ABSTRACT

In a recent move, Murex, an industry leader in trading, risk management and processing solutions for capital markets announced that it has certified its MX.3 technology platform to run on Microsoft Azure1 and Amazon’s2 cloud platform (AWS). The announcement underlines Murex’s commitment to rationalize, simplify, and reduce the cost of adoption for banks and FIs to pave the way for a modular future for risk management systems.

For capital market firms, banks, and financial institutions, the decision of whether to move to the cloud can be a difficult one. It is true that the cloud has empowered these institutions with the ability to adapt services and technology in a timely manner, without the need for additional internal infrastructure and personnel. It is also true that cloud-based solutions allow for robust disaster recovery options with minimal dependency on technical experts since the complexity and maintainability of on-premise technology is no longer an issue. However, to create effective and efficient technology infrastructure, these institutions must consider when and how to manage sensitive data. Due to the increased risk of hacker activity in a cloud vs. on-premise environment, security control adoptions play a critical role and can make these solutions potentially more expensive than on-premise models.

Despite this concern and others, banks and FIs are still cautiously entering the cloud arena because they find that the benefit to their business outweighs the risk.

Through an analysis of the risks and benefits in the areas of cost, regulatory impact, and security, the whitepaper will arm cloud-averse companies with the information they need to safely and successfully shift their Murex Environment to the cloud.

Why the Rush Towards Cloud?

Capital market firms, FIs, and banks are increasingly leveraging cloud solutions to meet their business needs by:

|

Lowering costs |

Enhancing Business Agility And Operational Efficiency |

Ensuring scalability and robustness |

|

The cloud turns a large up-front capital expenditure into smaller, ongoing operational costs. |

The cloud shifts the focus from IT to the business. |

The cloud provides elastic scalability to handle fluctuating business needs. |

|

• Enables a pay-as-you-go model for reduced capital and license expenditure |

• Improves service and quality |

• Creates a fault tolerance system |

|

• Reduces operating, maintenance and technical consultant costs |

• Reduces test cycle and time |

• Ensures application and platform auto scalability |

|

• Ensures a high level of redundancy and backup at a lower price |

• Enables better business enforcement |

• Enables on-demand scaling (up or down) of storage, cores, platform, software, service, etc. |

https://www.murex.com/news/Murex-to-Offer-Cloud-Based-Trading-and-Risk-Management-Solutions

https://www.risk.net/technology/risk-systems/5373836/murex-moves-onto-cloud

Easing the adoption of emerging technologies

- New technology offers the potential to disrupt the competitive landscape.

- Future-proofs the organization’s ability to grow horizontally and vertically.

- Virtualizes through quick deployment, archiving, relocation, etc.

Reducing risk and total cost of ownership

Automation, dynamic allocation, and maintenance enable resources to be extremely efficient.

Figure 1: MX.3 Certified on AWS and Azure

Murex: Driving Capital Market Innovation

Capital market firms, banks, and FIs around the world rely on Murex technology solutions for complying with global regulations while driving growth and innovation. As a leader in developing integrated trading, risk management, processing, and post-trade solutions, Murex continually enhances its platform to ensure relevance for its customers. The recent move by Murex to enable its clients to leverage the flexibility and economies of scale offered by the cloud is a step in this direction. Murex’s platform is native-cloud compliant across asset trading, risk, and operations, and it is fully deployable on all cloud environments – private, public, or hybrid.

In the subsequent sections, we look at the advantages of leveraging Murex in the cloud.

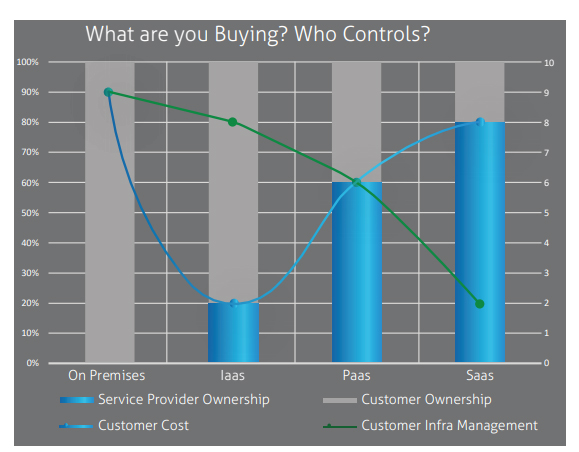

Figure 2(a): On Premises and Cloud Experience

Murex Cloud Certification: An Overview

- Murex is certified3 on Microsoft Azure and Amazon Web services (AWS) providers for deploying MX.3 environments on IaaS.

- Support of RHEL, SAP ASE (Sybase) and Oracle cloud compliant operating environments is available.

- Murex version v3.1.35+ on RedHat Linux RHEL 7.2+ and both Oracle 12c and Sybase ASE 16.0 SPO2 are supported on Microsoft Azure and Amazon Web services (AWS) cloud.

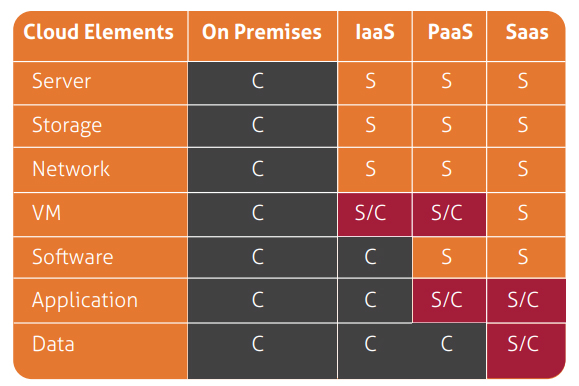

Figure 2(b): Infra ownership S=Service Provider C=Customer

Leveraging Murex in the Cloud: Three Key Factors to Consider

Cost Implications

Banks and FIs using on-premise Murex solutions typically procure expensive machines to use GRID services for parallel computing. In addition, the machines need to be upgraded and enhanced with high-end configurations due to evolving business demands such as increases in load, users, and/or storage. This, in turn, leads to increased maintenance and operational costs.

http://go.murex.com/rs/876-RTE-754/images/Murex%20Cloud%20Services%20COR2017.pdf

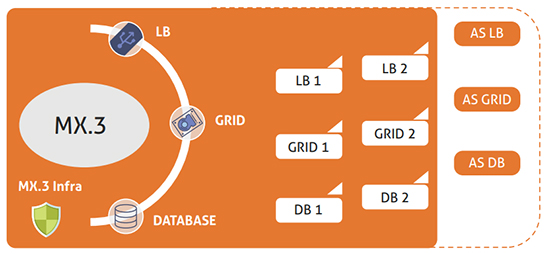

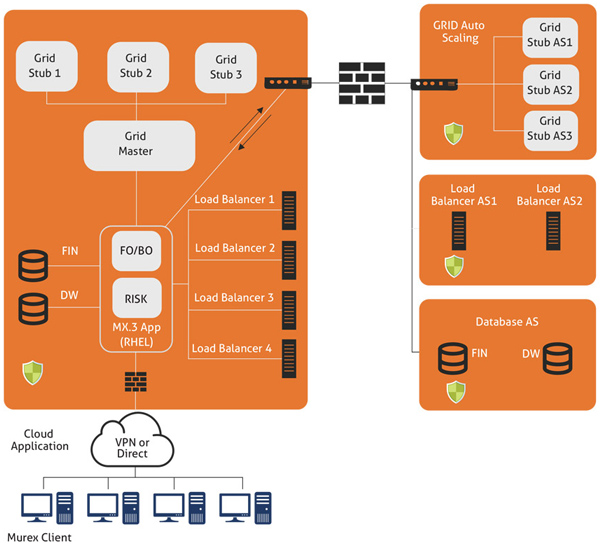

In comparison, if a financial institution adopts cloud-based Murex technology, the same infrastructure can be billed using a pay-as-you-go model with smooth, on-demand and automated elasticity of infrastructure. In an elastic system, resources are allocated to users on-demand and freed when no longer required. Murex auto-scaling enables the provisioning of capacity such as load

balancer, GRID, and database without manual intervention or observation (see Figure 3(a) and 3(b)).

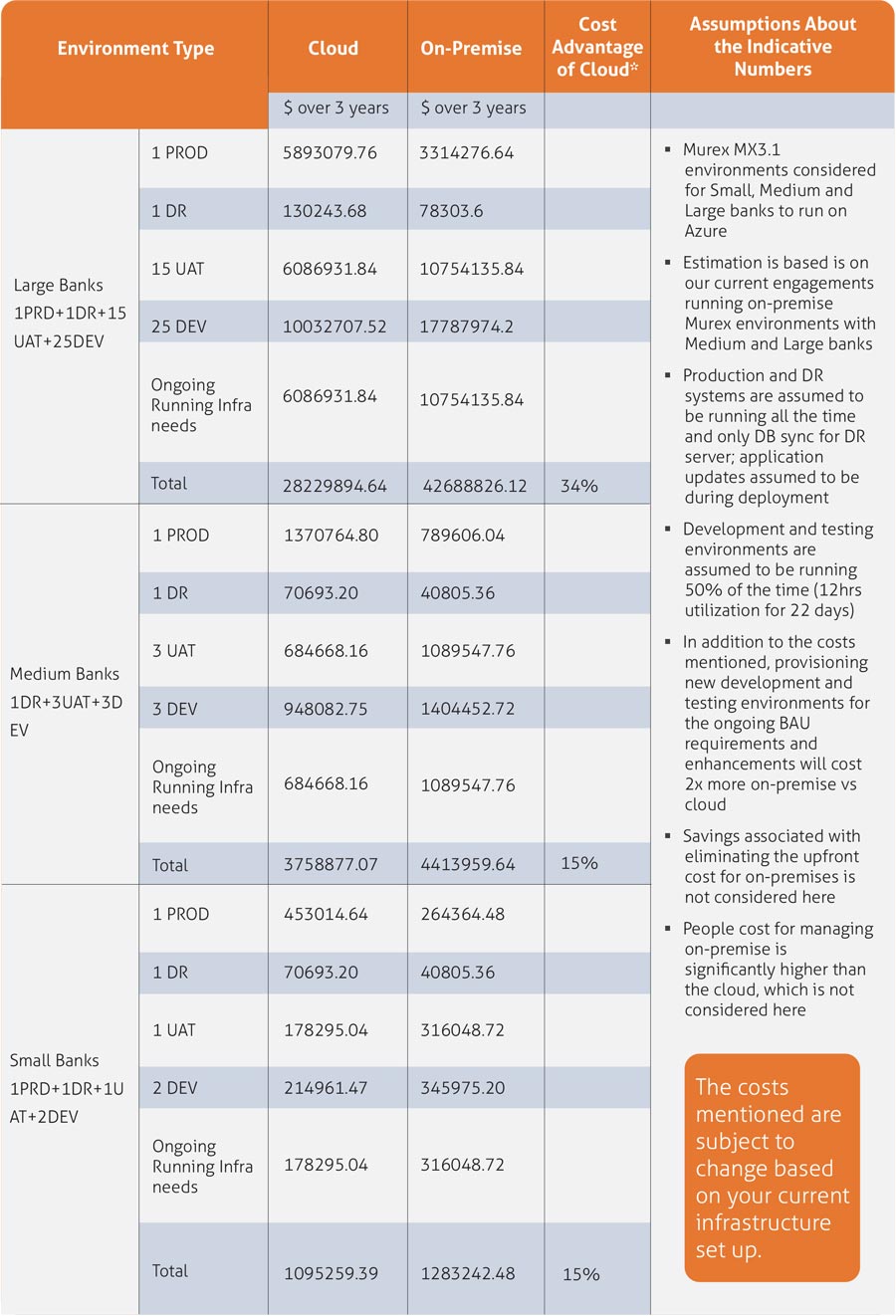

Though auto-scaling is not chargeable, the Virtual machines and EC2 compute instance will be charged with each GB of data transferred through the elastic load balancer. See Table 1 (pg. 4) for a comparative study of on-premises vs cloud cost for Murex customers over three years.

|

Mindtree cost reduction success story |

Highlights of auto-scaling |

How Murex auto-scaling works |

|

Mindtree, with its deep expertise in infrastructure management services, was chosen by one of the world's largest equity firms (which manages around USD 148 billion of assets), to provide an ITIL-based service management platform, provide continuous service improvement, and reduce costs. |

• Cost-effective solution that ensures proper resource/ infra utilization |

• Auto-scaling rule triggers on guideline breach |

|

Business Impact |

• Auto-scaling can be done based on parameters like CPU, memory, bandwidth, etc. |

• Defined rules monitor and verify statistics like CPU, memory, cores utilization, etc. |

|

• Improved operational effciency of around 30% and increased availability and stability of infrastructure |

• Eliminates the need for over-provisioning and ensures that the compute fleet is optimally utilized |

• Initiates a new server for scale-up and closes down the same to scale down |

|

• Consistency and control in IT inventory and change management |

• Defines minimum and maximum instances |

• Initiates standard boot (i.e. OS, Size, Image, etc.). |

|

• Significant cost reduction around 20% in infrastructure management due to process efficiencies, reusable frameworks, and automation |

• Saves compute costs by terminating under-used Instances |

• Launches services as required for applications |

|

• High availability of critical services to the customer’s business teams through 24/7 delivery and stringent SLAs |

• Computer crashing in the cloud will not affect the storage of data and hard disk crashing will not affect cloud data, eliminating the cost and burden of maintenance |

• Launches services as required for applications |

Figure 3(a): MX.3 Infra Auto Scaling (AS)

Table 1: Comparative Study of On-Premises Vs Cloud Cost for Murex Customers for 3 years

Figure 3(b): MX.3 Infra Auto Scaling on Cloud

Regulatory impact

Financial regulators have turned their attention to the cloud as concerns mount over supervising online storage services that house information from the world’s biggest banks. Critical market infrastructure operators such as DTCC, OCC, and the US Clearing House, are planning to move operations entirely into the cloud over the next few years as it offers a more secure, sophisticated, and cheaper alternative than in-house IT systems. Even the US financial regulatory authority stores information on Amazon’s AWS.

As global FIs become increasingly reliant on the cloud to store customer account data and safeguard their banking systems, regulators are worried about concentrating so much information in the hands of private players such as Amazon, Google, and Microsoft. Table 2 (pg. 6) illustrates cloud usage regulations and guidelines published by various authorities across the world.

Mindtree regulatory reporting success stories

Case Study 1: For a UK-based investment firm that manages one million records per day, Mindtree implemented an EMIR (European Market Infrastructure Regulation) reporting solution covering all five asset classes of OTC derivatives (Interest Rates, FX, Commodity, Credit, and Equity) and Exchange Traded Derivatives (ETD).

Business Benefit: The client achieved EMIR regulatory compliance in a timely manner and reduced its operational cost.

Case Study 2: Collaborated with French Multinational bank to analyze the status of MiFID transaction reporting. We identified issues, made recommendations, and implemented changes while adhering to MiFID guidelines.

Business Benefit: Lowered FCA report exceptions and rejections by 30%, thus increasing operational efficiency.

Case Study 3: Mindtree provided monthly consultation services to a US-based investment bank on the upcoming changes in regulatory compliance across the US, Europe and Asia including impact analysis for how the changes would affect the client’s technology systems and business processes.

|

Regulator |

Country |

Regulations and Guidance |

|

Federal Financial Institution Examination Council (FFIEC) |

United States |

“Outsourced cloud computing” guidance published by FFIEC (Jul 10, 2012). It reaffirms the financial institution’s obligations to applicable law and recognizes the benefits of utilizing the cloud |

|

Financial Conduct Authority (FCA) |

United Kingdom |

“Guidance for firms outsourcing to the ‘cloud’ and other third-party IT services” guidance published by FCA (updated Jul 25, 2018). This guidance encourages FS companies to use the cloud as long as necessary security controls are in place. FCA describes how FS companies can utilize the cloud while still managing their compliance obligations. |

|

Communication and Information Technology Commission (CITC) |

Saudi Arabia |

“The Cloud Computing Regulatory Framework” guidance published by CITC (Aug 11, 2016). This regulatory document offers guidance on how to handle sensitive business and personal information. The regulation also highlights data localization requirements. |

|

European Commission (EC) |

European Union |

“General Data Protection Regulation (GDPR)” guidance published by EC (Apr 27, 2016). It provides a consistent and unified legal basis for data protection and enforcement. FS and cloud providers with operations in the EU are bound by GDPR compliance obligations. |

|

Ministry of Industry and Information Technology (MIIT) |

China |

Details about new cyber cybersecurity law requiring data localization of “Critical information infrastructure” within Chinese borders. This security protection regulation guidance published by MIIT (Jul 11, 2017). “Notice on Regulating Cloud Services Market Activities” draft which could impact the way CSPs enter and operate within the Chinese market published by MIIT (Nov 25, 2016). |

|

Ministry Of Justice (MOJ) |

Brazil |

MOJ has drafted a bill, the Law for the Protection of Personal. New regulation concerning consent, security and cross border transfer of data. |

Security

In on-premise environments, security can be established with data encryption, firewalls, and IDs. The cloud, however, is an easier target for cyber-crimes. Security in the cloud is a major concern for capital market firms, banks, and FIs.

To address this, firms must secure sensitive intellectual property and leverage network and application firewalls built by cloud service providers to create a private dedicated network connection.

- Services like Amazon CloudFront, Amazon Route 53 and Microsoft Azure DNS services help to stop denial of service attacks

- Cloud inspector services also help automatically assess applications for vulnerabilities or deviations from best practices, including affected network, OS, and attached storage

Cloud governance is all about applying specific policies and principles to secure applications and data when they are located remotely. These policies and principles should be integrated with existing IT governance and not introduced in isolation. Mindtree helps companies determine the best approach to integrate new processes with existing IT governance policies, dashboards, and tools.

Mindtree Cloud security and Governance Services success stories

Mindtree helps auto manufacturer govern digital assets across the supply chain

A global auto manufacturer struggled to manage digital assets across different brands and business units. The manufacturer needed to reduce digital asset redundancy, and improve search, approval, and reporting.

Mindtree provided a cloud-based integrated platform for search, browse, review, download, and reporting and information management.

The Mindtree solution delivered several benefits:

- 99.5% application availability

- 15% increase in user adoption rates across multiple countries

- 50% increase in cost optimizations

CONCLUSION

As digitization increasingly pervades the business world, the challenge for banks, financial institutions, and capital market firms will be to find innovative ways of collaborating with new business models and next-gen technologies.

With the need to drive risk analysis and decision making in a matter of seconds, banks will need flexible bandwidth, architecture, and connectivity. Leveraging new technologies to host Murex on the cloud will enable FIs and capital market firms to cater to the increased demand for the elasticity of data and infrastructure for the trading community, thereby driving competitive advantage.

About the Author

Syed Musaveer Rahman

Technical Lead, Murex Practice, BFSI, Mindtree.

Syed Musaveer Rahman is presently Murex consultant with solid experience on Murex Production support and maintenance involving Datamart, MXML, Configuration Management activities. He is also a catalyst in discovering / analyzing / designing timely automation solution for Mindtree clients.

References:

https://www.murex.com/content/flyer-murex-cloud-services

http://go.murex.com/rs/876-RTE-754/images/Murex%20Cloud%20Services%20COR2017.pdf

https://www.murex.com/news/Murex-to-Offer-Cloud-Based-Trading-and-Risk-Management-Solutions