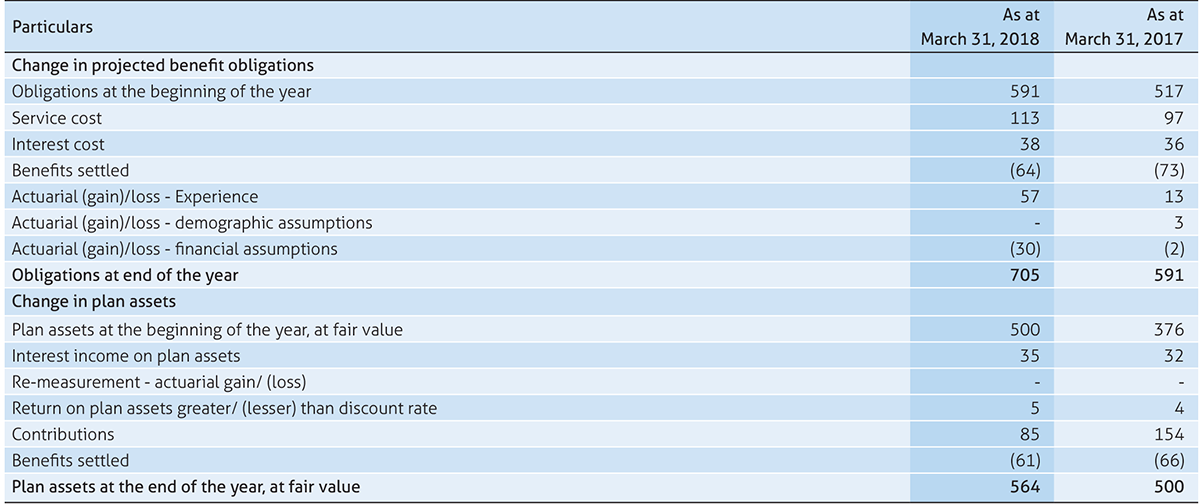

The estimates of future salary increase, considered in actuarial valuation, takes into account inflation, seniority, promotion and other relevant factors such as supply and demand factors in the employment market. The expected return on plan assets is based on expectation of the average long-term rate of return expected on investments of the fund during the estimated term of the obligations. The following table sets out the status of the gratuity plan.

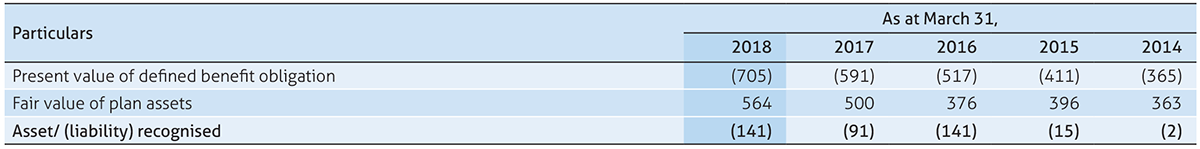

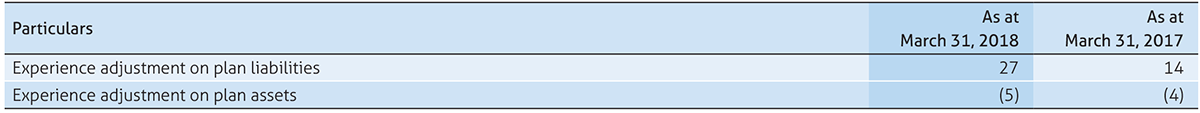

Historical Information : -

The experience adjustments, meaning difference between changes in plan assets and obligations expected on the basis of actuarial assumption and actual changes in those assets and obligations are as follows:

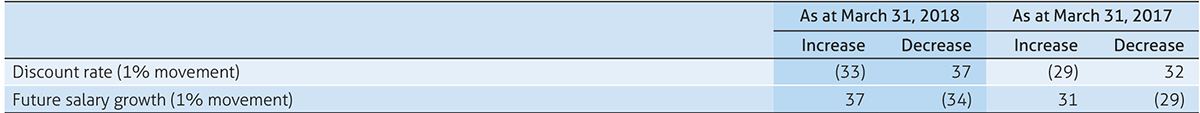

Sensitivity Analysis

Reasonably possible changes at the reporting date to one of the relevant actuarial assumptions, holding other assumptions constant, would have affected the defined benefit obligation by the amounts shown below:

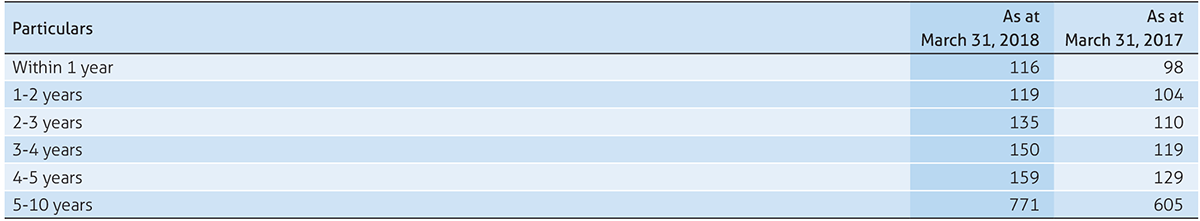

Maturity profile of defined benefit obligation:

The Group expects to contribute ₹ 116 to its defined benefit plans during the next fiscal year. As at March 31, 2018 and March 31, 2017, 100% of the plan assets were invested in insurer managed funds. The Group has established an income tax approved irrevocable trust fund to which it regularly contributes to finance liabilities of the plan.

The fund’s investments are managed by certain insurance companies as per the mandate provided to them by the trustees and the asset allocation is within the permissible limits prescribed in the insurance regulations.

21. Earnings per equity share

Reconciliation of the number of equity shares used in the computation of basic and diluted earnings per equity share is set out below:

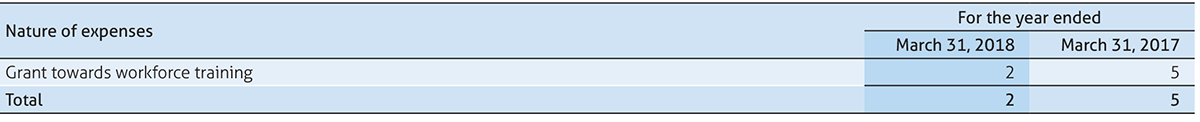

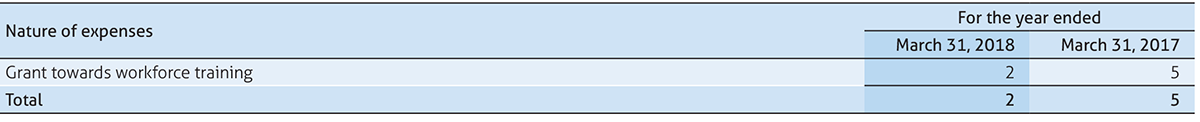

22. The Group has a development center at Gainesville, Florida, US. The state of Florida has offered various incentives targeted to the needs of the development center. The nature and the extent of the Government grant is given below:

The Group had availed a grant of USD 950,000 for renovation of project facility in the financial year 2011-2012. This grant is subject to fulfillment of certain conditions such as creation of minimum employment with specified average salary and capital investment at the development center at Gainesville, Florida, US.

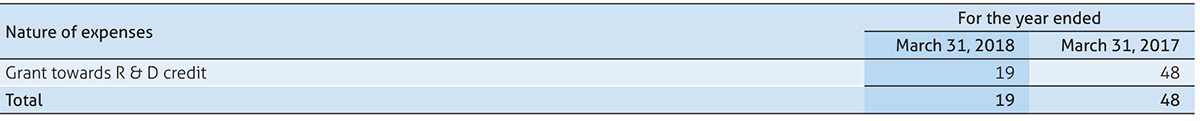

The Group has claimed R&D tax relief under UK corporation tax rules. The Group undertakes R&D activities and incurs qualifying revenue expenditure which is entitled to an additional deduction under UK corporation tax rules, details of which are given below.

As at March 31, 2018, the grant recognized in the balance sheet is ₹ 56 (As at March 31, 2017: ₹ 33).

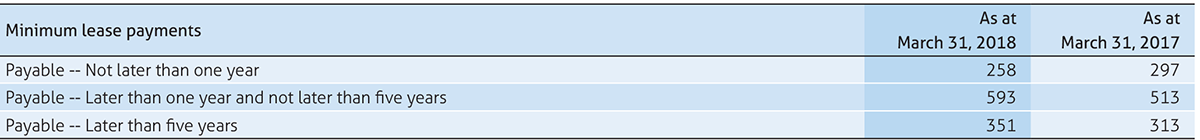

23. Operating leases

The Group has various operating leases, mainly for office buildings including land. Lease rental expense under such non-cancellable operating lease during the year ended March 31, 2018 and March 31, 2017 amounted to ₹ 400 and ₹ 467 respectively. Future minimum lease payments under non-cancellable operating lease as at March 31, 2018 is as below:

Additionally, the Group leases office facilities and residential facilities under cancellable operating leases. The rental expense under cancellable operating lease during the year ended March 31, 2018 and March 31, 2017 amounted to ₹ 565 and ₹ 514 respectively.

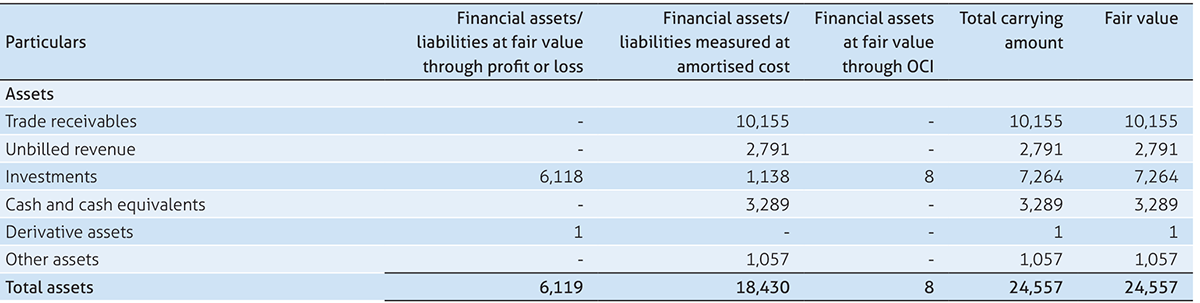

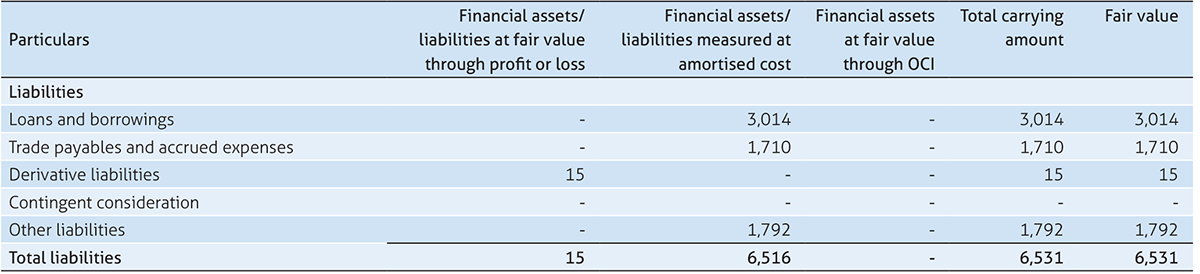

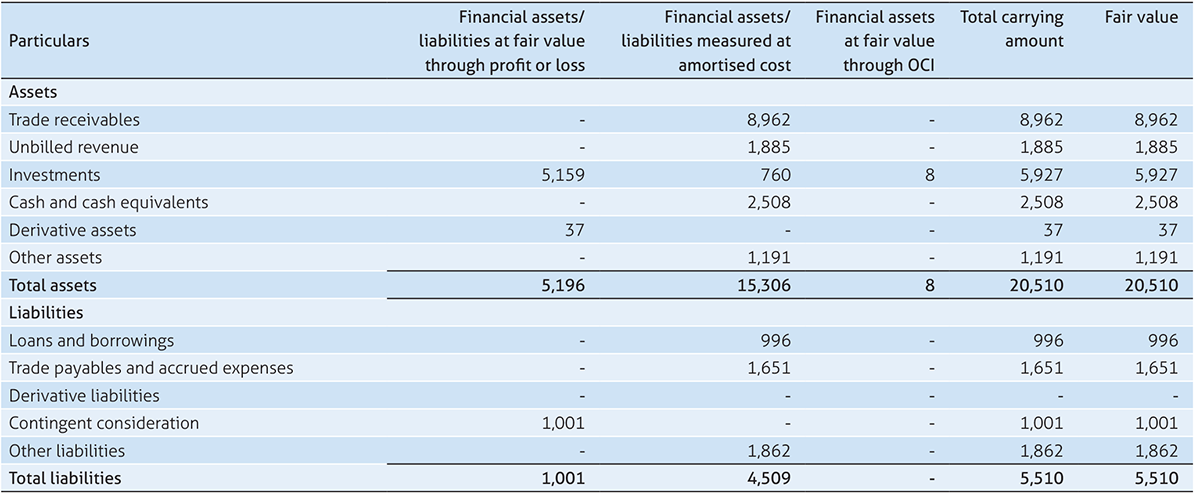

24. Financial instruments

Financial instruments by category

The carrying value and fair value of financial instruments by categories as at March 31, 2018, March 31, 2017 is as follows:

As at March 31, 2018

As at March 31, 2017

The management assessed that fair value of cash and short-term deposits, trade receivables, other current assets, trade payables, book overdrafts and other current liabilities approximate their carrying amounts largely due to the short-term maturities of these instruments. The fair value of the financial assets and liabilities is included at the amount at which the instrument could be exchanged in a current transaction between willing parties, other than in a forced or liquidation sale. The following methods and assumptions were used to estimate the fair values:

i) Long-term fixed-rate and variable-rate receivables/borrowings are evaluated by the Group based on parameters such as interest rates, specific country risk factors, individual creditworthiness of the customer and the risk characteristics of the financed project. Based on this evaluation, allowances are taken into account for the expected losses of these receivables.

ii) The fair value of the quoted bonds and mutual funds are based on price quotations at reporting date. The fair value of unquoted instruments, loans from banks and other financial liabilities, as well as other non-current financial liabilities is estimated by discounting future cash flows using rates currently available for debt on similar terms, credit risk and remaining maturities. In addition to being sensitive to a reasonably possible change in the forecast cash flows or discount rate, the fair value of the equity instruments is also sensitive to a reasonably possible change in the growth rates. The valuation requires management to use unobservable inputs in the model, of which the significant unobservable inputs are disclosed in the tables below. Management regularly assesses a range of reasonably possible alternatives for those significant unobservable inputs and determines their impact on the total fair value.

iii) Fair values of the Group’s interest-bearing borrowings and loans are determined by using Discounted Cash Flow (‘DCF’) method using discount rate that reflects the issuer’s borrowing rate as at the end of the reporting period. The own non- performance risk as at March 31, 2018 was assessed to be insignificant.

iv) The fair values of the unquoted equity and preference shares have been estimated using a DCF model. The valuation requires management to make certain assumptions about the model inputs, including forecast cash flows, discount rate, credit risk and volatility/ the probabilities of the various estimates within the range can be reasonably assessed and are used in management’s estimate of fair value for these unquoted equity investments.

v) The Group enters into derivative financial instruments with various counterparties, principally banks with investment grade credit ratings. Interest rate swaps, foreign exchange forward contracts are valued using valuation techniques, which employs the use of market observable inputs. The most frequently applied valuation techniques include forward pricing and swap models, using present value calculations. The models incorporate various inputs including the credit quality of counterparties, foreign exchange spot and forward rates, yield curves of the respective currencies, currency basis spreads between the respective currencies, interest rate curves etc. As at March 31, 2018 the marked-to-market value of derivative asset positions is net of a credit valuation adjustment attributable to derivative counterparty default risk. The changes in counterparty credit risk had no material effect on the hedge effectiveness assessment for derivatives designated in hedge relationships and other financial instruments recognised at fair value.

Fair Value

The fair value of cash and cash equivalent, trade receivables, unbilled revenue, trade payables, current financial liabilities and borrowings approximate their carrying amount largely due to short term nature of these instruments.

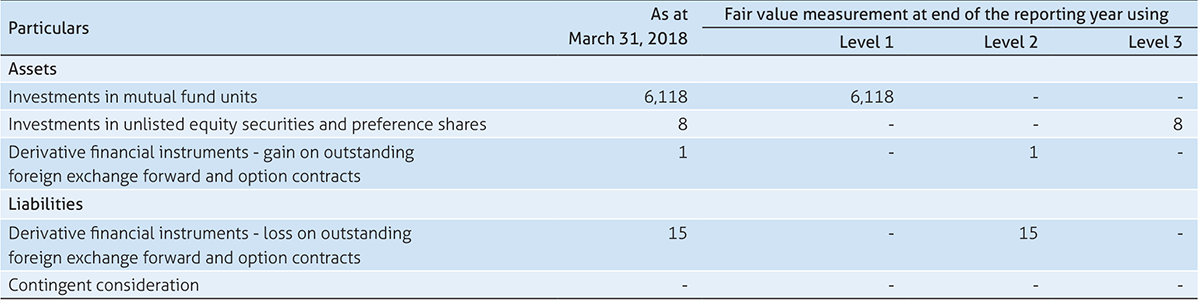

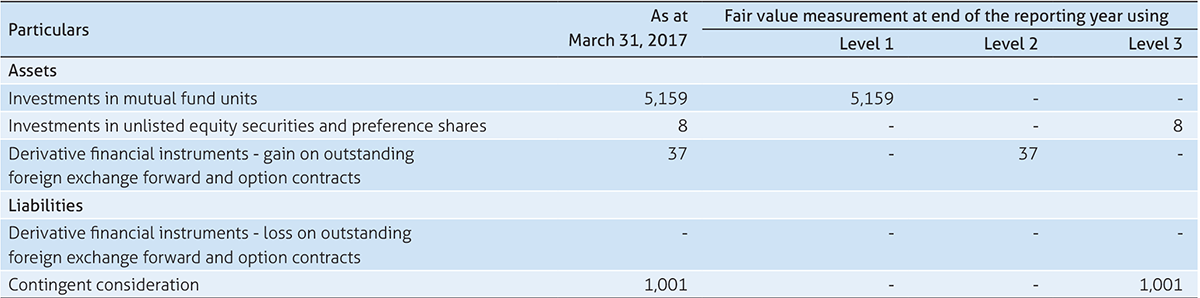

Fair value hierarchy

Level 1 - Quoted prices (unadjusted) in active markets for identical assets or liabilities.

Level 2 – Inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly (i.e. as prices) or indirectly (i.e. derived from prices).

Level 3 - Inputs for the assets or liabilities that are not based on observable market data (unobservable inputs).

The following table presents fair value hierarchy of assets and liabilities measured at fair value on a recurring basis as of March 31, 2018,

March 31, 2017:

As at March 31, 2018

There have been no transfers between level 1, level 2 and level 3 for the year ended March 31, 2018.

As at March 31, 2017

A reconciliation of changes in the fair value measurement of investments in unlisted securities in level 3 of the fair value hierarchy is given below:

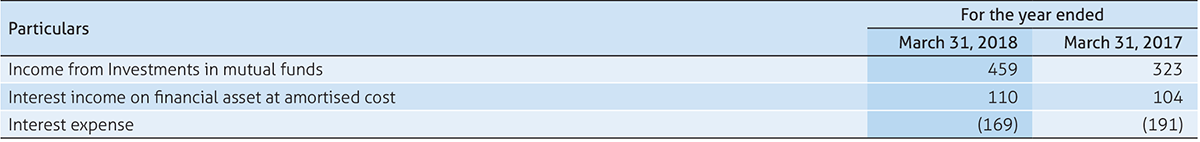

Details of income and interest expense are as follows:

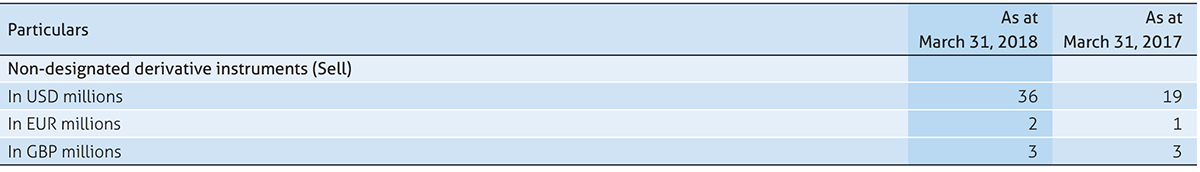

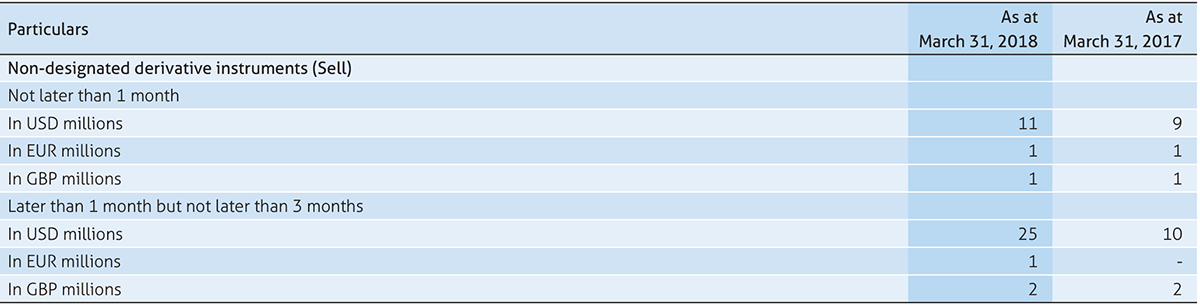

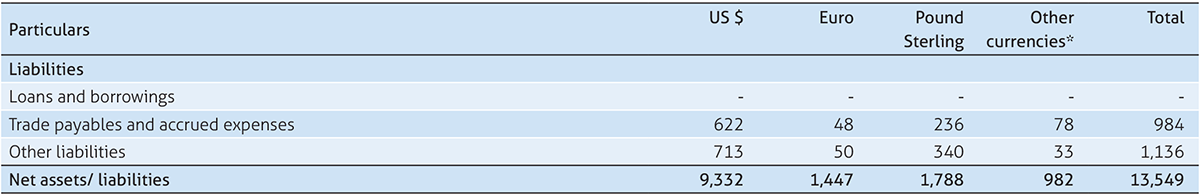

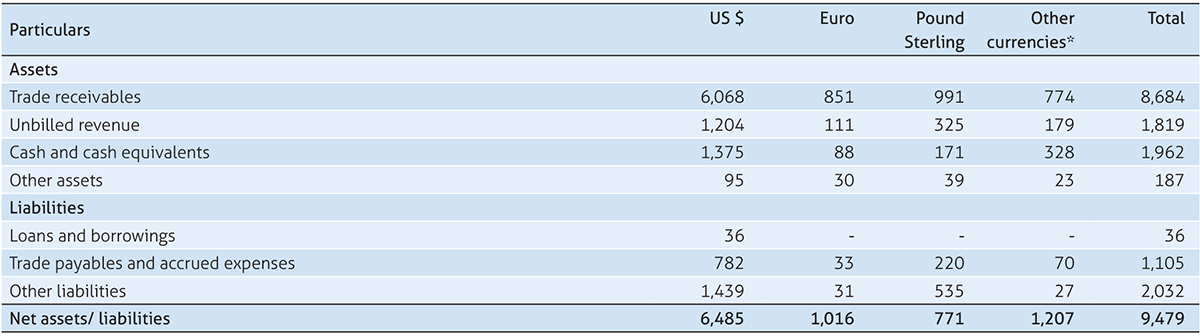

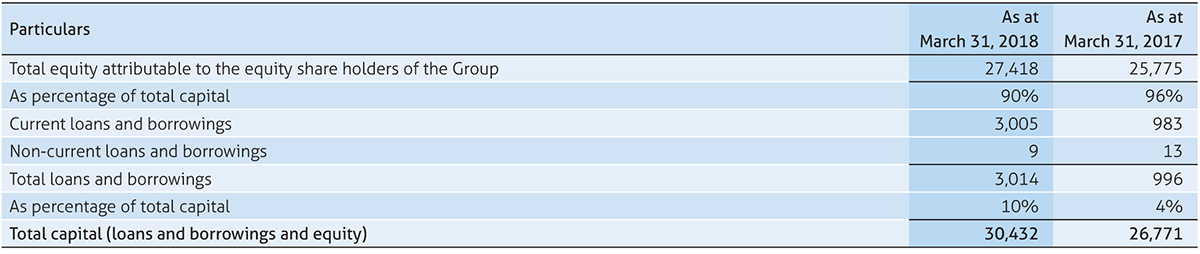

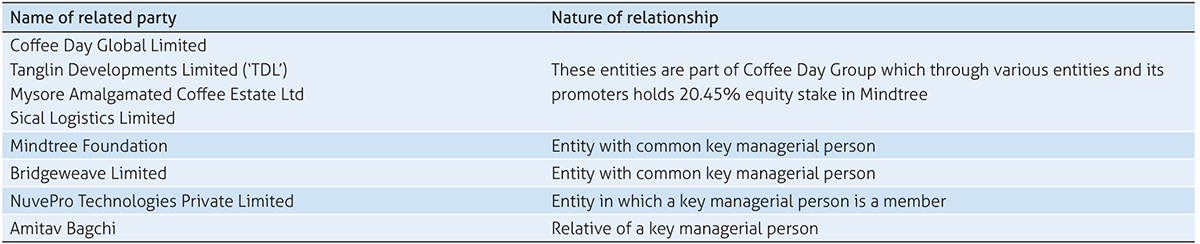

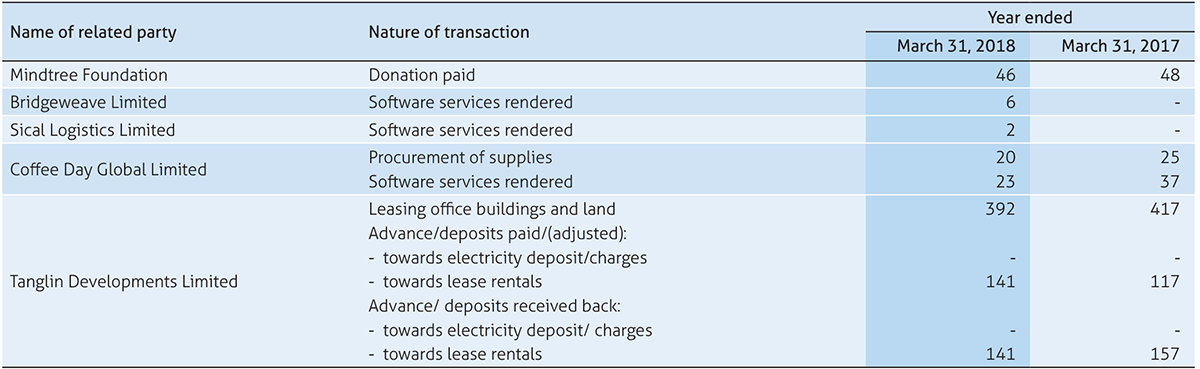

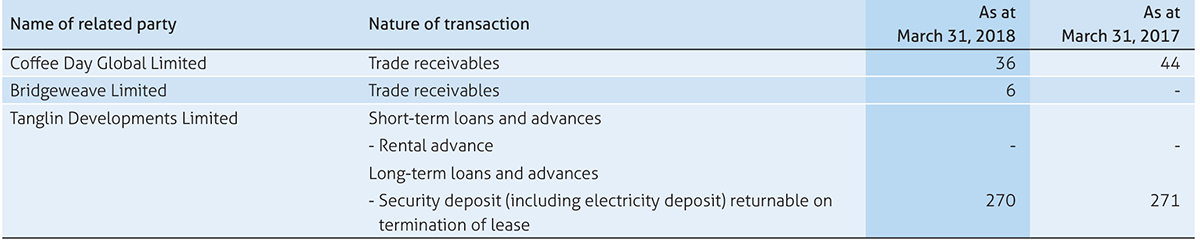

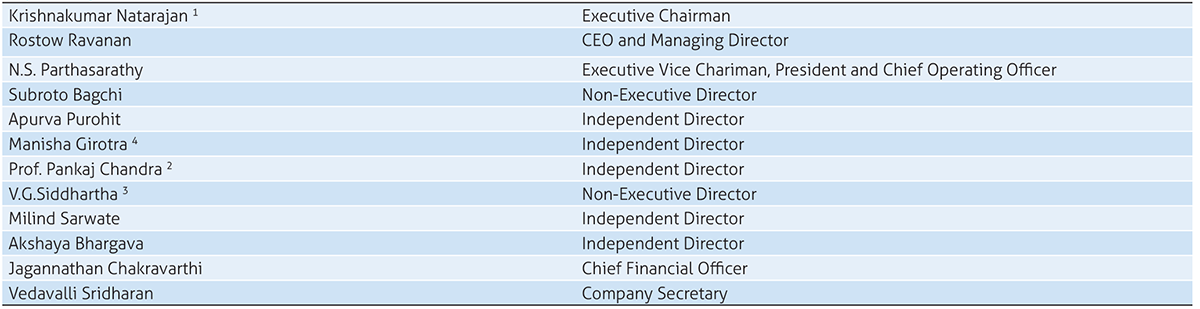

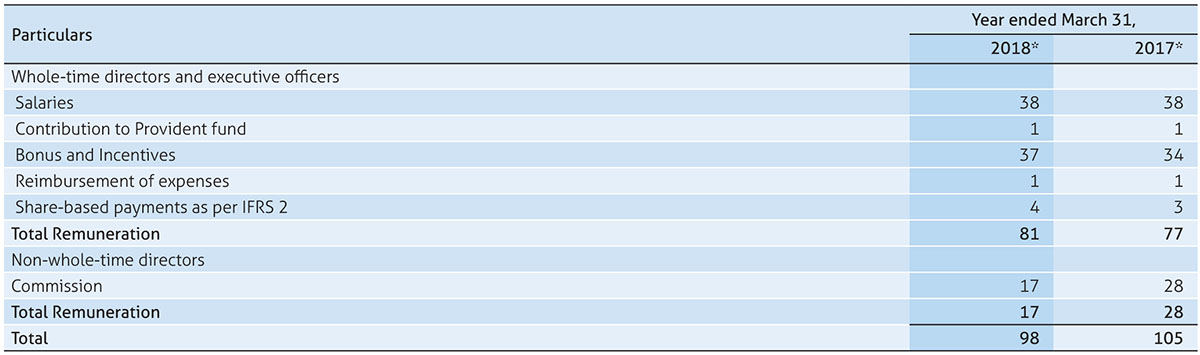

Derivative financial instruments