Accelerating paycheck protection program - Small business administration loan process with Mindtree Turbo Lending solutions.

The current global pandemic caused by COVID-19 is having an unprecedented impact on the entire world. The exponential growth of the virus led to millions of cases across the globe. With many countries on lockdown, it has had unforeseen sociological, psychological, and economical effects.

Across the world, the economic situation has been dire, with many small and medium businesses having to put their operations on hold due to cashflow issues. To make sure that they are taken care of, Federal Governments across the world have rolled out an economic stimulus package so that Paycheck Protection Program - Small Business Administration can keep their businesses - including their employees - afloat.

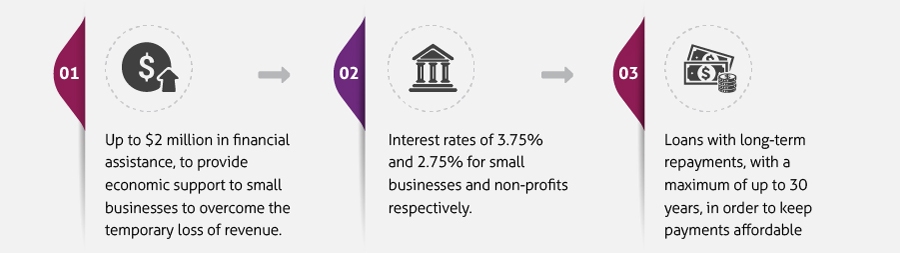

In line with this, the United States' Federal Government has rolled out an economic package for Small Business Administration(SBA). They are offering designated states and territories federal disaster loans at low-interest rates. It will help provide working capital to small businesses suffering substantial economic effects.

The plan proposed by SBA includes:

The Challenges

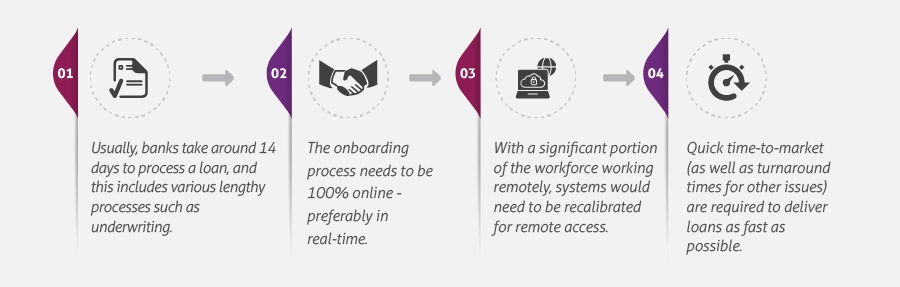

Although the attempt is well-intentioned, it needs to be backed by the robust on-ground infrastructure to put the theoretical proposals to practice. However, most banks do not have the technical expertise required to execute these requirements in real-time. Additionally, the onboarding workflows have to change, since they are optimized for traditional loan products - even though these can be repurposed for said loans.

What are the main challenges in delivering these loans to customers?

Other than this, the overall banking and financial services industry itself has some structural issues that can be considered as challenges in this context. This is not due to any fault of the industry itself. Some processes had been in place earlier, and those will now have to be navigated differently.

What are the challenges posed by the banking and financial services industry?

- System maintenance becomes a cumbersome process for activities at the onboarding/origination stage.

- High-risk customers are not accurately identified during credit processing at a group level.

- Subsidiary banks are often out-of-sync with parent institutions as they are unable to follow the same processes across service offerings.

- The inability to offer better products (having better interest rates or offers) or services for their customers - since banks are currently not able to cross-sell.

- There is no 360-degree view available for customers at the bank group level. Even though there is a lot of data on a customer at the subsidiary level, the lack of a consolidated perspective makes it tough to leverage this information to provide better offerings.

- Due to multiple vendor management systems, operating and maintaining them (as well as integrating them) becomes a costly affair. Moreover, the maintenance of these individual applications is also a time-consuming process.

Solution - What Mindtree Did to Step Up

Mindtree's Turbo Lending Salesforce-based Disaster Loan Management (DLM) Solution proved to be effective in helping banks and other financial institutions. By leveraging Salesforce, it enables businesses to lay a digital foundation across their lending cycle. It unifies all stakeholders (borrowers, lenders, brokers, dealers, and real estate agents) as well as multiple systems and interfaces, on a unified Loan Origination system to create a unified 360-degree view of the borrower.

Here are some of its features:

- A Salesforce accelerator pack will sit on the bank's loan origination system. This will ensure that banks can launch the online tool quickly and provide fast loans to customers and prospects.

- A single unified solution which can be easily integrated on the bank's website for providing faster credit for the bank's existing customers and prospects. This solution can be accessed through mobile, laptops, and desktops.

- It consists of a customer-facing portal interface to enable Loan Application Capture. Later, these applications go through a configurable Loan application lifecycle workflow for application review until credit decision.

- The solution automates key processes like Customer Due Diligence (CDD), Negative List (NL), Blacklisted (BL), Know Your Customer (KYC) check, and credit score checks in real-time.

- It can also be integrated with downstream loan management applications where approval loan applications can be onboarded.

- The solution can also assist in rolling out marketing campaigns as well.

As a result of this, there is an enhanced ability to deliver a seamless, transparent, digital-first lending experience while scaling efficiencies end-to-end.

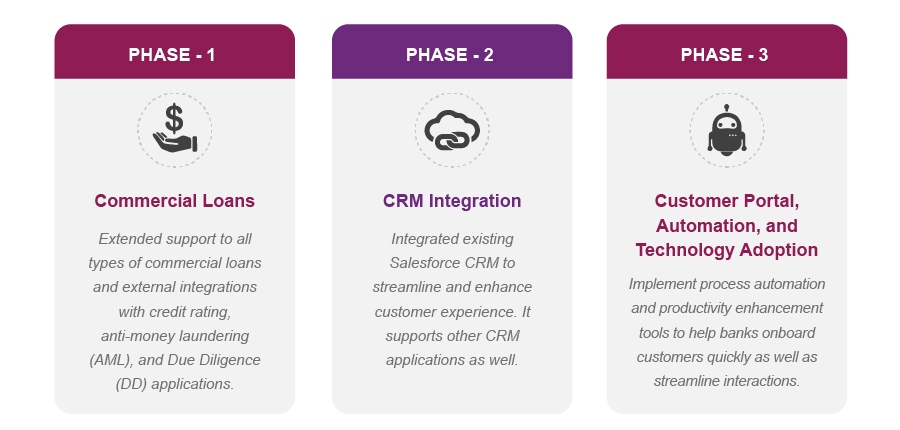

How Mindtree Implemented the Solution:

Adopting a phased approach to implementation, which encompassed three stages

Benefits

Mindtree provides faster application capture, near real-time onboarding, lower start-up costs, and improved customer experience; it also delivered the following benefits:

- 30% lower operating costs as the solution is cloud-hosted, saving resource overheads

- 20% higher staff efficiency through faster loan processing

- 15% savings on customization by leveraging Salesforce's out-of-the-box features, reports, and dashboards that are code-independent

- Holistic 360-degree view of the customer and improved customer experience through intuitive forms and proactive alerts for pending document/change in status

- Built-in configurable workflows

- Superior product uptake and adoption through analytics-driven product selection

- Earlier and higher ROI realization by leveraging existing Salesforce platform

- On-demand scalability to accommodate new products and downstream applications

- Reduced training requirements and costs for bankers, borrowers, agents, etc.

Summary

The effects of COVID-19 has impacted the world on a global scale, the efforts of the governments across the globe; people see some respite in their daily lives. In the United States, the federal government, which took steps to ensure that SMBs could survive in this harsh economic climate. Mindtree has been able to provide essential help by providing the technological support needed to implement SBA's loans through its Disaster Loan Management Solution. By streamlining organizational processes through secure configurations, vital aggregating processes, and transforming end-user experience, the solution Reduces TAT and cost for accessing multiple external ecosystems by providing a unified platform.