How P&C insurance carriers are impacted by COVID-19 and our initial view on how operations and IT need to respond to the "New Normal”.

Context

The current COVID-19 pandemic, with millions infected, is having an unprecedented impact across the globe and resulted in completely unforeseen economic effects.

The near-term economic impact is significant, and the recovery is predicted to be very lumpy, as various parts of the world and US economy re-open. Most businesses, large and small, have been forced to either completely suspend operations, or adopt a highly restricted operating model that results in sharply reduced revenue. The biggest winners so far are companies with digital products that can be purchased and serviced completely or mostly via the internet. This is increasingly likely to be the case for insurance, a product that is ideally suited for a completely digital operating model.

Property and casualty carriers, especially those with inflexible back office operations and technology, are in the extremely difficult situation of attempting to respond quickly and iteratively to continuously evolving demands, and at the same time to rapidly implement cost efficiencies and digital capabilities for interacting with prospects, policyholders, producers and service partners.

Business Impact

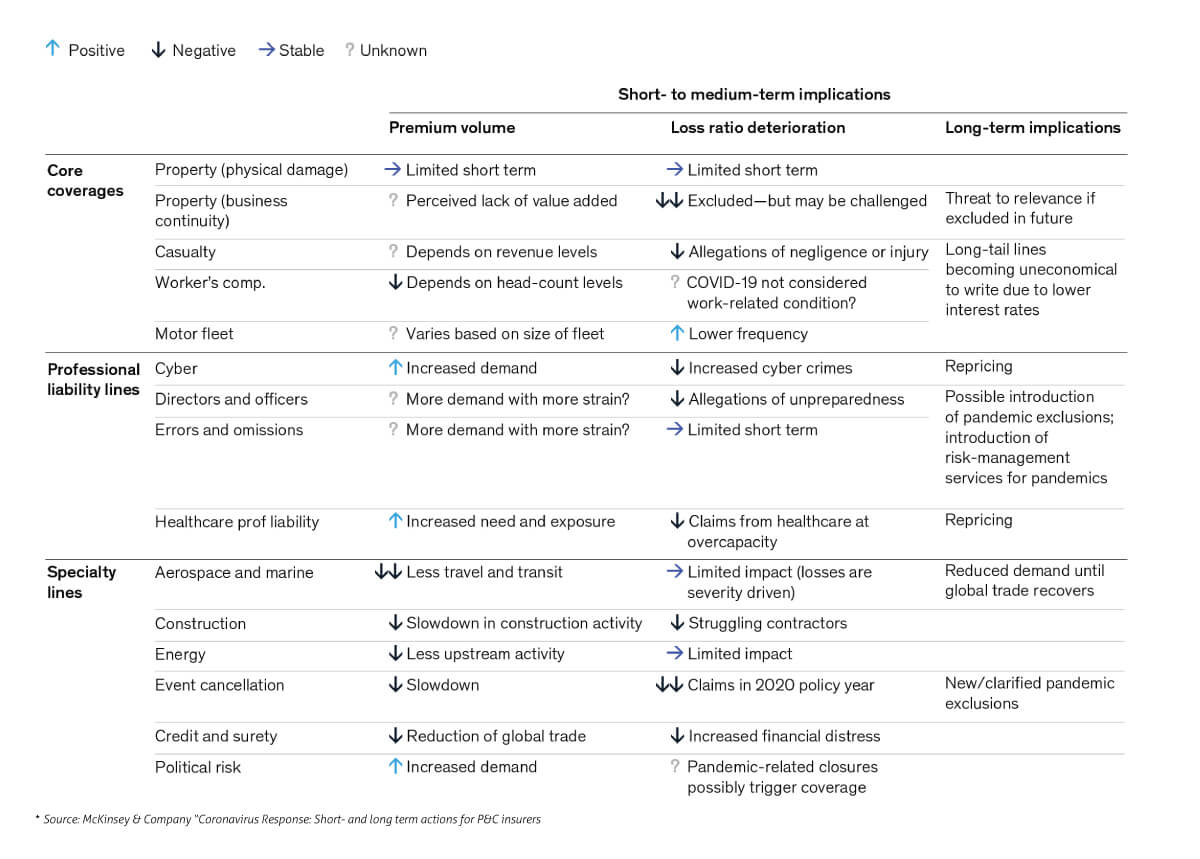

The overall business impact of COVID on the P&C industry varies considerably across lines of business and geographies. In some lines of business, demand and premium volume is actually increasing, while in others it is decreasing. While we have seen a number of good reports by various analyst firms, the following extract from McKinsey & Company’s “Coronavirus Response: Short- and long-term actions for P&C insurers” provides a concise and comprehensive view of likely business impact.

Impact on P&C Commercial Lines

The main takeaways from an operational and IT perspective based on the McKinsey report and similar analyses we’ve reviewed are as follows:

- The impact varies significantly by line of business. There is no “one size fits all” response.

- Flexibility and agility will be critical. Unfortunately, many traditional P&C carriers, especially in the commercial/specialty space are ill-equipped to move quickly.

- As mentioned, specific lines of business will be impacted to varying degrees. Some of the more significant examples we see affecting our P&C customers include:

- Workers Compensation - projected to experience a sharp reduction in premium volume resulting from severe, near term business contraction and very high unemployment. Some carriers are likely to exit this line or dramatically restrict their risk appetite.

- Commercial Trucking & Fleet – COVID has resulted in a dramatic reduction in exposure units (revenue miles driven), claim submission frequency and severity. A CCJ survey that measures the coronavirus’ impact on motor carriers, ranked last week’s business conditions as their worst week ever.*1 In response, a few nimble, aggressive carriers may consider offering rebates and discounts at renewal, following the private passenger auto response, in order to retain market share, which is in turn forcing a competitive response across the industry and is likely to leave less nimble competitors with a shrinking share.

- Cyber and Healthcare Professional Liability Lines – an uptick in demand in the near term is a growth opportunity for those carriers that are sufficiently prepared operationally and with supporting technology.

While most carriers' financial health remains quite strong, for now, some have begun reporting Q1 2020 financial losses and set aside “provisional reserves” for anticipated COVID liabilities. They are bracing for difficult and unpredictable financial challenges in Q2 and Q3 and beyond. On the other hand, one of our mid-sized specialty carriers told us just last week that “Q1 was slightly ahead of plan on premiums and slightly better on loss ratios, so it was our best quarter in years.”

Point being, there are going to be winners and losers in the coming months. While some carriers are pulling back into a bunker mentality, others are looking for opportunities. CIOs are likely to be caught in the middle of competing priorities as different lines of business want to move quickly in different directions.

Commercial Carrier Journal ‘Not enough freight to go around’: Carriers report dirt cheap rates as freight fallout worsens by Jason Cannon April 21, 2020

Operations Impact

Mindtree currently supports over 20 commercial/specialty carriers of varying sizes across multiple lines of business. We reached out to our customers and account teams to assess the current situation. Among the trends we are seeing:

- Call centers and service desks - receiving very high call volumes from concerned policyholders, agents/ brokers, and claimants with inquiries about coverages, billing, and related topics while the carrier workforce is operating 100% virtually. This poses serious customer service challenges for small to mid-sized carriers that lack robust virtual call center capabilities, productivity tools, and automation to reduce the load on over-stretched operations staff. A related problem is the challenge of onboarding new staff in a completely virtual operating model.

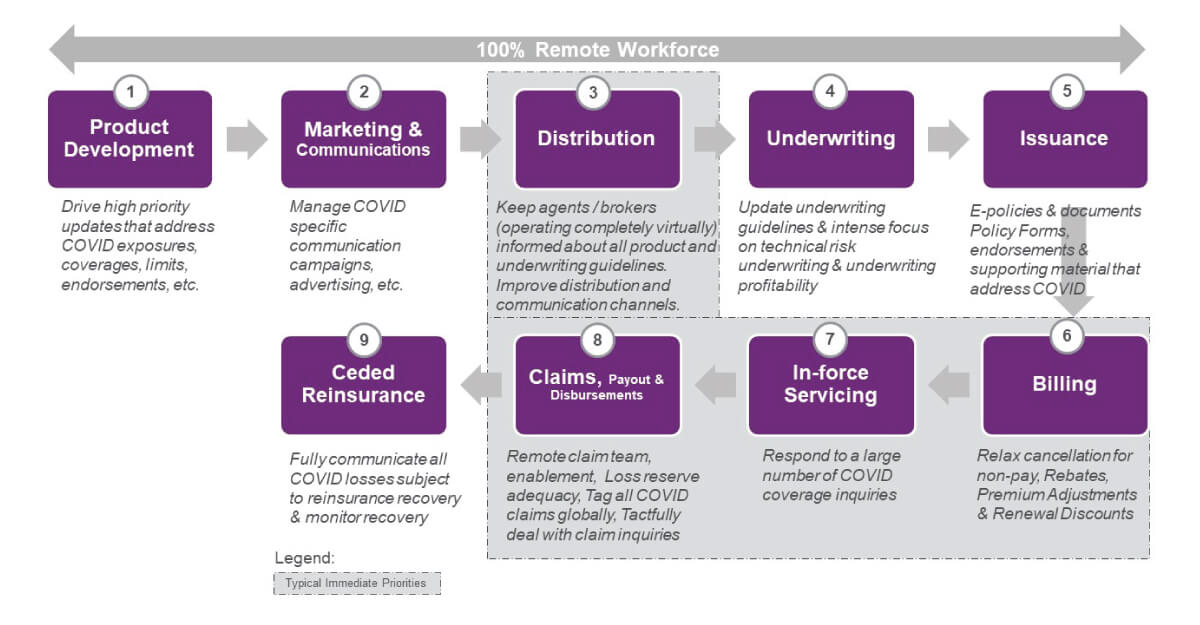

- COVID has triggered a heightened imperative for carriers to become more digital across the entire insurance operations lifecycle, with an initial priority focus on producer management, billing, in-force servicing and claims functions to make them more responsive and cost effective. One of our UK commercial lines carriers decided to roll out additional self-service capabilities on an emergency basis using a minimum viable product approach.

- Many clients are planning for a limited return to the traditional workplace model for the remainder of 2020. As a result, stop-gap measures introduced to quickly enable a virtual workforce need to be significantly enhanced to address employee productivity and communication, but also to improve security and related risks that arise from a highly distributed operating model.

- Several clients are re-evaluating their “on prem” datacenter operations and placing greater urgency on shifting where possible in the near term to a more cloud-enabled, usage based variable cost model

Core Operations - Demand for Changes and Immediate Priorities

Looking holistically across P&C core operations, we see a number of opportunities and challenges facing CIOs in the coming weeks and months.

Hotspots for immediate action include:

- Distribution

- In-force servicing

- Billing

- Claims

We are also seeing many other high priority ad hoc requests in the Data/Analytics arena in addition to the operating impacts mentioned above. Carriers that have not already created flexible reporting and analytics environments will struggle. Examples include:

- Ad hoc analysis of various core transaction data including premium/sales data, claims and loss reserves and related metrics.

- Forward-looking estimation models that provide the senior executive leadership team with the projected impact of COVID on the carrier’s financial performance, based on the latest available data, various scenarios and assumptions.

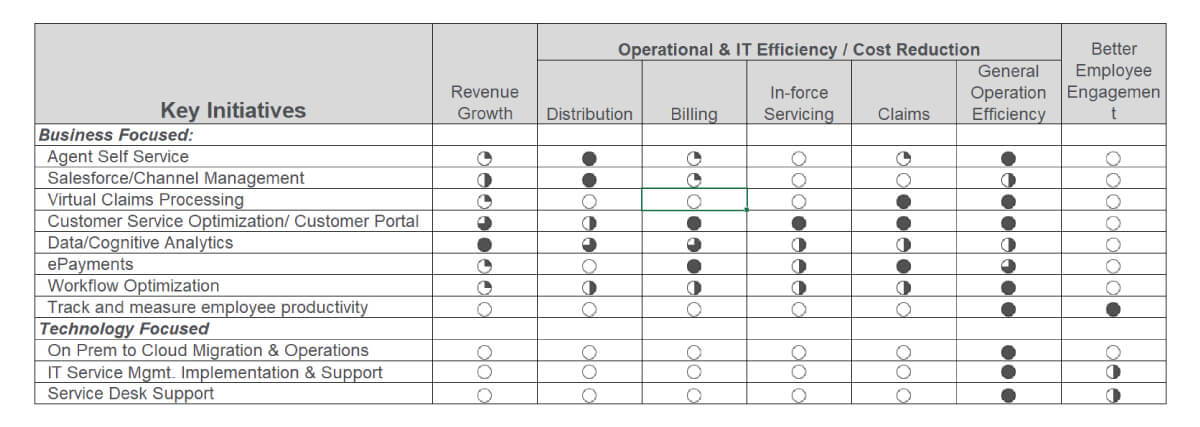

Technology initiatives to address the impact

CIOs and CTOs are being called upon to quickly re-prioritize and deploy resources to address COVID-related initiatives and to prioritize them to “Act Now” based on their specific situation.

While it is not feasible in this whitepaper to cover all of the potential IT responses to business and operational challenges, a few themes clearly stand out.

Near Term (0-3 months)

CIOS need to be prepared for continuously shifting priorities and have solution approaches lined up in the following areas:

- Digital Quick Hit Capabilities - Most carriers have the rudimentary infrastructure to enable self-service capabilities for policyholders and agents/brokers. Many are looking to leverage this and take incremental steps forward:

- Simple read-access to key information such as quotes, policy documents, claims status, endorsement requests, etc.

- Improve policyholder experience where practical.

- Claim triaging and automated routing to the most appropriate claim case manager

- Streamlined premium waivers, policy reinstatements for inadvertent cancellations

- Standalone “microsites” that provide stakeholders with critical updates, FAQs, etc.

- Remote Work Force Continuity & Infrastructure - Whether it is productivity and collaboration tools like Microsoft Teams, Slack or mission critical data center operations hardening, the current remote workforce situation brings new risks and challenges. CIOs need a go-forward plan to address these issues with a focus on selectively engaging cloud solutions and platforms to enhance scalability, continuity and security.

- Dev Ops/IT Operations/Core Processing

- Selectively apply product platform “hot fixes” that reduce process bottlenecks, enable operational streamlining or expose capabilities for web self-service.

- Virtual Pods - Enable teams collaborating remotely to provide critical patches and product changes quickly and effectively in an agile manner.

- Quickly and continually update rating engines with rating and pricing parameters to remain competitive in a highly dynamic market.

- Intelligent Automation - Most carriers have implemented RPA solutions, but frequently limited to basic, low-level back office tasks. The current crisis provides a strong incentive to revisit RPA and quickly apply it to more critical processes in billing, claims or policy servicing that can be augmented wholly or in part by the more robust capabilities available in the current crop of RPA/IA tools.

- Campaign Operations – Swift execution of COVID critical communications campaigns and updates to corporate portals, websites and social media with the latest COVID content.

- Data/Cognitive – tagging COVID claims for aggregate reserve and financial liability assessment, IBNR estimating and supporting senior executive needs for COVID impact on statutory and GAAP financials based on various economic assumptions and scenarios.

Medium Term (3-6 months or more)

More challenging situations exist when a diverse set of application systems need to be modified in response to rapidly changing conditions. CIOs need to have a rapid response plan for implementing policy rebates, pricing updates, forms changes and other COVID specific needs into the supporting systems for every insurance product. The ability to execute quickly on these imperatives varies greatly based on the number and the various technologies of the core platforms that are in place. At minimum we believe CIOs need to focus on:

- Dev Ops/IT Operations/Core Processing - Insurance Product Management (coverages, limits, rating etc.). Where existing tools fall short, consider quickly “bolting on” a modern product engine for new products that can co-exist with existing platforms, dealing with any limitations on the administration side.

- Digital - Look to service enable end-to-end key areas such as claims to allow for mostly digital claims processing from both external stakeholders (policyholders/claimants) and internal (call centers, claims adjusting and servicing).

- Cloud – Analyze the “on-prem” data center for immediate opportunities to transition to a more flexible, secure and scalable cloud approach and explore opportunities to reduce IT Ops costs and convert from fixed CapEx to variable OpEx based on transaction volume.

- Data/Cognitive – determine if any CAT data management and BI processes can be re-factored to meet COVID senior executive data/reporting needs, identify any ad-hoc, quasi-production data collection processes introduced for COVID and productionize them in order to be more responsive and efficient for providing COVID critical data and financial impact estimation modeling and data presentation.

Our insurance clients have initiated the following key initiatives on a high priority basis in response to COVID with the objective to unlock value in the following areas and most are very laser focused on operational, cost efficiencies and cost takeout.

Summary

The effects of COVID-19 have impacted the world on a global scale and a great deal of uncertainty still lies ahead. Carriers who take immediate action and develop a plan for the near term to make their operations and IT ecosystems more digital, flexible, nimble, and very cost efficient are very likely to emerge far ahead of their competitors as the world economy comes back online.

Download the whitepaper to learn more