Today, banking institutions which are in the cards and payments space are facing increased competition, challenges and opportunities, which are brought on by regulatory changes, macro-economic trends and alternative providers – primarily FinTech companies. In particular, the merchant on-boarding process is a complex, risk-prone, inflexible and expensive affair, which involves interfacing with disparate systems, while the bank’s competitors, mainly FinTechs and RegTechs, are providing much faster, less complex and more cost-effective solutions.

This apart, the current business demands acquirer banks and payment service providers to quickly onboard new merchants as customers, so that they can increase the volume of transactions they process, which in turn helps grow their business. However, the act of on-boarding questionable merchants who authorize fraudulent transactions results in charges and losses that affect the bottom line. These institutions urgently need technologies that can mitigate this risk and help them comply with regulations such as anti-money laundering, Know your Customer and Know your Customer’s Customer.

With this challenge in mind, merchant on-boarding became our answer. Ultimately, if you can’t onboard your merchants in seconds, you are increasing your competitor’s success rate.

The process of on-boarding merchants is complex and risk-prone, involving significant diligence checks and third-party verification to ensure merchants aren’t involved in fraud. Mindtree’s merchant onboarding solution is architected to simplify and streamline this process using Blockchain technology. The automated process also helps reduce operational costs and improves quality control by using standardized global best practices.

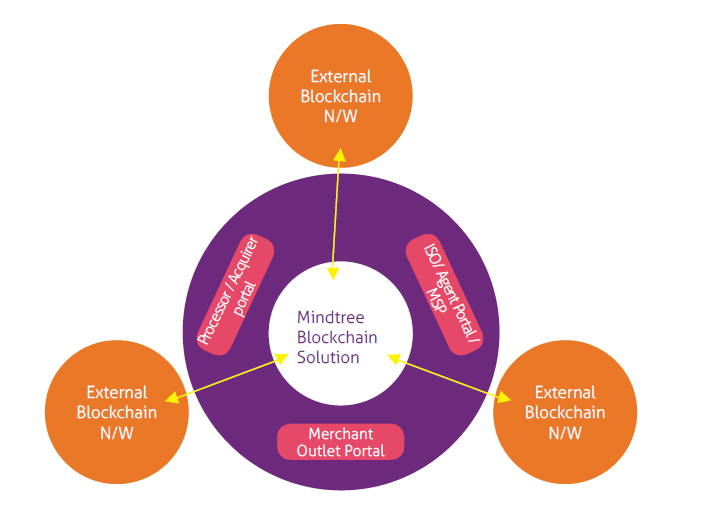

Mindtree’s merchant on-boarding solution has been developed on a Hyperledger fabric channel – which is a private distributed ledger framework for communication between members for all merchants that ensures secure and private sharing of document approvals and information between all dependent stakeholders. In a distributed ledger technology (DLT) framework, all banks will be on same channel. On a channel, banks will be able to share approvals of documents, and also keep some information private so they are able to update their own info without it being shared amongst other organizations. The credit bureau authorities, dispute management and payment organizations and all the others can use the same public channel whilst keeping their information private. The risk associated with high value merchant on-boarding is mitigated by sharing information between a consortium of all on-boarded acquirer banks, so that the associated hazards are shared amongst banks.

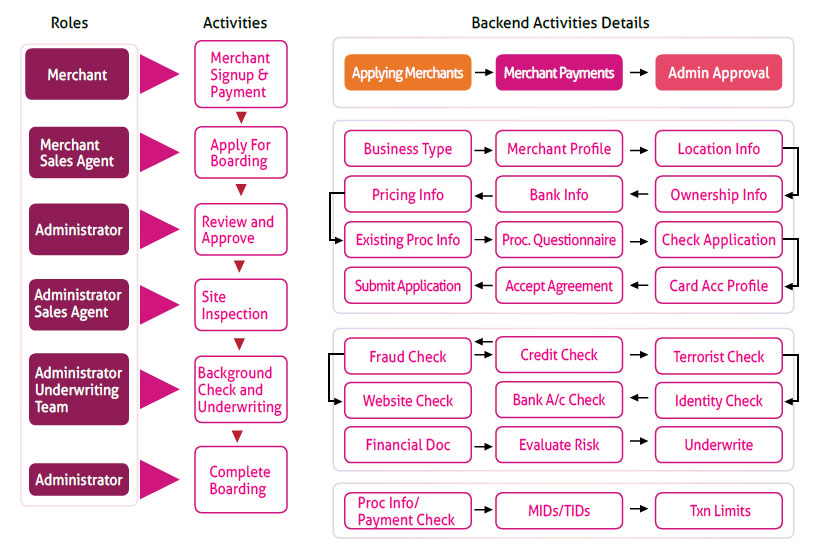

Existing Flow

Let’s think it on Blockchain:

The business logic mentioned above will be satisfied by Blockchain, while the business flow will exist within it.

Basic Architecture Diagram 1:

Basic Architecture Diagram 2:

|

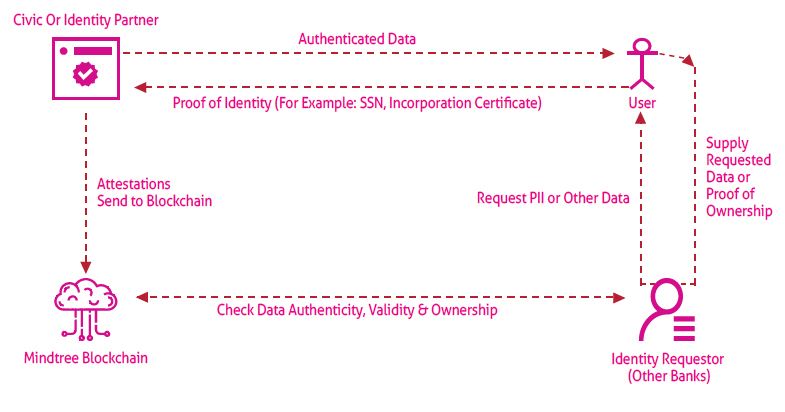

The default Blockchain properties enable us to achieve high security of data storage. The solution offers capabilities that enable transactions to be authenticated and authorized, in a secure and transparent manner. It also allows data to be transmitted within a secure network and accelerates information sharing across all parties. |

Benefits:

- Robust, secure data transmission through a secured and defect-free network

- Integrates with the external system to validate the authenticity of documents as part of the onboarding process

- Establishes process standardization and reduces physical documentation, thereby increasing the digitization of documents

- Faster sharing of information across all related parties

- Near real-time onboarding of merchants with all validation checks

- Achieves greater business agility with business-friendly configuration tools to create and change processes