Now what matters in the street today is transformation:

Infrastructure and Deployment – This is the core of the MasterCard network hub and spoke architecture. The authorization is in country, while clearing and settlements are processed through hubs

Financial Functions on Network - Issuer focused functions from Visa like VAA (Visa Advanced Authorization), Visa risk management, VVO (Visa View Online), Visa Offers etc.

Deep Learning and AI - Use of Artificial Intelligence (AI) to create lesser non-intrusive journeys for customers by delivering value through higher approval rates, fewer declined transactions and proactive credit limit management.

Middleware Ecosystem - Visa used AI/Machine Learning models to examine over 500 transaction attributes in real-time for indicators of fraud

Front-end Channels - Amazon Go piloted a contactless identity service linking customers’ credit cards with their palm-print to create a unique biometric signature. Customers can then pay in a store by holding their palm above an Amazon One device.

Multifunction Instrument Authorization - Curve’s smart card enables customers to link credit and debit cards to a single physical card using a mobile app. They can then switch between cards before making a payment.

Usage of Real-time RNN (Recurrent Neural network) - Improve channel experience, streamline and consolidate customer payments journeys, and enable real-time determination of unincluded parameters for frauds.

Blockchain Technologies - Kenya-based startup BitPesa, uses distributed ledger settlement, allowing customers to send and receive low-cost, near-instant payments without a bank account or even an enrolled wallet

Value Proposition:

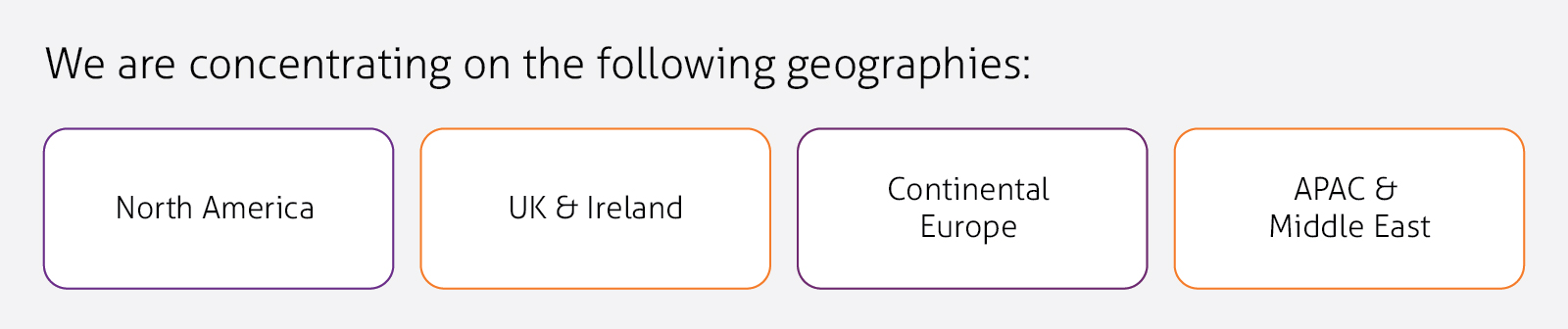

Mindtree is the strategic partner for major Cards and Payments players across globe, persevering its DNA as a nimble technology company with one eye on its legacy and founding principles while continuing to power an ever-changing business landscape.

Mindtree’s objectives in this space include:

- To provide data-driven cards and payments solutions

- To redefine financial crime prevention

- To engage with maturity and scale

- To help customers accelerate technology transformation