The client is one of Australia’s leading Personal Lines insurers offering motor, home and landlord insurance covers through different brands and retail partners.

Bots To Expedite The Process Of Debt Collection

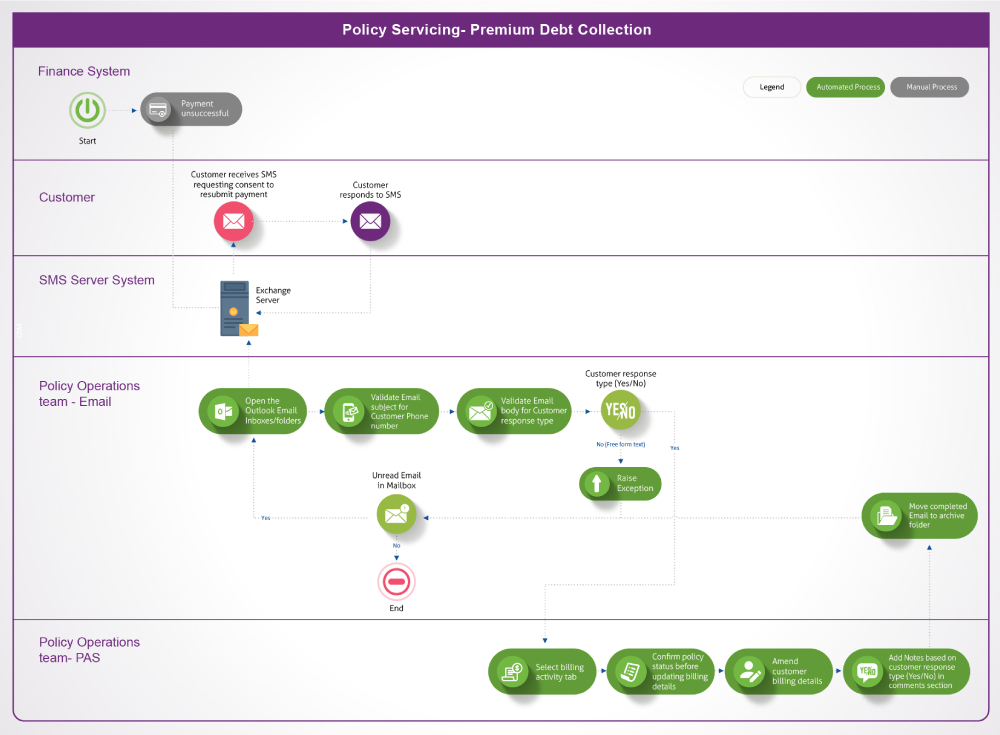

The client’s process for collecting outstanding premiums due on policies post an unsuccessful payment was to send an SMS to the customer with a reminder for payment. When the customer responds, the operations team of the client receives the SMS in the form of email in specific inboxes. The response is manually analyzed to decide on resubmission of the premium payment in the policy system.

The manual process of examining and verifying customer responses is time consuming and error prone. Typically, customer responses (“yes”/ “no”/ free text, etc.) have several variations with additional verbiage that is not always identified correctly for processing and decision-making. As the process involves debt collection, errors have an impact on the customer experience.

To manage policy dues and debt collection without manual intervention, the client identified Robotic Process Automation (RPA) as the solution. To implement RPA, Mindtree’s automation experts were engaged. Using its proprietary RAPID framework that maximizes benefits from RPA and delivers quick ROI, Mindtree created RPA bots configured to accurately read inbound emails from multiple inboxes. The bots can:

- Open target emails

- Validate email subject to identify the phone number for each customer

- Validate customer response for acceptance to resubmit the payment

- Amend billing details in the policy system

- Add comments to customer record based on customer response

- Move processed emails to archive

Efficient Bots Make Happy Customers

Using Mindtree’s RPA bots the client managed to completely overhaul its process for premium debt collection:

- Bots reduced human error and improved productivity by 100 percent in processing the responses

- Higher quality and faster response resulted in improved customer experience

- 90 percent consistency achieved for process; only 10 percent transferred as exceptions

- The turnaround time remained consistent irrespective of fluctuations in process volume