Financial trends and value creation 2013-14

Mindtree has achieved $500 million in revenues and $100 million in EBITDA as it completes its landmark 15th year of operations. This highlights the growth the Company has made over the years to become a global Information Technology solutions organization. Given below is the data on the Company’s performance for the last five years which brings out the value Mindtree has created for its shareholders:

Rs. in million, except per share data

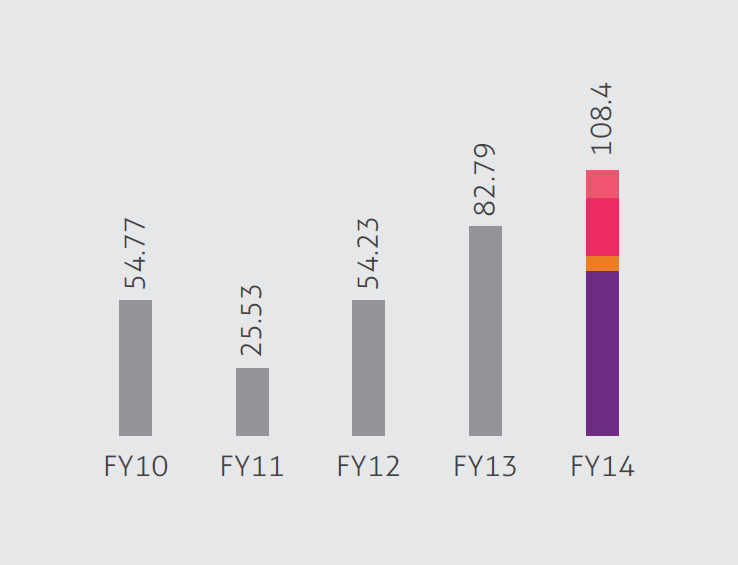

Earnings per share

Earnings per share (EPS) has doubled in the last five years from Rs. 54.77 in FY10 to Rs. 108.40 in FY14.

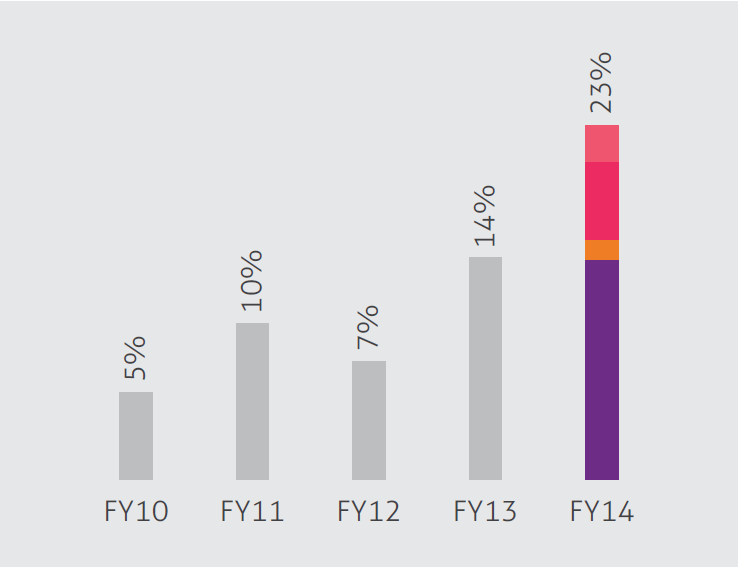

Dividend payout ratio

The dividend payout ratio has increased five fold in the last five years. The payout was 5% in FY10 and is at 23% in the current year.

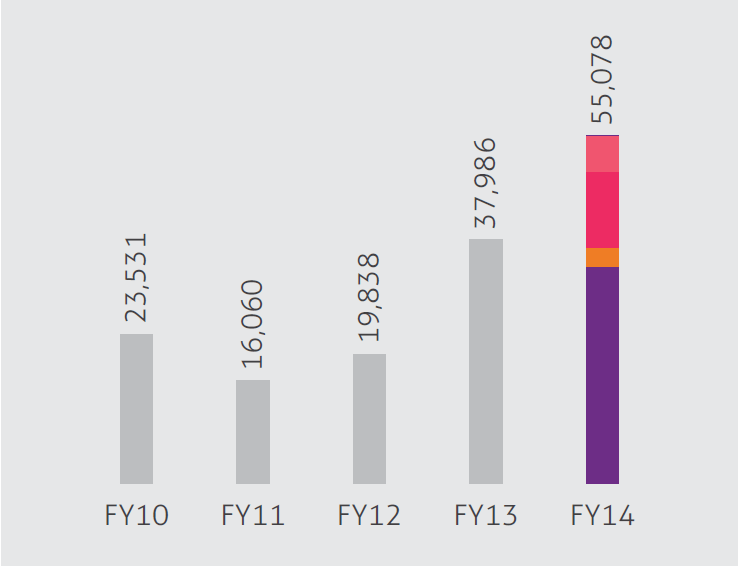

Market capitalization

Earnings per share (EPS) has doubled in the last five years from Rs. 54.77 in FY10 to Rs. 108.40 in FY14.

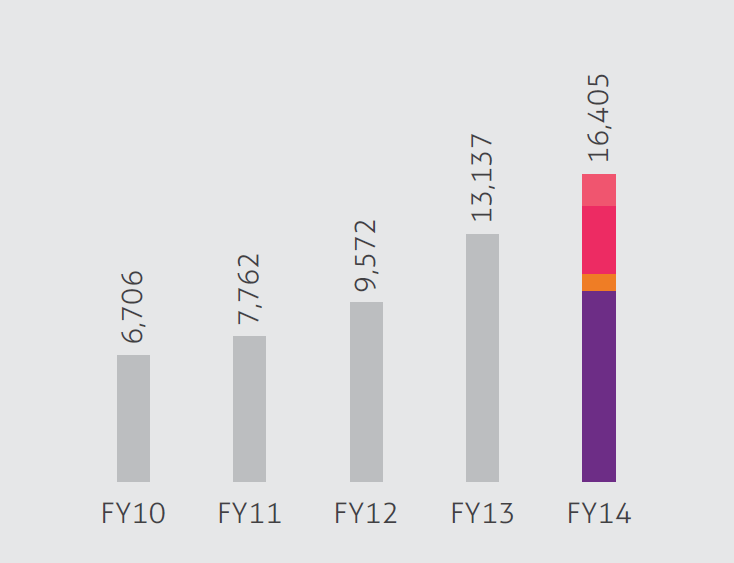

Net worth

The net worth has shown a steady and constant ascent from Rs. 6,706 million to Rs. 16,405 million in the last five years.

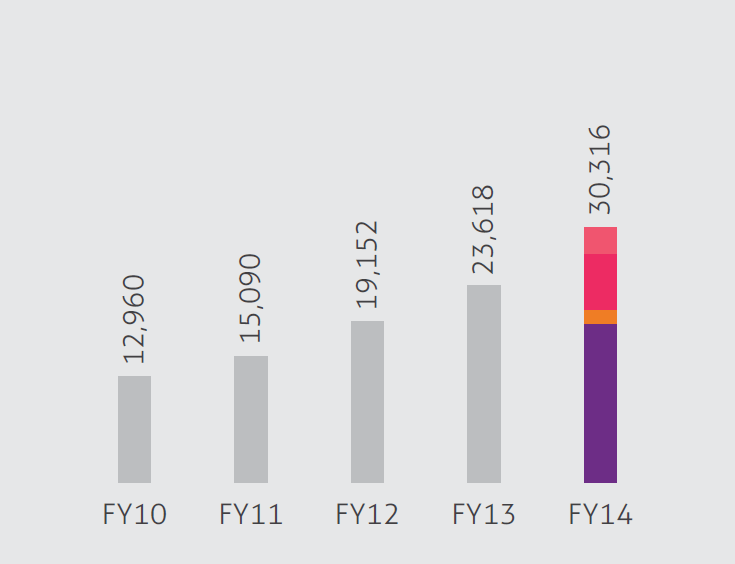

Revenue

Revenue crossed Rs. 30,000 million this year and it now stands at Rs. 30,316 million. Revenue has been growing steadily at a CAGR of 23.7% for the last five years.

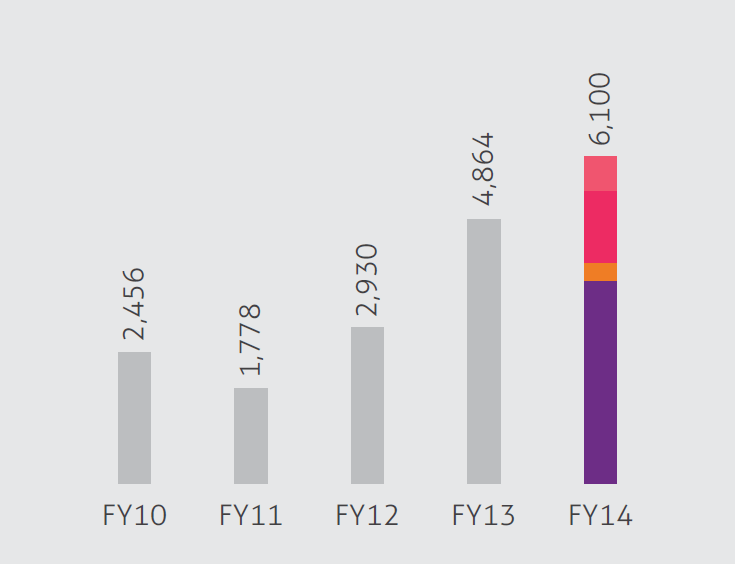

EBITDA

Earnings before interest, tax, depreciation and amortisation has increased from Rs. 2,456 million in FY10 to Rs. 6,100 million in FY14, a CAGR of 25.5% over the last 5 years.

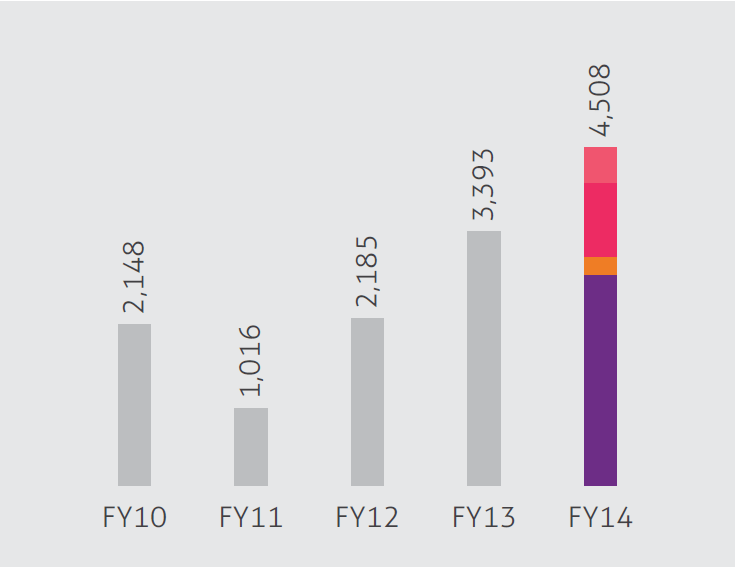

Profit after tax

Profit after tax has more than doubled from Rs. 2,148 million in FY10 to Rs. 4,508 million in FY14.

-

Annual Report 2013-2014

- Unleashing Possibilities

- Executive Messages

- Highlights 2013 - 14

- Board and committees

- Business responsibility report

- Directors' Report

- Corporate Governance Report

- Management Discussion and Analysis

- Enterprise risk management report

- Standalone financial statements

- Consolidated financial statements

- IFRS financial statements

- Global presence

- Notice of the Fifteenth Annual General Meeting

- Download Center

-

Annual Report 2013-2014

- Unleashing Possibilities

- Executive Messages

- Highlights 2013 - 14

- Board and committees

- Business responsibility report

- Directors' Report

- Corporate Governance Report

- Management Discussion and Analysis

- Enterprise risk management report

- Standalone financial statements

- Consolidated financial statements

- IFRS financial statements

- Global presence

- Notice of the Fifteenth Annual General Meeting

- Download Center