Financial trends and value creation 2012-13

Mindtree has created significant wealth for its shareholders as the company grew to become a global information technology solutions organisation. Given below is the data on the company’s performance for the last five years:

Rs. in millions except per share data

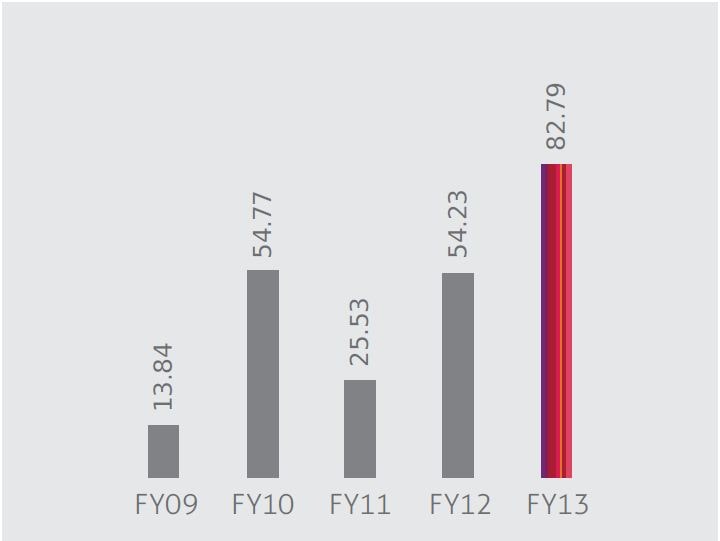

Earnings per share

Earnings per share (EPS) has increased six fold in the last five years from Rs. 13.84 in FY09 to Rs. 82.79 in FY13.

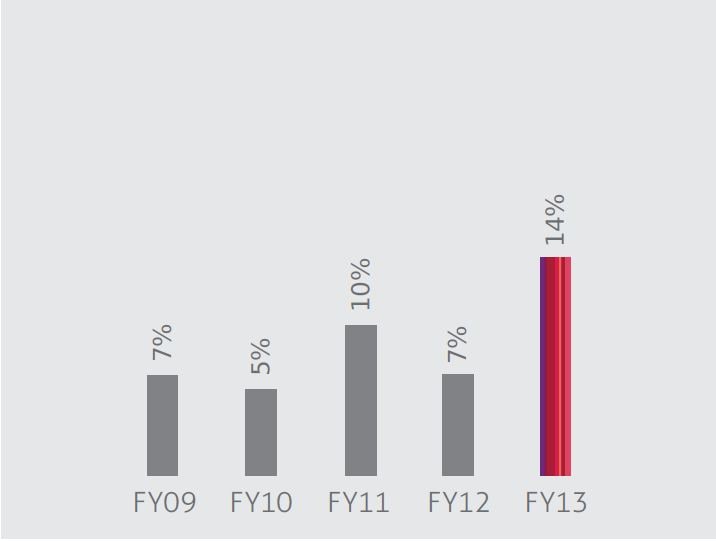

Dividend payout ratio

The dividend payout ratio has doubled in the last five years. The payout was at a high of 10% in FY11 followed by a payout of 14% in the current year.

Market capitalisation

Market capitalisation has increased from Rs. 8,019 million to Rs. 37,986 million i.e. by more than four fold in the last five years. (Based on NSE closing rate as on March 31)

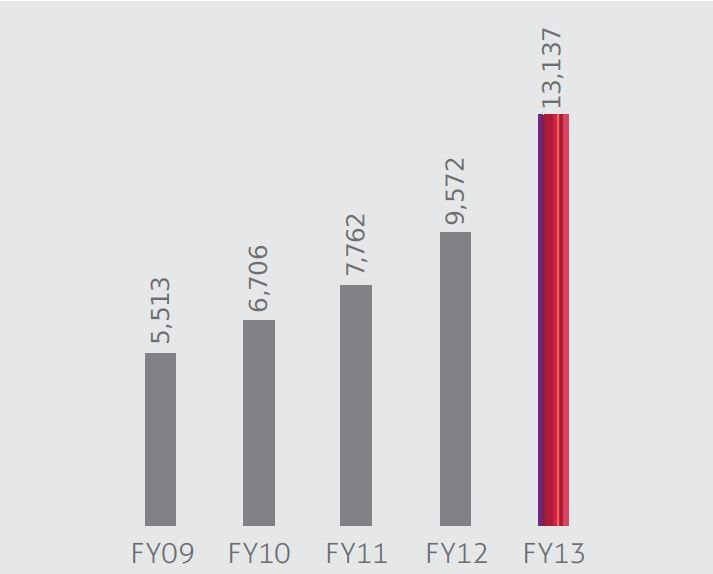

Net worth

The net worth has shown a steady and constant ascent from Rs. 5,513 million to Rs. 13,137 million in the last five years.

Revenue

We closed the year with Rs. 23,618 million in revenues. Revenue grew steadily at a CAGR of 13.8% for the last five years.

EBITDA

Earnings before interest, tax, depreciation & amortisation increased from Rs. 3,309 million in FY09 to Rs. 4,864 million in FY13, a CAGR of 8% over the last five years.

Profit after tax

Profit after taxes has grown more than six fold from Rs. 523 million in FY09 to Rs. 3,393 million in FY13.

-

Annual Report 2012-2013

- CEO's message

- Welcome Possible

- Highlights 2012 13

- Board of Directors

- Business Responsibility Report

- Directors' Report

- Chief Executive Officer (CEO) and Chief Financial Officer (CFO) Certification

- Corporate Governance Report

- Management Discussion and Analysis

- Enterprise risk management report

- Standalone Financial Statements

- Consolidated Financial Statements

- IFRS Financial Statements

- Global Presence

- Download Center

-

Annual Report 2012-2013

- CEO's message

- Welcome Possible

- Highlights 2012 13

- Board of Directors

- Business Responsibility Report

- Directors' Report

- Chief Executive Officer (CEO) and Chief Financial Officer (CFO) Certification

- Corporate Governance Report

- Management Discussion and Analysis

- Enterprise risk management report

- Standalone Financial Statements

- Consolidated Financial Statements

- IFRS Financial Statements

- Global Presence

- Download Center